M1 Review: A Robo Advisor With a Human Touch

Rating as of based on a review of services March 29, 2023.

Ranking

8.5/10

M1 gives you the benefits of a robo-advisor with the control of a traditional brokerage. If you’re someone who wants a hands-off approach but wants to have a little control when you need it, M1 might be for you.

Best for:

- Seasoned investors

- Self-directed

- Robo-advisor

- Low starting balance

Robo-advisors offer a completely hands-off approach to investing. For beginner investors, “set it and forget it” can be appealing.

But what if you wanted just a little more control? What if you wanted to make sure you had individual investment balances in stocks like Apple, Google, and Amazon?

With M1, you can.

This hybrid approach offers a lot of advantages, but it comes with some limitations too.

In this article, we’ll talk about the features of M1 so you can determine if you want to switch to this broker.

What Is M1?

Founded in 2015, M1 is a platform that combines aspects of robo-advisors and traditional brokerages. M1 simplifies investing with features that make creating and managing your portfolio easier and more and hands-off.

Using a methodology they call “Pies” and “slices,” you can pick and choose a variety of investments and the weight you want each to have in your portfolio. M1 has a stunning app, a lot of features, and a unique take on investing.

Pros & Cons of M1

Pros

- No minimum starting balance — Open an account with $0 but begin investing with $100 (or $500 for an IRA)

- No fees — No management fee and no trading fees

- Best of self-directed and robo-advisor investing — Choose your own investments, then let M1 manage your Pies for you

Cons

- Not a trading platform — M1 can’t be used as a trading account for individual securities

- No tax-loss harvesting — M1 offers tax priority selling but not tax-loss harvesting, which is now commonly offered by many investment services

Related: How to Profit from Losing Investments with Tax-loss Harvesting

M1 Features and How it Works

Here are some key features of M1 and how to use them.

Build Your Portfolio

M1 does things a little differently. To organize your investments, you use “Pies.” A Pie is like a mini portfolio within your overall portfolio. It is completely customizable and shows a visual representation of your asset allocation.

You can create your own Pies from scratch or choose one of more than 60 Expert Pies. Expert Pies use proven strategies for a wide variety of investing styles and risk profiles. When you build a Custom Pie, you’ll choose ETFs and stocks yourself. You can even combine a Custom Pie with an Expert Pie. You get as many Pies as you want.

These are the steps to create a Pie:

Choose investments to add to your Pie. Each asset you pick represents a “slice” of your Pie. So if you own Apple and Google, you’d have two slices in your Pie.

Define the target weight of each slice. This is how much of your portfolio you want to be dedicated to a particular slice. For instance, if you want 10% of your Pie to be in Google stock, you’d set that slice to 10% in your Pie.

Fund your Pie. When you deposit money into your account, it’s spread according to the allocation you set for your slices. So if you had a Pie with 10% Google, 20% Apple, and 70% Amazon, a $100 deposit would send $10 to Google, $20 to Apple, and $70 to Amazon.

Watch your portfolio rebalance. As you deposit new funds, your slices will correct themselves so they remain at the target weights you set.

Add, remove, and edit slices. Over time, you might wish your slices were set up differently. You can make changes to slices or add more whenever you want. Removing a slice is like selling stock and adding a slice is like buying stock.

Choose Your Account Type

M1 offers several account types:

- Individual brokerage accounts

- Joint brokerage accounts

- Retirement accounts – choose from Traditional IRAs, Roth IRAs, and SEP IRAs

- Trust account

- Custodial accounts

Regarding minimums, M1 requires a $100 minimum account balance to open a taxable account and a $500 minimum to open a retirement account. These are both incredibly low compared to many brokers out there.

Choose Your Investments

M1 offers a broad selection of stocks and ETFs. There are over 6,000 securities you can choose from that are on the NYSE, NASDAQ, and OTC exchanges.

One of the nicest things about investing with M1 is that they use fractional shares. Fractional shares allow you to invest every single dollar, down to the penny, in a stock.

For example, if a share of XYZ stock costs $200 but you only have $100 to invest, M1 would purchase 0.5 shares for you. Traditional brokers would require you to have the full $200 to buy a share.

This means you don’t have to wait to save up for full shares and can just invest whatever you have to invest.

Related: How to Invest in ETFs

Automate Your Investing

M1 is big on automating the things most investors hate to do. Once you have your account set up how you want it, you don’t have to micro-manage it as you might with a traditional broker.

Here are some of the ways to automate your investing:

Recurring investments. Set up automatic deposits into your investment account on whatever schedule you want. Just link a bank account and choose your frequency. This is a great feature whether you earn a regular paycheck or an irregular income.

Automatic rebalancing. Rebalancing a portfolio is time-consuming and takes practice to get good at. M1 offers automatic rebalancing to keep your slices at the percentages you set. That way, you maintain your target asset allocation without even thinking about it.

Built-in tax efficiency. There are a few ways to buy and sell investments for maximum tax advantages. You get built-in tax efficiency with M1, as they take a lot allocation strategy when they sell investments to automatically reduce the amount you owe in taxes. Keep in mind that this only applies to taxable accounts.

Cash balance control. Auto-Invest is the default setting for all M1 accounts. This means all of your money is automatically invested whenever your cash balance is equal to at least $25. But if you want to keep some money in your account, you can set a new minimum cash balance and only the excess will be invested. For example, if your minimum cash balance is $100 and your balance reaches $150, $50 will be invested and $100 will remain.

Borrow Against Your Investments

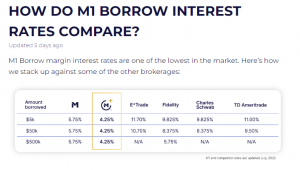

M1 Borrow lets you borrow up to 40% of the value of your account balance at a rate as low as 6.75% variable with M1 Plus. This gives you liquidity without requiring you to cash out your investments. You can use this portfolio line of credit for whatever you want.

Since the rate is competitive, it makes sense to choose this over a HELOC for home improvement or a traditional car loan for a new vehicle. 6.75% variable is significantly lower than most margin rates on investment accounts, meaning you can use the money to reinvest in your M1 portfolio.

If you have $100,000 in your account, you can borrow up to $35,000 at a very low rate. The only catch is that you have to have a margin brokerage account with at least $2,000 in it to use this service.

Here’s a snapshot of M1’s borrowing rates compared to competitors:

Earn and Save With M1 Spend

M1 Spend offers both a credit card and checking account to help users get rewards every day. There’s no minimum deposit required for the M1 Spend digital checking account and it offers Early Direct Deposit so you can get paid even faster. The annual fee for this account is $125 and there’s a 0.8% – 1% foreign transaction fee.

But this checking account is much better if you have M1 Plus. For M1 Plus users, this checking account earns an interest rate of 3.30% on all balances and the M1 Spend Visa® debit card earns 1% cash back on purchases. Plus, the annual fees and foreign transaction fees are waived.

M1 Pricing

There are two types of M1 accounts: M1 and M1 Plus. M1 doesn’t cost anything to use but M1 Plus costs $125 per year. Many fees, such as M1 Spend fees, are waived for M1 Plus users.

There are some other fees for having an account (like for wire transfers), but you won’t ever be charged for commissions on trades or to make deposits or transfers.

Right now, new users can try M1 Plus free for three months. After that, you can either downgrade to the standard M1 account or start paying the annual fee.

Related: Are Robo-Advisors Worth It? A Complete Guide

M1 Plus Disclosure - M1 Plus is a $125 annual subscription offering products and services from M1 Spend LLC and M1 Finance LLC, both wholly-owned, separate but affiliated subsidiaries of M1 Holdings Inc.*Your free trial (a $31.25 value) begins the date you enroll in the M1 Plus subscription, and ends 90 days after ("Free Trial"). Upon expiry of the Free Trial, your account is automatically billed an annual subscription fee of $125 unless you cancel under your Membership details in the M1 Platform.

What We Like about M1

Here are some of the features we like about M1:

- Large investment selection

- M1 invests idle cash (after you set a max)

- Buy fractional shares

- No fees for trading or opening an account

- Set up recurring deposits at any interval

- Multiple account types

- Ability to borrow at a cheap rate (M1 Borrow)

What We Don’t Like about M1

There are only a few things we don’t like about M1:

- New type of platform with a learning curve

- Limited investing advice

- Lack of control over individual trades

Summary

M1 has a nice value proposition. They give you the benefits of a robo-advisor with the control of a traditional brokerage, and there are more than enough features for most beginner and intermediate investors.

If you’re someone who wants simple, automated investing with the option of being as hands-on or hands-off as you want, M1 might be for you.