Tax-loss harvesting—or TLH for short—isn’t a new concept. But it’s gained greater popularity and media coverage in recent years, now that it’s being offered by some common investment services, like Wealthfront and Betterment.

In its simplest form, tax-loss harvesting is about minimizing capital gains taxes on your investment portfolio. It’s more complicated than that, so we’ll take a look at it more closely.

Betterment is not a licensed tax advisor. Tax Loss Harvesting+ is not suitable for all investors. Investing involves risk. Performance not guaranteed.

What’s Ahead:

What is tax-loss harvesting?

Tax-loss harvesting is a strategy in which certain investment assets are sold at a loss in order to reduce your tax liability at the end of the year. You can use tax-loss harvesting to offset capital gains that result from selling securities at a profit. You can also use tax-loss harvesting to offset up to $3,000 in non-investment income.

Tax-loss harvesting is a strategy that you only apply to taxable investment accounts. Tax-deferred retirement accounts like IRAs and 401(k)s grow deferred, so they aren’t subject to capital gains taxes.

Let’s say that you have $10,000 in capital gains on certain stocks and funds in a taxable investment account. In order to minimize the tax liability from those gains, you sell other assets that will generate a loss. If those losses total $5,000, it will cut your capital gains—and therefore your capital gains tax—in half. We’ll get into exactly how this works to your advantage in a little bit.

Tax-loss harvesting can be complicated if you try to do it manually. But it’s actually a very easy process when it’s done by computers. And since they have the computers that can do it, certain brokerage firms and investment platforms offer tax-loss harvesting as an (often premium) feature.

In certain situations, it may be advantageous to buy back the securities sold at a loss at a later date. There is a limitation to this practice, which is the subject of the next section.

Read more: Automated tax loss harvesting: Is it right for you?

The wash-sale rule

This is a rule concocted by the IRS to prevent taxpayers from creating tax losses using investments. The rule requires that a loss on a sale will not be permitted if the same or substantially identical security is purchased within 30 days of the transaction that resulted in the loss. That means either 30 days before the sale or 30 days after.

There are workarounds to this, but they work better when done by computer, particularly if it involves multiple transactions.

One way to get around it is to make sure that you wait at least 31 days after the sale of a security or fund to buy it back. Another is to purchase a similar, but not identical, investment to the one that sold. This could involve, say, selling energy stocks, and buying shares in an energy fund immediately after.

It seeks to take advantage of the fact while some investments and sectors may be in a down cycle, you sell them at a loss, but replace them with something similar so that you retain your investment when it recovers.

The tax benefits of tax-loss harvesting

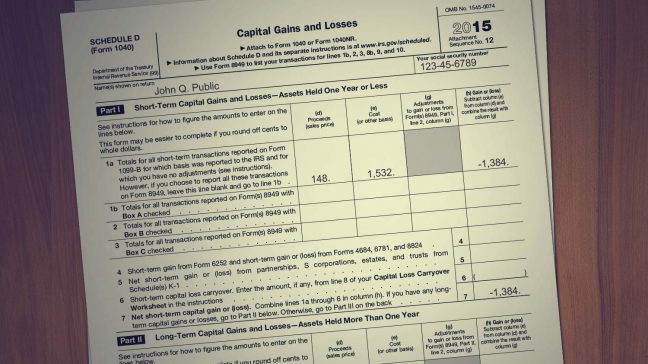

Since tax-loss harvesting can involve both long-term (held longer than one year) and short-term capital gains (held one year or less), there is a sequence to how the losses are applied.

Long-term losses are first applied against long-term gains, and then against short-term gains. Meanwhile, short-term losses are applied first to short-term gains. This sequence takes place because long-term capital gains are taxed at a lower tax rate than short-term capital gains.

It’s important to understand that the primary purpose of tax-loss harvesting is to defer income taxes. That’s the process of delaying the payment of taxes many years into the future. This allows an investment portfolio to grow and compound at a faster rate than it would if the money to pay taxes were withdrawn from the portfolio every year that gains occurred. The benefit will be fully maximized if you can defer the liability until after you stop working, when you will presumably be in a lower tax bracket.

As an example, let’s say that you have a mutual fund that continues to rise in value each year for the next 20 years. You offset capital gains distributions from the fund using tax-loss harvesting. At the end of the term, the fund has grown to four or five times your original investment—largely because you never had to pay tax on the annual gains.

This creates a kind of tax deferral that works something like a tax-sheltered retirement account, even though the money is in a taxable investment account.

Can tax-loss harvesting improve your investment performance?

Tax-loss harvesting is believed to have a significant positive impact on investment returns over the long run. Since the process is complex, and it has been calculated in somewhat different ways from different sources, it’s hard to pin down a definitive percentage improvement in the performance that it provides.

A study by Wealthfront shows that an investor could have increased after-tax investment returns by more than 1.55% per year between 2000 and 2013.

If the Wealthfront calculation is correct, it would mean increasing the after-tax investment return on a portfolio from say, 7% to 8.55%, and that could make a major difference.

If you were to invest $100,000 at 7% (non-TLH), the investment would be worth $386,968 after 20 years. If you were to invest the same $100,000 at 8.55% (with TLH), the investment would be worth $515,936 after 20 years.

That’s an additional $128,968 over 20 years!

Moral of the story: Tax-loss harvesting is well worth adding to your investment strategy.

Who does tax-loss harvesting?

You can probably do tax-loss harvesting on your own, but as I’ve already noted, it can be very complicated when you have multiple investments. You also have to be certain you don’t run afoul of wash-sale rules.

Popular robo-advisor platforms, like Wealthfront and Betterment, offer tax-loss harvesting, and it’s likely that other investment platforms do as well. A good financial advisor or wealth manager would also offer this service to their clients.

If you do some digging, you might be able to locate tax-loss harvesting software that can enable you to do it on your own. No recommendations here though, as I have not used any such software.

The best advice, however, is to invest with a platform or investment advisor that will handle it for you. Just make sure that you are not going to have to pay any extra fees for the service, which either reduce THL efficiency or cost so much that they eat away at the gains you receive from TLH.

Summary

Tax-loss harvesting is when you sell investments at a loss in order to reduce your tax liability. You can harvest losses to offset gains as well as up to $3,000 in non-investment income. According to the wash-sale rule, when you harvest losses, you cannot repurchase substantially identical investments for 30 days.

Tax-loss harvesting only applies to taxable investment accounts, not retirement accounts.

Tax-loss harvesting requires attention to detail, but it may be worth it. Studies have shown that regular tax-loss harvesting can increase long-term average annual investment returns by up to 1.55%.