Welcome to the Money Under 30 Investment Calculator, where you can plug and chug numbers to see how various types of investment might pay off over the years. Use this tool to find the expected annual growth rate for each so you can accurately predict your profits over a certain period of time.

Investment Calculator

How to Use the Investment Calculator

To use the investment calculator, simply input four numbers:

- Your initial investment amount

- How much you’ll continue investing each month, if anything

- The expected annual growth rate of the investment

- The number of years you expect to be invested

Note: This calculator works for the following types of investments:

- High-yield savings accounts (HYSAs)

- Certificates of Deposits (CDs)

- Money market accounts

- Retirement accounts

- Stocks

- ETFs

- Index funds

- Bonds

- REITs

Initial Investment

Your initial investment is simply how much you put in on day one.

Let’s say you open a Roth IRA with $250 of your graduation money. You plan to keep adding to it, of course, but for now, your initial investment is $250.

Similarly, if you were to buy $100 worth of a certain stock, your initial investment would be $100.

So your initial investment is just the first chunk of money that you put in.

How Much You’ll Invest Each Month

Again, this one is just as simple as it sounds. How much are you going to keep contributing to this specific investment over time?

Let’s say you earn $4,000 a month pre-tax and want to contribute $500 of it to your Roth IRA. Then $500 is the number you’ll put in this field.

It’s worth noting, too, that you can also put $0 in this field. You don’t have to make monthly contributions to every investment you make. To illustrate, it’s not uncommon for investors to buy, say, 10 shares of a certain stock and just let it sit in their portfolio and mature for a while.

That’s especially true for risky investments. You may want to wait and see how your investment performs before committing more money to it.

(Expected) Annual Growth Rate

Your expected annual growth rate is the amount your investment is projected to grow, expressed as a percentage.

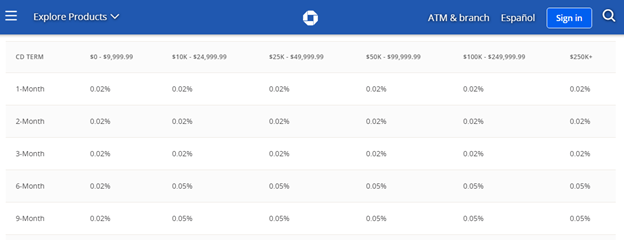

Sometimes, an expected annual growth rate is super straightforward. CDs, for example, have fixed interest rates that are guaranteed upfront so you’ll know exactly what your expected annual growth rate will be. Chase Bank’s CD guaranteed rate for a nine-month CD is 0.02%, so that’s what you’d put in this field.

Source: Chase

Other times, the expected annual growth rate of an investment may require a little additional research.

That’s why I’ve dedicated a whole section below to helping you find the expected annual growth rate of various investment types (e.g., savings accounts, stocks, crypto, etc.).

But first, let’s cover the final three fields of the investment calculator, including the last field you’ll have to enter:

Number of Years

Finally, the number of years is simply the amount of time you’ll wait to cash out your investment.

For example, if you’re 25 and you’re trying to determine how much your Roth IRA will earn before retirement at age 65, you’d put 40 in this field.

If you’re investing in index funds so you can buy a house in 10 years, you’d put 10 in this field.

The number of years you’re willing to keep your money invested is also known as your investment horizon. Since compound interest builds on itself, the longer your horizon, the more money you’ll earn.

Calculator outputs: final value vs. interest earned

Now let’s talk about the outputs.

Output No. 1: Final Value

The final value is the total value of your investment at the end of your investment horizon. Hopefully, this number is higher than you expected!

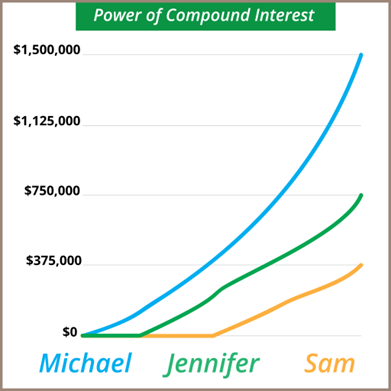

That’s because compound interest is the secret to wealth. If you invest enough money for a long enough time, it’ll build on itself and help you achieve financial independence much faster.

To illustrate the power of compound interest over time, here are three folks who invested the same amount of cash — just starting at different times. Michael started at 25, Jennifer at 35, and Sam at 45.

Source: Money Under 30

To learn more about the wealth-building superpower that is compound interest, check out If You Still Don’t Believe in the Power of Compound Interest, You Have to See This.

Output No. 2: Interest Earned

Finally, interest earned just shows you how much of your final value came from interest alone.

Final Value = Initial Investment + Monthly Contributions + Interest Earned

Therefore, interest earned can be a helpful metric for parsing out how much you contributed versus how much money your investment actually generated for you.

Now that you know how the Investment Calculator works, let’s talk about how to ID the expected annual growth rate of various types of investments (because it’s not always so straightforward).

Where Can I Find the Expected Annual Growth Rate for Various Types of Investments?

High-Yield Savings Accounts (HYSAs)

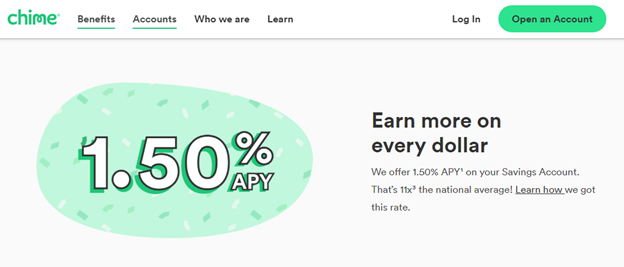

High-yield savings accounts are just regular savings accounts that pay out 10 to 20 times the national average for savings account interest rates — in today’s rates, that’s around 1.50% to 2.00%. Not a whole lot, but they’re zero risk and some even have sign-up bonuses of $150+.

Read more: Best High-Yield Savings Accounts Compared

To find the expected annual growth rate of a savings account, just look for the APY (annual percentage yield, aka that 1.50% to 2.00% number we discussed above).

Do note, however, that HYSA savings rates are variable — not fixed. So your final value isn’t guaranteed.

Source: Chime

Certificates of Deposit (CDs)

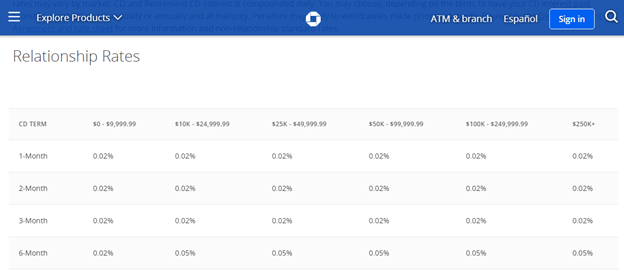

Unlike with savings accounts, CD interest rates are fixed — meaning you’ll know your exact expected annual growth rate upfront.

The tradeoff is that with CDs, your money is locked in — you can’t withdraw it until the CD reaches its maturity date (i.e., expiration date).

CD rates are also super low these days, averaging just 0.46% for six months according to the Fed. So your money is probably better off sitting in an HYSA, if nothing else.

Still, it’s good to be aware of CDs as an option in case rates go back up.

Read more: Best CD Rates, Updated Daily

To find the expected annual growth rate of a CD, just look for the percentage “rates” in the chart:

Source: Chase

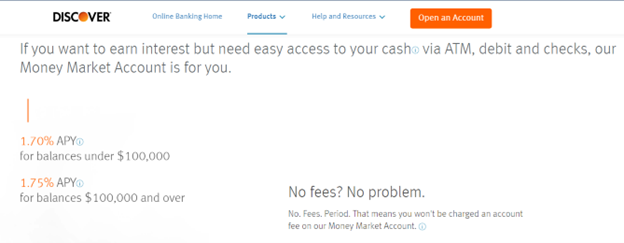

Money Market Accounts

Money market accounts are like hybrid checking and savings accounts. They generate interest like a savings account, but you can also write checks from them like a checking account and set up automatic bill pay.

Some money market accounts also have tiered interest rates, like 1.50% for balances of $10,000 or higher, 2.00% for $50,000 and higher, etc.

Read more: Best Money Market Accounts

To find the expected annual growth rate on a money market account, look for the APY:

Source: Discover

Retirement Accounts (401ks, Roth IRAs, etc.)

If you’re new to retirement planning, here’s the skinny: retirement accounts are special savings accounts that generate higher amounts of interest (think 7% compared to 2%) and have various tax advantages, but can’t be accessed without penalty before age 59 and a half.

Anyways, the expected annual growth rate of a retirement account can vary based on the mix of stocks, bonds, and index funds inside of it. But the median expected annual growth rate of a retirement account tends to be around 7%.

Do keep in mind that if you set your number of years for before you turn 59 and a half, you’ll incur penalties for early withdrawal.

Read more: Beginner’s Guide to Saving for Retirement

Stocks, ETFs, and Index Funds

Stocks are little tiny shares of companies that rise and fall in value based on the company’s performance, sector performance, the health of the overall economy, and countless smaller factors.

ETFs are like baskets of stocks that you can invest in all at once, united by a common theme. For example, instead of investing in 50 different solar power stocks, you can invest in a single solar ETF that contains 50 stocks and see similar performance (and save time and fees).

Finally, index funds are ETFs that represent an entire index like the S&P 500. Therefore, investing in an index fund is tantamount to investing in the stock market as a whole.

I grouped stocks, ETFs, and index funds together because you can find the expected annual growth rate for all three the same way: Google the CAGR, or “compound annual growth rate.”

The CAGR averages past performance and is often used to assess a possible trajectory of future performance. Microsoft, for example, has a CAGR of 15.5% — which is why it’s widely considered a “blue chip” stock that’s reliable and consistent.

Read more: Getting Started with Stocks: The Beginner’s Guide to the Markets

Bonds

A bond is like an IOU. You’re lending money to a corporation, your local municipality, or even the U.S. government, and they pay you back with interest.

Kinda empowering, no?

Anyways, bonds are widely considered to be safe investments and can even provide a stream of passive income via dividends.

Read more: How Does a Bond Work? A Simple (and Informative) Guide

You can find the expected annual growth rate for a bond by looking for the “Yield.” For example, Treasury I Savings Bonds, or I Bonds, change their yield every six months to match the rate of inflation. So the yields on I Bonds are 9.62% in September 2022.

Real Estate and Real Estate Investment Trusts (REITs)

Calculating the expected annual growth rate of a single piece of real estate can be pretty tricky. There are just too many variables like unforeseen expenses and troublesome renters that can render moot any expected growth.

That’s not to say you shouldn’t invest in real estate — just that the returns on a specific piece of property can be hard to estimate with a simple investment calculator.

Read more: Can You Make Money in Real Estate? Here’s What the Experts Say

REITs, on the other hand, are companies that own multiple pieces of real estate, from homes to office buildings to warehouses. They’re required to pay out 90% of their earnings as dividends, so you can use dividend yield as a rough substitute for the expected annual growth rate.

Read more: Investing in REITs: Everything You Need to Know

Crypto

Finally, there’s crypto.

Love it or hate it, crypto is both too new — and too unpredictable — to have an expected annual growth rate. Even LUNA, which was touted as an interest-bearing stablecoin that became the sixth most popular crypto on Earth — lost 99.9999% of its value overnight.

Therefore, I would strongly advise not putting any crypto in the investment calculator since you can’t bank on any of the numbers it gives you.

Read more: How to Invest in Cryptocurrency: A Beginner’s Guide

The Bottom Line

Now that you know how much you can possibly earn from different types of investments, I’d recommend taking our short quiz to determine your risk tolerance. Because while earning high returns feels great, investing within your comfort level feels even better.

And for more on accelerating your path to financial independence, stick with Money Under 30.