Betterment Review: The Way Investing Should Be

Rating as of based on a review of services February 24, 2023.

Ranking

9/10

Betterment is one way to invest for anybody who doesn’t want to worry about picking stocks or mutual funds. Rather than creating an online brokerage account and facing tens of thousands of investment choices, Betterment automatically allocates your money across different stocks and bonds based on your goal details. The platform is easy to use, has low fees, and is a great way to get started with investing.

If you’ve been avoiding investing because you don’t know how it works, that’s no longer a problem.

Betterment can provide automated investment management, from portfolio creation to periodic rebalancing and reinvesting.

You’ll have your choice of a taxable account or a tax-sheltered retirement account. And they perform all these functions for a very low annual advisory fee.

Once you open an account, all you need to do is enter your goal details and fund it – Betterment takes care of everything else.

About Betterment

Founded in 2008, Betterment is the largest independent online financial advisor, now commonly referred to as a “robo-advisor.”

Dozens of robo-advisors have come about since, with nearly every major brokerage in America creating at least one of its own. But Betterment remains the largest independent robo-advisor with over $33 billion in assets under management as of 2022.

Betterment provides automated investment management comparable to traditional human investment advisors but at a fraction of the cost.

Using the service, investors can have diversified ETF portfolios including stocks and bonds in thousands of companies, with virtually any amount of money they have to invest (you just need $10 to get started). Betterment offers both taxable accounts and tax-sheltered retirement accounts.

How Betterment works

Betterment Uses MPT to Choose Investments for You

As is typical of robo-advisors, Betterment uses Modern Portfolio Theory (MPT) to create and manage your investment portfolio. It’s an investment strategy that emphasizes asset allocation based on targeted risk levels.

You begin by completing a questionnaire that asks about your investment goals, time horizon, and other details. The answers you give are used to create a personalized portfolio recommendation.

There are multiple portfolio strategies to choose from and all but two include a mix of stocks and bonds. The default strategy, Core Portfolio, is widely diversified and designed for long-term investing goals.

Betterment then suggests investments to you depending on your risk tolerance with options ranging from conservative (more bonds, fewer stocks) to aggressive (more stocks, fewer bonds). If you’re a little more experienced, you can choose a Flexible Portfolio and adjust your asset weightings yourself.

Betterment Invests in 13 Different Asset Classes

As a Betterment investor, your portfolio is made up of investments in a variety of ETFs. There are six different categories of stocks and seven different categories of bonds you might invest in for a total of 13 asset classes.

These include U.S. Total Stock Market stock funds, Large-Cap stock funds, International Developed Market stock funds, and more. Betterment may also allocate your money to bonds including U.S. High Quality Bonds, U.S. Municipal Bonds, and several others. We’ll talk more about all the classes later.

With the use of index funds, investment expenses are minimal, which means fewer fees for you.

Betterment Manages Your Account

Once your portfolio has been created, Betterment manages it for you until you close your account. Betterment will provide periodic rebalancing, to help keep each asset class consistent with the target investment percentage. They’ll also reinvest dividends to help you reach your targets.

Betterment Provides Tax-Loss Harvesting

On taxable accounts, Betterment offers tax-loss harvesting. This is a strategy in which losing asset positions are sold off near year-end to offset gains in other asset classes. The losing asset classes are later replaced with comparable ETFs to maintain your portfolio’s target asset allocation.

Betterment Investment Methodology

Betterment invests in both U.S. and international stocks and bonds. This is typical of many robo-advisors.

You can choose a portfolio strategy to match your values. For example, if you’re interested in socially responsible investing, the Broad Impact, Climate Impact, and Social Impact strategies will focus on companies dedicated to these causes.

Value Stocks

Betterment offers one asset class feature that’s unusual among robo-advisors. Of the six stock asset classes included in their portfolios, three represent value stocks. They’re offered for large-, mid-, and small-cap U.S. stocks.

Value stocks trade at a lower price than a company’s fundamentals indicate. Those fundamentals can include dividend yield, price-to-earnings ratio, and revenue growth. The companies are financially stable, but their stocks trade at low prices relative to competitors.

Investing in value stocks is often a successful investment strategy. Value stocks tend to outperform the general stock market in the long run.

Financial Advising

Another unique feature of Betterment is that they provide financial advisors for accounts with balances over $100,000. This is included with the Betterment Premium plan for a higher management fee of 0.40%. Traditional financial advisors may charge fees equal to between 1% and 2% of your balance.

Betterment Investment Mix

The Betterment investment mix applies to both the Digital and Premium plans (see descriptions of each under “Betterment Fees and Pricing”). The tables below show the ETFs used for the six stock asset classes and seven bond asset classes.

For each stock asset class, there are three ETFs used. This is done to enable tax-loss harvesting so that Betterment can liquidate one ETF in an asset class and replace it.

But notice the use of alternative ETFs is much more limited with bond allocations. Six of the seven bond classes have no alternative ETFs at all. That’s because bonds, which focus primarily on interest income, are less likely to generate significant capital gains requiring tax-loss harvesting.

Betterment Stock Asset Classes and ETFs:

Asset Class Primary ETF Secondary ETF Secondary ETF

U.S. Total Stock Market Vanguard US Total Stock Market (VTI) Schwab US Broad Market ETF (SCHB) iShares S&P 1500 Index Fund (ITOT)

U.S. Value Stocks – Large Cap Vanguard US Large-Cap Value (VTV) Schwab US Large Cap Value ETF (SCHV) SPDR Portfolio S&P 500 Value ETF (SPYV)

U.S. Value Stocks – Mid Cap Vanguard US Mid-Cap Value (VOE) iShares Russell Midcap Value Index (IWS) iShares S7P Mid-Cap 400 Value Index (IJJ)

U.S. Value Stocks – Small Cap Vanguard US Small-Cap Value (VBR) iShares Russell 2000 Value Index (IWN) SPDR S&P 600 Small Cap Value ETF (SLYV)

International Developed Market Stocks Vanguard FTSE Developed Markets (VEA) Schwab International Equity ETF (SCHF) iShares Tr/Core MSCI EAFE ETF (IEFA)

International Emerging Market Stocks Vanguard FTSE Emerging Markets (VWO) iShares Inc/Core MSCI Emerging (IEMG) SPDR Portfolio Emerging Markets ETF (SPEM)

Betterment Bonds:

Asset Class Primary ETF Secondary ETF Secondary ETF

U.S. High Quality Bonds iShares Barclays Aggregate Bond Fund (AGG)

iShares National Muni Bond ETF (MUB) with Tax CoordinationN/A N/A

U.S. Municipal Bonds iShares National Muni Bond ETF (MUB) SPDR Nuveen Barclays Capital Muni Bond (TFI) N/A

U.S. Inflation-Protected Bonds Vanguard Short-term Inflation Protected Securities (VTIP) N/A N/A

U.S. Short-term Treasury Bonds Goldman Sachs Access Treasury 0-1 Year ETF (GBIL) N/A N/A

U.S. Short-term Investment Grade Bonds JPMorgan Ultra-Short Income ETF (JPST) N/A N/A

International Developed Market Bonds Vanguard Total International Bond (BNDX) N/A N/A

International Emerging Market Bonds iShares Emerging Markets Bond (EMB) Vanguard Emerging Markets Government Bond (VWOB) PowerShares Emerging Markets PCY Debt (PCY)

Socially Responsible Investing (SRI)

SRI is an investment strategy that invests in companies that meet certain social, environmental, and governance rules.

Betterment offers three different socially responsible portfolio strategies: Broad Impact, Climate Impact, and Social Impact.

Broad Impact invests in a wide variety of companies that meet many environmental, social, and corporate governance criteria. Climate Impact does the same with a focus on environmental qualifiers. Social Impact prioritizes companies working toward diversity and inclusion initiatives.

Each of the 13 stock and bond asset class ETFs in a regular portfolio can be replaced with SRI alternatives. Two or more ETFs may replace one asset class. Like a standard portfolio, the SRI portfolio offers tax-loss harvesting.

Higher bond allocations in your portfolio decrease the percentage attributable to socially responsible ETFs.

Goldman Sachs Smart Beta

This portfolio is managed by Goldman Sachs and is designed to outperform conventional market strategies. Unlike typical robo-advisor portfolios, which are passively managed by design, smart beta involves active management.

That means the fund manager buys and sells securities in an attempt to outperform the benchmark index. This strategy allocates 70% of your money to stocks and 30% to bonds.

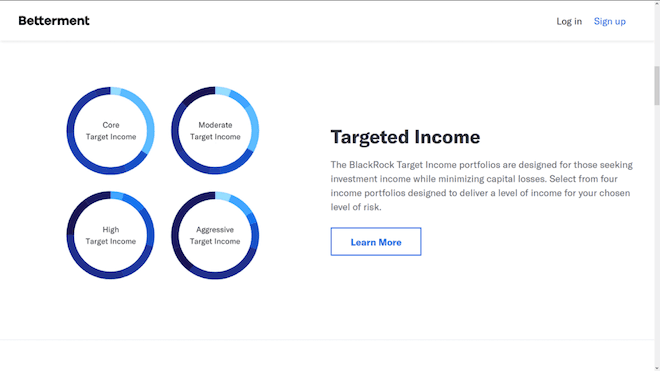

BlackRock Target Income Portfolios

BlackRock Target Income portfolios are for investors looking for steady income who want to minimize their capital losses. When you choose this strategy, you invest in bonds only. Betterment offers four different Target Income portfolio allocations:

Flexible Portfolios

This is another unique Betterment feature. Most robo-advisors choose your portfolio and allocation for you.

Betterment offers a Flexible portfolio option that lets you adjust individual asset class weights yourself. You can’t choose which ETFs to invest in, but you can change the allocations of your investments and increase or lower your position in certain asset classes.

Tax Coordination

When you choose the Tax Coordination feature, Betterment holds assets likely to generate large tax liabilities in tax-sheltered accounts like IRAs. Investments with lower tax liabilities are placed in taxable accounts.

For example, ETFs generating capital gains are typically held in taxable accounts, since long-term capital gains benefit from lower tax rates.

Features and Benefits

Minimum Initial Investment

You can open an account and begin investing with as little as $10.

Available Accounts

Available accounts include:

- Taxable individual and joint brokerage accounts.

- Traditional, Roth, SEP, and Roth conversion IRAs.

- Trusts and non-profit accounts.

- 401(k) plans.

Betterment Cash Reserve

Betterment Cash Reserve offers a nice interest rate of 2.25% APY. There’s no minimum balance required and no fees to worry about.

Another great feature that many savings accounts don’t offer is unlimited withdrawals from your account. Typically, you only get six withdrawals per month.

Betterment Cash Reserve APY Disclosure - Annual percentage yield (variable) is as of 9/26/2022. Cash Reserve is only available to clients of Betterment LLC, which is not a bank, and cash transfers to program banks are conducted through the clients’ brokerage accounts at Betterment Securities.For Cash Reserve (“CR”), Betterment LLC only receives compensation from our program banks; Betterment LLC and Betterment Securities do not charge fees on your CR balance.

Betterment Checking

Betterment also offers a checking account with no fees and no minimum balance. Plus, your ATM fees are reimbursed worldwide.

Best of all, your Betterment checking account also comes with a Betterment Visa® Debit Card that earns cash back on purchases from participating brands. Rewards are available at more than 10,000 merchants worldwide, both online and in-person (for online shopping, you’ll need to shop through Betterment’s “Earn Rewards” section on the site or app).

Cash back is automatically deposited into your account within 90 days. To make earning rewards easier, Betterment remembers where you shop most to show you relevant offers. You can also use the app’s locator to find offers in your area.

If you’re getting started with investing, the extra money in your account each month could give you the funds you need to boost your portfolio.

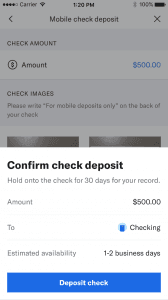

Mobile Check Deposits

Mobile check deposits are available through the app. This feature is convenient and straightforward to use.

Checking accounts and the Betterment Visa Debit Card provided and issued by nbkc bank, Member FDIC. Checking made available through Betterment Financial LLC. Neither Betterment Financial LLC, nor any of their affiliates, is a bank. Betterment Financial LLC reimburses ATM fees and the Visa® 1% foreign transaction fee worldwide, everywhere Visa is accepted.

Eligible when using your Betterment Visa® Debit Card with rewards deposited back in your Betterment Checking account after qualifying purchases. Cash back merchants and offers may vary. Anonymized transaction data is shared with our rewards partner, Dosh, to provide relevant offers. Terms subject to change.

Financial Advice Packages

Robo-advisors give investors a hands-off way to grow their wealth, but sometimes you need direct financial advice too. Betterment offers five different packages to help you plan for the future with a hand from dedicated financial experts.

This is a premium service that costs extra. The prices are:

- Getting Started Package – $299.

- Financial Checkup Package – $399.

- College Planning Package – $399.

- Marriage Planning Package – $399.

- Retirement Planning Package – $399.

External Account Syncing

Similar to financial account aggregators like Empower, Betterment lets you add external accounts to your Betterment account. The platform doesn’t actually manage them, but adding them to your account can give you a better overview of your finances. Betterment will also provide advice about your outside investments (if you have the Premium plan).

For example, you can sync an employer-sponsored retirement plan such as a 401(k). Betterment can then make recommendations on how to better manage this account and others.

(Personal Capital is now Empower)

Betterment Mobile App

Betterment offers its mobile app with all the functions and capabilities of the web version. It’s available in the App Store for iOS devices 11.0 and later and compatible with iPhones and iPads.

It’s also available on Google Play for Android devices 6.0 and up.

Deposits and Withdrawals

The most convenient way to make a deposit into your account is through electronic transfers from your checking account via the ACH network.

You can also transfer assets from outside brokerage accounts using the Automated Customer Account Transfer Service (ACATS). Transfers from retirement accounts can be completed through IRA rollovers.

Transferred funds are automatically invested within one or two business days. Betterment does not accept deposits made by check or by credit or debit cards. Wire transfers are recommended only for large transfers due to the fees involved.

Customer Service

Betterment can be contacted by either phone or email, Monday through Friday, from 9:00 am to 6:00 pm Eastern Time.

Betterment Account Protection

Your account is protected by coverage from the Securities Investors Protection Corporation (SIPC) for up to $500,000 in securities (including up to $250,000 in cash).

For additional account security, you can set up two-factor authentication. This can protect your account even if your password is compromised.

Two-factor authentication requires you to enter a unique verification code to access your account. You can receive the code either by text or email.

Betterment Fees and Pricing

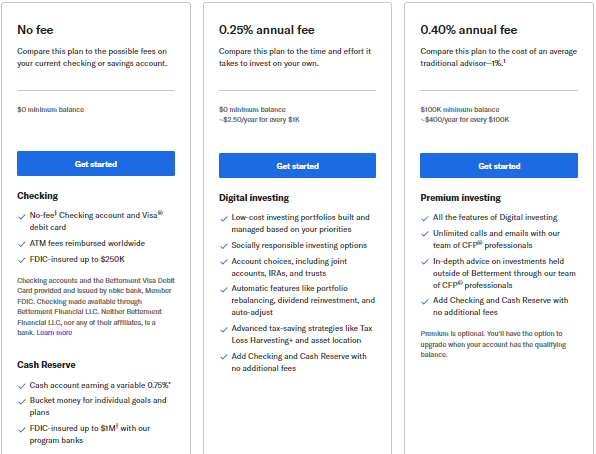

Betterment offers three different plans, each with its own fee schedule. The plans and pricing are as follows:

Betterment pricing structure for each of the three plans.

Pricing structure for each of the three Betterment plans.

The Digital plan is the basic service and applies to account balances under $100,000. There is no minimum balance required. This plan offers all automatic features and advanced tax-saving strategies.

The Premium plan requires a minimum balance of $100,000 and offers external account syncing as well as unlimited access to certified financial planners.

Read More:

Pros & cons

Pros

- Low minimum initial investment — Open an account with as little as $10.

- Low annual fee — The annual advisor fee is on the lower end of the robo-advisor range.

- Complete investment management — Your entire account is managed for just 0.25% a year.

- Tax-loss harvesting offered on taxable accounts — This strategy is built to help minimize the tax liability generated by your investments.

- Value investing in several stock asset classes — Three stock asset classes offer this highly successful investment strategy.

- Earn cash back with a Betterment checking account — If you open a Betterment checking account, you can automatically earn cash back from thousands of popular retailers that you can then invest.

Cons

- Limited investments — Investments are limited to stocks and bonds. There are no other alternatives.

- Higher annual fee on larger portfolios — You pay an annual fee of 0.40% for balances over $100,000. Although this includes extra support, this fee is high for a robo-advisor.

Betterment Compared

Who Is Betterment a Good Option For?

Betterment certainly won’t work for anyone who prefers self-directed investing. That’s simply not what they’re about. But there are others who may be very interested in opening a Betterment account.

New Investors

There’s a low minimum initial investment, which makes Betterment perfect for new investors. You can open an account and fund it with as little as $10.

Passive Investors

Maybe you know quite a lot about investing but you have a demanding job and an active personal life. You may prefer low-cost professional investment management as an alternative to managing your own portfolio.

Hybrid Investors

You might prefer self-directed investing for part of your portfolio but want at least some of it professionally managed. Betterment is the perfect management option for that purpose, given its low annual advisory fee.

Summary

Betterment is one of the best robo-advisors for new investors. With their low annual fees and no minimum investment requirements, almost anyone can open an account.

Betterment Cash Reserve Disclosure - Betterment Cash Reserve ("Cash Reserve") is offered by Betterment LLC. Clients of Betterment LLC participate in Cash Reserve through their brokerage account held at Betterment Securities. Neither Betterment LLC nor any of its affiliates is a bank. Through Cash Reserve, clients' funds are deposited into one or more banks ("Program Banks") where the funds earn a variable interest rate and are eligible for FDIC insurance. Cash Reserve provides Betterment clients with the opportunity to earn interest on cash intended to purchase securities through Betterment LLC and Betterment Securities. Cash Reserve should not be viewed as a long-term investment option. Funds held in your brokerage accounts are not FDIC‐insured but are protected by SIPC. Funds in transit to or from Program Banks are generally not FDIC‐insured but are protected by SIPC, except when those funds are held in a sweep account following a deposit or prior to a withdrawal, at which time funds are eligible for FDIC insurance but are not protected by SIPC. See Betterment Client Agreements for further details. Funds deposited into Cash Reserve are eligible for up to $1,000,000.00 (or $2,000,000.00 for joint accounts) of FDIC insurance once the funds reach one or more Program Banks (up to $250,000 for each insurable capacity—e.g., individual or joint—at up to four Program Banks). Even if there are more than four Program Banks, clients will not necessarily have deposits allocated in a manner that will provide FDIC insurance above $1,000,000.00 (or $2,000,000.00 for joint accounts). The FDIC calculates the insurance limits based on all accounts held in the same insurable capacity at a bank, not just cash in Cash Reserve. If clients elect to exclude one or more Program Banks from receiving deposits the amount of FDIC insurance available through Cash Reserve may be lower. Clients are responsible for monitoring their total assets at each Program Bank, including existing deposits held at Program Banks outside of Cash Reserve, to ensure FDIC insurance limits are not exceeded, which could result in some funds being uninsured. For more information on FDIC insurance please visit www.FDIC.gov. Deposits held in Program Banks are not protected by SIPC. For more information see the full terms and conditions and Betterment LLC's Form ADV Part II.