For most folks, buying a home will be the biggest purchase of your life. For that reason, you’ll want to get a killer deal!

Now, getting a deal on a house comes in two parts:

- The price of the home, and

- Your interest rate, aka mortgage rate

Because unless you’re paying cash, you’ll need to finance the amount of money you borrow to buy the house – and getting a low rate on that loan can save you (no joke) hundreds a month and $100,000+ over 30 years.

So let’s get it done! Let’s cover what mortgage rates are and how they work, what the best rates are, and how to maximize factors that will lower your rates.

Let’s crush some mortgage rates!

What’s Ahead:

Current mortgage interest rates

How do mortgage rates work?

As hinted in the intro, understanding your mortgage rate and getting a good one can literally save you $500+ a month and $100,000 over the course of the mortgage.

So let’s step back; what are mortgage rates, how do they work, and what does “The Fed” have to do with all this?

What is a mortgage?

A mortgage is just a special type of loan used to buy real estate. The word comes from the Old French term “morgage,” meaning “death pledge.”

Yikes. I would’ve been fine with calling it a “property loan,” but sure.

Anyways, most folks can’t afford a $300,000 home so they’ll pay what they can, borrow the rest, and pay it off over 15 or 30 years.

Here’s a breakdown of a typical mortgage, courtesy of our Simple Mortgage Calculator:

- Home price: $300,000

- Down payment: $30,000

- Principal (aka mortgage amount): $270,000

- Mortgage rate: 8.000%

- Term: 30 years

- Total monthly mortgage payment, before taxes and insurance: $1,981.16

Now that you know what a typical mortgage looks like, let’s zero in on the mortgage rate and how it works.

What is a mortgage rate?

Your mortgage rate is the interest rate you pay on your mortgage.

They come in two flavors:

- Fixed-rate mortgages have interest rates that are locked in, never to change over the course of the term

- Adjustable-rate mortgages or ARMs have rates that do change based mostly on outside economic factors.

Although your monthly payment doesn’t change either way – just the amount of your payment that goes towards your principal versus interest (explained below) – 95% of folks still choose a fixed-rate mortgage because they’re simpler and lower risk.

We’ll discuss fixed- versus adjustable-rate mortgages in a future piece, but for now, let’s stick with the basics and continue breaking down fixed-rate mortgages.

How do mortgage rates work?

Let’s circle back to the example given above, where you took out a $270,000 mortgage at 8%, resulting in a monthly payment of $1,981.16.

You might’ve noticed that something didn’t add up: 30 years of 12 monthly payments is 360 payments, and 360 x $1,981.16 = $713,217.60. That’s way more than the $270,000 you borrowed.

Is your lender really charging you a “fee” of $443,217.60 to borrow $270,000?

Yep! That’s why getting a low mortgage rate is mega, mega important.

Now, when you make a monthly mortgage payment, some of it will go towards paying your principal ($270,000) and some will go towards paying off your interest ($443,217.60).

For the first few years, your lender will apply most of your payment towards interest so they can collect their fee faster and stay in business. Between years 15 and 30, the majority of your payment will go towards paying off your principal.

This is what’s known as an amortization schedule, where the amount your lender applies to your interest vs principal changes over time. Understanding amortization means you won’t overestimate your percentage ownership in your home at a given time.

| Month | Payment | Interest | Principal | Balance left |

|---|---|---|---|---|

| 1 | 1,981.16 | 1;386.81 | 594.35 | 269,405.65 |

| 2 | 1,981.16 | 1;367.00 | 614.16 | 268,791.49 |

| 3 | 1,981.16 | 1;347.19 | 633.97 | 268,157.52 |

| 358 | 1,981.16 | 369.23 | 1,584.93 | 3,189.67 |

| 359 | 1,981.16 | 376.42 | 1,604.74 | 1,624.55 |

| 360 | 1,981.16 | 365.61 | 1,624.55 | 0 |

Now let’s discuss why mortgage rates are super, mega important.

Does a one percent increase really matter that much?

Hoo boy, yes it does.

Check it what happens if you raise or lower the rate on your $270,000 mortgage by just 1.5%, courtesy of our Simple Mortgage Calculator:

| Mortgage amount | Mortgage rate | Mortgage monthly payment |

|---|---|---|

| 270,000 | 7.5% | 1,887.88 |

| 270,000 | 8% | 1,971.16 |

| 270,000 | 8.5% | 2,076.07 |

| 270,000 | 9% | 2,172.48 |

As you can see, getting just a 0.5% better mortgage rate can lower your monthly payments by nearly $100, every month, for 30 years.

If we double the mortgage, the stakes get even higher:

| Mortgage amount | Mortgage rate | Monthly mortgage payment |

|---|---|---|

| 540,000 | 7.5% | 3,775.76 |

| 540,000 | 8% | 3,962.33 |

| 540,000 | 8.5% | 4,152.13 |

| 540,000 | 9% | 4,344.96 |

So in more expensive markets, 1.5% amounts to $569.20 per month in savings – enough to finance a car!

For more on the difference a fraction of a percent can make, check out How Much Does a 1% Difference in Your Mortgage Rate Matter?

That’s why nailing a good rate matters so much. So let’s dive into factors that fall within your control, and how you can maximize them to lower your rate as much as possible!

Factors that impact your mortgage rate

How does a lender calculate the mortgage rate they offer you?

Well, it’s a combination of factors both within and outside of your control. Understanding both can help you time the market and prepare your finances to score the lowest possible rates with lenders.

Factors within your control

To preface, “within your control” is relative. These are just slightly more in your control than, say, the global economy.

Your credit score – Your credit score makes a huge difference in your mortgage rates. Raising your score from 660 to 740, for example, can lower your rates by 0.5%. To learn more and improve your numbers, check out How To Improve Your Credit Score, Step By Step.

Your down payment – If you can increase your down payment to 20%, you’ll lower your mortgage rate and eliminate the need to pay for private mortgage insurance.

Your debt-to-income ratio – Mortgage lenders don’t just look at your income, but the amount of your income that goes to debts each month (student loans, car payment, etc.).

Your lender – Like car insurance providers, lenders see people differently and will charge various rates – emphasizing the importance of shopping around for both.

Your loan type – Government-subsidized mortgages like VA, USDA, and FHA loans have lower rates. To see if one of these is a fit, check out A Beginner’s Guide To Mortgage Loans.

Home type – Condos often have higher mortgage rates than single family homes or townhomes.

Home use – Borrowers who intend to live in the house as a Primary Residence get the best rates. People borrowing to buy rentals or vacation homes typically get charged more.

Your income type – W-2 salaried employees often get better loan rates than 1099/self-employed folks due to their perceived steadier income. Granted, this may not be something under your control! For more, check out Getting A Mortgage When You’re Self Employed: MU30’s Complete Guide.

Your cosigner – Finally, if you have a cosigner – family, spouse, etc. – each of their factors listed above can greatly affect your terms. Speaking from personal experience, listing a W-2 earner as the Primary Borrower can massively improve your mortgage terms.

Factors outside of your control

The national and local real estate market – If you’re borrowing to buy a house in a hot market, you may pay a higher mortgage rate due to simple supply and demand.

The Federal Reserve – The U.S. central bank indirectly impacts mortgage rates by making it more expensive for all the other bands to lend money.

The greater economy – Mortgage rates aren’t immune from inflation, as banks charge more for mortgages to cover rising their upkeep (wages, overhead, etc.)

How do you get the best mortgage rate?

Now that you’ve digested all of that info, let’s get down to brass tacks: how can you score the lowest possible mortgage rate?

Raise your credit score

Step 1, of course, is to raise your credit score as high as possible before applying for mortgages. Because again, boosting your numbers to the 700s can lower lower your monthly payment by hundreds.

Maximize your down payment

I know it’s difficult in this (or any) market, but the closer you and your cosigner can get to 20%, the more you’ll cleave off your monthly payment. A higher down payment lowers your principal, your rate, and reduces (or eliminates) the number of months you’ll pay for private mortgage insurance (PMI).

For more, check out our feature-plus-video on How much house can I afford?

Understand your cosigner’s finances

If you’re buying a home with a spouse, partner, or family member, you’ll want to consider that their finances will greatly affect your mortgage rates, too. That includes their credit score, debt-to-income ratio, income type (W-2 or 1099), past two years of tax returns, and more.

If your partner is a W-2 salaried employee with excellent credit and a low debt-to-income ratio, putting them down as the Primary Borrower on your loan applications can greatly reduce your combined rate.

By contrast, if they have a little work to do, consider sitting down and going through our guide How To Get Approved For Your First Mortgage together for a joint financial checkup.

Find the right lender

No two lenders are quite the same. From big banks to tiny credit unions, lenders can vary greatly in:

- Minimum down payment

- Required credit score

- Special rates for first-timers

- Customer service

- Availability and responsiveness (i.e. are they willing to draft up a last-minute offer for you on a Saturday night)?

That last bullet is why you shouldn’t necessarily default to using your bank as your mortgage lender, as big banks can move slowly and can cost you opportunities. Instead, check out my list of the 7 best mortgage lenders for first-time home buyers.

Compare mortgage rates

It might be easy to Google around and see which major lender currently offers the lowest rates. But advertised rates and your rates can (and will) vary.

That’s why it’s so important to shop around lenders. Each will see you differently and rates between lenders can easily vary by a full percentage.

Plus, shopping around multiple lenders also lets you monitor other critical metrics, like how quickly they respond and how much they seem to care about helping you score a deal.

Mortgage rate FAQs

Why were mortgage rates so low during the pandemic?

It’s a bit of a complex issue, but here’s an (over)simplification: to keep the economy going during COVID, the Fed kept interest rates extremely low, which encouraged more lending and essentially “oiled” the economy.

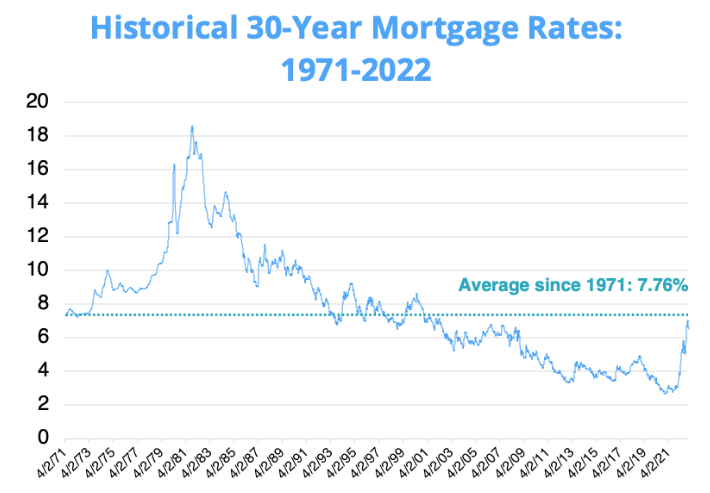

Now that rates are rising, is 2023 a bad time to buy?

Not necessarily. For perspective, the average mortgage rate for someone with Excellent credit (740+) was 6.976% on November 30th, 2022. That’s still below our national, historical average. Plus, with rents so high, the faster you can own property and build equity, the better (generally speaking).

Freddie Mac data, compiled by TheMortgageReports.com

What are “discount points”?

Discount points are chunks of your loan amount you can pay upfront to lower your interest rate. Each “point” is 1% of your loan amount, so if you borrow $270,000, one point would be $2,700 and 0.125 points (a common increment) would be $337.50.

Your lender can help you decide how many points (if any) are worth paying to lower your interest rate, typically based on how long you plan to live in the house.

At what point in the homebuying process should I be applying for a mortgage?

Generally speaking, it’s best to start applying after you have your finances ready and before you start looking at houses. That’s because modern sellers tend to only take you seriously if you have a preapproval letter in-hand (or the money to pay cash).

Is there a way to see my potential mortgage rates without affecting my credit score?

No. It’s a chicken or the egg thing. Lenders can’t provide you with accurate rates until they see your detailed credit report, and they can’t see that without a hard credit check.

That said, you can still get prequalified with self-reported data to see ballpark rates. Check out our Mortgage Prequalification Calculator.

The bottom line

I know, that was a lot to chew on. Mortgage rates are complicated, but the more you know, the lower your rate can be – eventually saving you tens of thousands on your new home.

And for more on crushing the home buying process, check out my guide on How to find the best real estate agent.