J.P. Morgan Self-Directed Investing Review: Easy To Manage Investing For Newbies

Rating as of based on a review of services April 11, 2023.

Ranking

8.6/10

J.P. Morgan Self-Directed Investing offers Chase clients and new investors a clean and intuitive, if basic, investing toolkit. Here’s MU30’s full review!

Best for:

- Chase clients

- New investors

- Basic trades

In the never-ending battle of the brokers, the big online trading platforms continue to viciously vie for signups from young investors, piling on features and getting caught in the regulatory crosshairs for growing too fast.

If you’re a more casual trader, however, you may be seeking somewhere calm, simple, and controversy-free. If so, J.P. Morgan Self-Directed Investing (SDI) may be an ideal fit.

Though limited in features, SDI lends tremendous convenience to existing Chase customers and invites newbies into the fold with a crisp, intuitive platform and robust customer support.

So what exactly can (and can’t) SDI do? How do they compare to both casual and advanced trading platforms? Can SDI offer non-Chase customers enough to keep them interested?

Let’s investigate J. P. Morgan Self-Directed Investing.

What is J.P. Morgan Self-Directed Investing?

J.P. Morgan Self-Directed Investing is Chase Bank’s stock market trading platform. SDI allows you to buy, sell, and trade the following investment products:

- Stocks.

- ETFs.

- Options.

- Mutual funds.

- Bonds.

And offers the following account types:

- General investment.

- Traditional IRA.

- Roth IRA.

How does J.P. Morgan Self-Directed Investing work?

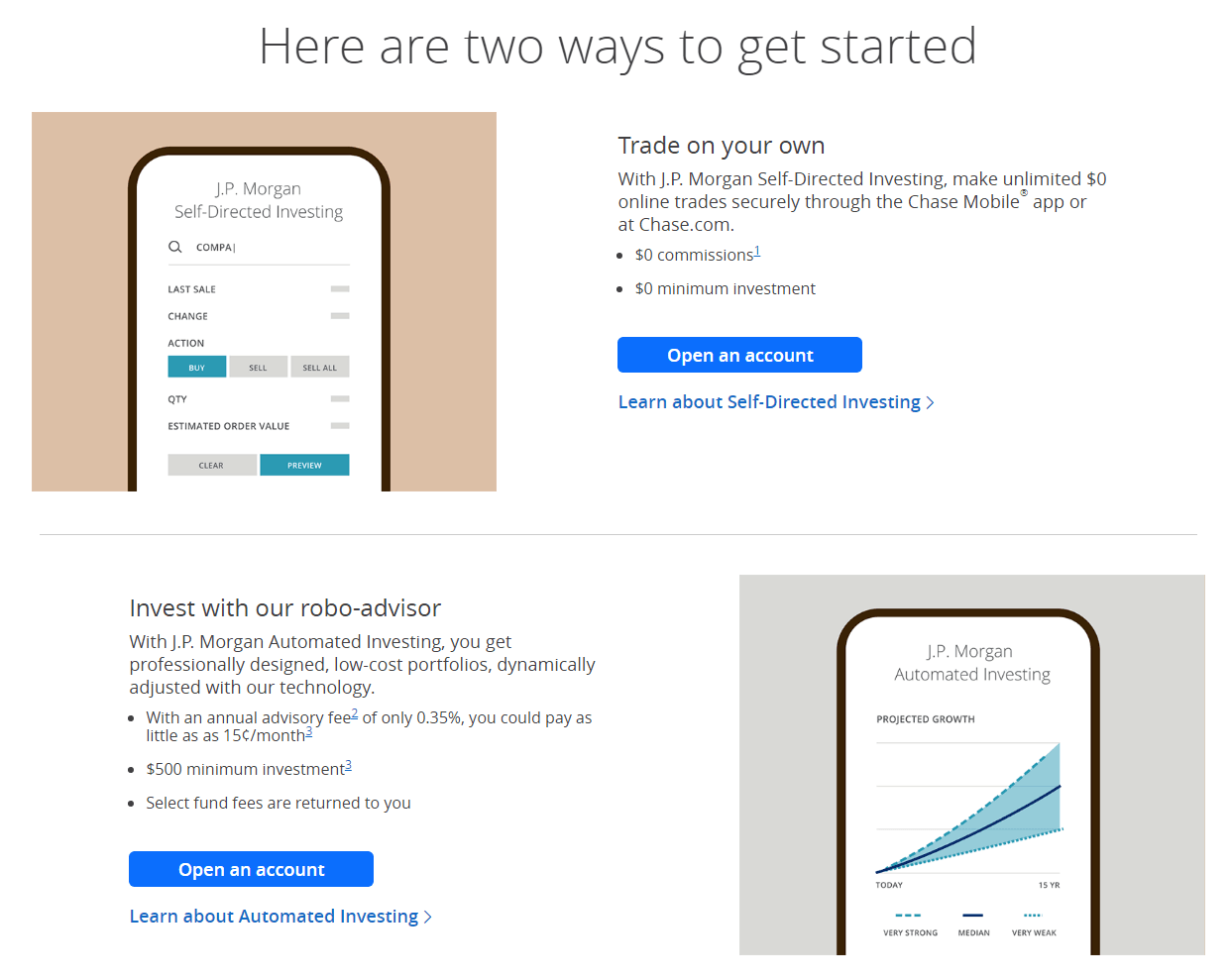

To open a J.P. Morgan Self-Directed Investing account, you’ll head to the landing page for Chase’s two investing accounts. There, you’ll be greeted by Chase’s crisp, inviting site design. Calm, user-centric language and layout will be a theme throughout your SDI experience.

You’ll see options to open either a Self-Directed Investing account or an Automated Investing account. As the names imply, Automated Investing is where you’ll open a passive/lazy portfolio and stay hands-off while the AI does the work multiplying your money.

For now, let’s opt for a hands-on approach so click “Open an account” under SDI.

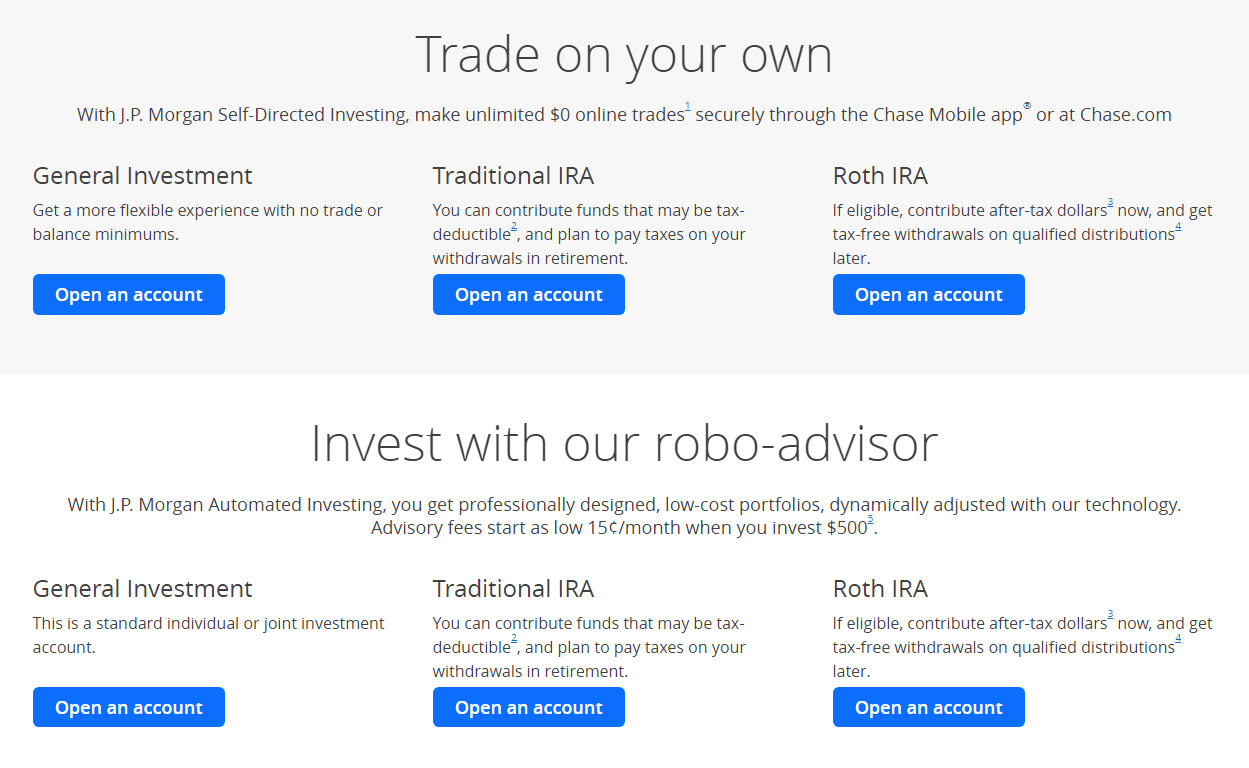

Interestingly, even if you tell Chase you’d like to open a Self-Directed Investing account, they’ll still show you some robo-advisor account options on the next page.

To be honest, I like this approach because it’s like Chase’s gentle way of saying are you sure you don’t want to let us invest for you? After all, having both an actively and passively managed investment account is a safe, sensible approach.

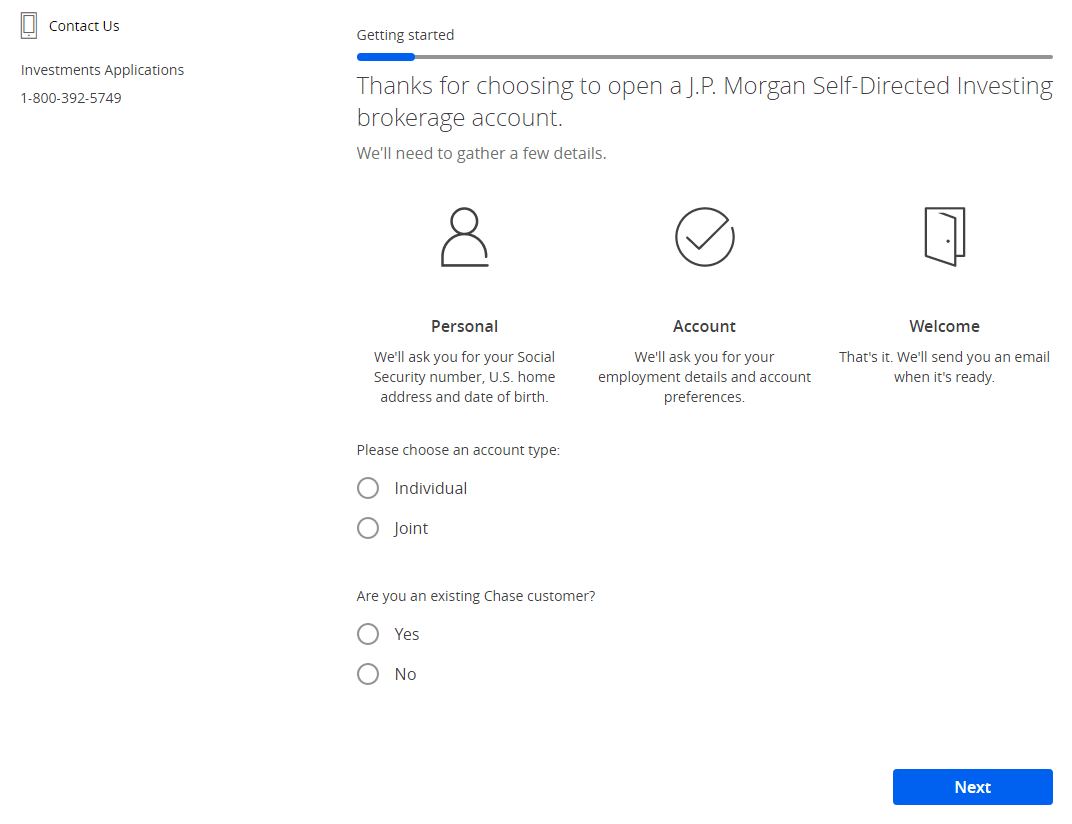

Anyhow, once you choose a Self-Directed Investing account type (I chose General), you’ll enter the account creation workflow.

Hiding on this page is another one of J.P. Morgan Self-Directed Investing’s key competitive advantages. See it? Top left. Chase is so dedicated to customer service that you can call them just for help filling out your application.

Granted, SDI isn’t the only trading platform with a customer support line, but Chase is known for knowledgeable staff and quick response times.

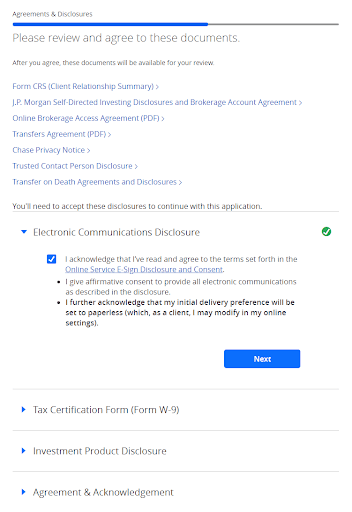

Moving on with the workflow, you’ll enter a beneficiary, read over some forms, and E-Sign a few documents.

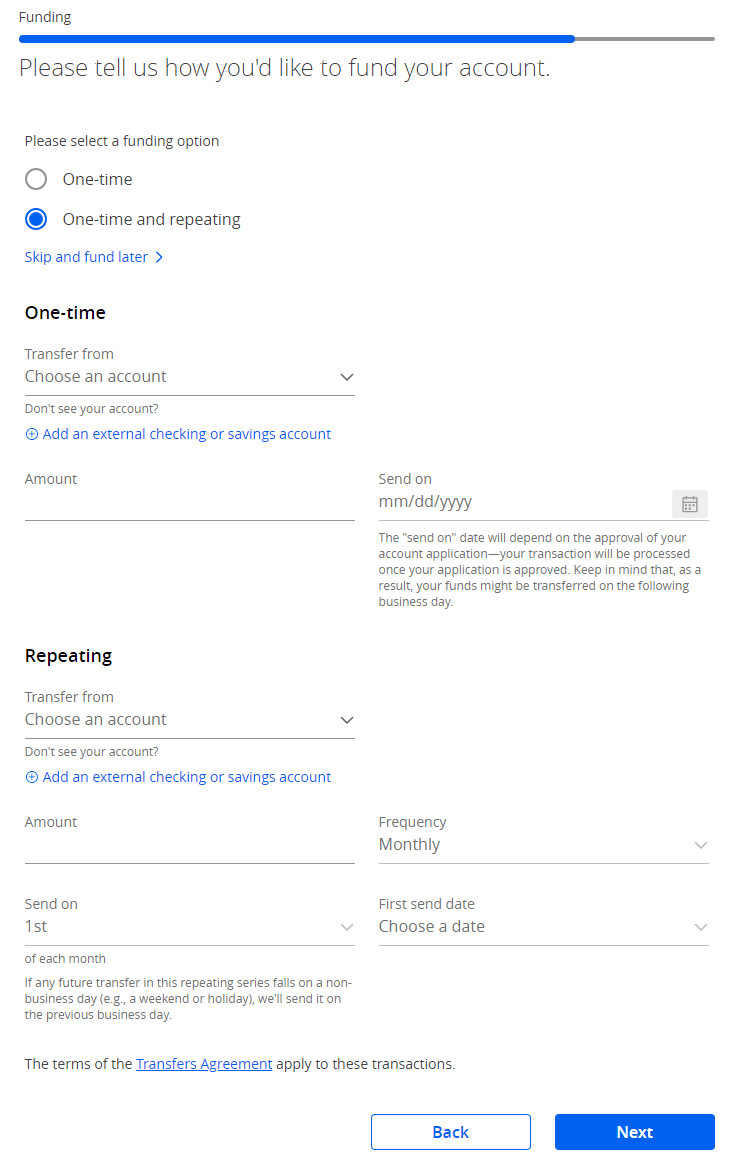

Once that’s done, Chase will prompt you for a source of funds for your account.

Once your application is approved, Chase will prompt you to download the Chase Mobile app, where you’ll basically be treated as a regular Chase customer with only one account type listed: Self-Directed Investing.

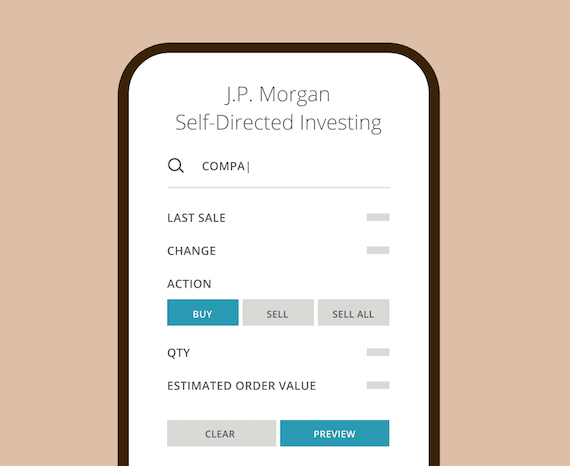

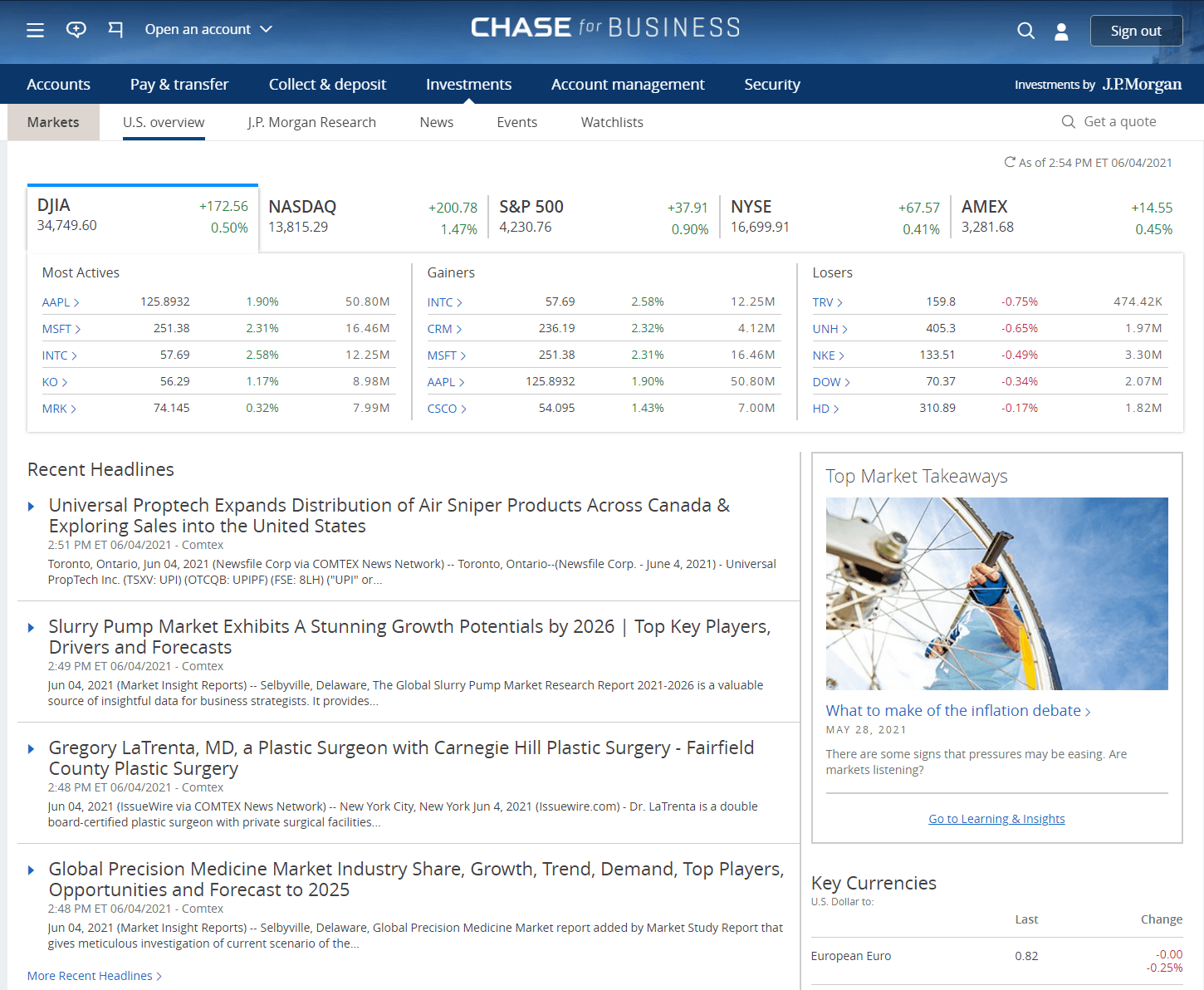

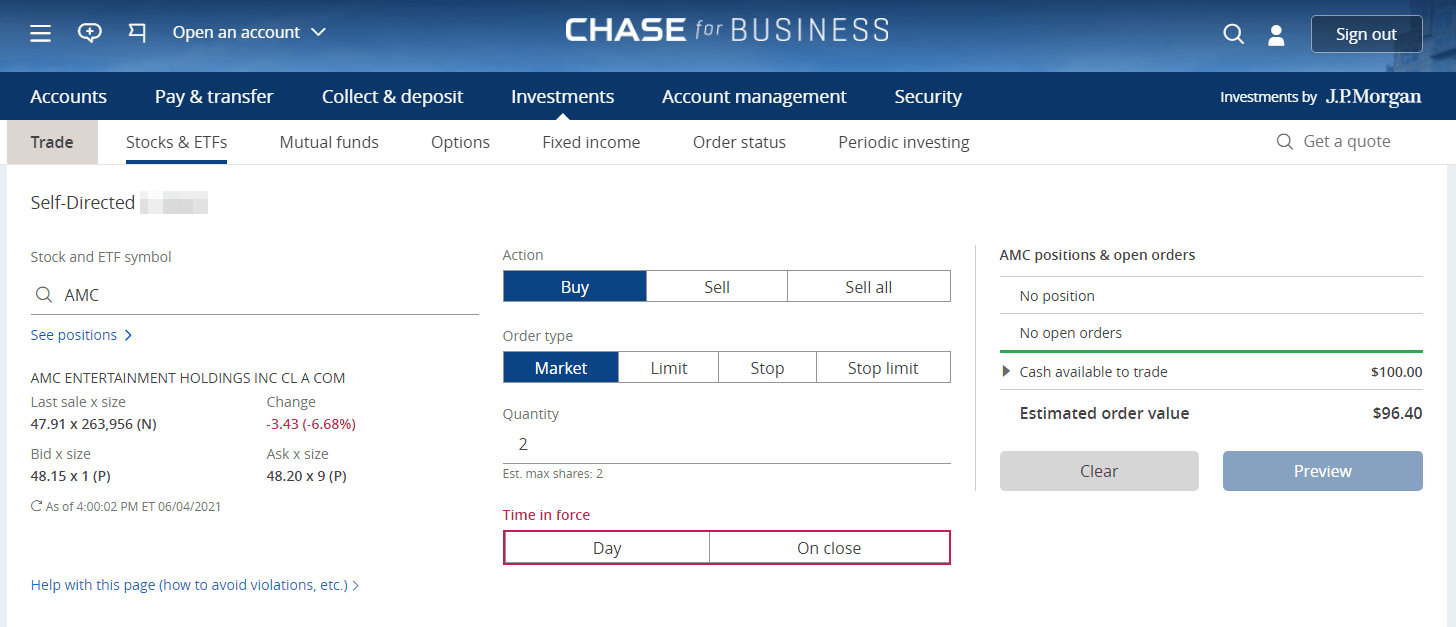

From here, you’ll open your brokerage account and enter J.P. Morgan Self-Directed Investing’s dashboard for buying, selling, and trading. You can also trade using the online dashboard from your computer:

Trading platforms tend to follow one of two philosophies to dashboard design: clean and simple, or dense and chaotic. Classical music or speed metal. Both have their pros and cons, and clearly attract different types of investors.

Clearly, Chase went for the former approach.

One thing you won’t see is a sea of tickers and EKGs of meme stocks.

Now, before you dive in and buy some shares, your next question might be: how much is this gonna cost me?

How much does J.P. Morgan Self-Directed Investing cost?

Like most modern trading platforms, J.P. Morgan Self-Directed Investing offers $0 commission trades; you can buy and sell stocks all day without Chase taking a cut. $0 commission trades have become the industry standard, but you shouldn’t take them for granted – just ask anyone who yelled at their greedy Wall Street broker in the 80s!

The three fees you’re most likely to run into are (you can find the rest on Chase’s site):

- $0.65 per options contract.

- $25 broker-assisted trades fee.

- $75 transfer fee between brokers (not cash withdrawals).

Transfer fees suck, especially if you plan to take brokers for a test drive for a few months. That being said, it’s unfair to pick on Chase for charging $75 to close or move your account since companies like Robinhood and Webull do the same.

Overall, however, Chase’s fees are still lower and fewer than most, so it’s an overall win for the platform.

J.P. Morgan Self-Directed Investing features

Whether you’re new to trading platforms or you’re considering a switch, what can J.P. Morgan Self-Directed Investing offer you?

$0 commission, $0 account minimum

As mentioned, J.P. Morgan Self-Directed Investing doesn’t charge commissions on trades (with the exception of options contracts) and doesn’t require an account deposit of any size on day one to open an account.

The latter is a nice perk for anyone looking to open a brokerage account to have on hand, but can’t afford to fund it quite yet. Like I mentioned earlier, having an account with $0 trading funds is still more useful than not having one at all.

A bonus of up to $700

Currently, you can score one of a few different bonuses when you sign-up for an account (through 7/13/23):

- $700 when you fund with $250,000 or more.

- $325 when you fund with $100,000-$249,999.

- $150 when you fund with $25,000-$99,999.

- $50 when you fund with $5,000-$24,999.

If you want to move a larger investment portfolio over, J.P. Morgan Self-Directed Investing will reward you handsomely.

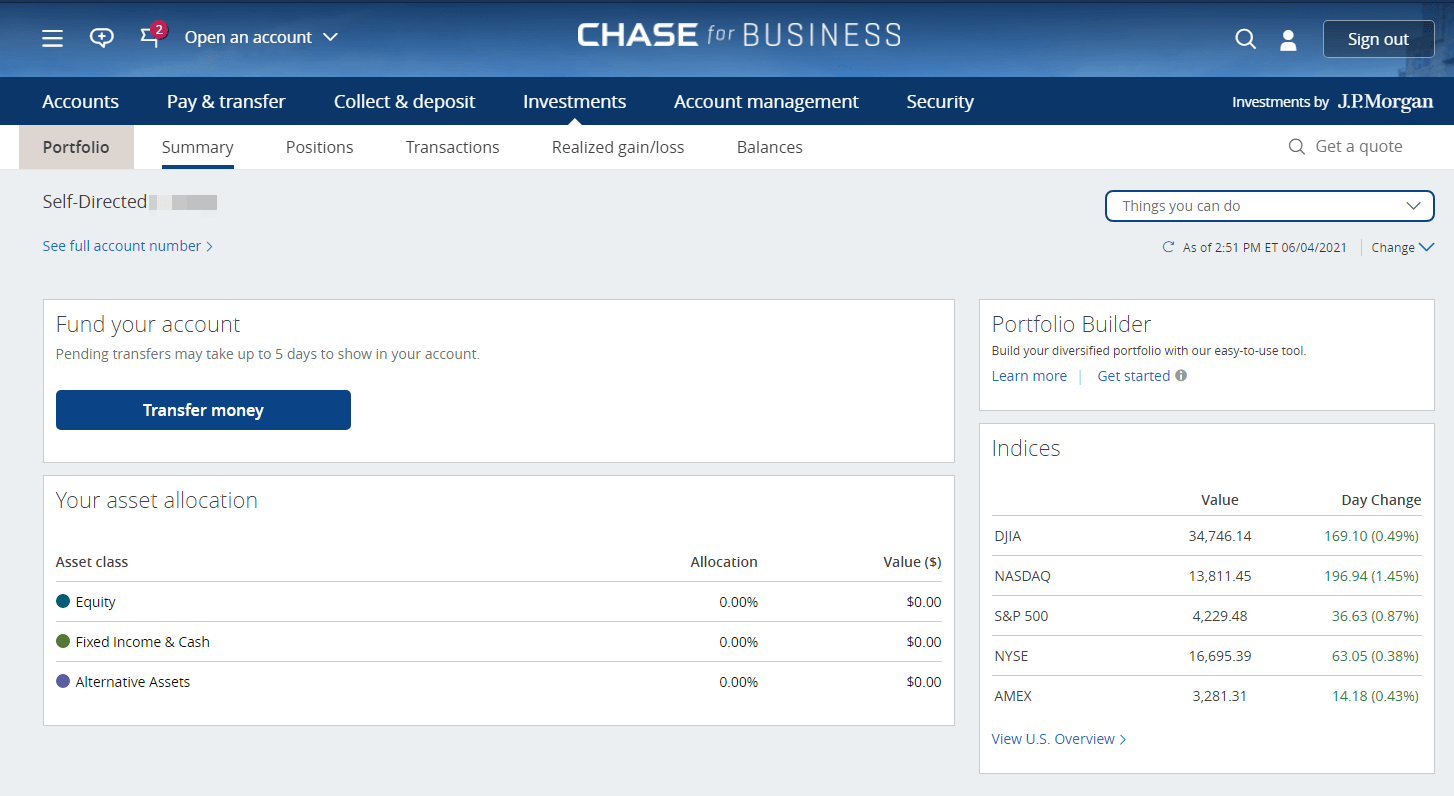

Portfolio Builder

Once your account clears and you drop in some funds, you’re immediately granted access to the entire stock market. If that seems a little overwhelming, Chase has your back with Portfolio Builder.

The Portfolio Builder starts with a quiz to help you determine a) your risk tolerance and b) your investing goals. It then suggests stocks, ETFs, and overall asset allocation based on your answers.

For example, if you have a high risk tolerance and short-term goals, Portfolio Builder may guide you towards some more high-performing stocks. If you’re more conservative with your money and plan to buy a house in five years, PB may instead guide you towards Blue Chip-based ETFs.

If investing is bowling, Portfolio Builder is like the bumpers on the side, guiding you towards a strike.

Integration with Chase apps

As mentioned, a huge draw of J.P. Morgan Self-Directed Investing is its smooth integration with Chase online and Chase Mobile. If you’re already familiar with the Chase ecosystem, you’ll love how J.P. Morgan Self-Directed Investing will:

- Pull your existing account info to greatly accelerate the signup and approval process.

- Seamlessly drop your investing account into your existing dashboard for easy access.

- Allow you to quickly move funds in and out of your Chase accounts.

For Chase users, keeping everything within the family may lend a sense of security, comfort, and convenience.

Simple desktop and mobile app

J.P. Morgan Self-Directed Investing edges out the competition by offering both a mobile and a desktop app that are well-designed and easy to manage.

Chase customer service

Last but certainly not least, investing through J.P. Morgan Self-Directed Investing gives you access to Chase’s renowned customer support team. Average connection times are quick, and staff are generally considered to be experienced and knowledgeable.

Chase’s customer support team can’t offer investing advice (Chase does offer complimentary investment check-ups, but only once you invest $100,000… sigh), but they’re super helpful to have around if you have technical questions or would like clarification on any fees or functionality.

My experience researching J.P. Morgan Self-Directed Investing

I appreciate that Chase offers a “safe space” for new and/or casual investors to buy stocks, ETFs, and bonds.

It may be basic, but investing should be boring.

With Portfolio Manager guiding you along and your bank account balance staring you right in the face, SDI discourages impulsive or emotion-based trading – and that’s what you want. The inability to set up recurring crypto buys, for example, is honestly more of a perk than a missing feature.

What I’d like to see is for Chase to do a better job at attracting young, new investors to the platform. Many novices are seeking a safe platform, and little things like an expanded learning center would leave the porch light on for them.

Until then, however, SDI still offers a compelling package as it exists today.

Who should use J.P. Morgan Self-Directed Investing?

All things considered, who is Chase’s investing platform best geared for?

Existing Chase customers

If you’re already tapped into the Chase ecosystem, you’ll love how simple and seamless adding a J.P. Morgan Self-Directed Investing account to your dashboard will be.

On paper, it may seem like consolidating your banking and investing apps into one may just save a little RAM, but having your brokerage and bank accounts in the same dashboard saves time and can help guide your investing choices.

New investors

J.P. Morgan Self-Directed Investing offers plenty to help new investors ease into trading, from a clean and simple interface to Portfolio Builder to a dedicated customer support line in case anything goes awry.

I wish Chase could offer a little more in the form of EDU materials and a learning center, but it’s not too hard to find those resources elsewhere.

Who shouldn’t use J.P. Morgan Self-Directed Investing?

J.P. Morgan Self-Directed Investing is an all-around solid trading platform, but it’s not for everyone. Which traders should look elsewhere?

Advanced investors and day traders

If you’re an experienced investor looking for a trading platform with all the options, J.P. Morgan Self-Directed Investing simply isn’t a fit. Even if you’re just a new investor looking to grow your day trading skills, you’ll quickly outgrow SDI’s limited functionality.

The platform is designed to be simple and streamlined for the casual investor to make simple trades. Specifically, here are some advanced features it’s missing:

- Pre-/post-hours trading.

- Penny stocks.

- Cryptocurrency trading.

- International investment vehicles.

- Detailed chart analytics.

- Third-party data integration.

Pros & cons

Pros

- Chase customer support — J.P. Morgan Self-Directed Investing stands out from other brokerage apps by offering a knowledgeable and accessible customer support team.

- Simple, intuitive interface — Chase’s trading platform is lean and clean, letting new investors get up and running without being overwhelmed by charts of data.

- A bonus of up to $700 — If you have $250,000 or more to move over to J.P. Morgan, you could earn a nice little bonus.

- Portfolio Builder — With the complimentary Portfolio Builder tool, J.P. Morgan Self-Directed Investing assists new investors by helping them gauge their risk tolerance and investing goals.

- Integration for Chase customers — For existing Chase customers, adding a J.P. Morgan Self-Directed Investing account to your dashboard is quick and seamless - and consolidating your trading platform into your banking app lends beaucoup convenience over time.

Cons

- Limited functionality — J.P. Morgan Self-Directed Investing offers a limited, basic list of investment vehicles and research tools, so aspiring day traders may quickly outgrow the platform.

- Portfolio Builder requires $2,500 min. — Even the automated Portfolio Builder requires you to have $2,500 in your account, excluding many young investors who may need it most.

- No crypto support — Unlike Robinhood, J.P. Morgan Self-Directed Investing doesn’t allow for crypto trading, and considering the big banks aren’t the biggest fans of unsecured currencies, it probably never will.

- Constant timeouts — In a death blow for day traders, Chase will automatically log you out due to inactivity every few minutes so you can’t keep the platform open for constant monitoring.

J.P. Morgan Self-Directed Investing vs. competitors

J.P. Morgan Self-Directed Investing E*TRADE TD Ameritrade

Trade commissions $0 $0 $0

Investment vehicles - Stocks

- ETFs

- Options

- Mutual funds

- Bonds- Stocks

- ETFs

- Options

- Mutual funds

- Bonds

- Futures

- Forex

- Penny stocks

- International bonds

- Single/multi-leg options

- CDs- Stocks

- ETFs

- Mutual funds

- Bonds

- Futures

- Forex

- Penny stocks

- International bonds

- CDs

Desktop and mobile? Yes Yes Yes

Account types - General

- Roth IRA

- Traditional IRA- General

- Roth IRA

- Traditional IRA

- Rollover IRA- General

- Traditional IRA

- Roth IRA

- Rollover IRA

- Joint Tenants WROS

- Trust

- UTMA/UGMA

Standout feature Integration with Chase apps Smart Beta ETFs and Socially Responsible ETFs Expansive account types

E*TRADE

If you’re an experienced investor looking for a new platform to grow into, you may find your forever home at E*TRADE.

If you’re an experienced investor looking for a new platform to grow into, you may find your forever home at E*TRADE.

E*TRADE’s platform has attracted an army of day traders by offering a wide assortment of investment tools, research, and analytics. Even more passive investors will be intrigued by E*TRADE‘s compelling Smart Beta and Socially Responsible ETFs, which are designed to outperform the market and support conscious capitalism, respectively.

TD Ameritrade

TD Ameritrade is the Costco of trading platforms. You may not find anything unique, but you will find everything.

is the Costco of trading platforms. You may not find anything unique, but you will find everything.

In addition to offering every conceivable investment vehicle American traders could (legally) ask for, TD Ameritrade offers a more A to Z learning experience. Most trading platforms tend to attract beginner or advanced traders, so it’s refreshing to see one cater so well to both. TD Ameritrade welcomes newbies with a robust online learning center, allowing them to slowly ease into its most advanced features at their own pace.

Summary

J.P. Morgan Self-Directed Investing offers a smooth and convenient way for existing Chase customers to add investing to their account dashboard.

Non-Chase customers may still be drawn in by SDI’s clean interface and robust customer service, but advanced investors and day traders will likely find the platform’s basic toolkit too limited to grow into.

Disclosure – INVESTMENT AND INSURANCE PRODUCTS ARE: NOT A DEPOSIT • NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE