blooom Review: Easily Grow And Optimize Your 401k & IRA

Rating as of based on a review of services December 2, 2022.

Ranking

9.5/10

Are you worried that you’re not doing a good job managing your retirement plan? If so, blooom can manage your plan for just $10 per month.

Best for:

- Those who need help managing their retirement accounts

- Low-fees

- Investing without a minimum

Maybe you’ve got a lot of money sitting in your employer-sponsored retirement plan, your IRA, or both. And maybe you’re not so sure you quite know how to manage it successfully. If not, there’s help!

A robo-advisor called blooom specializes in investment management for retirement plans, including employer-sponsored plans and IRAs. For a very low monthly fee, you may even have access to a professional manage your retirement portfolio (at most institutions). From there, all you’ll need to do is continue funding your plan, and blooom will handle all the investment details for you.

About blooom

Based in Leawood, Kansas, blooom was launched in 2013. It’s a registered investment advisory and robo-advisor, except it specializes entirely in retirement accounts. In fact, what sets blooom apart from the competition is that it’s the first – and still practically the only – robo-advisor available for the management of employer-sponsored retirement plans.

From the beginning, blooom was all about managing employer-sponsored plans, especially 401(k)s. But just this year they expanded their program to include management of IRA accounts as well. The company now has over $3 billion in assets under management.

blooom is filling an important and often overlooked niche. Though there are many robo-advisors that manage IRA accounts, there are practically none providing investment management for employer-sponsored plans. And since millions of people have trillions of dollars invested in these plans, there’s finally an option to have them professionally managed. That’s a major benefit to anyone who either lacks the experience or the inclination to manage their own retirement plan.

How blooom Works

How to sign up for blooom

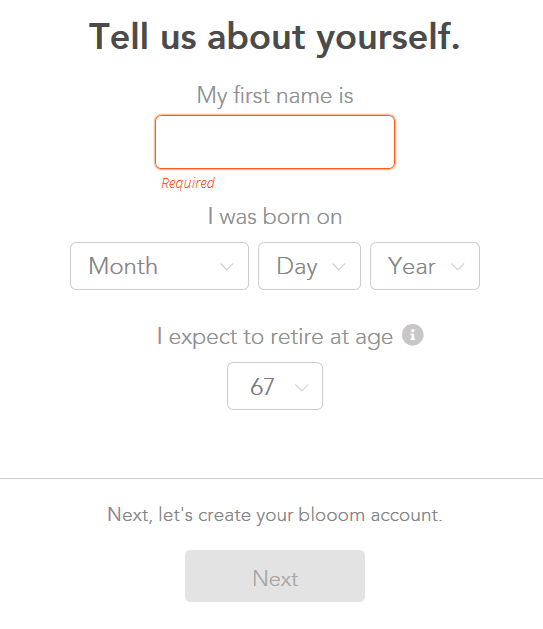

The sign-up process takes place completely online. You’ll start by linking blooom with your retirement plan, whether that’s an IRA account or an employer-sponsored plan.

Next, you’ll answer a few simple questions.

You’ll then create your blooom account, and lock your information by providing your email address and creating a password. Next, you’ll log into your retirement plan account. From there, blooom will perform your free analysis, and make investment recommendations.

You will be required to put a credit card on file with blooom. Fees for the management service are charged outside your plan, and will not be deducted from your plan balance.

blooom for employer-sponsored retirement plans

The service is available for managing most types of employer-sponsored retirement plans. That includes 401(k)s, 401(a)s, 403(b)s, 457 plans, and the federal government’s Thrift Savings Plan (TSP).

There are two major advantages to how blooom works:

- You don’t need the consent of either your employer or your plan administrator to use the service.

- blooom can manage your plan at most institutions where your plan is held.

There are only a very few 401(k) management services that work with your plan, and all require employer or administrator participation. But that’s not necessary with blooom. Since you retain ownership of the account, blooom is merely a service you add to manage the plan for you.

To the second point, blooom works with your existing plan. For example, if your 401(k) or 403(b) is held with a mutual fund family, blooom will work within the funds provided by the plan. If it’s a brokerage account with many options, blooom will select the best investments for your investor profile (Note: blooom does not manage brokerage accounts).

The service will begin by providing a free analysis of your current portfolio allocation. It will show you the hidden investment fees you are paying for your plan, and also recommend the right mix of stocks and bonds to help you best achieve your retirement goals.

If you sign up for the ongoing Standard or Unlimited subscription, blooom will provide the following services:

- Minimize hidden investment fees.

- Rebalance your portfolio on a regular basis (if needed).

- Provide financial advice from blooom advisors.

- Provide suspicious activity alerts, to let you know if there may be fraudulent activity connected with your account.

blooom for IRAs

blooom only recently rolled out their robo-advisor service for IRA accounts. You can use blooom either to manage your IRA, or to manage both your IRA and your employer-sponsored plan.

While blooom can manage an employer-sponsored retirement plan at most institutions, IRA accounts must be managed by Fidelity.

blooom will perform the same service with your IRA as they will for an employer-sponsored plan. It will review your current investment allocations, determine the investment fees you’re paying in your plan, then make reallocations to potentially lower your investment fees, and create a portfolio that’s consistent with your retirement goals.

blooom investment approach

Whether you sign up for the service for your IRA or your employer-sponsored retirement plan, blooom may employ some of the following investment strategies:

- They may sell your current investments into cash, then buy the recommended investment positions. (IRA’s only)

- Blooom’s strategy does not include individual stock exposure, and circumstances may lead to your individual stock positions being excluded from their management or sold for reallocation.

- If you have company stock in an employer plan, they’ll recommend you sell your allocation down to not more than 10% of the total plan value.

- The service will not only work to minimize hidden investment fees, but they’ll also eliminate managed account services and take you out of target date funds, which tend to charge high fees as a matter of course. You must turn off the managed account services before Blooom can assist on this one.

Your portfolio is created based on your current age, retirement age, and your risk tolerance profile. These will be determined at the time you sign up for the service. However, you can change your portfolio allocation by adjusting your retirement age or your risk tolerance after you engage the service.

blooom fees and pricing

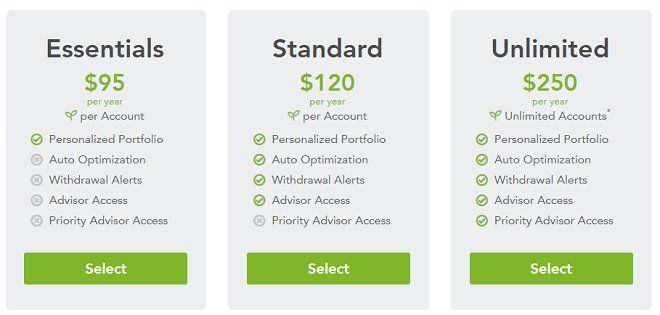

Pricing is simple with blooom. Rather than charging a percentage fee on the balance of your account, they use a simple, single annual fee depending on the type of account you sign-up with. There are currently three options to choose from:

- Essentials ($45) – This is their least expensive option and it offers you the ability to get your portfolio personalized that you would implement.

- Standard ($120) – Slightly more expensive, this options includes all of the features bloom has to offer EXCEPT for priority advisor access. You’ll still have the ability to utilize auto optimization.

- Unlimited ($250) – This option is ideal for people with multiple 401k’s or IRAs because there is no limit to the number of accounts you can utilize with blooom under this plan (as long as they belong to you). Plus, you’ll be provided priority advisor access.

But before you pay a fee, you’ll be entitled to a free analysis of your plan. The analysis will uncover hidden investment fees you might be paying and make investment recommendations based on your retirement goals.

blooom features and benefits

Minimum initial investment

Whether you have an employer-sponsored retirement plan or an IRA, blooom has no required minimum initial investment or account balance to participate in the service (IRA’s cannot have $0 balance).

Available accounts

Available employer-sponsored plans include:

- 401(k)

- 403(b)

- 457

- 401(a)

- Thrift Savings Plan (TSP)

Available IRA accounts include:

- Traditional IRAs

- Roth IRAs

- SIMPLE IRAs

- SEP IRAs

- Spousal IRAs

- Non-deductible IRAs

Customer Service

blooom customer service is available by email or live chat, Monday through Friday, from 9:00 am to 4:00 pm, central time. No direct phone service is offered.

Access to financial advisors

If you have investment-related questions, blooom has financial advisors on staff who are available to discuss your retirement plan (Standard or Unlimited membership only).

This is where blooom departs from the majority of robo-advisors, that work primarily or exclusively with an automated system.

Account custodian

With employer-sponsored retirement plans, blooom works with whoever the custodian is that’s currently holding your plan. But in the case of IRA accounts, you’ll be required to move your plan to a Fidelity custodian account if you want blooom to place trades for you.

Account protection

blooom doesn’t take actual custody of your retirement plan or your IRA. The funds are held with a custodian, that will have appropriate financial protection, typically through SIPC. Meanwhile, blooom is a fiduciary, which requires that they act in your best interest – not theirs.

For security purposes, blooom uses bank-level security with encrypted servers to protect your personal information. This includes 256-bit encryption, secure servers, and third-party verification during communications.

Pros & cons

Pros

- No minimum initial investment — Unlike some investment management services, blooom does not require a large account balance. You can have a plan managed with as little as $1.

- No need to move your employer-sponsored retirement plan — blooom will manage your plan exactly where it’s at, using the investment options available within that plan.

- Very low management fee on large plans — If your plan value is $100,000, the $120 annual management fee works out to be 0.12%, or about half what typical robo-advisors charge.

- Professional management for what may be your largest asset — Millions of people have employer-sponsored retirement plans, but not nearly as many know how to manage them – blooom could handle that for you.

- You don’t need your employer’s consent — blooom can be added to any plan as a self-selected service.

- Manage any type of retirement plan — blooom manages 401(k), 403(b), 457 and TSP plans, as well as all types of IRAs.

- Hybrid investment management — blooom can manage part of your IRA, while you manage the rest of it under self-directed investing.

- Suspicious activity alerts — Few think about fraudulent activity in connection with retirement plans, but it does happen. You’ll be alerted when suspicious activity is detected.

Cons

- IRA plans are limited to just one custodian — blooom can currently only manage your IRA if it's held at Fidelity (but can offer fund recommendations for many others).

- Monthly fee will be high for small accounts — At $120 per year, the management fee will be the equivalent of 2.4% on an account balance of $5,000.

- Not available for taxable investment accounts — blooom specializes entirely in retirement accounts. If you want a taxable account managed, you’ll need to use another service.

- The service does not offer phone support — Contact is limited to email and live chat only.

blooom compared

blooom Betterment Wealthfront

Minimum investment $0 $10 to start investing $500

Fees $120 per year with Standard membership tier, $90 for each additional account Betterment Digital: 0.25% Betterment Premium: 0.40% 0.25%

Unique features Designed for employer sponsored retirement plans Can use sub-accounts employing different portfolios to reach multiple goals High-yield Cash Account & live financial planning

Best for Most types of retirement accounts, including employer sponsored plans Taxable brokerage accounts and multiple types of IRAs Taxable brokerage accounts and all types of IRAs

Betterment

![]()

Although Betterment is the only direct competitor with blooom for the management of an employer-sponsored retirement plan, it’s not something you have a choice over. Your employer must contract with Betterment for management of the entire plan, which will remove you from the equation. For that reason, my discussion here will center on Betterment vs. blooom as an IRA plan manager.

From a management standpoint, Betterment offers many more investment options than blooom. For example, they use ETFs in their portfolio options, giving you exposure to outperform the general market. They also provide socially responsible investing and other options like Goldman Sachs Smart Beta, or Innovative Technology, among their portfolio options, as well as an interest-bearing cash account. And account balances of $100,000 or more have access to live financial advisors (for an increased management fee) — an option not available with blooom.

But the fee structure is where variables enter the picture. Betterment charges a fee of 0.25% on most accounts. blooom doesn’t become competitive on its $120 advisory fee (per year, per account on the Standard membership tier, then $90 per additional account) until your IRA account reaches $48,000. At that level, the effective fee drops to 0.25% – the same as Betterment

Wealthfront

The comparison between Wealthfront and blooom is very similar to that of Betterment vs. blooom. Wealthfront does not manage employer-sponsored retirement plans at all, so it doesn’t compete with blooom in that area.

When comparing Wealthfront and blooom on other criteria, Wealthfront has more investment options than blooom. For example, their standard portfolios add natural resources and real estate to the basic stock and bond portfolio. Blooom’s portfolios include stocks and bonds (and commodities and real estate funds when available), which gives Wealthfront a major advantage in the area of portfolio diversification.

With Wealthfront, you can also choose to build your own portfolio from scratch using a collection of expertly vetted ETFs, which the Wealthfront research team has hand-selected. Beyond the basic portfolio allocation, Wealthfront also offers the ability to invest in specific categories such as socially responsible investing (SRI), technology ETFs, and healthcare ETFs. Or, you can tax-efficiently move ETFs from an outside brokerage to Wealthfront in order to build a portfolio. Additionally, it’s easy to edit your existing portfolio by deleting, or adding, an ETF.

On the fee side, Wealthfront’s fees are similar to Betterment. With an annual management fee of 0.25%, the match point for blooom will similarly be $48,000, at which point their annual management fee of $120 translates into a 0.25% fee.

On larger accounts; however, the fee structure arrangement favors blooom. While a $200,000 IRA managed with Wealthfront will incur a $500 annual management fee, the fee with blooom will fall to 0.06%, with the annual fee remaining at $120 regardless of the size of your account.

Researching blooom

On balance, I find blooom to be the perfect investment service for anyone who is looking for professional management of their retirement plan. Though there are many robo-advisors available to manage an IRA account, blooom faces competition only from Betterment on the management of employer-sponsored retirement plans, and that’s only if the employer enters into a plan-while wide arrangement with Betterment. Otherwise, blooom is the only choice in the field.

I’m also impressed by the ability to use blooom with any employer-sponsored plan, regardless of the custodian, and without the need for approval by the plan administrator. That opens the service to nearly anyone who needs professional management for their retirement plan.

The situation is more constrained with IRA accounts since you’re limited to just one broker (but can offer fund recommendations on many others). But that’s easily offset by the fact that you can combine both managed and self-directed portions within the same account. It’s likely many users will want to engage in some level of self-directed investing while taking advantage of professional management for most of the account.

However, I find it inconvenient that blooom provides no phone support or mobile app access. Turning what is likely to be the largest single asset account for most investors over to a service that lacks either is a definite limitation. The company does expect to roll out a mobile app in the future, but no indication has been made in regard to phone support.

Who is blooom best for?

The short answer: anyone who lacks either the time, experience, or inclination to manage their own retirement plans.

Best of all, blooom is available to manage many types of retirement plans. If you have an employer-sponsored plan at work and an IRA, blooom can manage both. They handle all aspects of plan management, including portfolio construction, rebalancing your asset allocations periodically and minimizing fees. Once you sign up for the Standard or Unlimited service, your only responsibility will be funding your account as well as managing login credentials (like security questions, verification codes, etc). Everything else will be handled for you.

If you don’t have investment management skills, count yourself in the majority. You can use blooom to manage your retirement plan, while you keep busy with other areas of your life. Meanwhile, you can be secure in the knowledge that your retirement plan is on track.

Who is blooom not good for?

It’s important to understand that blooom is an investment management service. It is specifically not set up to work with self-directed accounts. That’s true whether it’s an employer-sponsored retirement plan or an IRA. If you have a self-directed plan, blooom will not work for you.

You may also decide against the service if for any reason you prefer not to have Fidelity act as custodian for your IRA account. It’s an excellent selection of broker platforms, but if you prefer the services provided by a different broker, you’ll need to avoid blooom.

Finally, I would caution against using blooom on accounts of less than $20,000. For example, on a $10,000 account, the $120 annual management fee would work out to 1.2%. That may be too big a reduction in your annual return to justify the service. But it’s a determination you’ll need to make for yourself, since you may decide you’re willing to pay a high percentage fee in exchange for professional management.

Summary

If you’ve been winging it with your retirement plan – buying a fund here and a few stocks there – blooom is giving you another option: professional management. However, blooom can still be a great option if you’re unhappy with managing your own plan.

This will be especially important if you have a large retirement plan, such as $100,000 or more. blooom is incredibly cost-effective on larger plans, with an annualized advisory fee that’s substantially lower than typical robo-advisors. You owe it to yourself to give this service a try.

Read more:

- Betterment Review: The Way Investing Should Be

- Wealthfront Review: Automated Investing And Financial Planning That’s Free Up To $10,000