Gemini™ review: earn interest on your crypto investment

Rating as of based on a review of services March 23, 2023.

Ranking

9/10

Thinking about crypto? This MoneyUnder30 guide explains how Gemini and the Gemini Mastercard work.

Best for:

- Investors worried about fraud

- Newer crypto investors

- Education-hungry investors

These days, it feels like everyone I know is investing in cryptocurrency. It’s hard not to develop a serious case of FOMO.

That’s why sites like Gemini™ are so useful. You don’t have to worry about ledgers or tokens. Just sign up and start watching the top cryptocurrencies. You can even add some to a watchlist and keep an eye on them for a while before making a move.

But there are plenty of other features that make Gemini™ stand out.

What is Gemini™?

Identical twin brothers Cameron and Tyler Winklevoss are best known for their role in the founding of Facebook. In 2014, they shifted to cryptocurrency, intending to make it accessible to everyone. In addition to investing in no fewer than 25 digital asset startups, they founded Gemini™, a big part of their holding company Gemini™ Space Station.

In a crowd of cryptocurrency startups, Gemini™ stands out. It was the first to be named a trust bank by the New York State Department of Financial Services, which means it’s tightly regulated. The founders also prioritized security, with Gemini™ becoming the first cryptocurrency provider to pass the SOC 1 Type 2 and SOC 2 Type 2 compliance exams.

How does Gemini™ work?

Signing up with Gemini™ takes just a few steps and a quick identity verification. To get started with Gemini™, go to the website and click “Get started.”

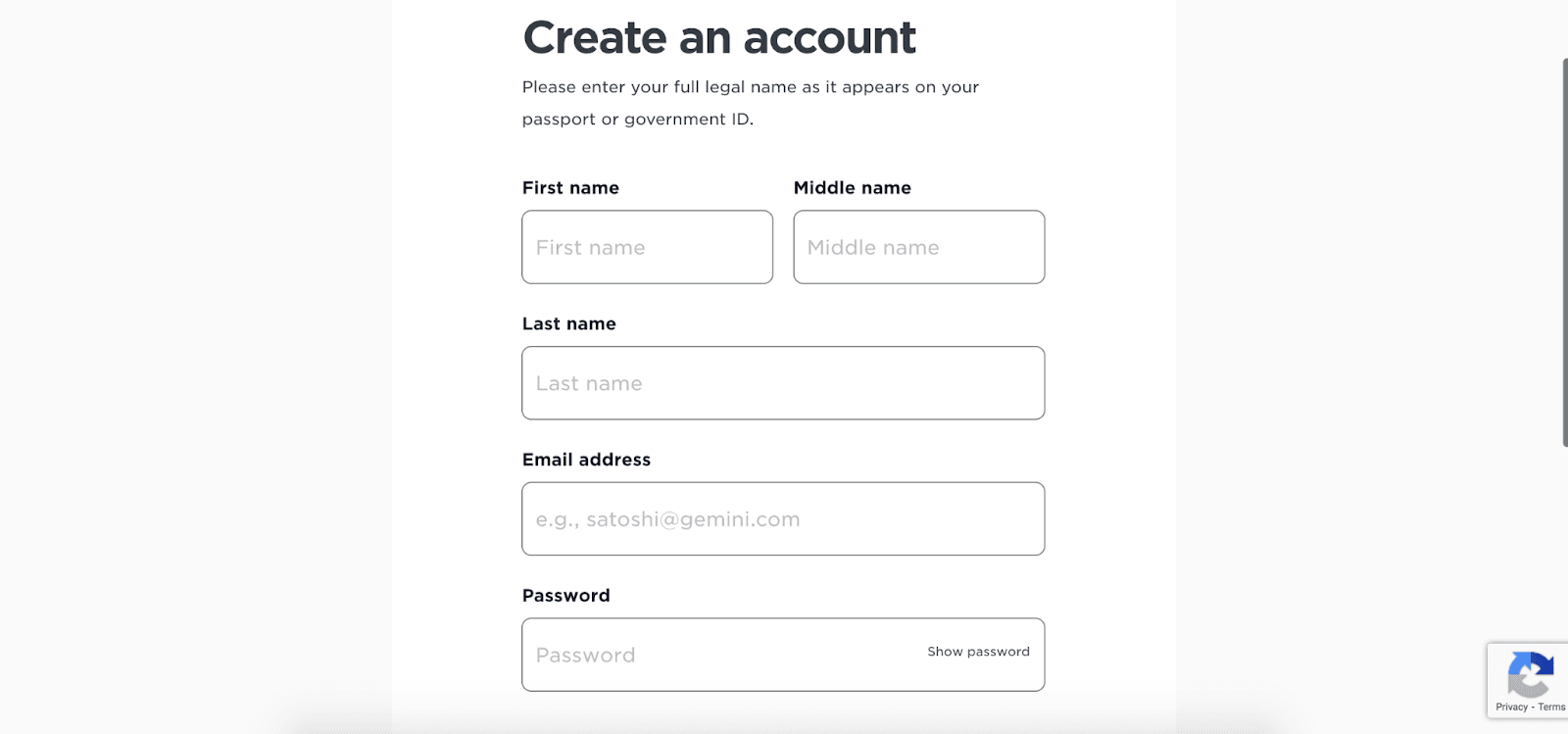

You’ll need to enter your contact information and choose a password to create an account.

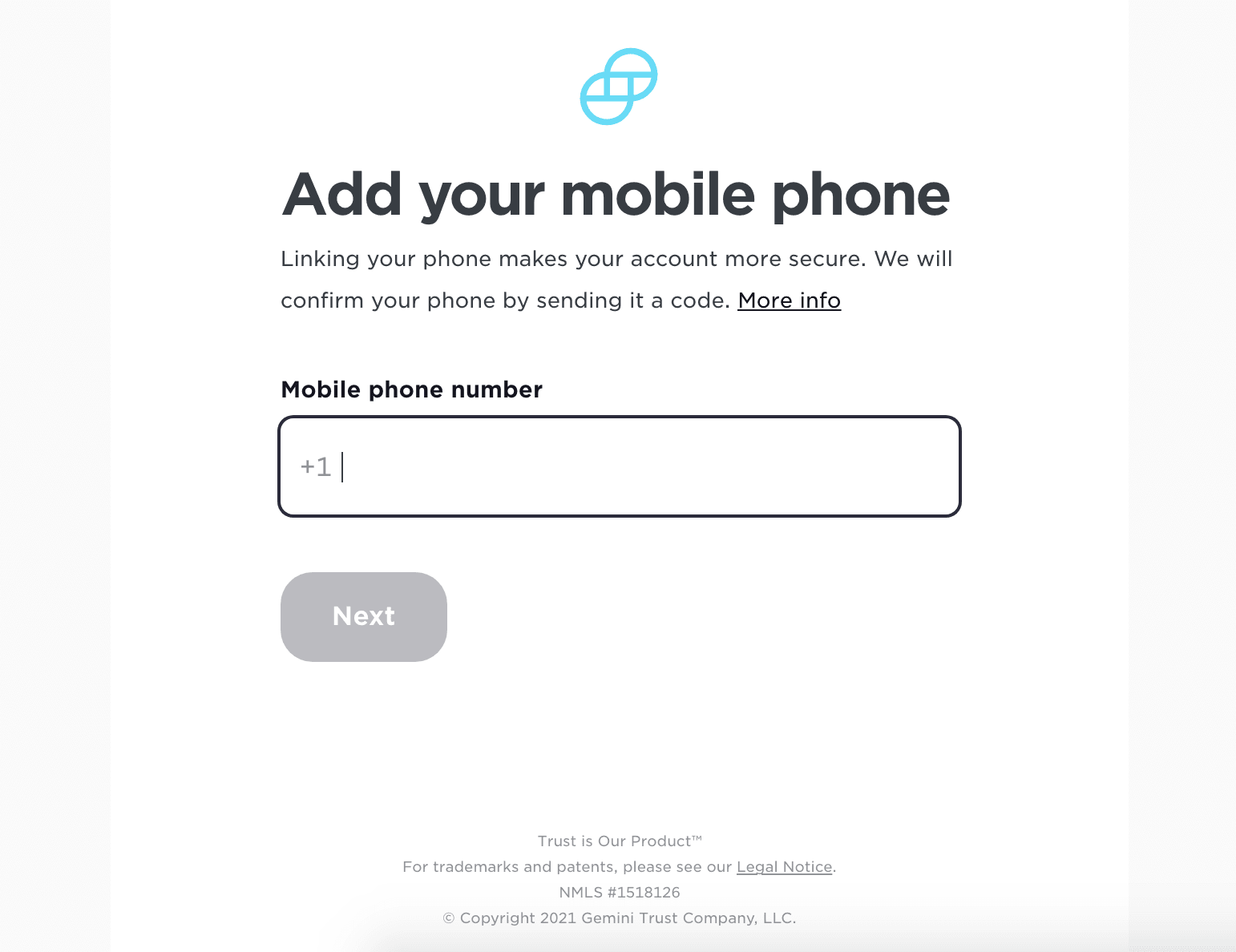

Gemini™ uses two-factor authentication to verify your account. You’ll input your cell number and wait for a text to come through with a seven-digit code. You’ll have to provide this code to continue your account setup.

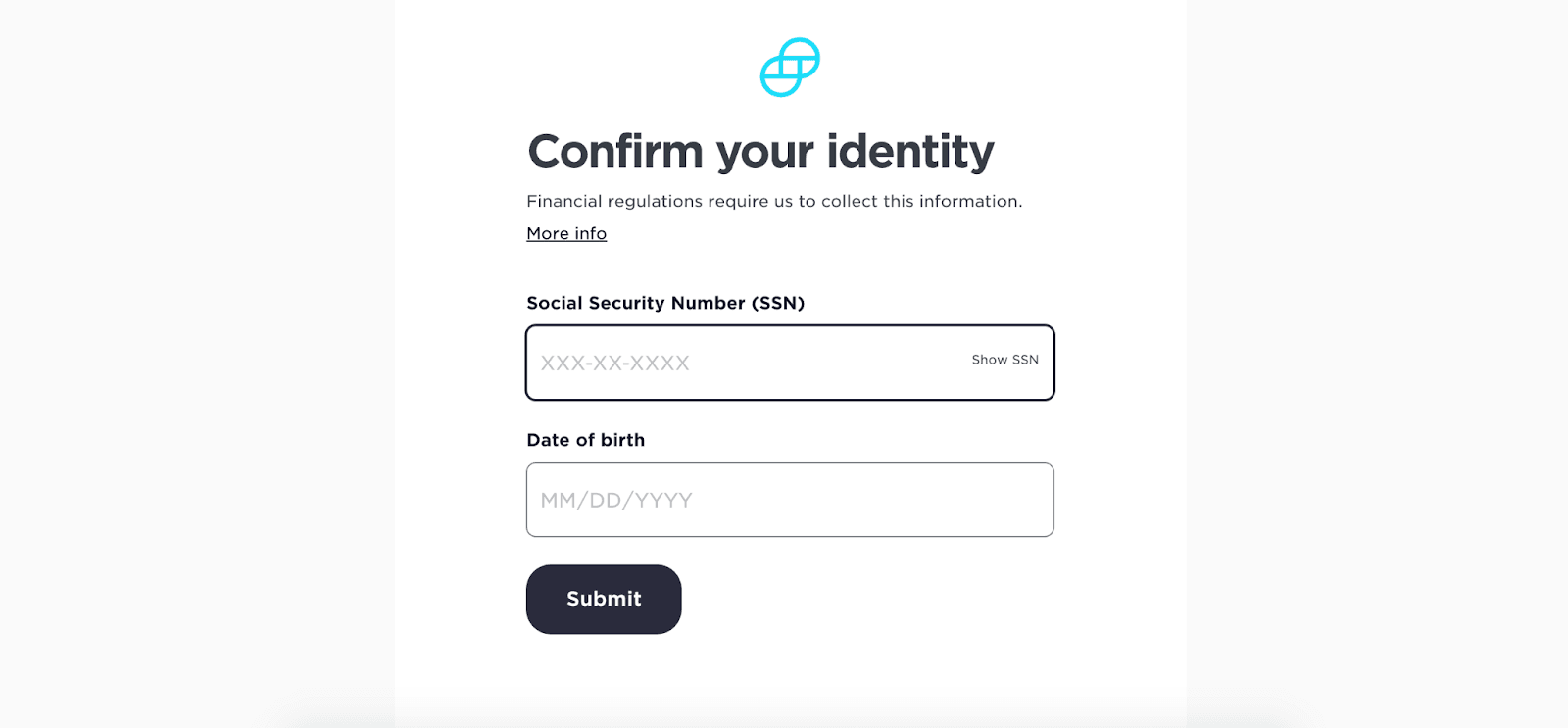

As always, when setting up a financial account, you’ll need to provide your Social Security Number (SSN) and date of birth to verify your identity.

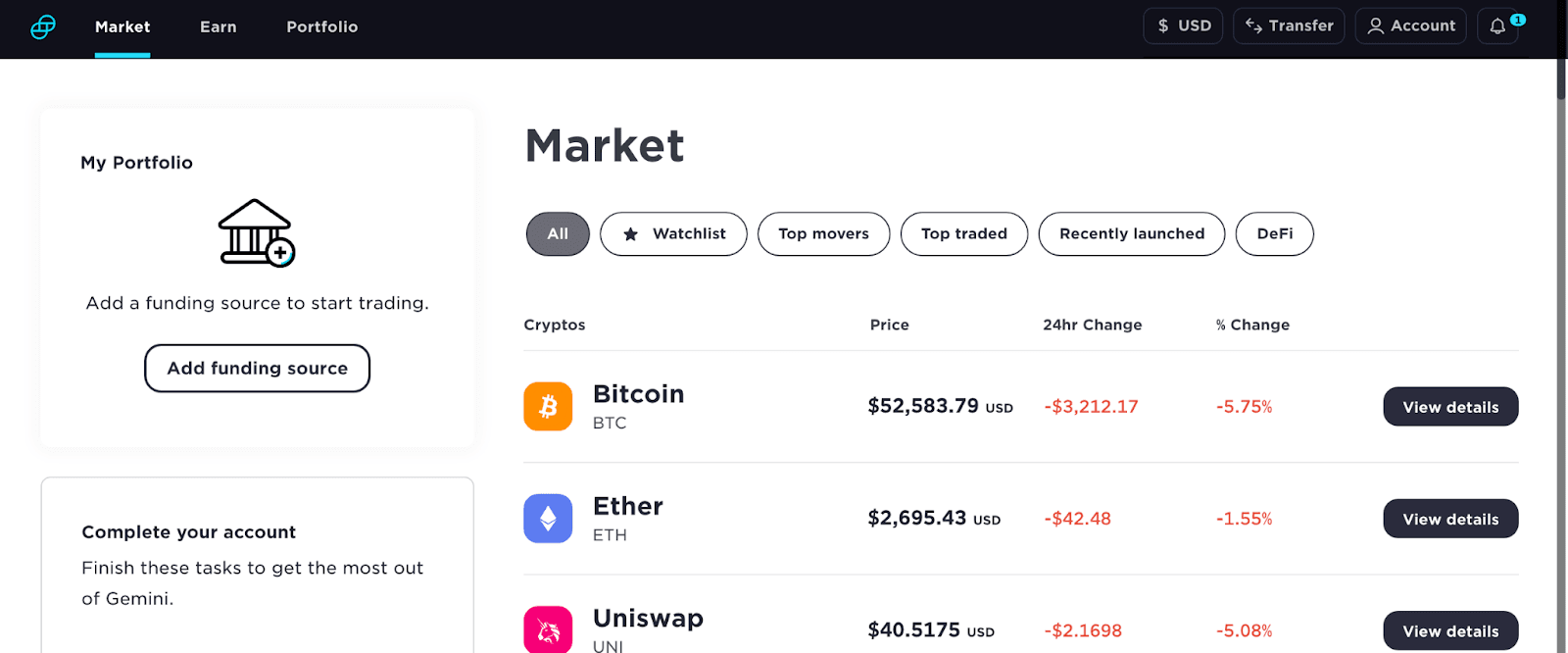

Next, you’ll be invited to add a funding source so that you can start making purchases. You can skip this step and complete it later by going to “Settings.” You’ll be redirected to your dashboard, where you can watch the performance of various cryptocurrencies. Click on “View details” to see more or make a purchase.

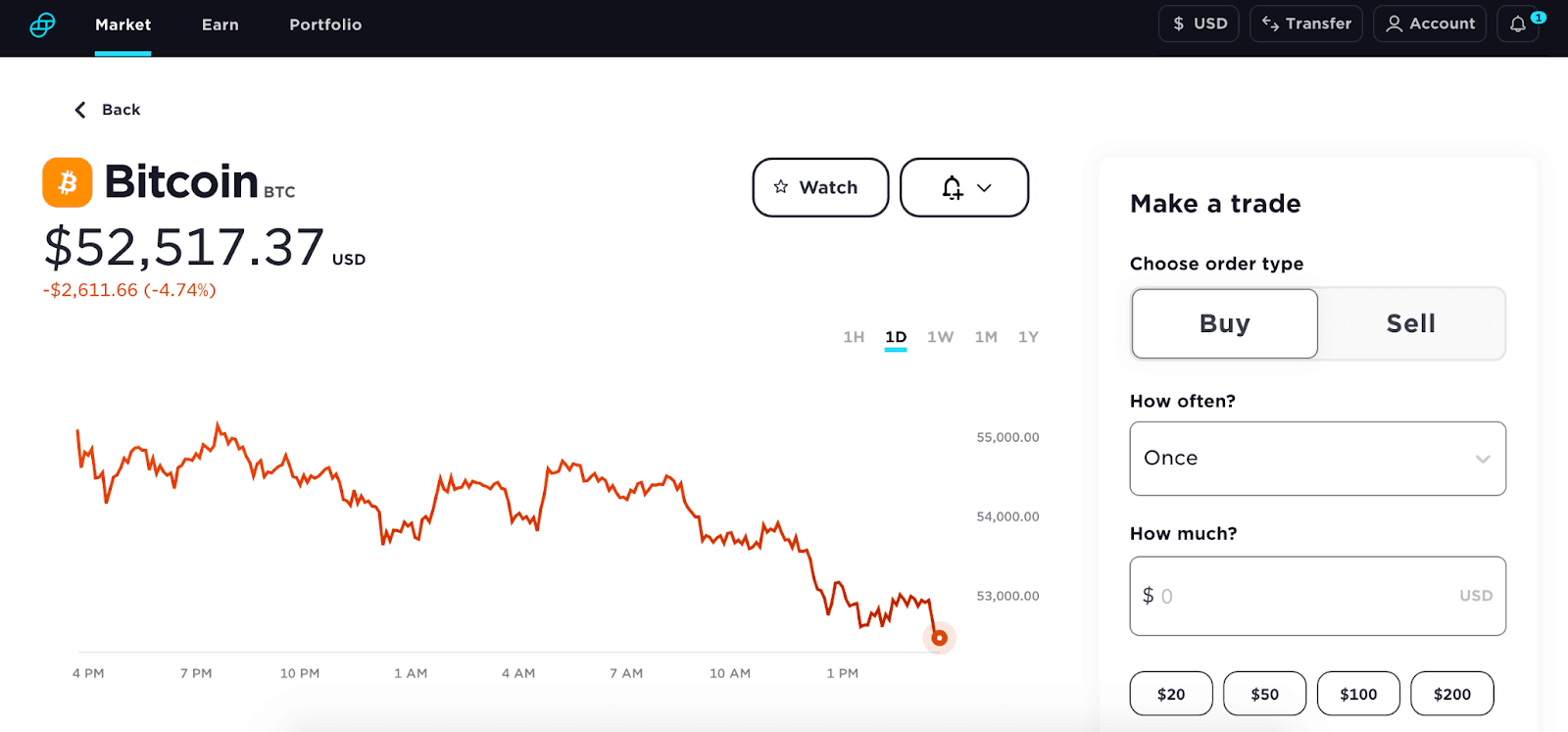

If you want to make a purchase, you can do so from the details screen. You can also set up recurring trades.

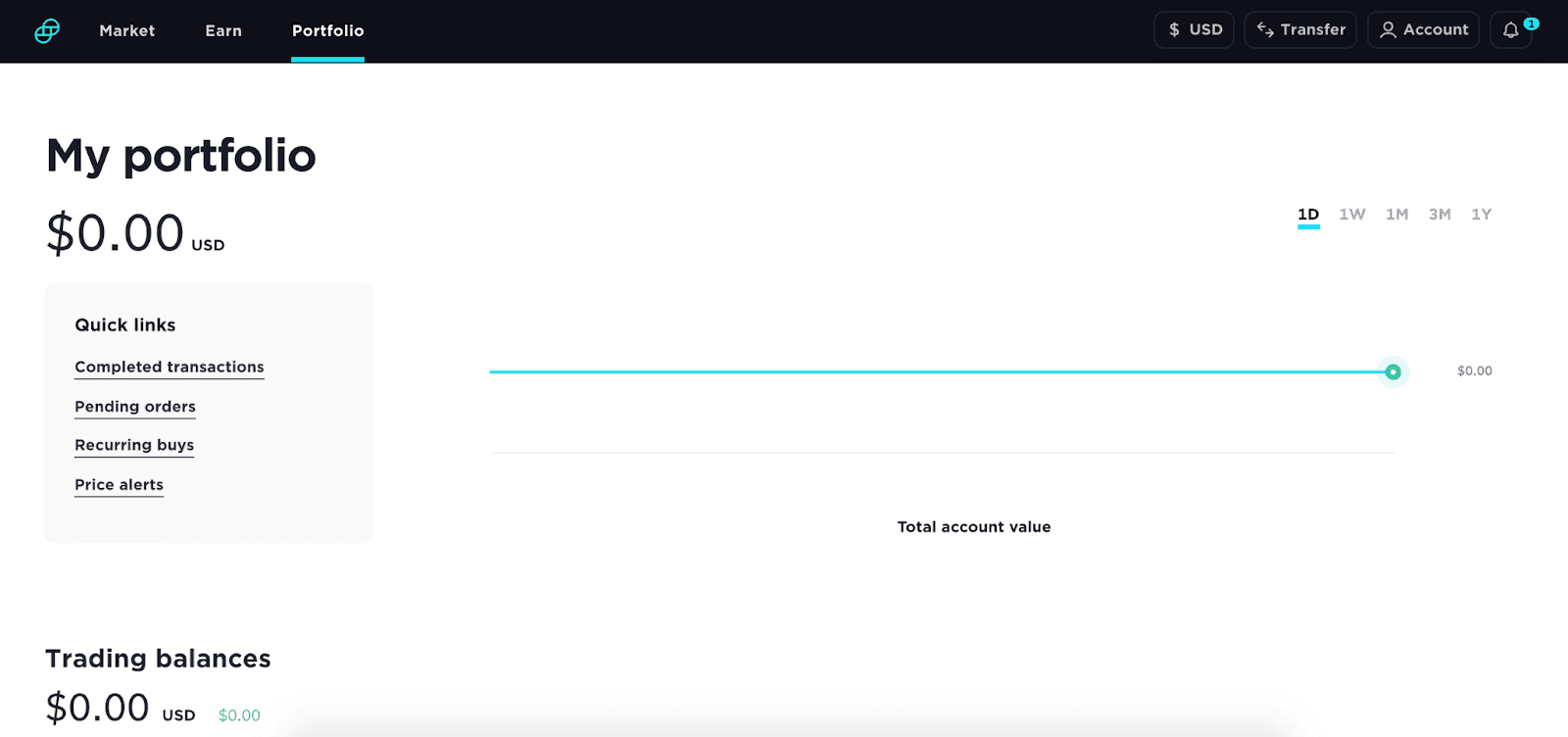

Once you’ve begun trading, you can check the assets in your portfolio. You can also set up price alerts to be notified when any of the cryptocurrencies you can trade through Gemini™ reaches a specific price point.

Pricing for Gemini™

Gemini™ uses a series of fee schedules based on where you conduct the trade. Whether you place your order on Gemini™’s website or through its mobile app, you’ll pay both a convenience fee and a transaction fee. But don’t worry. Gemini™ will give you a tally of what fees you’ll be charged before you make your purchase.

With Gemini™, the more you buy, the lower the per-transaction fee. Gemini’s™ web and mobile order fees are as follows:

- Orders of less than $10: $0.99.

- Orders of $10.00 – $24.99: $1.49.

- Orders of $25.00 – $49.99: $1.99.

- Orders of $50.00 – $199.99: $2.99.

- Orders of more than $200.00: 1.49% of your order value.

Most deposits and withdrawals are free. However, if you deposit funds using a debit card, you’ll be charged a fee of 3.49% of the total amount.

Gemini™ features

With an increasing number of cryptocurrency trading platforms on the market, it’s important to know what sets each one apart. Here are some of Gemini’s™ standout features.

Easy signup

Signing up with Gemini™ is a breeze, with an interface that walks you through the process. You simply enter some information and set up an account. Once you’re in, you can deposit some money to be prepared to buy when you see a good opportunity.

Competitive interest rate

When you purchase cryptocurrency through Gemini™, you can opt into a feature called Gemini Earn to start accruing interest on your balance. Gemini™ pays up to 8.05% APY on cryptocurrency balances. This rate can vary with the market.

Easy-to-use interface

From its website to its mobile app, Gemini™ prioritizes ease of use. You’ll get visual dashboards that help you watch which cryptocurrencies perform best. You can set up one-time or recurring trades and check your portfolio from your mobile device or the desktop website.

Top-notch security

Gemini™ is licensed in New York as a trust company, which means it has to follow regulations, including being subject to regular audits by the New York Department of Financial Services. Gemini™ was also the first cryptocurrency provider to gain SOC 1 Type 2 and SOC 2 Type 2 compliance.

Watchlists

Gemini™ lets you add cryptocurrencies to your watchlist to monitor performance before making a move. You can sort cryptocurrencies by top movers, top traded, and recently launched to make it easy to find cryptocurrencies to keep an eye on.

Cryptopedia®

Watchlists aren’t the only way Gemini™ helps you learn all things cryptocurrency. The site also offers Cryptopedia®, a comprehensive resource for investors. This free website is available to everyone, including non-members, and includes articles on everything from the history of Bitcoin to NFTs.

Gemini ActiveTrader®

For advanced cryptocurrency traders, there’s Gemini ActiveTrader®, which gives you access to more features. With ActiveTrader®, you get advanced charting, multiple order types, auctions, and block trading.

Gemini Clearing®

If you want to exchange money with other cryptocurrency traders quickly, Gemini Clearing® is a feature to pay attention to. The settlement is fast and anonymous, but you’ll still have Gemini™’s security to protect the transaction.

Business-to-business services

Financial institutions can benefit from Gemini Custody® or Gemini Wallet®, which are Gemini™’s institutional-grade cryptocurrency storage services.

My experience researching Gemini™

Right off the bat, what I noticed about Gemini™ was how easy the interface was to use. Even a cryptocurrency novice like myself can figure out what to do if I want to buy or sell. This ease of use doesn’t just apply to the website, either. The mobile app gives you a handy way to track your portfolio from wherever you are.

But what stands out about Gemini™ is its extremely high-interest rate. Currently, you can earn 8.05% on your cryptocurrency balances. You’d be challenged to find a financial institution that’ll offer you a return like that.

Gemini™ is set up to help you learn the ropes. You can monitor what’s going on with all the most popular cryptocurrencies and add some to your watchlist. By keeping an eye on the top performers, you can truly learn about various cryptocurrencies to make a fully informed purchase decision.

Who is Gemini™ best for?

Beginner traders

Gemini™ is designed for novice cryptocurrency investors, although Gemini ActiveTrader® opens up more features for advanced traders. But if you’re just getting started, the interface and the ability to create watchlists make it great for learning the ropes.

Buy-and-hold investors

Gemini™’s impressive interest rate makes it the ideal platform for those who are prepared to hold onto their cryptocurrency for a while. Make sure you sign up for Gemini Earn if you want to take advantage of the higher interest rate.

Security-conscious users

Gemini™ takes security seriously, having completed the SOC 1 Type 2 and SOC 2 Type 2 compliance exams. You can also opt to secure your account with a security key, and Gemini™ invests in advanced cold storage for all the crypto held in its wallet.

Credit card users

Gemini™’s new credit card is an excellent benefit for anyone interested in trading cryptocurrency. You don’t have to do anything but shop to start earning cryptocurrency that you can hold in your high-yield account.

Who shouldn’t use Gemini™?

Investors on a budget

Gemini™’s fees are on the high side when compared to other cryptocurrency exchanges. You won’t pay your deposits and withdrawal fees unless you use a debit card, so you’ll save a little money there.

International users

Although Gemini™ is available in more than 50 countries, including the U.S., there are cryptocurrency exchanges with a broader reach. If you live outside the U.S. or plan to move eventually, check out the list of supported countries and ensure you’ll have the necessary access.

Pros & cons

Pros

- Top-notch security — Gemini™ provides some of the best security in the industry, making it a great choice for those concerned about breaches.

- Easy to use — The interface is intuitive, making it easy to not only learn how to trade but also learn which cryptocurrencies are the right fit for your portfolio.

- High interest yield — The 8.05% APY offered on cryptocurrency balances makes Gemini Earn an impressive savings option.

Cons

- High fees — The fees on trades are higher than with other cryptocurrency platforms, but the fees reduce with higher-dollar transactions.

- Not available in all countries — Although U.S. traders have access, traders in some countries will not.

Gemini™ vs. their competitors

Coinbase

Gemini™ isn’t the only platform designed for cryptocurrency beginners. Coinbase’s interface makes cryptocurrency investments accessible to everyone. Best of all, you can take courses that help you learn more about cryptocurrency.

Although it’s hard to beat Gemini™’s top-notch security, Coinbase provides a vault with time-delayed withdrawals to help keep your funds safe. You can also earn up to 6% APR on your crypto balance.

eToro

If lower fees are your goal, eToro may be a good alternative. The selection of cryptocurrencies is much smaller.

Although the fees are lower with eToro, you’ll pay a $5 withdrawal fee on all types of withdrawals. There’s a $30 minimum to take funds out of your eToro account. You’ll also get CopyTrader™, which lets you copy another trader’s activity. You can customize the amount you want to invest but follow the same patterns in your trades.

Gemini Credit Card® review

In April 2022, Gemini teamed up with credit card issuer WebBank to release a co-branded credit card that rewards you with crypto cash back whenever you spend fiat currency with your Gemini Mastercard®.

If you’re a budding crypto investor who wants to boost your digital wallet with crypto rewards, this card could be a smart option. But before you zip off to apply, it’s worth diving deeper into the Gemini Mastercard®’s details, rates, and rewards program to make sure it’s a good fit.

What is the Gemini Credit Card®?

The Gemini Credit Card® (or Gemini Mastercard®) is a cash back rewards credit card issued by WebBank. It runs on the Mastercard payment network, which means that cardholders get a range of essential Mastercard benefits alongside access to crypto cash back via Gemini.

The Gemini Credit Card® stands out because it rewards you with crypto assets whenever you purchase a traditional currency using your Mastercard. This enables you to build your crypto portfolio without investing your cash by purchasing crypto coins directly from an exchange.

It’s worth pointing out that you’ll need a Gemini account to collect your crypto rewards. But once you’re set up with Gemini and get your credit card, you can also transfer any crypto rewards you accumulate to Gemini Earn — a high-interest-bearing account.

Notably, the Gemini Credit Card® has no annual or monthly fees. That means it’s a reasonably cheap way to invest small amounts in crypto.

Just bear in mind that the Gemini Mastercard® isn’t the most lucrative rewards credit card. At a max of 3% crypto cash back, its rewards rate is lower than some other cash back cards.

Finally, remember that crypto can be a volatile investment. If you’re looking for an investment with less risk, you might want a credit card that offers rewards in a traditional fiat currency.

Rewards and benefits

As we’ve already pointed out, the Gemini Credit Card®’s unique selling point is its rewards scheme. There aren’t many credit cards out there offering crypto rewards. But to help give you an idea of how Gemini rewards work, let’s break down the cash back system in more detail.

Earning crypto rewards

The Gemini Credit Card® enables you to earn rewards in the cryptocurrency of your choice.

As part of the rewards program, you can choose to receive your cash back from over 50 cryptocurrencies. These include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Filecoin (FIL)

- Zcash (ZEC)

- Bitcoin Cash (BCH)

- Litecoin (LTC)

- Dogecoin (DOGE)

- Tezos (XTZ)

When it comes to how much crypto you’re eligible to receive, reward amounts depend on the type of purchase you’ve made.

You can get:

- Up to 10% back in crypto on gas at the pump and electric vehicle charging stations (up to $200 per month for 12 months)

- 3% on dining purchases

- 2% on grocery store purchases

- 1% on other purchases

Redeeming crypto rewards

The Gemini Mastercard® will automatically convert cash back rewards into your chosen cryptocurrency and deposit the crypto in your account. Unlike some other credit cards, Gemini disburses rewards immediately after most purchases.

If you want to diversify your portfolio, you can change the type of crypto you’re getting in rewards at any point. Just remember that this won’t affect the crypto rewards you’ve already received, so you can’t instantly turn your Bitcoin rewards into Ethereum.

Mastercard benefits

The Gemini Credit Card® doesn’t just give you crypto benefits. Because it’s a part of the Mastercard payment network, it also comes with some basic Mastercard benefits.

These benefits include:

- Retailer perks and partner discounts with DoorDash, Lyft, and ShopRunner

- Mastercard concierge

- Assistance with trip planning and discounts from Mastercard’s Travel & Lifestyle managers

Rates and fees

Here’s a breakdown of the Gemini Credit Card®’s rates and fees structure:

- Cash Advance Fee: $10 or 3% of the amount of each cash advance, whichever is greater.

- Cash Advance APR: 30.49% Variable

- Foreign Transaction Fee: $0

- Smart Chip: yes

- Max Late Fee: $20

- Max Overlimit Fee: $35

- Max Penalty APR: 34.49% Variable

- Grace Period: 25 days

How to apply for the Gemini Credit Card®

If you’re keen to apply for the Gemini Mastercard®, you can submit an application on the Gemini website.

Gemini lets you find out if you pre-qualify for its credit card with absolutely no impact on your credit score.

If you complete the form and pre-qualify. Afterward, WebBank (the card issuer) will make a hard inquiry into your credit report to reach a final decision on your eligibility.

Either way, you’ll typically receive an answer in about a minute. In other cases, Gemini may contact you for additional information, so WebBank can finish processing your application.

Once approved, your new card should arrive in five to seven days.

What are my chances of getting approved for the Gemini Credit Card®?

Gemini doesn’t publish a minimum credit score you need to qualify — but the Gemini Mastercard® is designed for those with good or excellent credit.

That translates to a FICO score of 670 or higher. If your credit score is higher than 670, your chances of approval are pretty good. If your score is less than 670, you may want to consider applying for an alternative card.

Summary

If you’re looking for an easy-to-use crypto platform, Gemini™ is a great tool to consider. With Gemini Earn, you can even accrue interest at a rate higher than most high-yield savings vehicles. It’s a handy way to get your start in crypto while also setting money aside for the future.

And if you want to earn passive crypto income, the Gemini Mastercard® could be a great way to do it — but it’s worth researching all the options available to you before you apply. Compare credit cards using our free online tool now.