Wealthfront's Cash Account: What It Is & How To Use It

Rating as of based on a review of services May 5, 2023.

Ranking

8.3/10

Wealthfront’s Cash Account has been open for over a year, but is it a good place to stash your cash? Find out if there are better options.

Best for:

- Wealthfront investors

- Early payday deposit

- Those looking for an FDIC insured bank

The benefits of high-yield savings (and checking) accounts are a popular topic here on Money Under 30. All you have to do is choose the right bank and you could be earning way more than just pennies, as traditional banks offer.

If you currently invest with Wealthfront, you have the option to get a great interest rate by keeping your money in Wealthfront’s Cash Account.

Wealthfront has joined other robo-advisors looking to find a foothold in cash management, which was typically dominated by banks and credit unions. These new rob-advisor accounts typically offer attractive APYs or an easy way to spend cash as a way to lure new and existing customers further into the companies’ ecosystems.

What is a Wealthfront Cash Account?

You have the option to get a higher interest rate than brick-and-mortar banks offer by keeping your money in Wealthfront’s Cash Account. This is not a traditional checking, savings, or even high-yield savings account, though. Instead, it is a cash account held at a brokerage firm.

Wealthfront has joined other robo-advisors looking to find a foothold in cash management, which was typically dominated by banks and credit unions. These new robo-advisor accounts originally offered attractive APYs as a way to lure new and existing customers further into the companies’ ecosystems. Unfortunately, APYs have been sinking over the last few months due to the current economic conditions.

How does a Wealthfront Cash Account work?

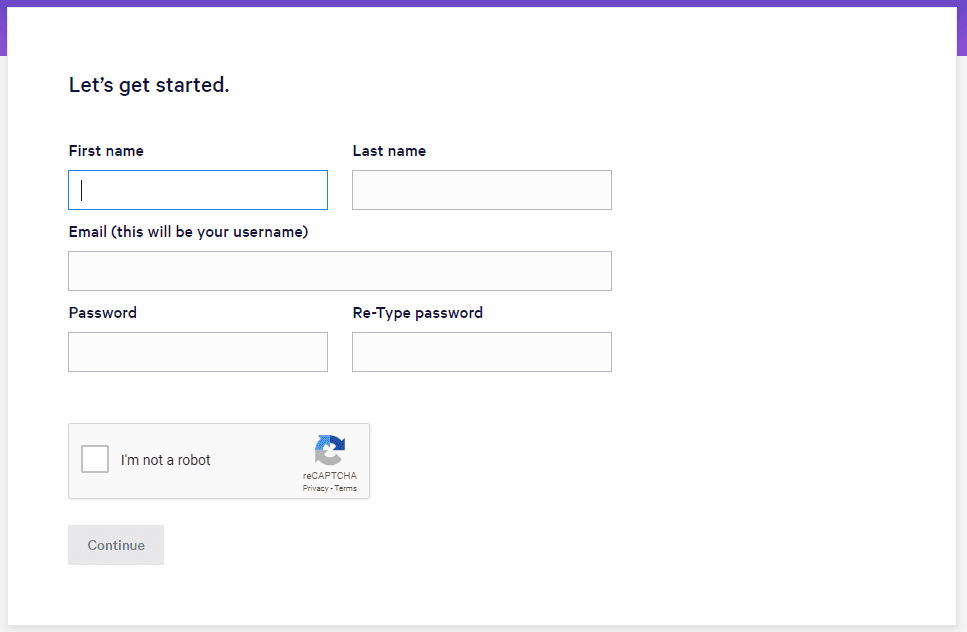

Signing up for a Wealthfront Cash Account is an easy process. Here’s what you need to know.

First, click the Get Started button on Wealthfront’s homepage. Next, click Open a Wealthfront account.

Enter the required information, verify you aren’t a robot, and click continue.

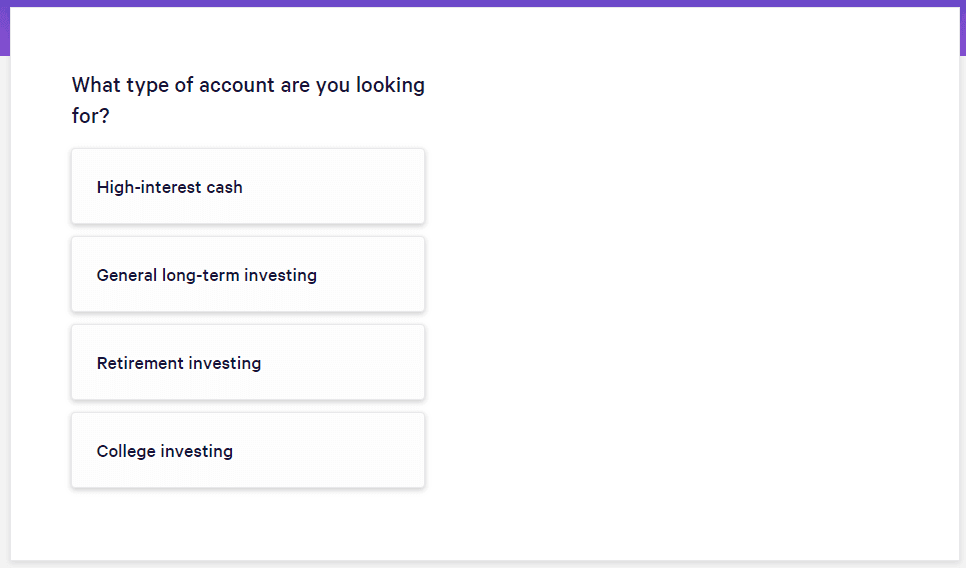

You’ll next enter your mobile number and click continue where you’ll enter the verification code and click continue again. Now, specify the account type you want (High-interest cash).

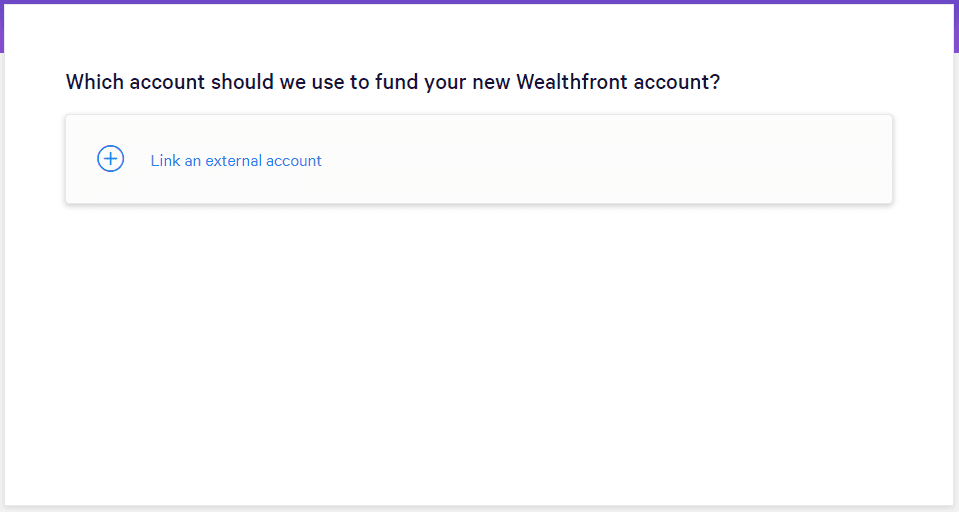

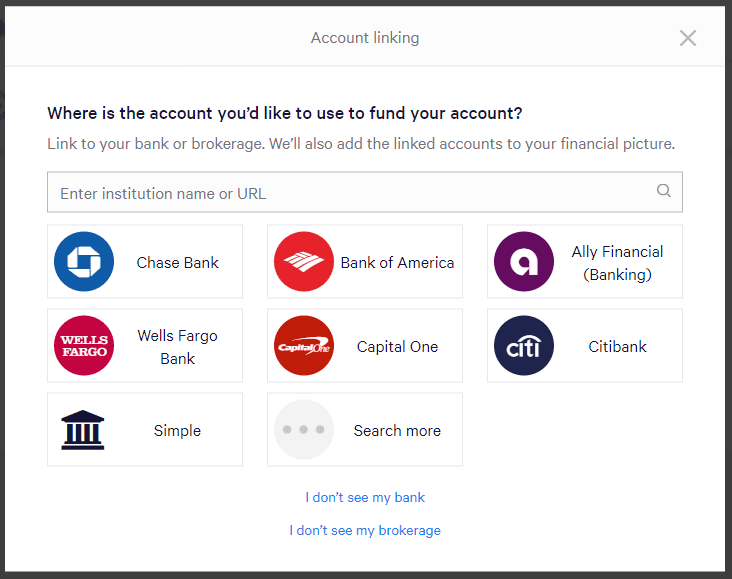

Decide if you want an individual, joint, or trust account and click I want this account, and then you’ll have to link an external account to fund your Wealthfront Cash Account.

Choose your account or click I don’t see my bank – you’ll need to log into your bank account so you can choose which account to fund your account from.

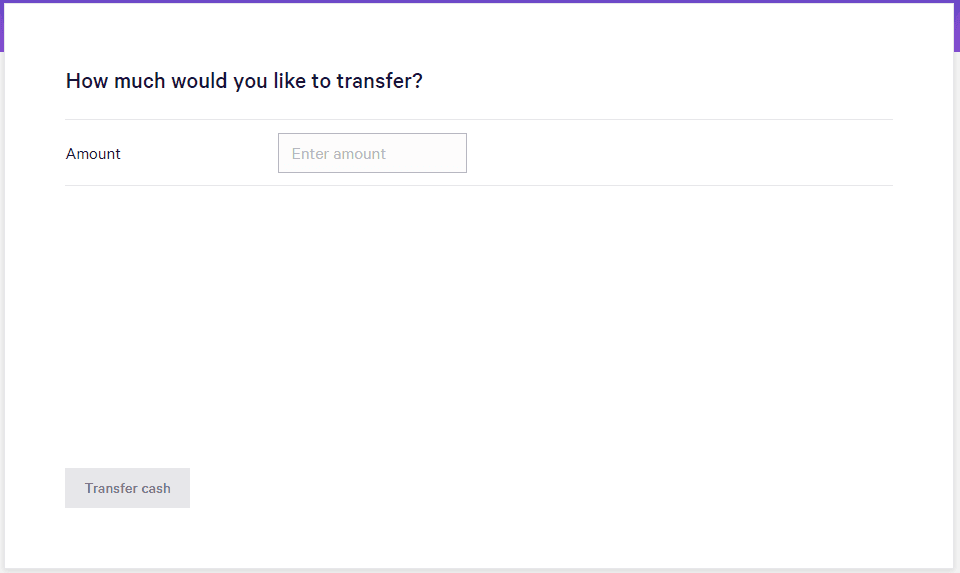

Enter the amount to transfer and click ‘Transfer cash’.

Finally, complete the account opening procedures. Once your account is open, you can start earning 4.55% APY with your new Wealthfront Cash Account.

How much does the Wealthfront Cash Account cost?

As far as fees go, you are not charged any advisory fees for the cash account. The usual 0.25% investment advisory fee does not apply.

To make things even better, the minimum to open an account is only $1 and there aren’t any additional deposit requirements beyond that.

You do have to pay the following fees connected with a Wealthfront Cash Account if you use these features:

Service Fee

Out-of-network ATM or bank teller $2.50 plus ATM owner fee or bank teller fee

Out-of-network ATM balance inquiry $0.50

International transaction fees $2.75

Cash loads (at participating retailers) Up to $5.95

Features and details of the Wealthfront Cash Account

4.55% APY

The Wealthfront Cash Account currently pays 4.55% on deposits. Interest accrues daily and is credited to your account monthly. This rate is 8x what you would earn with a typical checking account.

This account doesn’t work like a traditional savings account, though. Instead, Wealthfront takes the money you deposit and sweeps it to one of many unaffiliated participating banks. These banks hold your money and pay Wealthfront interest.

Wealthfront keeps a small portion of the interest for themselves and gives the rest to you. Since the money is in a bank account, there is no market risk that your money will decrease in value as there would be if you had invested the money in a conservative investment option.

FDIC insured

Your deposits are FDIC insured up to $5 million for an individual account or $10 million for a joint account.

The cash is only FDIC insured while it is in a bank account at one of the unaffiliated banks. When you initially deposit money into your Wealthfront Cash Account, it takes one to three business days to sweep the funds from Wealthfront to the unaffiliated bank.

Wealthfront does state that customers are responsible for monitoring how much of their cash is swept to each of the unaffiliated banking institutions to make sure that the balance in each unaffiliated bank does not exceed the FDIC insurance limits. As of April 22, 2020, banks include:

- Associated Bank.

- Citibank N.A.

- Cross River Bank.

- CrossFirst Bank.

- East West Bank.

- Green Dot Bank.

- HSBC Bank USA, NA.

- Independent Bank.

- Peapack-Gladstone Bank.

- State Street Bank and Trust Company.

- TriState Capital Bank.

- Wells Fargo Bank, National Association.

Easy-to-access money

Accessing your money is easy even though it is swept into these unaffiliated bank accounts. Simply log in to your Wealthfront account and request the money. Withdrawals will take one to three business days to arrive at your bank account.

Quick transfers to invest with Wealthfront

Previously, transfers from Wealthfront’s Cash Account took some time to get to your Wealthfront investment account and actually get invested. As of February 2021, Wealthfront has sped this process up.

You can now use money in your Cash Account to invest in your Wealthfront investment account within minutes. Speeding up this process helps you invest your money faster, allowing your money to spend more time invested in the market.

Unlimited free transfers

The Wealthfront Cash Account offers unlimited free transfers, which can take one to three business days to reach your bank account when making a withdrawal.

Wealthfront does have added the option to transfer funds between its cash account and its taxable brokerage accounts. Transfers to other Wealthfront accounts are not available at this time.

Low minimum opening

There is only a $1 initial opening deposit with no further deposit requirements.

Many banks have minimum average daily balances or deposit requirements to avoid fees. When you consider this account has no fees, a $1 minimum with no further deposit requirements is a great way to get started with a cash management account.

Checking features

Checking features are available with the Wealthfront Cash Account including the ability to:

- Receive direct deposits including paychecks, tax refunds, Social Security benefits, and child support in the account (up to two days early).

- Get a debit card.

- Pay bills using your account’s routing and account number or your debit card.

- Use your debit card to take out cash at 19,000 fee-free ATMs (out-of-network ATMs charge $2.50 fee plus ATM owner fees).

- Pay friends with payment apps such as Paypal, Venmo, and Cash App by linking your Wealthfront Cash Account using your routing and account numbers.

- Deposit checks with the mobile app.

- Send checks right from the app.

Self-Driving Money™

Wealthfront’s ultimate vision is to fully automate your finances across spending, savings, and investments and put it all to work effortlessly, a vision they call Self-Driving Money™. Once you’ve directly deposited your paycheck to Wealthfront and paid your bills from your Cash Account, their software will optimize every remaining dollar. With the click of a button, you’ll be able to let Wealthfront automatically move your money to the most appropriate accounts for your lifestyle and goals. The idea is that Wealthfront will handle all your payments and investments, letting its algorithms do the “driving” for you.

Wealthfront recently delivered the final set of features that make up V1 of their first Self-Driving Money™ vision. You can now use Wealthfront to automate your savings plan so you no longer need to have the stress of manually monitoring accounts and moving money. Once you have a Wealthfront account, you’ll be prompted to set up your Self-Driving Money™ plan when you open the app.

My experience researching the Wealthfront Cash Account

Wealthfront’s Cash Account offering is straightforward. They’re not looking to hide anything and disclose exactly how their product works upfront. During times of rising interest rates, the Wealthfront Cash Account even had competitive APYs.

Unfortunately, Wealthfront’s APYs have dropped like a rock after the Federal Reserve essentially dropped their target interest rates to zero in response to the coronavirus pandemic.

Rates are expected to stay low for the considerable future, so don’t expect the Wealthfront Cash Account’s APY to increase anytime soon.

That said, this account does have a few helpful features, especially if you’re a W-2 employee. The ability to receive direct deposits up to two days early could help your cash flow situation. However, your paycheck isn’t guaranteed to arrive early and depends on how your company processes your payroll.

Other than the higher FDIC insurance limit, the cash account is much like a bank account you could open at most online banking institutions.

Who is a good fit for the Wealthfront Cash Account?

Brick-and-mortar bank customers

If you’re a brick-and-mortar banking customer, the Wealthfront Cash Account may be a great deal. Old-fashioned banks typically pay next to no interest on the money you keep in your savings account.

If you’re only earning 0.10% APY, this is 3x times better. In these cases, you should seriously consider opening a Wealthfront Cash Account.

Wealthfront investors

If you’re looking for a place to park your cash while you wait for the perfect time to invest within Wealthfront, a Wealthfront Cash Account may be a good fit.

You can easily transfer your money between your investment and your cash account when you need it. Even better, your cash will earn interest while it’s sitting around doing nothing.

Who shouldn’t use a Wealthfront Cash Account

People looking for higher APYs on their money

You can find better options if you’re looking for a higher APY. Just because a Wealthfront Cash Account is a better deal than a brick-and-mortar bank doesn’t mean it is the best option for you.

High-yield savings accounts earn APYs several times higher than Wealthfront’s Cash Account.

Wealthfront Cash Account is certainly an option to store my money until you are ready to invest it with Wealthfront.

Pros & cons

Pros

- Higher APY than the vast majority of checking accounts — The APY on Wealthfront's high-yield checking account is much higher than the typical 0.01% to 0.10% APY many banks and credit unions offer.

- Get direct deposits up to two days early — If your direct deposits qualify, you may get access to them up to two days before you could in a normal bank account.

- Invest quickly — You can now invest money in a Wealthfront investment account from your Wealthfront Cash Account within minutes.

- Relatively low fees — Wealthfront’s Cash Account only has a few relatively reasonable fees.

Cons

- No ATM fee reimbursement option — Some banks and bank-like accounts offer reimbursement for some or all ATM fees incurred.

Wealthfront Cash Account compared

Wealthfront Chime® SoFi Stash

Account offered Cash account Spending account and savings account Cash account Checking account with a debit card that gives you access to over 19,000 fee-free ATMs around the U.S.²

APY 4.55% None with spending account, 2.00% with savings account 0.20% N/A

Fees $2.50 out-of-network ATM fee and fees for out-of-network balance inquiries, foreign transactions and cash loads $2.50 over-the-counter or out-of-network ATM fee None Out-of-network ATM fees, cash deposit fees, foreign transaction fees

Minimum account balance required $1 None None None³

Chime®

Chime is a mobile app that offers financial services. Depending on your needs, offers a spending account and a savings account with features their customers are looking for.

Chime allows you to get paid up to 2 days early when you direct deposit your paycheck into their accounts. Early access to direct deposit funds depends on payer.3 They offer a feature, called Chime Spot Me®, which allows certain customers to overdraft with debit card purchases without paying overdraft fees as long as they qualify.5

Additionally, Chime focuses on providing as fee-free of an experience as possible.2 Their only significant fee is a $2.50 over-the-counter or out-of-network ATM fee. This should be avoidable by using one of their 60,000+ fee-free ATMs.6

If you use Chime’s savings account, you can even use round-up tools to automatically save the change from every purchase in their FDIC insured account.^ There are no minimum balance requirements with Chime, so you can get started with any amount.

A major downside with Chime is they don’t pay interest on their spending account but their savings account has a 2.00% APY.7

^ Round Ups automatically round up debit card purchases to the nearest dollar and transfer the round up from your Chime Checking Account to your savings account.

2 There’s no fee for the Chime Savings Account. Cash withdrawal and Third-party fees may apply to Chime Checking Accounts. You must have a Chime Checking Account to open a Chime Savings Account.

3 Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

5 Chime SpotMe is an optional, no fee service that requires a single deposit of $200 or more in qualifying direct deposits to the Chime Checking Account each month. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases and cash withdrawals initially, but may be later eligible for a higher limit of up to $200 or more based on member's Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. Your limit will be displayed to you within the Chime mobile app. You will receive notice of any changes to your limit. Your limit may change at any time, at Chime's discretion. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe won't cover non-debit card transactions, including ACH transfers, Pay Anyone transfers, or Chime Checkbook transactions. See Terms and Conditions.

6 Out-of-network ATM withdrawal fees may apply except at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM.

7 The Annual Percentage Yield ("APY") for the Chime Savings Account is variable and may change at any time. The disclosed APY is effective as of November 17, 2022. No minimum balance required. Must have $0.01 in savings to earn interest.

SoFi

SoFi—best known for its student loan refinancing—now also offers a cash management account.

SoFi’s cash management account is a super simple “hybrid” account that has no account fees and ATM reimbursement for every ATM around the world. You can either store your cash to invest later (through SoFi of course) or simply use it as a regular bank.

Stash Banking Account¹

Stash is better known as the fintech company that allows users to invest small amounts of money. And you can invest with as little as just one cent⁴ – so a lot of people can easily start investing.

When you can get a Stash bank account, you’ll have access to a debit card. There are no hidden fees for this account³, such as out-of-network ATM fees², and Stock-Back® rewards at certain vendors that’s automatically deposited into your Stash investment account.⁵

*Terms and conditions apply

Summary

Compared to traditional brick-and-mortar banks, Wealthfront has significantly more perks.

The Wealthfront’s Cash Account offers an APY that is typically higher, no fees, and unlimited transfers, and is a good option – especially if you plan to invest with Wealthfront.

Read more:

- Wealthfront Review: My Experience Using Wealthfront

- Stash Review: This Simple App Helps You Start Investing In Minutes

*Terms and conditions apply – Stash legal disclosures

This material is not intended as investment advice and is not meant to suggest that any securities are suitable investments for any particular investor. Investment advice is only provided to Stash customers. All investments are subject to risk and may lose value.

¹Account opening of the bank account is subject to Green Dot Bank approval. Bank Account Services provided by and Stash Visa Debit Card issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Investment products and services provided by Stash Investments LLC, not Green Dot Bank, and are Not FDIC Insured, Not Bank Guaranteed, and May Lose Value.

²Fee-free ATM access applied to in-network ATMs only. For out-of-network ATMs and bank tellers a $2.50 fee will apply, plus any additional fee that the ATM owner or bank may charge.

³Other fees apply to the bank account. Please see Deposit Account Agreement for details.

⁴For Securities priced over $1,000, purchase of fractional shares starts at $0.05.

⁵Stash Stock-Back® rewards is not sponsored or endorsed by Green Dot Bank, Green Dot Corporation, Visa U.S.A., or any of their respective affiliates, and none of the foregoing has any responsibility to fulfill any stock rewards earned through this program.

Money Under 30 is a paid Affiliate/partner of Stash. Investment advisory services offered by Stash Investments LLC, an SEC-registered investment adviser.