TurboTax Self-Employed review

Rating as of based on a review of services April 19, 2023.

Ranking

9/10

TurboTax Self-Employed is a tax software for freelancers, contract workers, and small business owners. While it costs a little more than the competition, its features make it super easy to file your return quickly and accurately.

Best for:

- Freelancers

- Gig workers

- Small businesses

- Schedule C filing

If you’re a freelancer, gig worker, or entrepreneur, you may be wondering how you’ll file taxes this year.

I didn’t say it was the most exciting thought, but hey, we all have to pay taxes.

Lucky for us, one of the easiest and quickest options is with TurboTax Self-Employed.

Yes, it’s slightly more expensive than competitors like H&R Block or TaxSlayer. But it also has the easiest user experience, in my opinion. Here’s an overview of how it works.

What is TurboTax Self-Employed?

TurboTax Self-Employed is a tax software designed specifically for freelancers, independent contractors, and small business owners whose tax filing needs are a bit more complex than your typical employee.

TurboTax is the most popular tax filing service in the U.S. In 2021, over 50 million people used TurboTax to file their taxes.

How does TurboTax Self-Employed work?

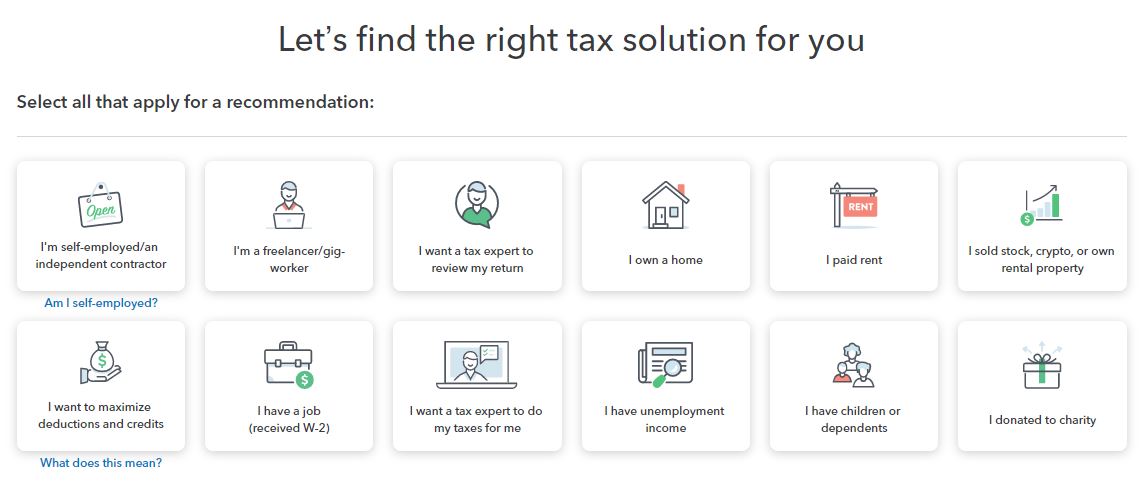

Filing your return with TurboTax feels like taking a Buzzfeed quiz. And honestly, I’m here for it. Just look at this screenshot for example.

One of the first things TurboTax asks when you sign up is, “How are you feeling about doing your taxes?”

One of their many quippy responses is, “We get it — the tax code is pretty crazy. But we have help options on every screen to make things a lot less, um, taxing.”

It’s super conversational and comforting. Like they’re saying, “Hey! We know filing taxes can suck sometimes, but we got you boo.”

But beyond its conversational tone, TurboTax uses a question-and-answer-based system to make filing your taxes super easy. All you do is answer each prompt as it pops up on the screen. And before you know it, your entire return is complete.

Here’s a brief overview of what the filing process looks like:

- Create your TurboTax account.

- Answer some questions about your current financial situation.

- Gather all the tax documents it says you’ll need.

- Enter in information about your income and expenses.

- Let TurboTax help you maximize your deductions and credits.

- File your state tax return if you need to.

- Review your forms.

- Finish and file them electronically.

TurboTax Self-Employed filing plans

TurboTax offers three different ways to file self-employed taxes with options ranging from a DIY filing plan to full-service preparation. Although the three options – TurboTax Self-Employed, Live Assisted Self Employed, and Live Full Service Self-Employed – all achieve the same end goal of a correctly-prepared self-employed return and offer the same forms and credits, the different plans require varying levels of intervention from you, the filer. They also give you different options for getting help.

TurboTax Self-Employed

This is the online DIY filing plan you’re probably most familiar with. It supports all possible situations and forms including those commonly needed for freelance or contract income.

This plan also allows you to deduct business-related expenses (and search from 500 different credits and deductions for more savings), includes a Self-Employed Tax Calculator for quarterly tax payments, simplifies Schedule C filing with year-over-year comparison charts, and more.

With Self-Employed Online, you’ll have access to general help and tech support but will not be able to ask a pro tax-related questions specific to your situation.

For the purposes of this article, we’ll be focusing on this plan.

Read more: How much should you budget for self-employed taxes as a freelancer?

Live Assisted Self-Employed

This plan is something between DIY and full prep. You’ll still be responsible for filling out your return yourself, but you’ll have the opportunity to get live support from tax pros with self-employed experience if you need it as you file. And when you’re done, they’ll look over your return to make sure you didn’t miss anything – including deductions you might qualify for.

Basically, upgrading to Live Assisted just unlocks access to expert help.

Live Full Service Self-Employed

This is the costliest of the three plans because it’s the most hands-off for you. You’ll turn your taxes over to an expert, give them the info and documents they need, and have your taxes taken care of for you.

How much does TurboTax Self-Employed cost?

There are three different versions of TurboTax Self-Employed available, each at a different price point. The plans and prices are:

- TurboTax Self-Employed – starting at $129, base DIY filing plan

- Live Assisted Self Employed – starting at $219, lets you file with professional help

- Live Full Service Self-Employed – starting at $409, includes professional filing so you don’t have to do anything except provide the tax documents

These prices are only for federal returns and you will need to pay an additional fee for state returns. This is going to be between $59 and $64 per state e-file.

Choose the cheapest option, TurboTax Self-Employed, if you want to do it yourself (with general support available when you need it). Choose the mid-tier option, Live Assisted Self Employed, if you want a tax expert to review your final return before you submit it and you want on-demand live support. Or, go with the full-service option, Live Full Service Self-Employed, if you want a tax expert to do your entire return for you.

TurboTax Self-Employed features

No matter which TurboTax Self-Employed plan you choose, you’ll get access to these cool features:

Search over 500 self-employed tax deductions

TurboTax searches over 500 deductions across dozens of industries to help you identify which ones apply to your unique situation. So, if you’re a rideshare worker, freelancer, online seller, or real estate agent, for example, it’ll help you maximize those write-offs.

In addition, if there are several ways to calculate a deduction — such as using the actual vs. standard mileage rate for vehicle deductions — it’ll crunch the numbers both ways to see what gets you the biggest savings.

Read more: 10 Deductions You Didn’t Know You Could Take As A Business Owner

Get a personalized audit assessment

Every business owner shares one common fear: the thought of getting audited. But with TurboTax Self-Employed, your return will be run through a personalized audit assessment. Any red flags will be pointed out along the way.

Although it’s not a bulletproof way to shield yourself from an audit, it does a good job of lowering your chances.

Prepare and submit 1099s and W2s

If you’re self-employed, there’s a good chance you’re either receiving 1099-NECs from the clients who paid for your services. Or, you’re creating them for people you hired to help run your business.

The good news is TurboTax helps with both. You can use the software to create unlimited W-2 and 1099 tax forms for any contractors or employees you hired this year. Likewise, you can snap a photo of any 1099s you received and upload them into TurboTax.

Get access to 24/7 customer support

Perhaps one of the biggest benefits of using TurboTax Self-Employed is that you have access to general customer support, tax experts, or self-employment specialists depending on which plan you choose. This is super beneficial if you’re a new business owner or have a more complex return than you’ve had in the past.

And if you start with the cheapest TurboTax Self-Employed version and decide you want to upgrade to the Live Assisted or Live Full-Service version for more tailored support, you can do that at any time without having to start over.

Integrate with Lyft, Uber, UberEats, and Quickbooks Self-Employed

Lyft, Uber, and UberEats drivers can automatically import their income and expenses into TurboTax, so they don’t have to manually enter everything themselves.

Same goes for anyone who uses QuickBooks Self-Employed to track mileage, income, or expenses. TurboTax will automatically import your data and add it to your return.

This may seem like a small feature, but it has the ability to save you a huge chunk of time. Plus, it reduces the likelihood of making a tax return error.

My experience researching TurboTax Self-Employed

After reading through hundreds of TurboTax Self-Employed reviews, it’s obvious plenty of people love this software.

“Simple,” “fast,” and “easy to use” are phrases that come up in almost every review. People say the program is well thought out and painless to navigate. This has been my experience too.

The second most talked about feature is the deduction tool. TurboTax searches almost every deduction imaginable and does a great job at finding even obscure write-offs you may have never heard of.

I haven’t personally used TurboTax Self-Employed, but I do use regular TurboTax to file my return for over five years and absolutely love it. It’s set up kind of like a game where all you do is answer questions as they pop up on the screen. Meanwhile, TurboTax is filling out your return in the background without you ever really knowing.

I honestly had fun filing my taxes with TurboTax when I first began to use them. (Maybe that’s just the math nerd in me or the fact that I was getting refunds because I was a broke college student). Either way, I’d finish my return for the year thinking, “Why do adults hate tax season so much? This was easy peasy!”

That said, there is one thing that aggravated me about TurboTax, and that was all the constant upselling. On every screen, I felt like I was being bombarded with opportunities to get expert help or upgrade for more features.

This one annoyance was easy for me to overlook because the software is truly amazing. But it’s something you’ll want to watch out for.

Read more: How TurboTax Self-Employed can save you time, money, and headaches

Who is TurboTax Self-Employed best for?

Independent contractors

If you’re a freelancer, rideshare driver, consultant, side-gigger, or anyone else who’s classified as an independent contractor, TurboTax Self-Employed is a good option for you.

Your tax situation is more complex than the typical W2 employee, and TurboTax does a great job of making sure nothing falls through the cracks.

For example, you can tell TurboTax what type of self-employment work you do, and it’ll scan over 500 potential deductions to show you which ones apply to your situation. For rideshare drivers, it could be things like car repairs, insurance, and your cell phone. For freelancers, it could be professional fees, a laptop, tools, and supplies.

Read more: 3 Ways To Make More Money Freelancing

Small business owners

Whether you’re a brand new business owner or a seasoned pro, TurboTax Self-Employed walks you through all the steps you need to take to file your return correctly and accurately. It covers self-employment tax, working from home remotely, business income and deductions, and more.

Another perk is that if you have employees, TurboTax Self-Employed will also help you generate 1099s and W2s for them.

Who shouldn’t use TurboTax Self-Employed?

Corporations and multi-member LLCs

Small businesses classified as multi-member LLCs, S corporations, or C corporations can’t use TurboTax Self-Employed. Instead, you’ll need to use TurboTax Business, which is only available as a CD or download.

Cost-conscious filers

If you’re looking for the cheapest way to file your taxes, TurboTax may not be the way to go. They offer a premium product, at a premium price.

So if you’re on a tight budget, know you can file self-employed taxes online at a much lower cost. For more options, including cheaper or even free services, click the link below.

Read more: Best tax software for 2023

Pros & cons

Pros

- Super conversational — TurboTax feels like an AI friend who really loves taxes and wants to help you file your return the right way. Simply answer questions as they appear on the screen and you’ll be finished in no time.

- Online software — No downloads or clunky computer programs here. Complete your return online from anywhere (even your smartphone).

- Three levels of support to choose from — A true goldilocks situation, go with the cheapest option if you want to do it yourself, the mid-tier option if you want a final review from an expert, or the full-service option if you want a tax expert to do your taxes for you.

- Great customer support options — You can get help with your taxes 24/7 from general customer support, self-employment specialists, tax experts, and more.

Cons

- Pricing — You’ll pay more for TurboTax than you will for other tax software platforms. And if you need more support, you’ll have to upgrade to the costlier Live Assisted or Live Full-Service plans. Keep an eye out for deals and promotions ahead of Tax Day to save.

- No in-person filing option — Rivals like H&R Block give the option of filing your return in person. TurboTax Self-Employed only has the option to meet virtually, which may not be your thing.

TurboTax Self-Employed vs. competitors

If you’re thinking TurboTax Self-Employed isn’t for you, here are a few alternatives to consider:

TurboTax Self-Employed H&R Block Self-Employed TaxSlayer Self-Employed

Cost Online:$129 + $59 to file your state tax return

Live Assisted: $219 + $64 to file your state tax return

Live Full Service: $409 + $64 to file your state tax returnOnline: starting at $85 + $37 to file your state tax return

Online Assist: starting at $145 + $37 to file your state tax returnOnline: $64.95 + $39.95 to file your state tax return

Number of self-employed plan options 3 2 1

Features Maximum refund guarantee, 100% accuracy guaranteed, Schedule C filing, deduction tool, Quickbooks Self Employed integration, Lyft, Uber, and UberEats integration Maximum refund guarantee, 100% accuracy guaranteed, Schedule C filing, deduction tool, expense tracking, Uber importing, Maximum refund guarantee, 100% accuracy guaranteed, Schedule C filing, deduction tool, quarterly estimated payment reminders

H&R Block

H&R Block has two options for self-employed filing. You can either file on your own, with the choice of paid assistance as well, or hire a professional to file for you. And of course, you have the option of visiting your local H&R Block branch if you’d rather get face-to-face support.

No matter which plan you choose, you’ll get access to a deduction maximizing tool, expense tracking, and tax importing for Uber drivers. H&R Block’s prices are on par with TurboTax, but come out just a hair cheaper. And H&R Block comes out on top for live support in-person and online.

Read our full H&R Block review.

TaxSlayer

TaxSlayer Self-Employed is comparable to TurboTax Self-Employed but costs less than half the price. You can speak with a self-employment expert if you need help, but TaxSlayer only offers the option for DIY filing.

TaxSlayer has one feature TurboTax and H&R Block doesn’t appear to have, and that’s reminders for quarterly estimated tax payments. At the same time, it doesn’t integrate with any rideshare apps or bookkeeping software. TurboTax may be easier to use and more robust than TaxSlayer, but if you’re comfortable enough filing and your situation isn’t too complicated, you’ll save with TaxSlayer.

Read our full TaxSlayer review.

Summary

TurboTax Self-Employed may cost a little more than other tax filing solutions, but its robust features and easy question-and-answer setup make it a no-brainer for anyone who wants to file taxes quickly and accurately. So, if you’re a freelancer, gig worker, or small business owner, you can sign up for an account today and give it a try. You won’t pay anything until you submit your return.