Sometimes in life, you just don’t need a whole six months of auto insurance coverage.

What if you’re just borrowing a friend’s car for a while? Or going on a road trip? Or you only plan to own a car for two months?

Do you really need to pay $900 for a whole six months?

Or is “temporary car insurance” a thing?

Here’s everything you need to know about temporary car insurance: when you need it, when you don’t, and how to get it when it’s not on the menu.

What’s Ahead:

What is temporary car insurance?

Temporary car insurance is any coverage you can get that lasts less than six months.

I phrase it like that because “temporary car insurance” isn’t really a thing. It’s more of a “hack” that you can take advantage of in certain cases.

See, the auto insurance companies don’t want you covering your car for less than six months. They don’t say why, but having studied the weird world of auto insurance for years, I have a few guesses:

- Insuring drivers for less than six months is riskier since carriers will generate less income from premiums

- They don’t want you shopping around for better rates too frequently

- It cuts down on overhead

- Six months is a good amount of time to reevaluate your driving record and raise/lower your rates accordingly

In short, like a six-pack of beer, a “six-pack” of auto insurance just made sense.

But what if you only want one beer? What if you only need one month of car insurance?

Auto insurance companies won’t officially sell you just one, two, or four months of coverage — but there’s still a way you can get it.

(Oh, and don’t trust any no-name company offering to sell you a policy shorter than six months — they’re all scams).

How does temporary car insurance work?

It’s pretty simple: you buy a regular car insurance policy and cancel it when you no longer need coverage.

Let’s say you’re borrowing your friend’s car for two months while they’re out of the country. Even though you’d technically be covered under their insurance, your friend has politely requested that you purchase your own coverage. That way, any accidents you cause won’t drive up their rates.

Nobody sells just two months of insurance, so you call up a major carrier and purchase a six-month policy. You pay month-to-month, and after two months, you cancel the policy.

At that point you may be “short rated” by $50, which is a special early termination fee that I’ll explain later.

But in the end, you come out ahead. A full six-month policy would’ve cost you $900. But since you canceled after just two months, you were refunded $600 minus the short rate of $50. So, $350 in total, or $550 in savings off a full policy.

What are the drawbacks to the temporary car insurance “hack”?

To set expectations, the temporary car insurance “hack” isn’t effortless to pull off. As mentioned, you could be “short rated,” rejected for a refund, and your rates could actually go up in the future.

Here’s a breakdown of all three and how to avoid them.

1. Some states allow providers to charge secret cancellation fees

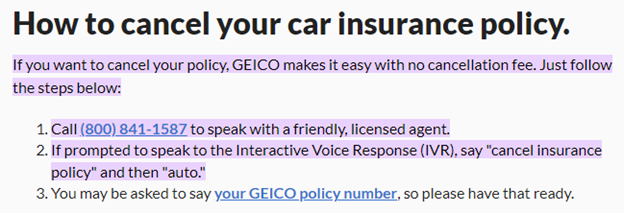

Some providers like GEICO will proudly state that they don’t charge customers cancellation fees for terminating their policy early.

Source: GEICO

Well, I’m here to tell you that this isn’t really true. It’s 99% misleading at best.

That’s because certain states have laws in place that allow insurance providers to charge early cancellation fees even if they say they don’t. This is called “short rating”, and it basically entitles providers to a percentage — sometimes up to 100% — of your unpaid premiums.

Short rating tends to catch policyholders off guard because it’s often buried in your terms and conditions, and nobody goes looking for it. Then, when you cancel early and expect no cancellation fees, you get short rated for between $40 and $100.

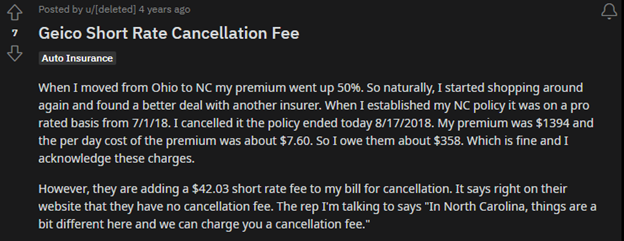

Source: Reddit

Here’s a list of short rate laws by state. If your state lists “Nonpayment of premium” under “Auto” as a valid reason to short rate your policy, your provider may short rate your policy when you cancel mid-term.

Unfortunately, it’s also hard to predict how much they’ll charge. Personally, I’d just ask them on the phone if they short rate policies and, if so, by how much.

2. Refunds aren’t guaranteed

Even if they short rate you $50 or so, most insurance companies will refund you for unused policy months. So, if you purchase a six-month policy for $600 and use just three months, they’ll refund you $300 – $50 = $250.

That said, not all providers are so chill with refunds. Some will only refund if you:

- Switch insurance companies

- Move out of state

- Sell your car

- Etc.

Some, like Progressive, will only refund you 90% max, keeping 10% to cover administrative fees, etc.

So before trying the temp insurance hack on any provider, be sure to check their cancellation policy and their refund policy.

3. Temporary car insurance can lead to lapses (and higher premiums)

Finally, using the temporary car insurance hack can leave “gaps” in your coverage that could cost you later.

Let’s say you plan to buy a car in six months. In the meantime, you’re just going to borrow your friend’s car for a month or two while you get groceries, go on road trips, etc.

If insurance is $75 a month, getting temp insurance would save you 4 months x $75 = $300.

Sounds good on paper, but the insurance companies really don’t like it when you have lapses in coverage like that. They see that four-month gap and wonder:

- Did this person just drive around uninsured during that time?

- Did they refuse to pay their premiums to their last provider?

- Did their last provider cancel their policy for some reason?

Basically, gaps freak them out and make you look way riskier to insure. As a direct result, drivers with gaps in coverage pay $15 more per month, and sometimes, providers won’t even cover them.

To summarize, trying to get temporary car insurance really only makes sense if you:

- Don’t mind getting short rated for up to $100

- Know for sure that your provider will refund your unspent policy time

- Don’t mind paying up to $15/month extra when you get your own policy OR plan not to leave a gap

Who’s the best provider for temp insurance?

Unofficially, I’ve heard across various forums that Nationwide and USAA are the two best providers for trying to get temporary car insurance. I’ve even heard that USAA will actually work with you to make a temp policy happen, although I can’t confirm this myself since I’m not military-affiliated.

In the end, I’d recommend calling up several car insurance companies and just having an open, honest conversation with an agent. Discuss with them your needs and whether their short rate/cancellation/refund policies will work in your favor.

But before making those calls, let’s make sure you even need temporary car insurance. Because in most cases, a different type of insurance (non-driver, UBI, etc.) may be a better fit and save you way more money.

Read more: Best car insurance companies

When might temporary car insurance make sense?

Despite the caveats, when might it still make sense to get temporary car insurance?

If you’re borrowing a friend’s car for a month or longer

The most common use case for securing temporary car insurance is when you’re borrowing someone else’s car for a prolonged period of time.

Now, you might’ve heard the old chestnut that “the policy follows the car, not the driver” and that’s true. As long as your friend gives you written or verbal permission to drive their car, you’re technically covered under their policy. This is what’s known as “permissive use.”

However, if you then cause an accident, your friend’s auto insurance premiums will get more expensive.

That’s why your friend might suggest you get a temporary auto insurance policy as a condition of borrowing their car frequently or for a long period of time. If they don’t ask, offer.

If you’re renting a car for a month or longer

If you’re planning a long rental from Enterprise or Turo, you might want to consider temporary car insurance as an option for staying covered.

That’s simply because the coverage offered by the rental car company can get expensive over weeks and months. Your own insurance may be cheaper, even if you keep it for all six months.

But before you shop for rental car insurance, always check your credit card benefits. Believe it or not, most rewards cards these days include Collision Damage Waivers, aka rental car insurance.

Read more: Credit card rental car insurance: The best perk you didn’t know you had

If you’re driving someone else’s car during a road trip

You might also consider getting temporary car insurance if you plan to take turns driving during a long road trip. In effect, you’re borrowing someone else’s car for hundreds of miles of driving, and if something were to happen, their insurance premiums would shoot up.

So, if your best friend or roommate is volunteering to put all that mileage on their car, it might be a nice gesture to get $80 of your own insurance so you can safely drive it without jeopardizing their rates.

If you’re buying a car for a short period of time

Finally, if you’re only intending to own a car for a few months before selling it, trying the temporary car insurance hack might make sense. After all, even the strictest refund policies list “selling your car” as a qualifying reason.

That said, if you plan to sell one car in June and buy another one in August, it definitely makes sense to keep your coverage so you don’t get dinged for having a lapse.

When should you skip temporary insurance?

Driving to Canada — no additional insurance needed

You don’t need any special or temporary type of auto insurance to drive to Canada. Your U.S. coverage will protect you for the first six months. After that, you need a visa and a Canadian auto insurance policy.

Driving to Mexico — Mexican tourist auto insurance

If you plan to drive to Mexico or rent a car when you arrive, no U.S.-based insurance – temporary or otherwise — will cover you. You’ll need Mexican tourist auto insurance.

Driving your parent’s car — no additional insurance needed

As a “member of household,” you don’t need temporary insurance to drive your parents’ cars. The only exception is if they manually excluded you from coverage, or if they ask you to purchase a separate policy for yourself so they can keep their rates more affordable.

You barely ever drive — usage-based insurance (UBI)

Some people who barely ever drive think they can get away with purchasing, then canceling, then repurchasing coverage whenever they need it.

I mean, they technically can — but all those gaps in coverage are going to cost them big time.

Instead, you can opt for usage-based insurance, which only charges you a low base rate plus a few cents per mile you drive. To learn more, check out our review of Metromile.

Driving for Uber/Lyft/DoorDash — commercial auto insurance

Most insurance providers consider driving for a rideshare or food delivery app to be a “business use” of your vehicle that’s not covered under a basic policy, temporary or otherwise.

Instead, you’ll need commercial auto insurance, which is typically sold as an add-on to a basic policy. You might still be able to cancel your commercial auto policy early, but I’d speak with your provider first.

Leaving your car at home — resident student discount

If your car is titled in your parents’ name and you plan to leave it at home while you’re at school 100+ miles away, you have two options for saving on insurance:

- Buy temporary car insurance for when you’re home

- Take advantage of your provider’s resident student discount

No. 2 is the better option, as it prevents lapses in coverage that could hike your rates later. Be sure to also snag your provider’s other student discounts to cut your rates even further.

Frequently borrowing random cars — non-owner insurance

Finally, if you tend to rent or borrow different cars on a consistent basis, a non-owner insurance policy would make more sense than temp insurance.

The former is basically liability-only insurance for people who frequently borrow cars, and it tends to be pretty cheap.

Summary

Outside of a few niche cases, trying to pull off “temporary car insurance” just isn’t worth it. You’ll be better off in the long run if you purchase a regular policy, stay gap-free, and maximize every possible discount.