Splash Financial Review – Student Loans Refinancing Made Easy

Rating as of based on a review of services January 11, 2023.

Ranking

9/10

Splash offers student loan refinancing for everyone, including married couples! Here’s our full Splash Financial review.

Best for:

- Married couples

- Lower interest rates

- Borrowers with excellent credit

If you’re tired of going from lender to lender, trying to find the perfect student loan refinance, you need to give Splash Financial a try.

The company specializes in student loan refinances, and works with multiple banks and credit unions to provide the best rates and terms available. You can even pre-qualify before completing a full application, without hurting your credit score.

What is Splash Financial?

Splash Financial is a student loan refinancing service, based in Cleveland, Ohio, and was founded in 2013. The company offers refinancing of student loans, and was launched because the founders saw their friends “drowning in student loan debt.”

Their mission is to lower your monthly payments, while allowing you to pay off your loan in less time, freeing you up to make a splash in the world!

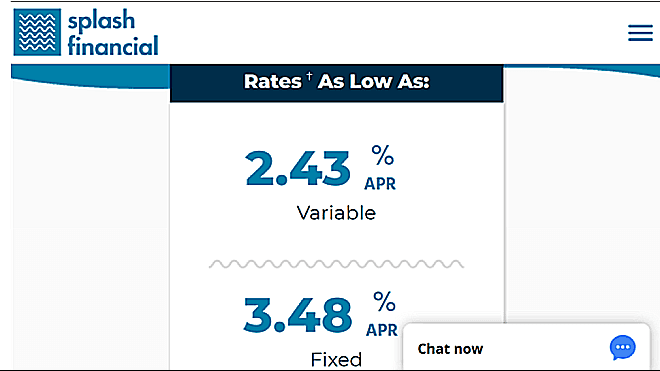

The company offers variable rates as low as 2.43 percent APR (at the time of writing), and fixed rates as low as 3.48 percent APR (at the time of writing).

It serves as a student loan refinance company and is funded by banks and credit unions. As such, Splash Financial is not the direct lender and does not service your loan. Servicing will be handled by the final lender.

Splash Financial has the following ratings from third-party services:

- A Better Business Bureau (BBB) rating of “A+” on a scale of A+ to F. The company has not been BBB accredited, but the agency has had an open file on it since September 2014.

- Trustpilot gives the company a rating of 5 stars out of 5.

- The employment site Glassdoor gives the company a rating of 4.3 stars out of 5.

How Splash Financial works

Four-year degrees qualify for financing

To be eligible for a student loan refinance you must be either a US citizen or a permanent resident alien. You’ll also need to be a graduate of a Title IV accredited institution, with a four-year degree.

Parents who took out student loans for their children are eligible and the child does not need to have graduated.

Associate degrees also qualify

Splash offers refinancing for all associate degrees.

Types of loans that are included in refinancing

Loans eligible for refinance include federal student loans, private student loans, and Parent PLUS loans. You can also refinance several loans into a single new loan. There is no limit to the number of refinances you can have with the company.

Married couples can refinance

And in a feature unique to Splash Financial, married couples can refinance their student loans together. Alternatively, one spouse can take over the other spouse’s loan, after executing an affidavit to acknowledge the transfer of loans from one spouse to the other.

You can check your rate in under three minutes, by clicking on the Get My Rate button. You’ll need to provide basic information, including your monthly income and the degree and the school you graduated from.

Splash Financial will then do a soft pull of your credit report, which will not negatively impact your credit score. This will give you an opportunity to see rates based on the term of the loan and the monthly payment before you even submit a formal application.

Splash Financial available loans

Fixed-rate loans

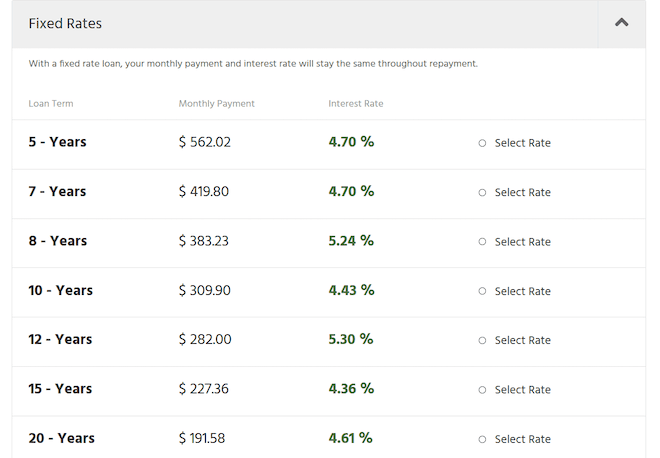

Fixed-rate loans are available in terms ranging from five years to 20 years. With a fixed-rate refinance, both your interest rate and your monthly payment remain the same throughout the loan term.

Variable-rate loans

Splash offers variable rate loans of 25 years.

Here’s how it works: variable-rate loans will fluctuate over the life of the loan. That includes both the rate and the monthly payments. The rate is comprised of an index and margin added together. The index is typically the one-month LIBOR, which means the rate and payment will be subject to change on a monthly basis. The amount of the margin is determined at the time you apply for the loan.

Variable-rate loans also have caps. For loan terms between five and 10 years, the cap is 9 percent. That means if your initial rate is 3 percent, the maximum rate over the life of the loan will be 12 percent. For loans between 12 and 20 years, the cap is 10 percent.

Your first payment will generally take place 30 days after your loan disperses. Also, be aware that it takes between three and 14 days after disbursement for your old loans to be paid off. You may need to make a payment on one or more loans to avoid incurring a late payment fee, or a derogatory entry on your credit report. The overpayment should be refunded to you shortly after the original loan has been repaid.

Splash Financial features and benefits

Minimum loan amount

The minimum loan amount is $5,000.

Maximum loan amount

There is no maximum loan amount requirement.

Co-signer availability

Yes, you may be able to get a co-signer.

Geographic availability

All 50 states have access to Splash.

Student loans eligible for refinance

Federal and private student loans, and Parent PLUS student loans.

Medical and Dental student loans during residency

Refinance existing student loans, and pay just $100 per month while in residency, and for up to six months after completing residency and fellowships. The total loan term can be as long as 20 years.

Economic hardship

Since Splash Financial is not a direct lender, you’ll have no specific policy for borrower hardship. However, many of the participating lenders do. You can check with your ultimate lender to determine what their policy is in the event you experience a hardship.

Refer a friend bonus

If you refer someone to Splash Financial who completes a refinance, you’ll get a $250 cash bonus– and so will the person you referred. And there’s no limit to how many times you can earn the bonus. If you’re satisfied with the service, and you know a lot of people with student loan debts, you might even be able to turn it into a nice second income!

You can register by entering your email address to create a unique referral link that will be used to track your referrals. Using social media, email, or text, you can share your unique link with other people. When they click through the link and get their loan, you’ll be eligible for the bonus.

Platform security

Splash Financial uses Secure Socket Layer (SSL) verification to protect your identity. They use SSL encryption to provide a secure connection to their website from your browser.

Customer service

Available by phone or email, Monday to Friday, 9:00 am to 6:00 pm, Eastern time, and Splash’s customer support team is also available during their standard business hours via live chat as well.

Finally, Splash Financial is also available on Facebook, Twitter, and LinkedIn.

Applying for a student loan refinance with Splash Financial

To begin the pre-qualification process, you’ll need to provide your email address and create a password to login.

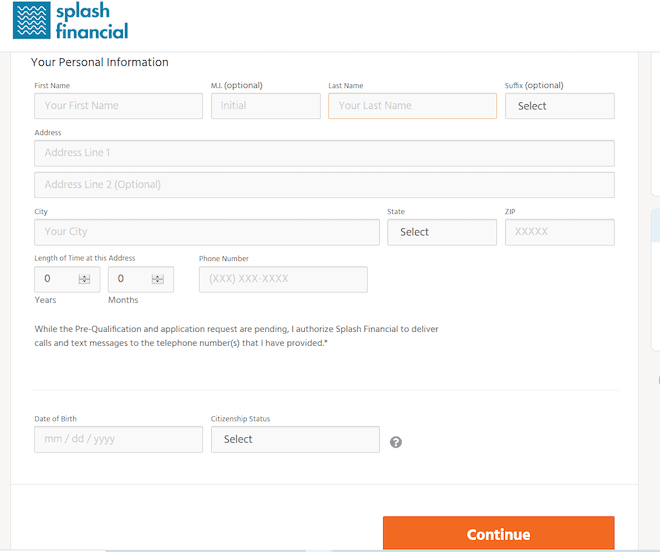

You’ll then need to provide basic information, including your name, address, length of time at that address, phone number, date of birth, and citizenship status. (Please note that you opt out of your phone number being used for the purposes of receiving calls and text messages. That’s the one I selected!)

Once you provide basic information, more specific information will be requested, relating to your education, financial information and the loan amounts you are refinancing:

In a follow-up screen you’ll be required to provide your social security number for the soft credit pull.

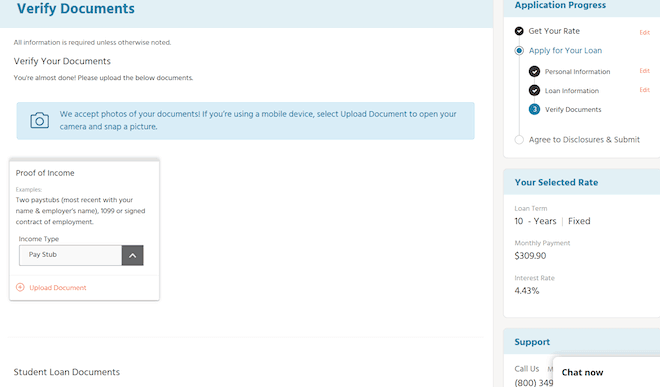

By clicking “Check My Rates” at the bottom of the last screen, you’ll be provided with the option to choose either fixed or variable rates, as well as the term and rate for each. For a $30,000 loan, I chose a 10-year fixed rate at 4.43%, with a monthly payment of $309.90.

I found this to be a bit odd, but once you hit the “Continue” button after selecting your rate, it brings you back to another screen that asks you to reverify your employment and housing information. So be it, I did.

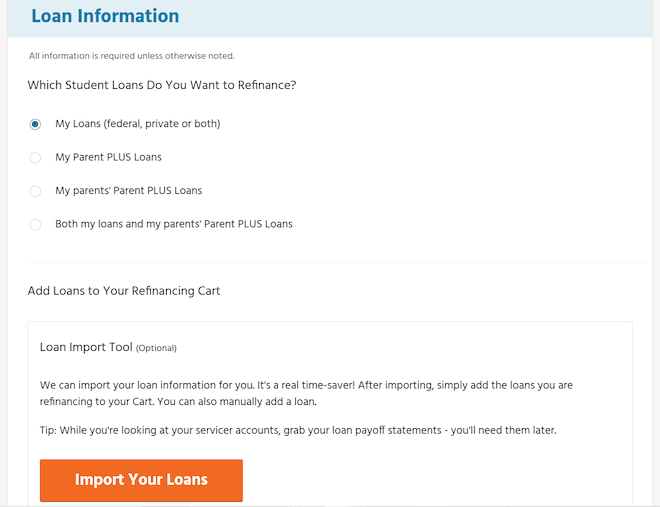

You’ll then come to the Loan Information input screen, where you’ll indicate the type of loan you want to refinance, as well as provide the specific loans that will be included in the new loan. The screen even comes with an “Import Your Loans” button that enables you to upload the information. Alternatively, you can enter the information manually.

You’ll then need to upload the required application documentation.

Loan documentation requirements include the following:

- Income verification, including recent pay stubs or a tax return.

- Photo ID, which can be a driver’s license, passport, or other state-issued ID card.

- Payoff verification statements from each existing student loan servicer, projecting the payoff amount 10, 15, or 30 days into the future.

- Verification of graduation, which can be a copy of either your diploma or your transcripts.

You can upload the documents using your mobile device. You can take photos of the necessary documents, then select the Upload Document to open your camera and take the picture.

Though you can get loan rates through the Get My Rate feature, the rate will be locked only once a full application has been submitted with all required documentation.

What if you don’t qualify?

If your borrower profile falls outside the criteria of participating lending partners, no rates will be provided at all. You can then add an eligible cosigner and prequalify again. But if you don’t have a cosigner, you may need to improve your credit score then prequalify again.

If you do need to prequalify multiple times, Splash Financial will automatically save your application, including any documents uploaded with it.

Once you complete your application, you can track the status of your loan application on the Splash Financial account dashboard.

Also, since many participating lenders are credit unions, you may be required to become a member of that credit union to get the best rates.

Adding a cosigner

The minimum indicated credit score for qualification purposes is 670. But you may need a cosigner even at that score level if your income or other factors are not considered acceptable.

The maximum debt to income ratio is generally 50 percent, and if you exceed this threshold, you may also need to add a cosigner.

Not all participating lending partners accept cosigners, but many do. A cosigner may be necessary if either your credit is not acceptable, or your income is considered insufficient to make the payments on the loan. The cosigner must meet lender eligibility requirements and will be jointly liable for the new loan. A cosigner can be a spouse, parent, relative, or another adult who meets the lender’s criteria.

Your cosigner will be jointly responsible for the loan for the entire length of the term. Some participating lenders do offer cosigner release programs. That will usually require a minimum of 12 consecutive on-time payments, as well as a reevaluation of the primary borrower’s income and credit history. In short, the lender will need to verify that the primary borrower is capable of making the payments without a cosigner.

Splash Financial fees and pricing

Other than interest, there are no fees associated with Splash Financial loans. That means no application or origination fees, and no prepayment penalties.

The company advertises variable-rate loans as low as 2.43 percent (to a high of 7.60 percent), and fixed rates as low as 3.48 percent (to a high of 7.02 percent). However, since Splash Financial works with many different banks and credit unions, specific interest rates will be set by each individual institution.

Many lenders will also discount your rates if you set up an autopay program. The rate discount is typically 0.25 percent, and you can sign up for it when your loan is finalized.

Who is Splash Good For?

Splash is an excellent choice for anyone who is looking for a low-cost refinance on their current student loans. Since it includes participation by multiple banks and credit unions, you’ll be able to get the best rates and terms without needing to shop each institution individually.

It’s also an excellent choice for couples where each spouse has his or her own student loans. You’ll have the option to refinance your current loans either individually, jointly, or with one spouse applying for a single loan to pay all the couples student loan debts.

Who is Splash Not Good For?

You’ll want to be careful using Splash if all or most of your student loan debts are federal loans. Since Splash refinances will be through banks and credit unions, you’ll be converting federal loans to private loans. In doing so, you’ll lose certain important benefits that come with federal student loans but not private ones.

For example, federal student loans offer Income-based Repayment (IBRs) plans that enable you to lower your monthly payment to a small fraction of your income. They also offer Public Service Forgiveness Loans (PSFL) that completely forgive your loan balance after 10 years of work in government or certain charitable organizations.

If you refinance federal student loans into a private loan with Splash, you’ll lose those government benefits.

Splash Financial Alternatives

Splash isn’t the only online source for student loan refinances. There are other platforms that we also recommend.

Credible works very similar to Splash in helping you to get rates and terms from multiple lenders with a single application. But Credible may provide access to the lenders that Splash doesn’t and vice versa.

Earnest is another option that works similar to both Splash and Credible but has a number of other compelling features. For example, rather than looking strictly at your credit score and your debt-to-income ratio, Earnest also takes into consideration your career and the progress you’re making. If you’re on the fast track, you’re more likely to be approved for a loan – even if the numbers don’t entirely make sense.

Some other benefits Earnest has includes the ability to skip one payment each year, as well as being able to swap between fixed and variable interest rates at no additional charge. They also offer unemployment protection if you lose your job. (The last feature is also available with Splash, depending on the lender providing the loan.)

Pros & cons

Pros

- Dedicated student loan refinance provider — Student loan refinances are all Splash Financial does. It’s what they specialize in, and not just a line item on a long menu of related services.

- Splash works with multiple lenders — That will give you the best opportunity to have your refinance approved, and at the lowest possible rate.

- Prequalify with a soft credit pull — Splash Financial can get your credit without lowering your credit score. But once you make a full application, a hard credit pull will be performed.

- Refer a friend bonus — Earn $250 for each referral who refinances with the company, with no limit on how many bonuses you can earn.

Cons

- No mobile app — Splash Financial does not currently offer a mobile app to enable you to track your application or service your loan.

- Splash Financial is not a direct lender — Your application will be processed and approved by a partnering lender, usually a bank or credit union, who will also service your loan going forward.

- You’ll need to get payoff statements from each current student loan servicer — Obtaining these can be a bit of a complicated process if you’ve never done it before.

- You may lose certain benefits if you refinance a federal loan — Federal student loans come with certain reduced payment options and even loan forgiveness. Since all participating lenders with Splash Financial are private sources, federal benefits will be lost.

Should you use Splash Financial to refinance your student loans?

Banks and credit unions offer some of the lowest interest rates on student loan refinances available. Since Splash Financial works primarily with these institutions, you’ll have an opportunity to have access to some of the best rates in the industry. What’s more, you won’t need to investigate rates with many different banks and credit unions. Through Splash Financial, you’ll get the best rates offered by participating lenders.

Splash Financial is also an excellent choice for married couples when each spouse has student loans. You’ll have the option to refinance your loans either individually, jointly, or through consolidation under one spouse alone. This is a unique offer not available with other student loan lenders.

The company has excellent ratings from both the Better Business Bureau and Trustpilot, and reports a 95 percent customer satisfaction rate. And of course, there’s also the Splash Financial Refer a Friend program, giving you an opportunity to earn $250 for each referral you provide who successfully applies for a refinance.

If you have student loans you’re looking to refinance, Splash Financial is one source you definitely need to check out.

Summary

Splash can show you your best rates for student loan refinancing. They also cater to married couples, making them completely unique in the aggregator industry.

If you’d like to learn more, or you’d like to apply for a student loan refinance, check out the Splash Financial website.