The Southwest Rapid Rewards Plus Credit Card, like all co-branded travel cards, is aimed at people who regularly fly with Southwest Airlines.

This is a premium travel card that offers 3,000 miles every year you have it, a discount on in-flight purchases, and two free EarlyBird Check-Ins each year.

This card also features a rewards structure, providing bonus miles on spending categories like transit, commuting, internet, cable, phone, and select streaming.

Another strength of this card is its 50,000-mile signup bonus — which is more than enough to get you a round-trip ticket or two!

If you’re thinking about adding the Southwest Rapid Rewards Plus Credit Card to your wallet, this guide will help you decide.

What’s Ahead:

- Is the Southwest Rapid Rewards Plus Card for me?

- What makes this credit card different?

- What are my chances of getting approved?

- All the details of the Southwest Rapid Rewards Plus Card

- Alternative credit cards to the Southwest Rapid Rewards Plus Card Credit Card

- How do you determine which credit card is right for you?

- Southwest Rapid Rewards Plus Card FAQ

- Why choose the Southwest Rapid Rewards Plus Card?

Is the Southwest Rapid Rewards Plus Card for me?

The Southwest Rapid Rewards Plus Card is designed for frequent flyers who like to travel with Southwest.

This means that if you’re a loyal Southwest customer or live near a Southwest hub, this card might be a great option for you. You’ll accelerate your earnings toward free flights and get some solid perks, such as two free EarlyBird Check-Ins each year.

If you aren’t a fan of Southwest or live in a place where Southwest isn’t as prevalent, this card likely won’t be as valuable as another airline or generic travel rewards credit card.

What makes this credit card different?

What makes the Southwest Rapid Rewards Plus Card different is its focus on Southwest Airlines.

Because it’s a co-branded card, it can offer unique benefits and perks that generic travel credit cards can’t. If you fly Southwest frequently, you’ll enjoy these perks.

This card also comes with a great signup bonus in the form of 50,000 points when you spend $1,000 using the card within three months of opening your account.

You can also receive 10,000 Companion Pass qualifying points boost each year. With the Companion Pass, you can name one person, such as a spouse, partner, or friend, to be your companion. They can get a free ticket on any flight you book for yourself.

Generic travel cards don’t offer these specialized benefits and bonuses, so they likely won’t be as appealing to people who prefer to fly with Southwest.

Related: Best credit card sign up bonuses

What are my chances of getting approved?

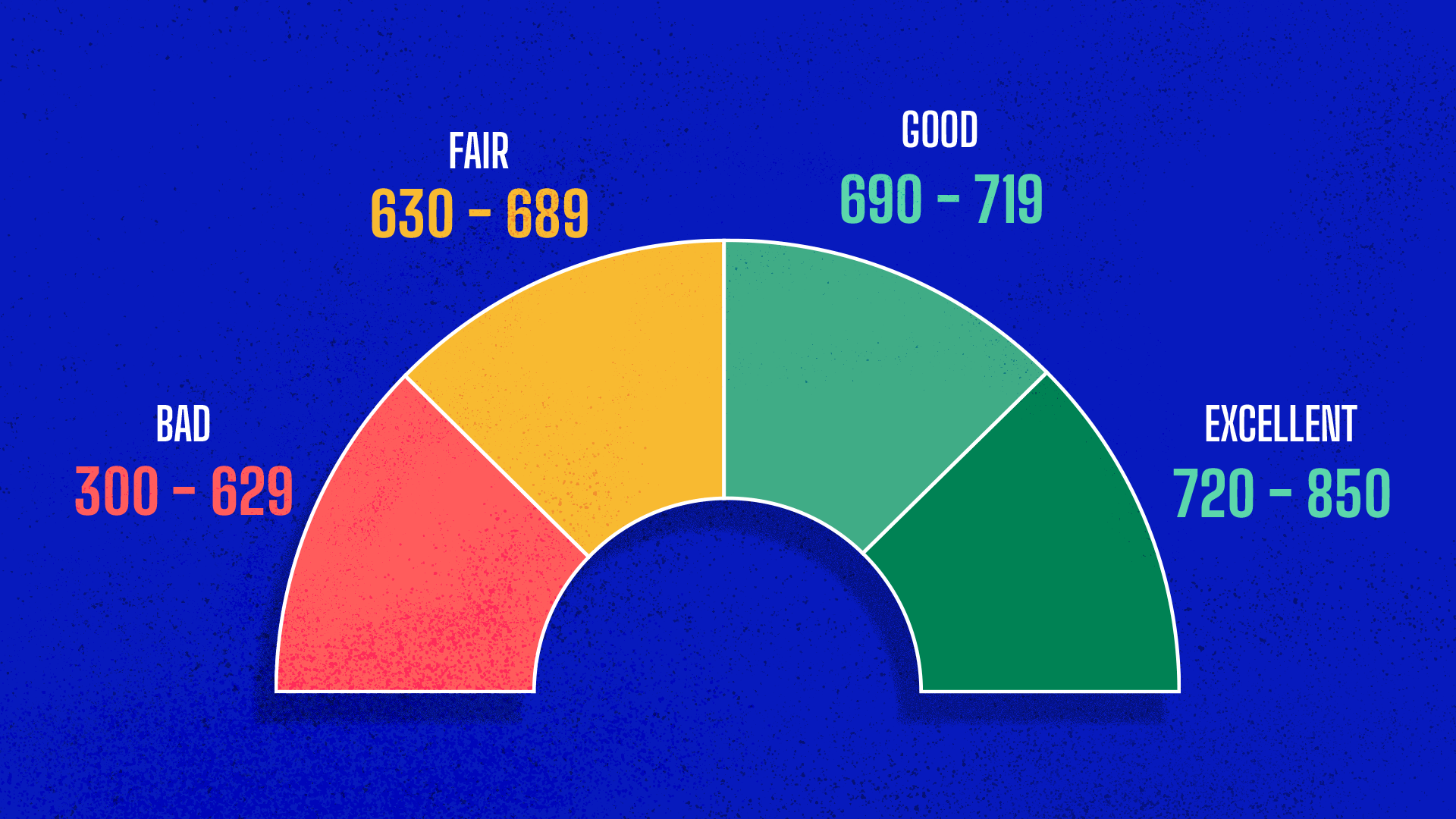

As with any credit card, it’s important to think about whether you have a chance of qualifying before you apply. Applying for a new credit card drops your credit score by a few points, so you don’t want to lower your credit for no reason.

Chase, this Southwest credit card’s issuer, says that applicants require good credit to be eligible for the card. That means you should try to have a credit score of about 670 or higher before you apply.

All the details of the Southwest Rapid Rewards Plus Card

Credit cards are complicated, so before you sign up for one, you must make sure you understand how they work.

Rates and fees

The first thing to look at when you want to get a new credit card is how much the card will cost. Some cards, including travel cards, have annual fees, so you want to make sure the benefits and perks you’ll get cover the cost of having the card.

The Southwest Rapid Rewards Plus Card charges $69 per year.

Perks and rewards

When it comes to travel cards, it’s all about the perks and rewards. A good travel card should let you earn your way toward free trips and help you travel more comfortably.

The Southwest Rapid Rewards Plus Card does it all, with a great signup bonus, strong ongoing rewards, and some nice perks to use whenever you’re on a flight.

To start things off, you can earn 50,000 points when you spend $1,000 within your first three months of having the card.

After that, you’ll earn:

- 2 points for each dollar spent on Southwest purchases.

- 2 points for each dollar spent on Rapid Rewards® hotel and car rental partners.

- 2 points for each dollar spent on local transit and commuting, including rideshare.

- 2 points for each dollar spent on internet, cable, phone services, and select streaming services.

- 1 point for each dollar spent on all other purchases.

As for perks, cardholders will get a 3,000-point bonus on each card member anniversary. You can also use the card to get two free EarlyBird Check-Ins each year and 25% back on all inflight purchases.

You’ll also get all the typical credit card perks and benefits, including extended warranty protection and purchase protection.

Related: Best travel rewards cards

How to apply

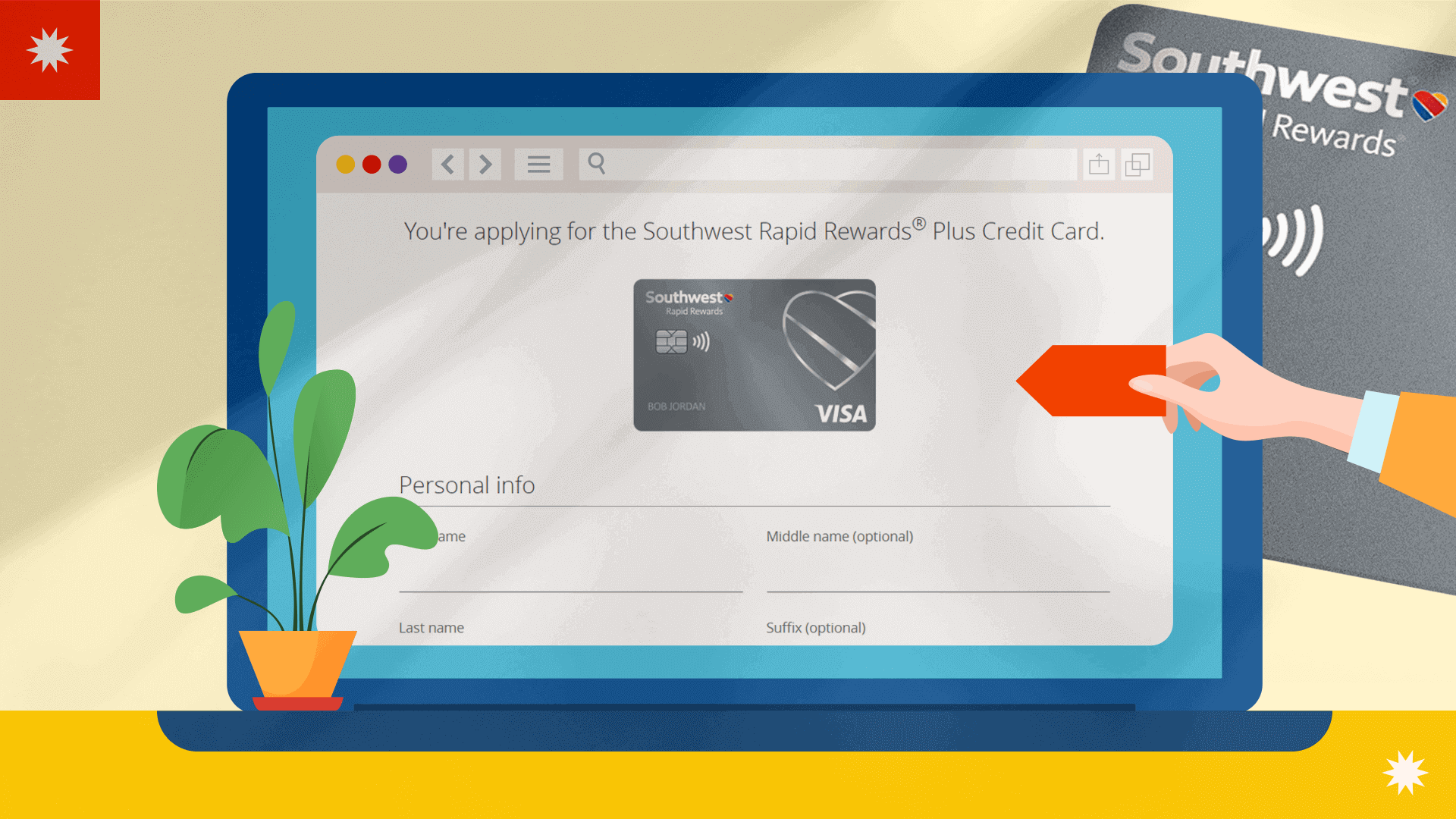

The easiest way to apply for the Southwest Rapid Rewards Plus card is to visit Chase’s website. Chase is the bank that Southwest partners with to offer this credit card.

To start the process, you’ll enter your personal info, including your:

- Name.

- Date of birth.

- Mother’s maiden name.

- Social Security number.

- Address.

You’ll also need to provide your Southwest Rapid Rewards number if you have one. If you don’t, Chase will automatically set one up for you if you’re approved.

Finally, you’ll enter whether you rent or own, your monthly rent payment amount (if applicable), and your total annual income. Once you apply, Chase will review it and make a lending decision.

Typically, Chase can make a decision instantly. However, if the bank has trouble matching your information to your credit file or wants to take a closer look at some of the application details, you may have to wait for a decision in the mail.

Contact info

If you have issues with your Southwest Rapid Rewards Plus card, the best thing to do is reach out to Chase’s customer service.

You can contact Chase by signing in to your account and sending a secure message. You can also call credit card customer service at 1-800-432-3117 or contact @ChaseSupport on social media.

Other stuff you should know

One important thing to note about the Southwest Rapid Rewards Plus card is that it’s not the only Southwest travel card available. There are two others: the Priority card and the Premier card.

The Plus is the entry-level card. It has the lowest annual fee but the fewest perks of the three Southwest cards.

The Premier card is the next level up from the Plus card. It has a higher annual fee at $99 but offers 3x points on all Southwest purchases, 6,000 points on every cardmember anniversary, and bonus qualifying points toward A-List status.

The Priority card is the top-end Southwest card. It has a $149 annual fee but offers 7,500 points on every card member anniversary and a $75 credit for Southwest travel each year. You’ll also receive four upgraded boardings each year.

Another thing to consider is that the Southwest Rapid Rewards Plus card is designed for Southwest flyers. The rewards you earn are pretty inflexible and typically only good for Southwest flights. There are some gift card redemption options, but they aren’t a good value.

Alternative credit cards to the Southwest Rapid Rewards Plus Card Credit Card

If the Southwest Rapid Rewards Plus Card doesn’t seem like the right one for you, consider the following alternatives:

- Southwest Priority: This card is useful for people who spend a lot on it and want to earn A-List status.

- Southwest Premier: For frequent travelers, this card’s annual statement credit and points mostly cover the fee. You’ll also enjoy the upgraded boarding perk.

- Chase Sapphire Preferred® Card: This is another Chase card with far more flexible rewards, letting you redeem points for any travel.

- Capital One Venture Rewards Credit Card: This card has a $95 annual fee and offers strong cash back rates on travel purchases.

- American Express Gold: This is the mid-tier Membership Rewards card. It offers flexible rewards and a good earnings rate on food and travel.

How do you determine which credit card is right for you?

When you’re in the market for a new credit card, you should compare your options to find the right one. When making this comparison, consider the following factors:

- Your ability to qualify. Card issuers design different cards for people with different credit profiles. Before you apply, make sure you have a good chance of qualifying for the card.

- Fees. Some cards, especially travel cards, carry annual fees. Make sure you’re getting enough value from the card to make the fee worth paying.

- Perks. Each card has a different set of perks and benefits. Make sure the perks you receive from the card are useful for you.

- Rewards. Credit cards can offer cash back, points, miles, or other rewards. Make sure the rewards on offer align with your goals. It’s also important to think about their flexibility. You don’t want to be stuck with miles you can’t use. Also, consider the rate of earning those rewards, and look for cards that offer bonuses on the types of purchases you make most often.

- Rates. In general, you should avoid carrying a credit card balance whenever possible. However, sometimes you have to carry a balance. When that happens, having a card with a low interest rate is good.

Southwest Rapid Rewards Plus Card FAQ

Can I pool my Southwest miles with someone else’s?

No, Southwest does not offer any way to pool your rewards with another person.

What is the Southwest Companion Pass?

The Southwest Companion Pass is a perk you can earn through a credit card signup bonus or by taking a lot of flights in a single year. When you earn this pass, you can choose one other person to get a free ticket on every flight you book until the end of the calendar year after you earned it.

So, if you earn the pass in 2023, it will expire at the end of 2024. Some passes earned through promotions have different expiration dates.

Can I redeem my Southwest points for things other than flights?

Yes, you can redeem your Southwest points for gift cards to many popular retailers. However, redeeming points for flights is typically a better value.

Why choose the Southwest Rapid Rewards Plus Card?

With a strong signup bonus and some nice perks, the Southwest Rapid Rewards Plus Card is a good option for frequent Southwest fliers.

Given its reasonable price, substantial signup bonus, and valuable perks, we give the Southwest Rapid Rewards Plus Credit Card a 4 out of 5 rating.

If you think this is the right card for you, apply now.