The two main types of credit cards are secured and unsecured. There are so many different categories of unsecured cards.

Secured credit cards are designed to help you build credit, whether you have poor credit or no credit at all. They look like unsecured cards but work differently.

A secured card isn’t your only option if you’re still building credit, but it might be your best. Unsecured cards for poor credit can be costly and restrictive. But ultimately, which type of card is right for you depends on your history and credit use.

Let’s take a look at the differences between secured vs. unsecured credit cards now.

What’s Ahead:

Differences Between a Secured and Unsecured Credit Card

Secured credit cards Unsecured credit cards

Deposit Yes No

Credit limit Low, or based on deposit Varies, based on credit

Credit score to qualify Scores below 579 (or no credit at all) can qualify Typically scores over 670

Typical/average APR 16%, but can be MUCH higher 16%

Annual fees Usually Sometimes

Helps to build credit Yes Yes

The main thing that sets secured and unsecured credit cards apart from each other is that you need to pay a security deposit when signing up for a secured card, but you don’t need to make a deposit for an unsecured card.

Having to make a deposit to secure a line of credit makes it pretty easy for anyone to get approved. It helps you qualify for a secured credit card even if you’ve never opened a line of credit before or you have bad credit.

Credit card companies use the deposit as collateral. This means your money is theirs to keep if you’re not able to pay off your card. But after you’ve made the deposit, a secured card works like any other credit card.

Both secured and unsecured card issuers report your payment history to the three major consumer credit bureaus. This allows secured card users to improve their credit with regular use and repayment. With a year of on-time payments, many secured card users can get approved for a standard, unsecured card.

That’s not to say you can’t get an unsecured credit card when you have poor or no credit. A lot of people go straight to an unsecured card, but they might end up paying more in fees than they need to. To help you decide whether a secured or unsecured card is right for you, take a look at the features of each.

How a Secured Card Works

If someone gave you $200 to hold on to, would you loan them $200? If you’re already holding their money, there’d be no risk on your part if you did. This is essentially what banks are doing when they offer secured cards. Let’s look at some of the key features of a secured credit card.

You Pay a Security Deposit

Back to that security deposit. Applicants for secured credit cards must submit a refundable security deposit before their account is approved. The card issuer holds onto this money but only keeps it if the cardholder repeatedly fails to make payments. This is also known as defaulting.

If you can’t pay your bill, you lose the deposit. If you do make all your payments on time, you’ll get the deposit back if you ever close the account.

With a secured credit card, your security deposit usually becomes your credit line. So if you make a $500 deposit, you might be approved for a credit line of $500.

You Still Need to Make Payments

A secured credit card acts exactly like a credit card, and that goes for how you pay it too. We always recommend paying your balance in full each month to start building your credit safely. If you’re ever late on a payment, you will get charged a fee and this will show up as a negative mark on your credit.

Just as with any other credit card, secured card users receive a statement each month that includes the due date. Most secured cards also have a grace period that gives extra time between when the billing cycle ends and when your payment is due to help you avoid charges. Alternatively, secured cardholders may choose to carry a balance and pay interest.

If you do get a secured credit card, it’s important to understand that your deposit is not used to make payments.

Your Credit Line Might Be Lower

Both secured and unsecured credit cards are revolving lines of credit, meaning you can borrow up to your credit limit each month as long as you are paying off your debt. But secured cards usually have smaller credit lines than unsecured credit cards because your borrowing limit is often set by your deposit.

It Helps You Build Credit

Using a secured credit card is an excellent way for people who are either new to credit or rebuilding their credit because payments are reported to the bureaus. The more full payments you make on time, the better your credit will be.

Related: How to Build Credit the Right Way

You Can Graduate to an Unsecured Card

Most secured credit cards have a program that lets you graduate to an unsecured credit card.

Here’s how this works. After a set number of on-time payments on your credit report, many secured credit card companies give you the option to open an unsecured credit card or even transition your existing secured card. This means getting your deposit back and probably a credit line increase.

It’s a Great Way to Learn Financial Responsibility

Secured credit cards make great first cards for young adults because they teach good credit card habits. Because your credit line is small, the risk is relatively low, and it gets you used to swiping a credit card and making a payment every single month.

As you prove you’re ready to manage your credit, you can move on to an unsecured credit card.

Related: How To Establish Credit When You Are Just Entering Adulthood & Why You Should

How an Unsecured Card Works

With no security deposit required, you qualify for an unsecured card based on your creditworthiness. This is a metric banks use to decide how risky it is to loan money to you. Here are some details you’ll want to know about unsecured cards.

It Isn’t Secured Against Anything

An unsecured credit card isn’t secured against any type of collateral. Your credit limit is determined by factors like income and credit score instead of how much you deposit.

There is no collateral against the credit line with an unsecured credit card, so the credit card provider is taking a calculated risk assuming you’re going to make payments on the credit card and ultimately pay the balance back.

If you default on the balance or miss payments, the credit card provider has the right to charge late fees or collect the balance from you, and it will harm your credit score.

Your Credit Line Might Be Higher

An unsecured credit line helps you build credit quickly. You will often get a larger credit limit than you would with a secured card, which can give you a better credit utilization ratio. This is the ratio of the money you borrow to the amount of money you are allowed to borrow.

Keeping your credit utilization ratio, also called your debt-to-credit ratio, below 30% is ideal, and a lot easier to do with higher credit limits.

For example, if your credit limit is $5,000 and you consistently use and pay back less than $1,500 each month, you’ll likely be approved for new credit – and probably even more credit – in the future. The longer you maintain a good credit utilization ratio, the stronger your credit will be.

Why You Would Get a Secured Credit Card

So, should you choose a secured credit card or an unsecured credit card?

A secured credit card would make sense for you if you were brand new to credit. It’s a safe, low-risk way to figure out what you’re doing and build your credit while you learn. This is also a smart option for anyone who is digging their way out of credit trouble.

It’ll take longer for you to improve your credit with a secured card, but be patient and you’ll see progress.

With a secured credit card, you risk losing your security deposit and can hurt your credit with late payments. Just remember this when choosing between secured vs. unsecured credit cards and know that whichever option you choose will have long-term impacts.

Why You Would Get an Unsecured Credit Card

An unsecured credit card would make sense for you if you have some credit history. There are a lot more unsecured credit cards to choose from, making this a better choice if you’re looking for flexibility. Many even let you earn rewards when you spend money in qualifying merchant categories.

Unsecured credit cards also offer higher credit limits, allowing you to make larger purchases with your card. But with this comes the risk of taking on more debt. Plus, unsecured credit cards are harder to qualify for. Most require a credit score of at least 670 for approval, so this is not a good option for your first-ever card or if your credit is very poor.

Look out for fees as well and remember that the fees you pay for unsecured cards are always non-refundable.

Related: What Credit Score Do You Need to Get Approved for a Credit Card?

Best Secured Cards for Building Credit

OpenSky® Secured Visa® Credit Card

The OpenSky® Secured Visa® Credit Card is an excellent option for people who are just starting their credit profile or are working to rebuild it. One of the great features of OpenSky is that they believe everyone should have an opportunity to build their credit, so there is no credit check required to apply for the card. Plus, you won’t wait weeks to find out if you’re approved. OpenSky will give you an immediate decision.

You choose how much you want to deposit between $200 and $3,000. This deposit is fully refundable. OpenSky reports your activity to all three major credit reporting agencies.

One of the other great features of this card is the Facebook community for other OpenSky card members to share their progress or ask questions about credit.

There is an annual fee of $35 and you don’t earn rewards. The APR is 22.14% (Variable) and the cash advance APR is 22.14% (Variable). Lastly, there is a 3% foreign transaction fee.

Learn more about the OpenSky® Secured Visa® Credit Card.

Capital One Platinum Secured Credit Card

The Capital One Platinum Secured Credit Card is another excellent option for rebuilding your credit with a secured card.

There is a required (refundable) security deposit of either $49, $99, or $200, but that deposit amount is not necessarily equal to your limit. The starting credit line is $200 for all users, but the better your credit, the lower the deposit you will need to make. You can also make a larger deposit to unlock a higher limit. This card does require a credit check.

Capital One performs regular credit line reviews on this card, so you’re automatically considered for a higher credit line in as little as six months. Capital One will also monitor your account to determine if you qualify to upgrade to an unsecured Platinum card and get your deposit back.

The capital One Platinum Secured Credit Card comes with some additional features like security alerts from Eno, Capital One’s virtual assistant. Eno will notify you of suspicious activity as soon as it happens.

There is no annual fee but the interest rate is on the high end at 29.99% (Variable).

Learn more about the Platinum Secured Credit Card from Capital One.

Citi Secured Mastercard

The Citi® Secured Mastercard® is one of the most beginner-friendly secured credit cards out there. With features like Flexible Payment Due Dates and no annual fee, this card is a solid choice for newbies and anyone who wants to get it right with their credit.

This card offers a credit limit of between $200 and $2,500. Your limit will be equal to whatever deposit you make.

This Citi® Secured Mastercard® charges no annual fee or hidden fees and offers a lower everyday APR of 26.74% (Variable). If there is a chance you will need to carry a balance, consider this card before the others. Typically, secured credit cards have much higher interest rates.

Using the Citi app, you can check your FICO credit score at any time (without affecting your credit) to see how it is improving.

Learn more about the Citi® Secured Mastercard®.

Best Unsecured Cards for Poor or Fair Credit

If your credit is poor to fair, a secured credit card is probably your safest option. That being said, there are unsecured credit cards you can qualify for with bad credit. Learn about some of the top options below.

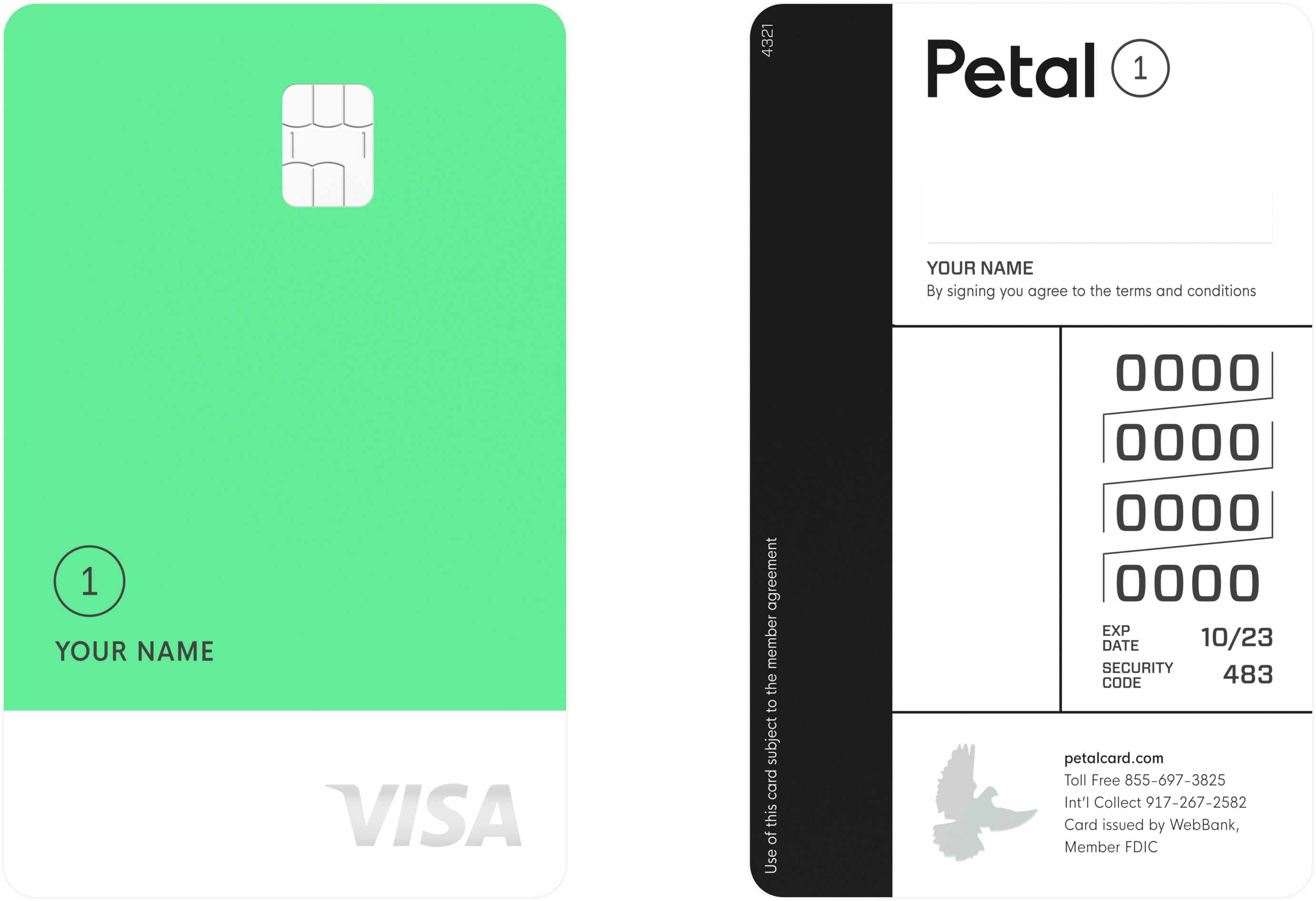

Petal® 1 “No Annual Fee” Visa® Credit Card

The Petal® 1 “No Annual Fee” Visa® Credit Card has one of its main perks right in the name. With no annual fee, this unsecured credit card for borrowers with no or limited credit won’t break the bank like some cards out there. There are also no foreign transaction fees or fees for exceeding your limit.

Credit limits for this credit card range from $300 to $5,000. $5,000 is pretty generous for a beginner’s unsecured card, making this a perfect option for anyone who plans to put a lot of spend on their card (and, hopefully, pay it back on time each month).

Another thing to love about this card is the cash back. You can earn between 2% and 10% back on your purchases at participating merchants, which is really competitive for a card that’s pretty easy to qualify for. Cash back can be redeemed as credits toward your balance.

You don’t need a credit score to be approved. If you’re applying for the first time, you’ll receive a Cash Score, which is basically Petal’s own way of showing you how creditworthy you are. You can see if you’re pre-approved from the site or mobile app without affecting your credit.

Learn more about the Petal® 1 “No Annual Fee” Visa® Credit Card.

Capital One QuicksilverOne Cash Rewards Credit Card

The Capital One QuicksilverOne Cash Rewards Credit Card is a fantastic choice for people with fair credit.

You earn unlimited 1.5% cash back on every purchase you make and you don’t need to opt into any rotating categories. There is no cap on how much you can earn and your rewards never expire.

There’s no foreign transaction fee, and you can be automatically considered for a higher credit line in as little as six months.

On the downside, the card does come with a $39 annual fee, and the regular purchase APR is relatively high at 29.99% (Variable). Always avoid carrying a balance when you can.

Learn more about the Capital One QuicksilverOne Cash Rewards Credit Card.

Indigo® Mastercard® Credit Card

The Indigo® Mastercard® is designed specifically for bad credit. If you’re set on an unsecured card but your credit isn’t great, the Indigo® Mastercard® is a pretty good option.

Based on your creditworthiness, you may or may not pay an annual fee for this card. The possible fees are between $0 - $99. The credit card’s purchase rate is 24.9% APR. For a card designed to build credit, that’s not too bad.

The credit limit on this card only goes up to $300, and Indigo deducts the annual fee from your credit line. So if you qualify for the $300 credit line and your annual fee is $59, your credit limit may start at $241. It wouldn’t hurt to keep your spending at a minimum anyway, but you might find this restrictive.

You can pre-qualify for this card before applying and going through a credit check. Just visit the website and fill out some basic information to see if you’re approved.

Learn more about the Indigo® Mastercard® Credit Card.

Summary

The question of whether you should get a secured vs. unsecured credit card really comes down to how much risk you’re willing to take and how much experience you have with credit.

Secured credit cards require a security deposit, but they offer the safest way to build or rebuild your credit by making monthly on-time payments. Unsecured cards, for those with less than perfect credit, tend to be riskier but can offer benefits like rewards and lower annual fees and interest rates.

Both can help you build credit from scratch or improve your score with regular, on-time payments each month.