PersonalLoans.com Review: Find Your Perfect Personal Loan Fit for Free

Rating as of based on a review of services October 31, 2022.

Ranking

8/10

If you need cash fast, a personal loan may be the solution — but finding the right lender and the right offer can be a tricky and time-consuming ordeal. Fortunately, PersonalLoans.com simplifies the process by collecting your information and presenting a loan offer best suited to you.

Best for:

- All credit types

- Multiple lenders

- Reasonable rates

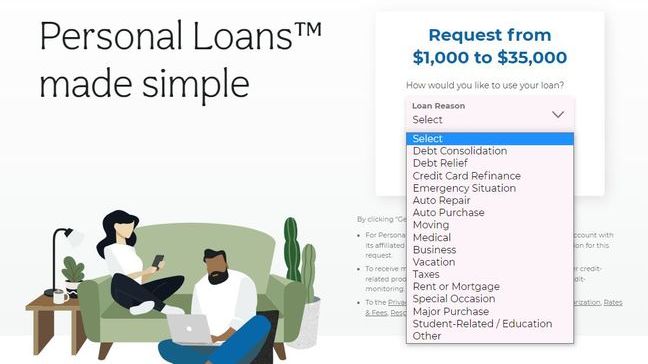

PersonalLoans.com is an online lending marketplace that offers consumers easy access to peer-to-peer, bank, and installment loans. You can use these loans for nearly any purchase or expense: rent, taxes, vacations, medical procedures, auto repairs, debt consolidation, and more.

And if all that weren’t enough to pique your interest, the site is also completely free to use.

Overview of PersonalLoans.com

PersonalLoans.com offers some of the most flexible terms around, so it’s definitely worth a browse. Here’s a snapshot of what’s available:

- APR: 5.99% to 35.99%

- Loan amounts: $1,000 to $35,000

- Loan terms: 90 days to 72 months

- Fees: None with PersonalLoans.com; no hidden fees with individual lenders

- Prepayment penalty: None

- Repayment terms: Once or twice a month (dependent on lender)

Source: PersonalLoans.com | Screengrab by editor

I liked the range of options PersonalLoans.com was offering, so I had to give it a try for myself. This is how my journey went.

Pros & Cons

Pros

- Personalized offers — PersonalLoans.com evaluates your unique information and presents the best loan offer for your financial profile and needs.

- Fast cash — Customers may receive cash in their bank account as soon as the next business day.

- Multiple lenders — Since PersonalLoans.com is a loan aggregator, you’ll have access to multiple lenders and multiple offers all in one convenient location.

Cons

- Loan aggregator — PersonalLoans.com is not a direct lender, so if you are truly interested in pursuing a specific loan offer, you need to continue the process with that lender to see if you’re approved.

- Marketing — While PersonalLoans.com is completely free to use, you will be added to their mailing list (the site may be compensated for sharing your information and advertising other loan-related products, such as debt relief, credit repair, and credit monitoring).

How PersonalLoans.com Works

Step 1: Submit a Request for Your Loan Online

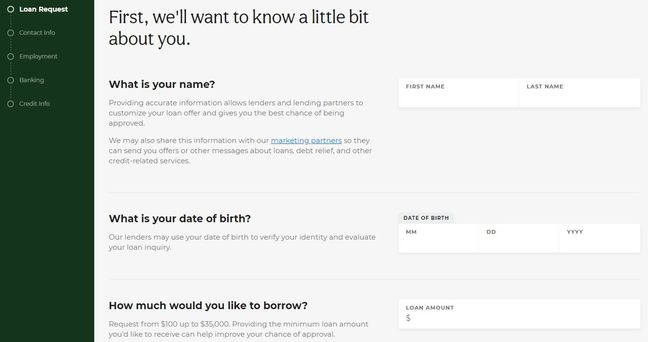

The PersonalLoans.com online request form is like many other online lending portals, so if you’ve filled one out before, you already know what to expect. However, if the process is new to you, here’s a basic breakdown.

- First, you’ll be asked for some standard, personal info. You’ll provide your name, date of birth, Social Security number, and contact information.

- Next, PersonalLoans.com requires that you share information about your income, including your bank account and your credit. Lenders use this information to verify your reliability as a borrower.

- Finally, the site will also ask for details about your specific loan request, such as the loan amount and why you are seeking a personal loan.

Source: PersonalLoans.com | Screengrab by editor

What I really liked about PersonalLoans.com’s application process was that it was so user-friendly. Every step and question was straightforward and even explained why the question was being asked. I felt as though someone was walking me through the whole process.

Step 2: Receive Offers from Actual Lenders

The beauty of a service like PersonalLoans.com is that it’s all online, so the process is lightning fast. After submitting my request, it wasn’t more than a few minutes before I received my proposal.

Not only did I get my offer quickly, but it was a suitable offer as well. And therein lies the next benefit. PersonalLoans.com takes your online loan request and runs it through a proprietary algorithm that is designed to connect borrowers and lenders. It isn’t as simple as it sounds — after all, not all lenders are willing to work with all borrowers, and vice versa.

Here’s a simple example to clarify things for you:

You want to do some renovations in your kitchen. The contractor tells you the job will cost $15,000, and you want to give yourself a buffer of $2,000 in case of unforeseen expenses. You submit a request for a loan but get rejected by the lender. Why? Not because of your credit history, but because this lender only gives loans up to $10,000.

In short, you and the lender are incompatible. Now, you’ll have to find another lender, fill out the online loan request form all over again, and hope that this time you strike gold.

Fortunately, PersonalLoans.com simplifies the process, and their nifty algorithm does all the work for you. Instead of racing from lender to lender with your fingers crossed, PersonalLoans.com works to connect you with a lender that meets your criteria.

Step 3: Peruse, Review, and Accept the Loan Terms

Step three is all about fine-tuning the deal you’ll ultimately accept.

For instance, if your finances are somewhat limited and your loan offer requires you to put down a significant amount per month to pay off your loan faster, it just might not be the offer that works for you (even if it’s a good one!). Instead, you might consider a long-term loan that will allow you to pay off your debt slowly, albeit with a bigger overall interest payment.

Whatever your personal situation, read through each offer carefully, understand what you’re signing up for, and don’t skip the terms and conditions.

Read more: 6 Things to Know Before You Take Out a Loan

Step 4: Get your Loan

Remember, until this point, you are under no obligation whatsoever. PersonalLoans.com will not hold you to any offer, and neither will the lender, so if you’re not happy with the offer, skip it and request another.

Once you’ve considered all the angles and the deal looks good, it’s time to sign!

Unlike secured loans or more specified loans such as a mortgage or auto loan, personal loans can be spent however you want. These usually hit your account within the next business day, though PersonalLoans.com can’t make any guarantees, since it’s simply the intermediary.

Read more: Unsecured vs. Secured Loans: What’s the Difference?

Why Use PersonalLoans.com?

PersonalLoans.com‘s biggest selling features are that it’s easy to use and completely free, but it also boasts a few other factors that make it stand out.

OLA Member

As an OLA member (Online Lenders’ Alliance), PersonalLoans.com commits itself to fair and honest consumer practices.

The OLA member designation is essentially a safety feature that’s built into the online business world. It means that PersonalLoans.com is required to comply with all federal laws and regulations, protect its consumers from fraud and other illegal threats, and deliver the best experience to all users.

OLA members must give consumers adequate cancellation time, never display false information or misleading advertising, and manage third-party affiliates with integrity.

Flexible Terms

Another feature of PersonalLoans.com that gives it a leg up on competitors is its flexibility in terms.

Many personal loan connectors limit their customers to short repayment plans, strict policies, and strict caps on loan amounts — but not PersonalLoans.com. I was actually amazed by the breadth of options PersonalLoans.com offers its borrowers.

While many lenders cap personal loans around $10,000, PersonalLoans.com works with lenders that range in loan amounts from as little as $1,000 all the way up to $35,000.

In addition, PersonalLoans.com lenders let you pay back your loan as quickly as 90 days from receipt of the money or as long as 72 months, depending on your credit and the type of loan you take out.

Different Types of Loans

The last point I want to highlight that makes PersonalLoans.com stand out among other lender channels is the variety of loans available.

Most lending portals offer one type of loan. PersonalLoans.com, on the other hand, offers you three different types, so you can find the one that suits you. Select from peer-to-peer loans, bank loans, or installment loans. Each is different in the amount you can borrow and the credit score needed for approval.

As a final benefit, PersonalLoans.com also has some great financial education tools, including smart budgeting and spending articles, scam alerts, and helpful tutorials for responsible financing.

Improved Reputation

A few years ago, PersonalLoans.com had an abysmal F rating with the Better Business Bureau. Thankfully, things have turned around and while they’re not BBB-accredited, they do have a B+ rating.

They also have a 4.6 on Trustpilot; however, the most recent reviews are all from 2020 and so are rather outdated. On Sitejabber, PersonalLoans ranks 29th among all loans sites, with 3.13 stars.

PersonalLoans.com vs. the Competition

Marcus by Goldman Sachs

- Rates: 6.99% - 24.99% APR

- Loan amounts: $3,500 to $40,000

- Loan terms: 36 to 72 months

Marcus by Goldman Sachs is another attractive option for consumers seeking a personal loan, as they offer loans with a fixed rate for the life of the loan and no fees whatsoever.

As with competitors, their application asks for some basic information, such as your reason for requesting a personal loan and the amount you want to borrow. Your credit score will not be affected by the application, and you’ll know in minutes if you qualify.

But one of the best perks of Marcus by Goldman Sachs is that you can receive a discount (0.25% APR reduction) when you set up AutoPay. Your payment will come automatically out of your account each month, and those on-time payments will strengthen your score over time. Marcus also offers an added incentive for on-time payments: if you pay your loan on time and in full every month for 12 consecutive months, you can skip a month without accruing interest.

Get a quote with Marcus by Goldman Sachs or read our full review.

Fiona

- Rates: From 3.99% APR

- Loan amounts: $5,000 to $250,000

- Loan terms: 6 to 144 months

Fiona and PersonalLoans.com both work with a variety of lenders to present you with a personal loan offer best suited to your unique financial needs and standing. In fact, Fiona presents applicants with four offers to consider. With Fiona’s selection of reputable lenders, you can request personal loans up to a whopping $250,000 and receive offers in a matter of seconds.

While PersonalLoans.com specializes in personal loans (as the name implies), Fiona also compares other financial products, including high-yield savings accounts, credit cards, mortgages, life insurance, and more. With this in mind, if you’re contemplating more than just a personal loan, Fiona may be a better fit for your current financial needs.

Get a quote with Fiona or read our full review.

Bad Credit Loans

- Rates: 5.99% to 35.99% APR

- Loan amounts: $500 to $10,000

- Loan terms: 90 days to 72 months

If your credit score is not particularly attractive to lenders at the moment, consider an alternative platform like Bad Credit Loans.

Like PersonalLoans.com, Bad Credit Loans connects you with a variety of lenders and options and is completely free to use. The terms available are not quite as extensive as those offered through PersonalLoans.com, but remember this platform caters specifically to those with poor credit.

Bad Credit Loans is a great option for anyone with a poor credit score and who cannot otherwise get a loan. Applicants must provide the same set of information requested by PersonalLoans.com, so be prepared to share your contact information, income, bank details, and more.

Get a quote with Bad Credit Loans or read read our full review.

Summary

PersonalLoans.com provides a service that is not uncommon in today’s lending society, but it does so with an entirely different flavor.

PersonalLoans.com works with a wide range of lenders to provide you with more flexible terms than many of its competitors. You’ll find loans up to $35,000, repayment terms up to 72 months, and rates as low as 5.99% APR.

Additionally, consumers can select from not one, not two, but three different types of personal loans: peer-to-peer, bank, and installment loans. And the cherry on top is it is completely free to use.

Marcus By Goldman Sachs® Offer Terms and Conditions - Your loan terms are not guaranteed and are subject to our verification of your identity and credit information. Rates range from 6.99% to 24.99% APR, and loan terms range from 36 to 72 months. For NY residents, rates range from 6.99%-24.74%. Only the most creditworthy applicants qualify for the lowest rates and longest loan terms. Rates will generally be higher for longer-term loans. To obtain a loan, you must submit additional documentation including an application that may affect your credit score. The availability of a loan offer and the terms of your actual offer will vary due to a number of factors, including your loan purpose and our evaluation of your creditworthiness. Rates will vary based on many factors, such as your creditworthiness (for example, credit score and credit history) and the length of your loan (for example, rates for 36 month loans are generally lower than rates for 72 month loans). Your maximum loan amount may vary depending on your loan purpose, income and creditworthiness. Your verifiable income must support your ability to repay your loan. Marcus by Goldman Sachs is a brand of Goldman Sachs Bank USA and all loans are issued by Goldman Sachs Bank USA, Salt Lake City Branch. Applications are subject to additional terms and conditions. Receive a 0.25% APR reduction when you enroll in AutoPay. This reduction will not be applied if AutoPay is not in effect. When enrolled, a larger portion of your monthly payment will be applied to your principal loan amount and less interest will accrue on your loan, which may result in a smaller final payment. See loan agreement for details.