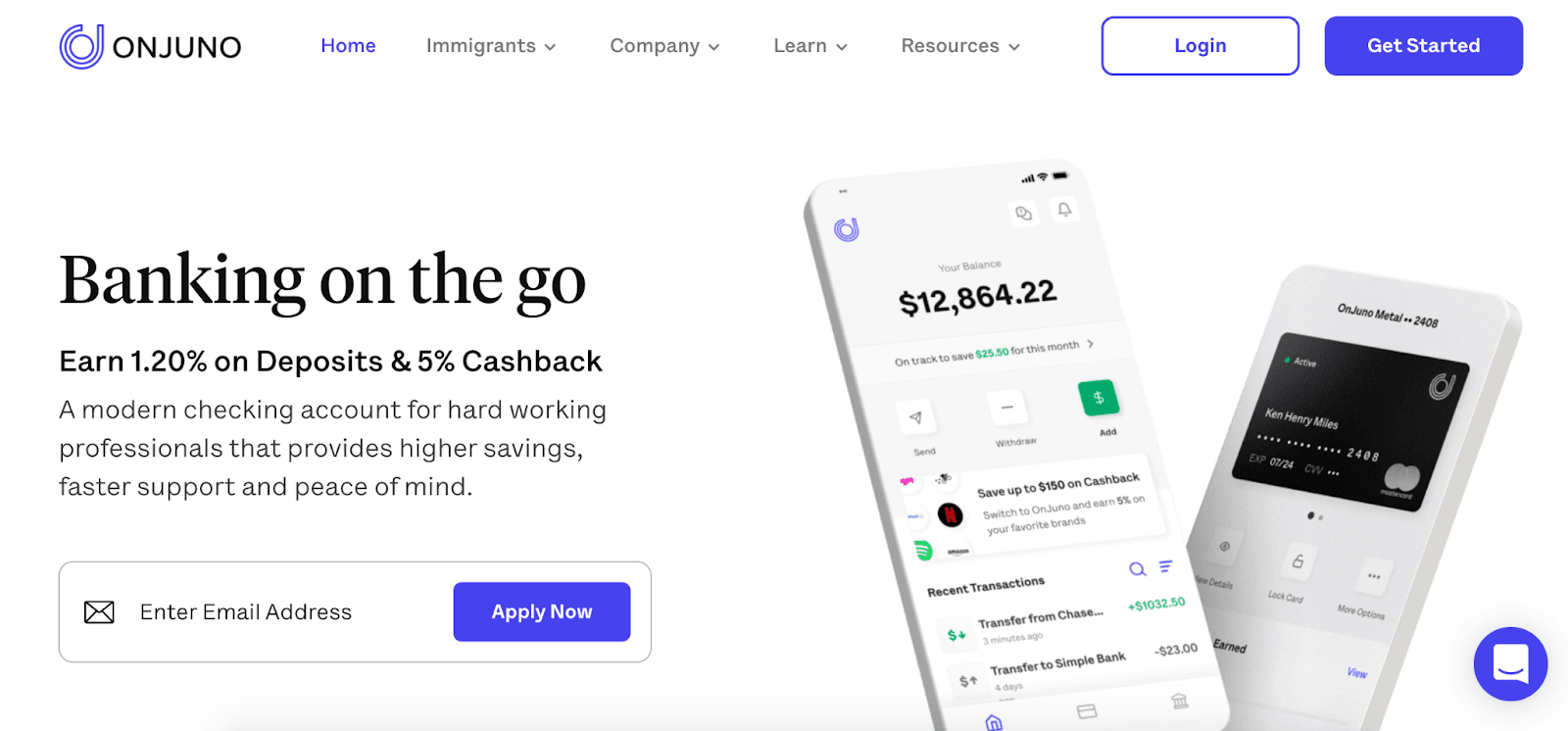

Juno Review: Checking With Cash Back

Rating as of based on a review of services November 29, 2022.

Ranking

9/10

With an impressive Bonus Rate on checking and 5% cash back on purchases with certain merchants, Juno is a prime contender in the fintech world these days. Here’s MU30’s full review.

Best for:

- Young consumers

- Online money management

- Direct deposit recipients

Finding an account that offers more than 0.50% APY is tough these days. I had a tough time even finding a CD offering that rate, and with a CD, your money is locked up for months.

That’s what’s so impressive about Juno. You’ll get a Bonus Rate of 1.20% on your balance of up to $5,000. There’s even a Metal Membership that lets you earn that rate on up to $50,000. It’s a great deal, and there are even more features that make it appealing.

Let’s dive into what makes Juno truly unique!

What is Juno?

Juno is new to the fintech world, having been founded in 2019. The company is run by a team of “engineers, designers, and product thinkers” who work together to find innovative ways to make managing your money convenient and easy.

Online checking account services are handled by Evolve Bank & Trust, a lender that has a 95-year history in financial services. This means you’ll get all the usual protections you’d expect from a lender, including FDIC insurance up to $250,000 per depositor, zero liability for fraudulent transactions, and account security. Unlike other lenders, though, you won’t pay any hidden fees, even for overdrafts, and you’ll enjoy a higher-than-average Bonus Rate on your checking balance.

How does Juno work?

When you’re ready to sign up for an Juno account, simply go to Juno and input your email address.

You’ll need to create a password to start setting up your online checking account.

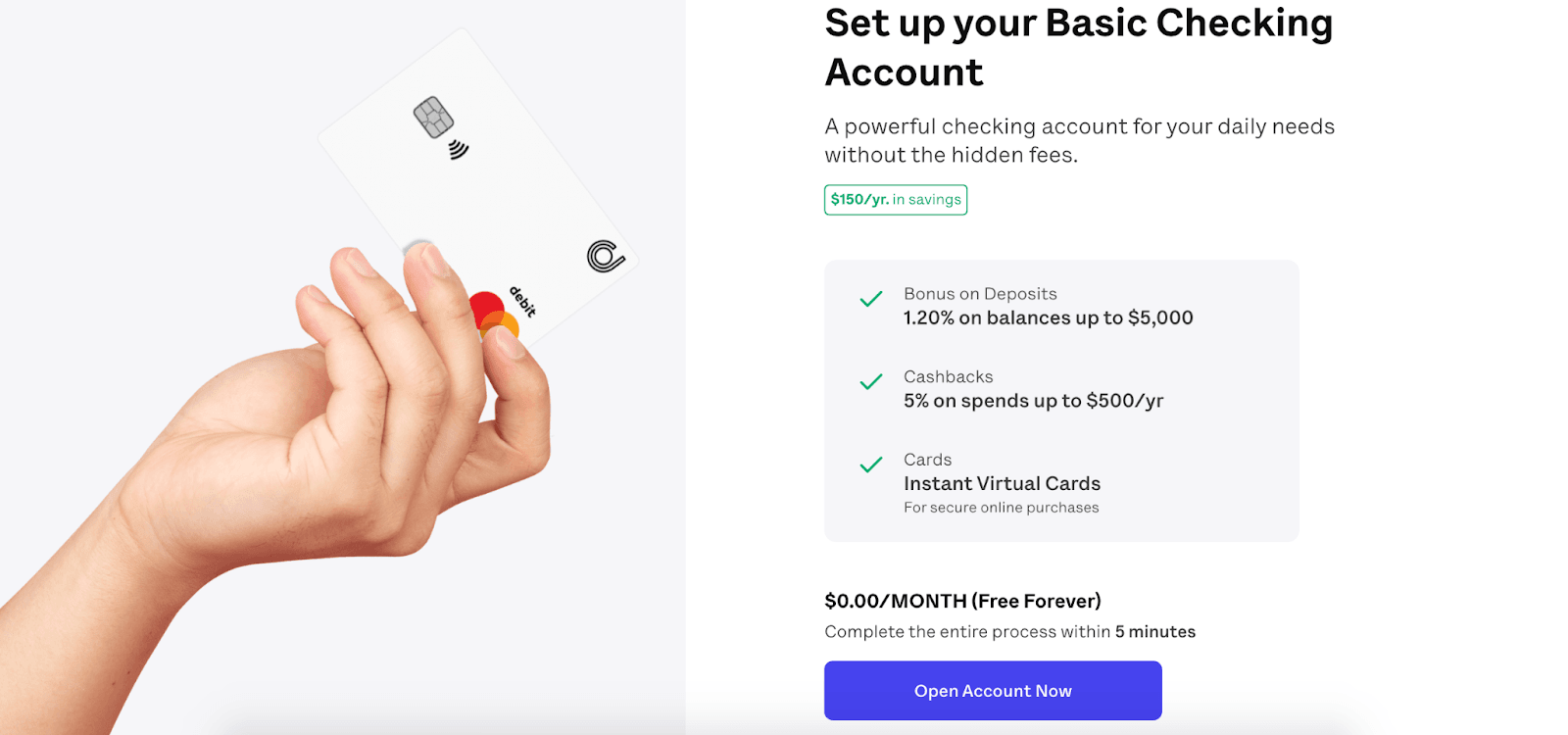

You’ll then need to verify your email address. Their email went to my spam folder, so check there if it doesn’t show up right away. Once you’ve done that, you’ll be invited to get started. Click “Open account now” to begin filling out your application.

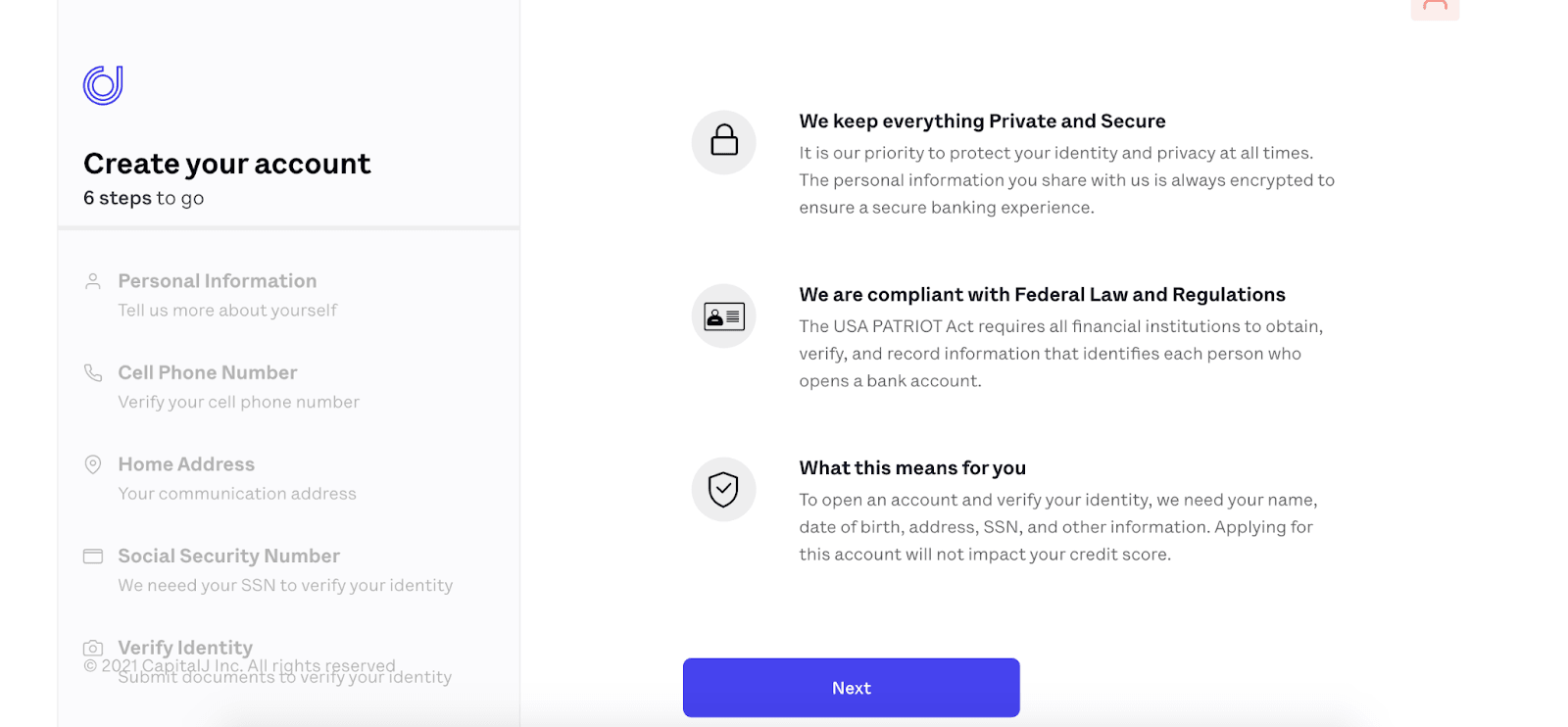

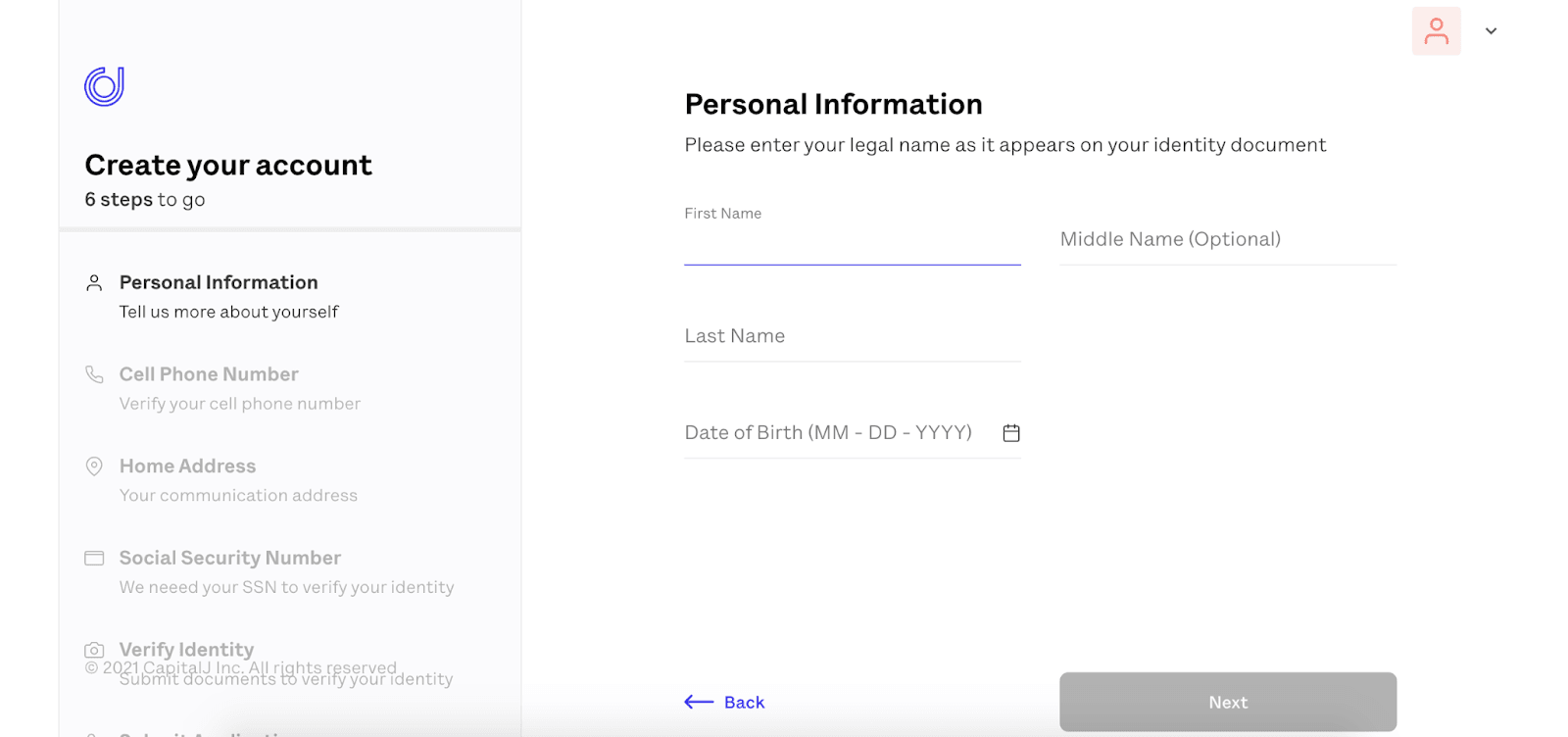

The process of setting up your account takes just a few steps. You’ll need to provide contact information and verify your identity, so make sure you have your Social Security Number handy before you choose “Next”.

First, you’ll need to provide your legal name and your date of birth.

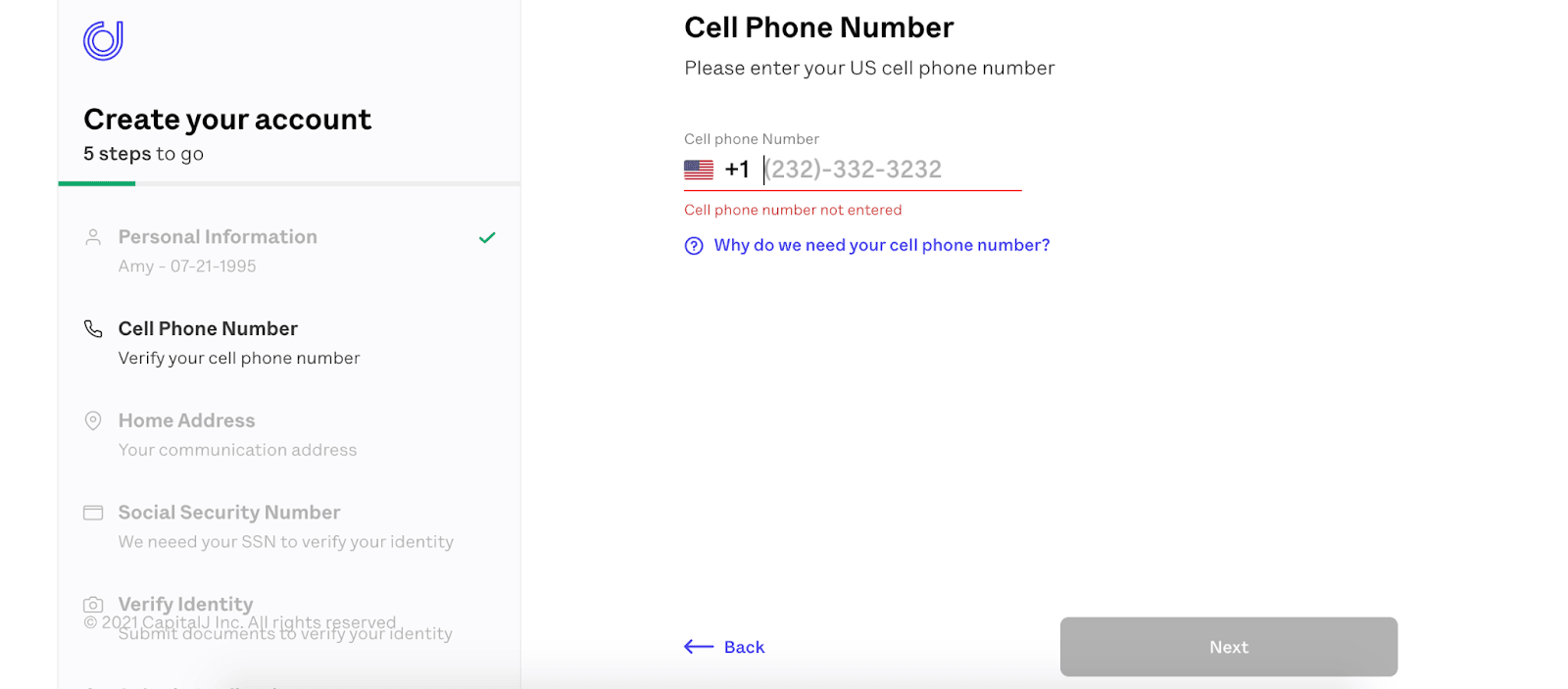

You’ll next need to provide your cell phone number. Juno will send a verification code to your cell phone. You’ll have to input that verification code to progress to the next step.

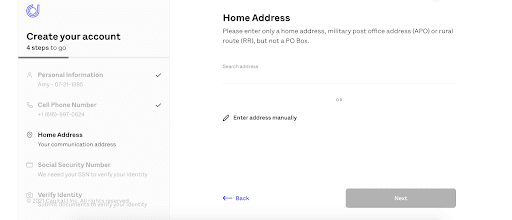

Once you’ve verified your cell number, you’ll be asked for your home address. This needs to be a street address.

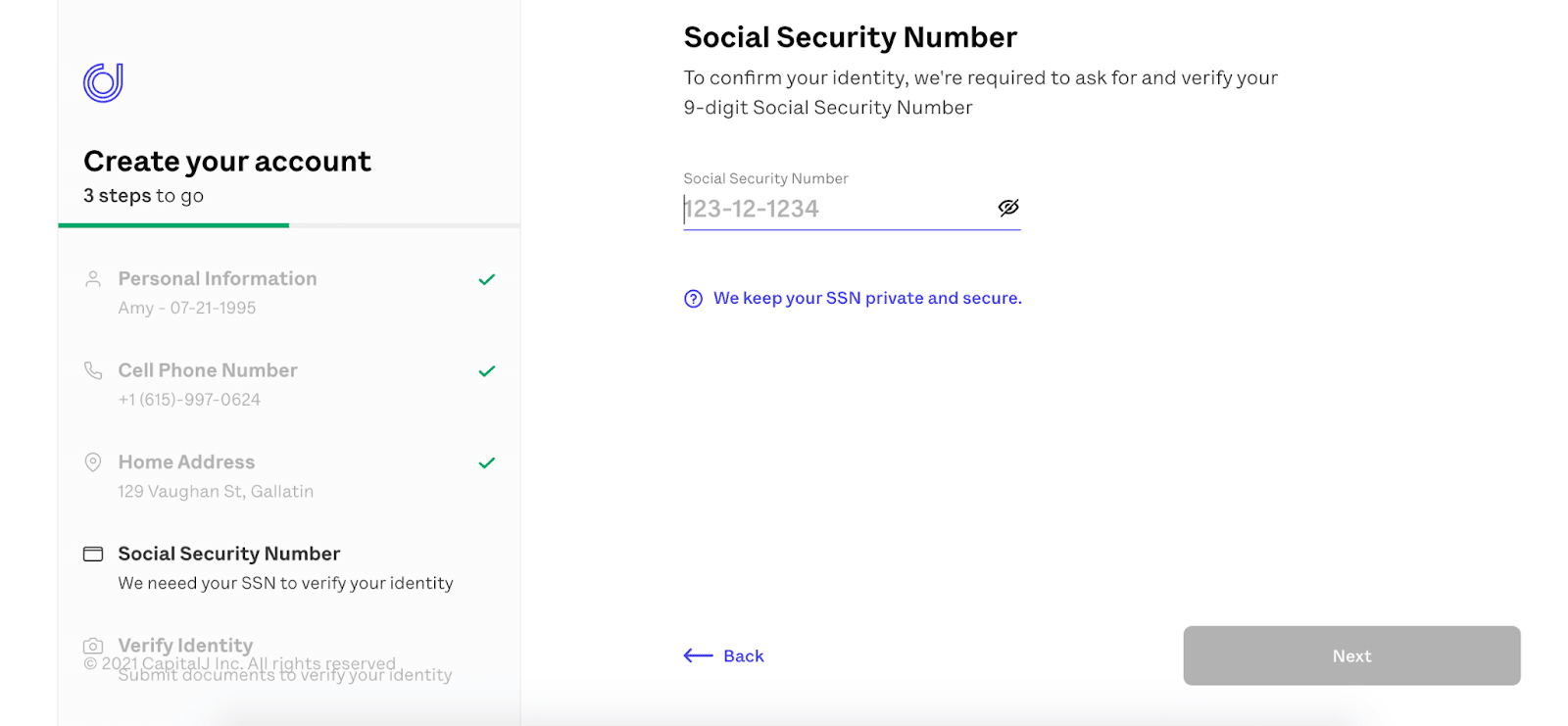

The final step is to input your Social Security Number so that Juno can verify your identity. And don’t worry, the Juno application process doesn’t affect your credit score!

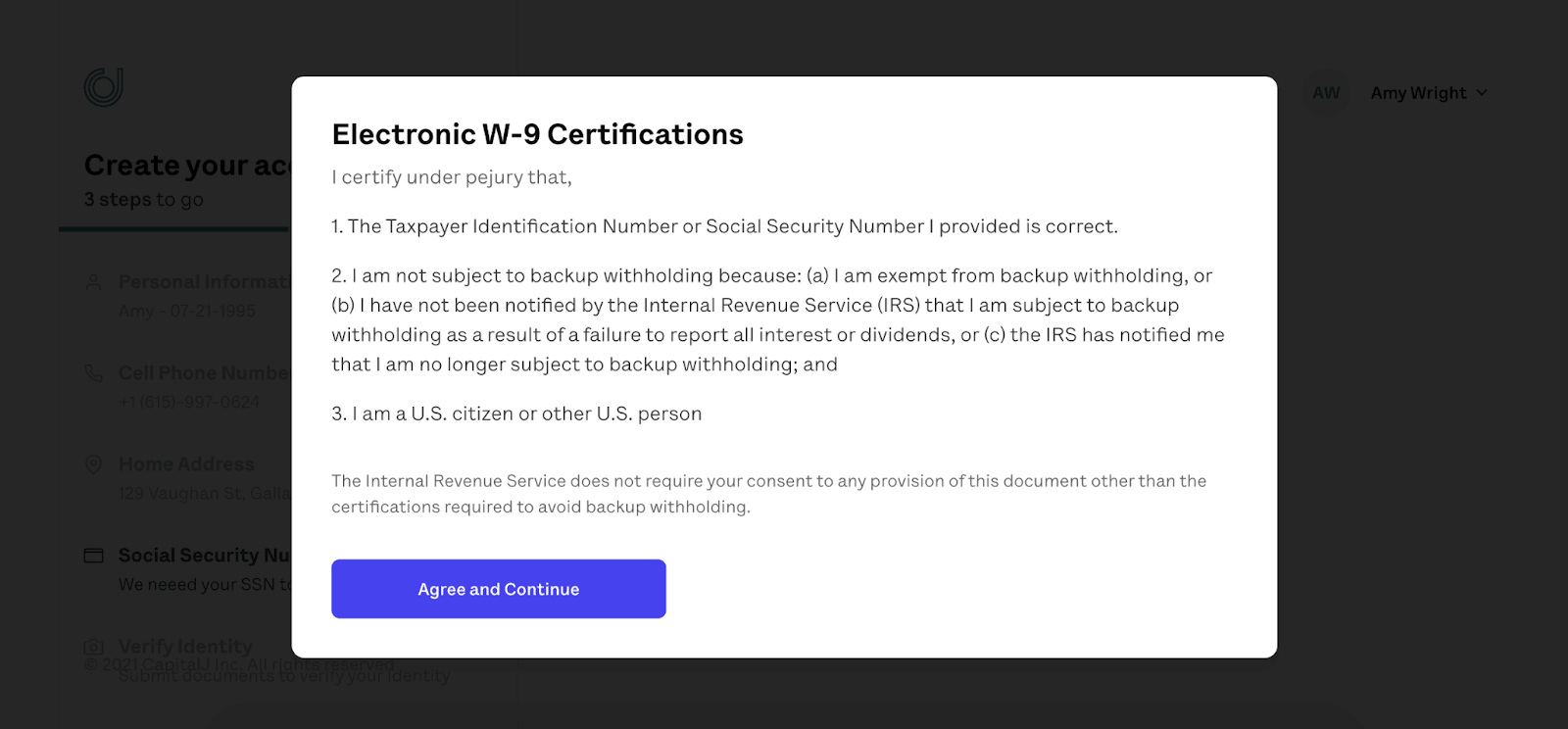

You’ll need to certify that your Social Security Number is correct before continuing.

Once you’ve verified your identity, you’ll just need to sign some documents to finalize your application. The entire process took less than five minutes.

Pricing for Juno

Juno has two tiers, Basic and Metal. Both accounts are free, but the Metal Membership requires that you have at least $250 a month in direct deposits.

But it’s important to note that Juno doesn’t just save you the monthly service fees. There are no fees for transfers or withdrawals, and you don’t even pay an overdraft fee. You’ll be able to use your debit card at 85,000 AllPoint and MoneyPass® ATMs across the globe for free, and the Basic plan includes one fee-free out-of-network ATM transaction each statement period. With the Metal Membership, that increases to three transactions per statement.

Juno features

If you’re in the market for a new online checking account, or even if you’re not, there are some compelling reasons to consider Juno.

High bonus rate

Juno’s biggest selling point is their 1.20% Bonus on their online checking account. It’s hard to find this in a savings account, let alone checking. If you have the Basic account, you’ll be limited to $5,000 in deposits with the 1.20% Bonus, at which point it switches to 0.25%. Metal Membership holders qualify for 1.20% on deposits of up to $100,000. Balances of $100,000+, unfortunately, earn no interest.

And note that Juno reserves the right to change up this Bonus at any time.

No hidden fees

You don’t have to worry about hidden fees with Juno. That means no service fees, overdraft fees, or pesky charges for little things like transfers. The Basic account is always free, but to qualify for fee-free Metal Membership access, you’ll need at least $500 a month in direct deposits.

No minimum balance requirement

With Juno, you have no minimum opening deposit and no minimum balance requirement. You won’t ever have to deposit a dime into your account, but you’ll earn a whopping 1.20% Bonus on the dimes you do put in.

To qualify for the better perks you get with a Metal Membership, you’ll need to set up direct deposit to have at least $500 going into your account each month.

Cash back on purchases

Juno has a unique approach to its cash back program. You get to choose up to five merchants, and when you spend with those merchants, you get 5% cash back. Juno’s list of participating providers includes grocers, department stores, restaurants, and streaming services (so really anywhere you’d likely spend a lot of money). Some big-name brands include:

- Target

- Walmart

- Starbucks

- Taco Bell

- Netflix

- Airbnb

There is an annual limit to your cash back, and that limit depends on the plan you choose.

- Juno Basic – 5% cash back on purchases of up to $500 per year (equivalent to a max of $25 per year).

- Juno Metal – 5% cash back on purchases of up to $6,000 per year (equivalent to a max of $150 per year).

Additional bonuses for new users

Juno offers several incentives for new users, including:

- Earn $10 on your first crypto trade or deposit (minimum $10)

- Earn $50 when you set up your first qualifying direct deposit of $250+.

- Earn $10 when you refer a friend to Juno and they fund their Juno wallet with at least $50.

Free debit cards

All of Juno’s accounts come with virtual cards that you can use for online spending or connect to your Apple, Google, or Samsung Pay wallets. But you can also get a physical card for local purchases. Metal Membership holders automatically get an attractive black debit card, while Basic account holders can request a standard white debit card at no charge.

Free cash withdrawals

Juno has partnered with both Allpoint and MoneyPass® to offer fee-free cash withdrawals at 85,000 ATMs throughout the world. Basic account holders also get one additional fee-free out-of-network withdrawal per month, while Metal Memberships get three monthly withdrawals at out-of-network ATMs.

You are limited to a $500 daily cash withdrawal limit, but this is a security measure to prevent fraud.

Fast, easy application process

Applying for an Juno account takes just a few minutes. The approval process doesn’t require a credit check, so you won’t see an impact on your score. You’ll just need to provide your Social Security Number and contact details to apply. Best of all, as soon as you’re approved, you’ll have access to your virtual debit card so you can start making online and contactless purchases.

Easy integrations

Not only can you use your virtual debit card with Apple Pay, Google Pay, and Samsung Pay, but the Juno app easily connects to other popular financial solutions. With just a quick setup process, you can use your Juno funds to pay friends via Venmo and Zelle, sync up to Coinbase to manage your cryptocurrency, or send your funds to CashApp to put toward your investments.

Immigrant applicants welcome

For those who are new to the U.S., Juno makes getting an online checking account easy. You’ll only need a Social Security Number and your passport to verify your identity. Juno’s low foreign exchange rates also make it affordable to easily transfer funds to your loved ones outside the U.S.

Customer support

If you ever need help with your account, Juno offers three ways to get support. You can speak to a support representative by phone Monday through Friday from 9 a.m. to 6 p.m. PST.

You can also use their chat feature between 5 a.m. and 6 p.m. PST.

Finally, Juno also has a FAQ and support center with useful articles you can browse.

Top-notch security and privacy

Juno promises cutting-edge security to keep your financial data safe, including protection against liability for unauthorized transactions. But the company also promises your data will never be sold.

My experience researching Juno

To research Juno’s offerings, I actually took a little time to look at what other fintech companies are offering. It’s difficult to find a lender that offers better than 0.50% APY on checking. Even with savings, rates tend to hover around 0.50% or 0.60%. That makes Juno’s 1.20% Bonus a pretty powerful and therefore uber attractive offering.

It’s important to note that Juno is the one who pays you that Bonus Rate. Evolve Bank & Trust manages the banking end of things, but the Bonus Rate is offered by Juno as an extra. The Bonus Rate will be deposited into your account at the start of each month.

I also love the list of merchants eligible for 5% cash back. For best results, choose the brands you spend the most money with each month. I’d definitely pick Amazon, Target, and Walmart, but there are fast-food restaurants, cafes, food delivery apps, and drugstores. With the Metal Membership, you can earn as much as $150 a year through cash back. It drops to $25 a year with the Basic plan.

Speaking of the two plans, if you have at least $500 a month in electronic deposits, the Metal Membership really is a far better option. There are no extra fees to use it, and the benefits are much better. You can use three out-of-network ATMs a month and enjoy the 1.20% Bonus on up to $50,000, rather than just $5,000. Plus, you’ll get cash back on up to $3,000 in purchases each year versus $500 with the Basic plan.

All in all, Juno is an online checking account that pays you simply for parking your money there. When combined with 5% cash back on your purchases, it’s an offer that’s a far better deal than any other fintech company I’ve seen.

Who is Juno best for?

Those with savings elsewhere

With the Basic account, you’ll earn a 1.20% Bonus on only $5,000 in deposits. This increases to $50,000 for the Metal Membership. So if you want to earn more than 0.25% on amounts above that, be prepared to have a separate account for transferring those extra funds.

Direct deposit customers

The Metal Membership offers the biggest benefits and is completely free, but you’ll need at least $500 in direct deposits each month. Although, even if you don’t meet requirements for a Metal Membership, earning 1.20% on up to $5,000 in deposits is still a great deal.

Mobile bankers

Juno’s full-featured app makes it ideal for consumers who manage their money primarily on a mobile device. You’ll get access to all the features you need from the app, including the ability to pay bills, transfer funds, and even shoot a payment to a friend to pay for those concert tickets.

Who shouldn’t use Juno?

All-in-one bankers

If you prefer to do all your money management in one place, this might not be the best option for you. Juno only offers an online checking account. However, the app does make it easy to connect up to 3,800 financial institutions via Plaid, so transferring your money to your savings, money market, and investment accounts is a breeze.

In-person bankers

Juno has no physical locations, so you won’t be able to walk into a local branch, but you can deposit checks through the mobile app, access cash at 85,000 ATMs, and get customer support via text or phone.

Pros & cons

Pros

- Attractive Bonus Rate — You’ll get the cash liquidity that comes with an online checking account while also earning Juno's Bonus.

- The application process is a breeze — Signing up takes about five minutes, making this one of the easier online checking account applications!

- No hidden fees — You’ll enjoy truly fee-free checking, including no service fees, no charges for overdrafts, and fee-free ATM access at 85,000 locations.

- 5% cash back — Choose five merchants from Juno’s partners and earn 5% cash back on your purchases with those retailers.

- Easily integrate apps — You can link apps like Venmo, CashApp, Robinhood, and Coinbase.

Cons

- No physical branches — For those who prefer an in-person experience, an online-only checking account might not be the best option.

- Limited support times — If you need help on a weekend or after 6 p.m. PST, you’ll have to wait until the next business day to chat with a representative.

- Withdrawal and deposit limits — Like many financial institutions, Juno restricts daily deposits and withdrawals to keep accounts secure.

Juno vs. their competitors

Juno Chime Discover Bank

Monthly service fees None None None

APY 1.20% bonus None; 2.00% APY on savings None, 3.90% APY on savings

Special features 5% cash back with select merchants Access to direct deposit funds up to two days early 1% cash back on purchases with all merchants

Chime®

If you’d like early access to your paycheck, Chime is worth considering. Simply set up direct deposit and you’ll be able to use your funds up to two days earlier than you would with other lenders.3 Like Juno, Chime offers a checking account, but you’re only covered for up to $200 in overdrafts without fees. Chime simply takes the funds for the overdraft out of your next direct deposit.5

If you’d like early access to your paycheck, Chime is worth considering. Simply set up direct deposit and you’ll be able to use your funds up to two days earlier than you would with other lenders.3 Like Juno, Chime offers a checking account, but you’re only covered for up to $200 in overdrafts without fees. Chime simply takes the funds for the overdraft out of your next direct deposit.5

Chime doesn’t issue interest on their checking accounts, but you can set up a savings account and earn on your balance there. You can set up autosave and/or have Chime round up each purchase and put the change in your savings account to gradually build your balance.^ Lastly, there’s the notifications feature. You can set up alerts to be notified of each transaction and even get a notification with your current balance every morning.

^ Round Ups automatically round up debit card purchases to the nearest dollar and transfer the round up from your Chime Checking Account to your savings account.

3 Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

5 Chime SpotMe is an optional, no fee service that requires a single deposit of $200 or more in qualifying direct deposits to the Chime Checking Account each month. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases and cash withdrawals initially, but may be later eligible for a higher limit of up to $200 or more based on member's Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. Your limit will be displayed to you within the Chime mobile app. You will receive notice of any changes to your limit. Your limit may change at any time, at Chime's discretion. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe won't cover non-debit card transactions, including ACH transfers, Pay Anyone transfers, or Chime Checkbook transactions. See Terms and Conditions.

Discover Bank

Another checking account that offers cash back is Discover Bank, which issues 1% cash back on up to $3,000 in purchases. Although the overall cash back is much lower, it covers all purchases, not just those with a select group of merchants. You’ll also get free checking, including no fees on overdrafts.

Another checking account that offers cash back is Discover Bank, which issues 1% cash back on up to $3,000 in purchases. Although the overall cash back is much lower, it covers all purchases, not just those with a select group of merchants. You’ll also get free checking, including no fees on overdrafts.

Your checking account with Discover won’t earn interest, but Discover’s savings account pays 3.90% APY. You can move some of your money into Discover’s 12-month CD and earn 4.75% APY, but you won’t be able to access those funds during that time. One area where Discover Bank does excel is in customer service. You’ll have access to 24/7 phone support for any issues or questions you have about your account.

Summary

When it comes to high Bonus Rate online checking account options, Juno has the best game around. You’ll earn a whopping 1.20% Bonus and extra bonus perks like 5% cash back on purchases with certain retailers.

You might be better off with a savings account once you hit the $5,000 threshold, but with the Metal Membership, you can earn the 1.20% on balances all the way up to $50,000.