Novo Review: My Experience Using Novo

Rating as of based on a review of services December 7, 2022.

Ranking

9/10

When you start your own business, you’ll quickly find that using your personal bank account can get overwhelming. Novo can help you separate your business and personal finances for free!

Best for:

- Freelancers

- Startup founders

- Small businesses

Freelancers often start off paying their business expenses out of our own checking account. But as I added more clients, I started to see the need to separate things.

Novo understands this need, making it easy to open and manage an account, with no minimum balance requirements.

But what sold me on Novo was its online-only setup. I still have the occasional client who pays by paper check, and I needed to be able to deposit those using my phone.

You can also easily transfer money and make electronic payments using the Novo app, which comes in handy when I pay for marketing expenses like website design and business cards.

Novo is an independent technology company geared toward freelancers and small business owners. It’s part of a growing trend of online-only banks offering an alternative to traditional lenders. As with other online-only banks, this platform is great as a supplement to a personal bank account.

How does Novo work?

Once you click on the Get Started button on Novo’s website, you’re invited to start your application. You don’t have to commit to completing the entire process today. There’s also an option to finish an application you’ve already started on this page.

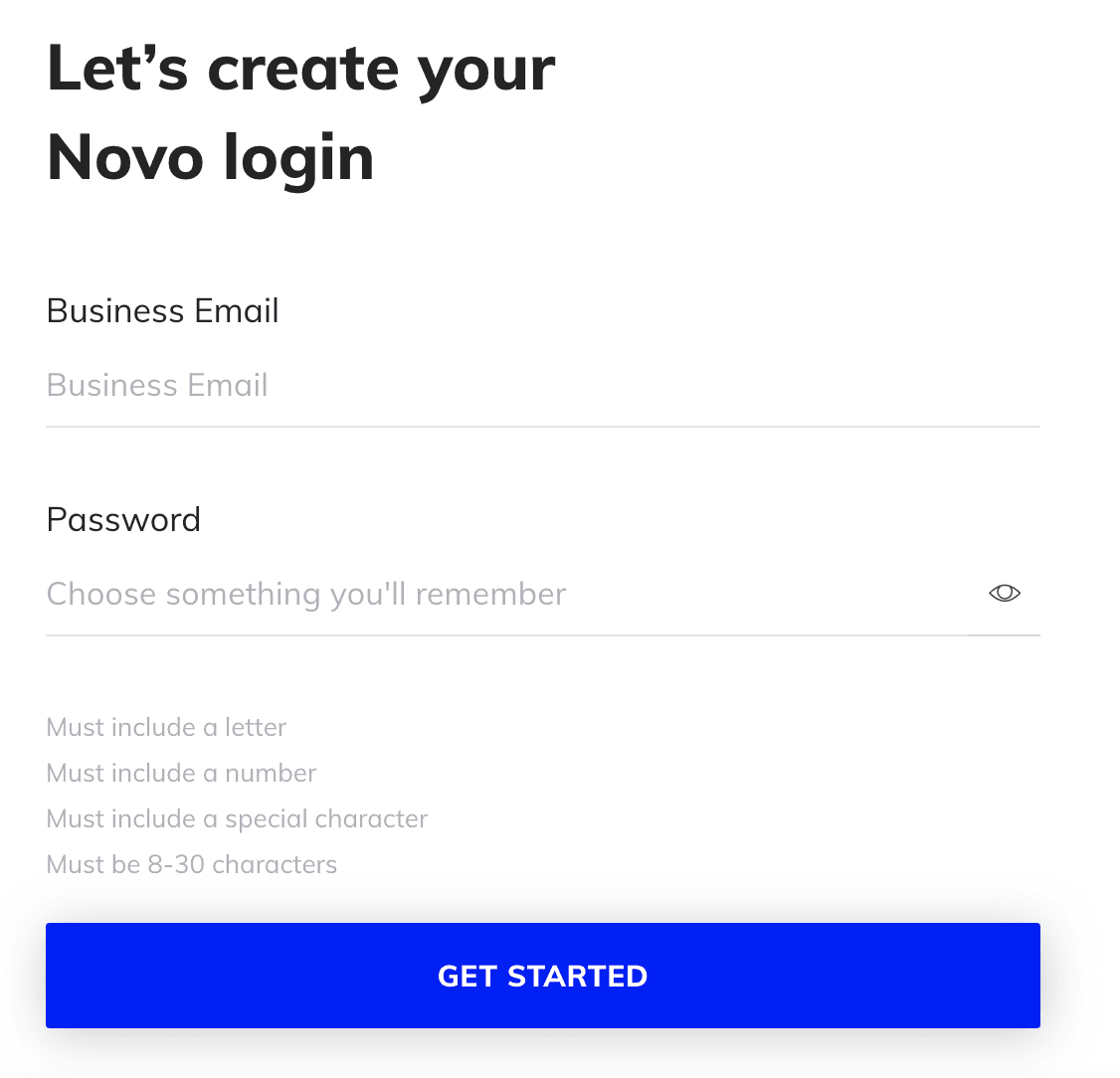

You’ll input a business email and password early on in the application process that you can use to get back in later.

Once you’ve input your business email and created a complex password, Novo will send a confirmation code to your business email address. You’ll need to input in this code within 60 minutes or it will time out and you’ll have to request another one.

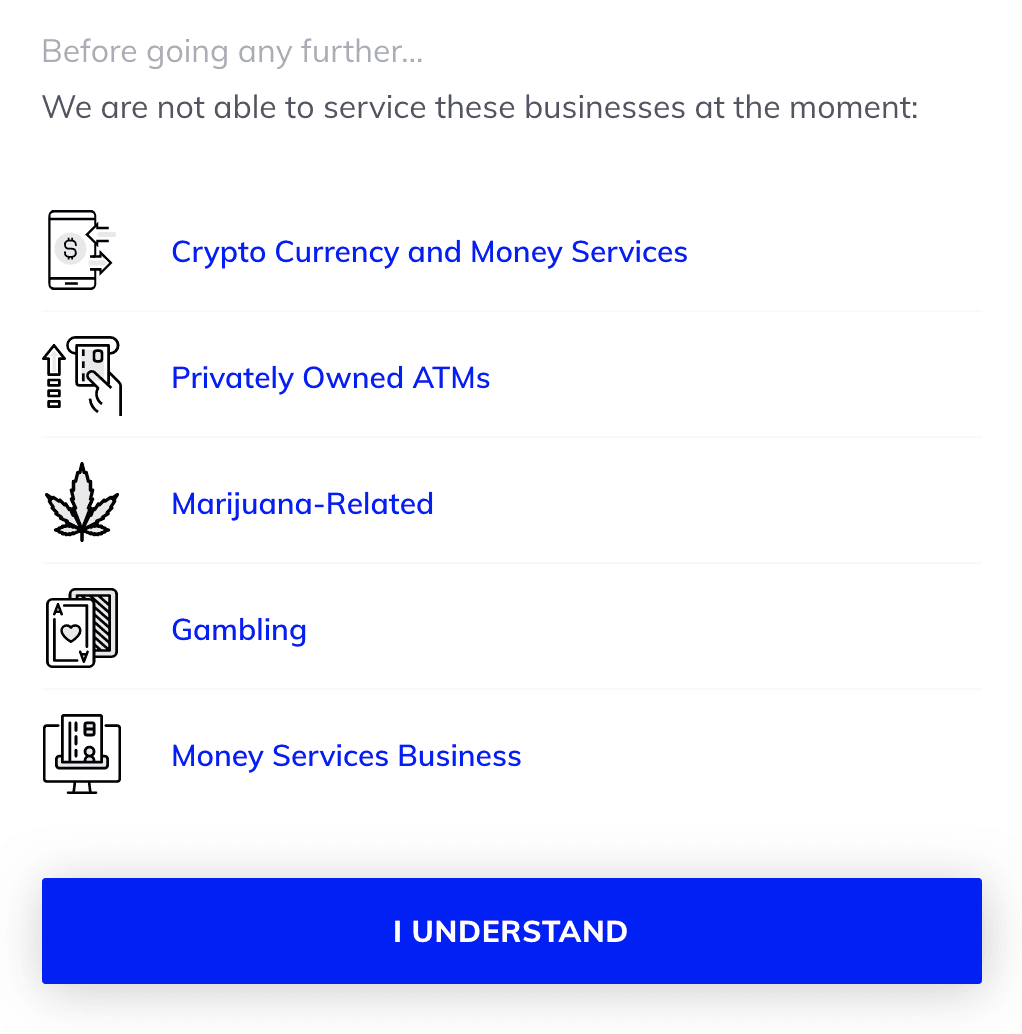

It’s important to note that if your freelance business is related to cannabis or gambling, Novo will reject your application. There are also a few other types of businesses that currently can’t use the platform. You’ll get a warning about that before you proceed.

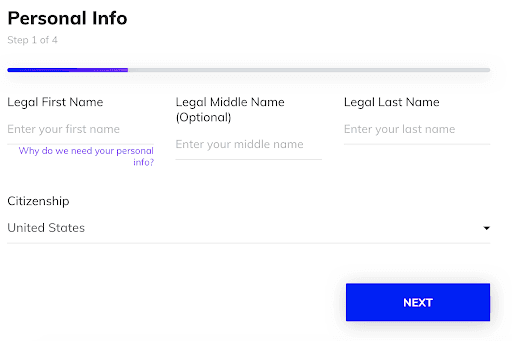

At this point, Novo will take you through the application process, gathering your financial and background information. This data will be used to determine whether you qualify for an account.

Once you’re approved for an account, you can link up your other bank accounts to easily transfer funds back and forth. You can also start accepting ACH payments, depositing checks and paying your bills using your new account.

Pricing for Novo

Although there are no minimum balance requirements, you will need $50 to get started. It’s also important to note that you won’t earn interest on the funds in your account. It’s meant to help you facilitate business transactions.

I make sure I transfer any extra money I make over to my personal savings from time to time to earn at least a little interest on it.

You’ll enjoy fee-free services with Novo, as long as you keep a positive balance. Here’s the company’s current fee schedule.

| Monthly service charge | $0 |

|---|---|

| Early account closing fee | $0 |

| Incoming ACH | $0 |

| Outgoing ACH | $0 |

| Insufficient funds charge | $27 |

| Uncollected funds returned fee | $27 |

Novo features

As a freelancer, you’ll get many benefits from using Novo, including:

Fee-free banking

Even if you keep a $5 balance each month, you’ll never pay a fee for your account with Novo. That makes it perfect for freelancers and small business owners who simply need an extra account to keep finances separate.

Once you’ve deposited the initial $50, you can transfer and add funds as needed.

Easy sign-up

One barrier to setting up a business-specific checking account is the time and effort it takes to do so. Novo removes that obstacle, letting you easily sign up online.

You’ll only need $50 and good credit to go through the application process and be approved.

Integrations

Although Novo is relatively new on the scene, it already integrates with Xero, Zapier, Slack, and TransferWise. There are more apps coming soon.

With integrations, you can transfer funds and push updates to your communication channels. Directly in Slack, for instance, teams can see when invoices are due or payments have been sent.

Easy transfers

Since Novo isn’t intended to be your sole bank account, it’s essential that you can easily transfer funds back and forth.

If you need $100 to pay a vendor, you’ll have to be able to move that money over from your personal account if you don’t have the funds available. But, most importantly, you can transfer money occasionally to your personal account, letting you pay yourself a salary for the hard work you’re doing.

Who is Novo best for?

Businesses that pay freelancers

Paying freelancers brings its own challenges, whether you subcontract some of your work or you run your own business.

You can easily pay via ACH, or link up bank accounts to pay using your favorite payment app. You can even pay freelancers through Slack and other collaboration platforms.

Freelancers and small business owners

Novo is geared toward freelancers, as well as those who own small businesses or startups. There are plenty of options for large companies and personal consumers. This option is designed for those who fall in between those two extremes.

You’ll have an app to help you manage everything and the tools necessary to run your business.

Tech-savvy consumers

Banking with an online-only platform means being comfortable using the apps that have become a part of the banking experience with most lenders today. However, with traditional banking, even with these apps and tools, you’ll have a local branch you can call or visit whenever you need that personal experience.

It’s important to make sure you’re comfortable using apps for all your banking. Novo does provide human-backed customer service if you need help, but your transactions will all be through the app.

Who shouldn’t use Novo?

Those who don’t own businesses

Not only is Novo not ideal for personal accounts, you won’t even be approved unless you’re running a business.

If you’re a freelancer, as long as you can demonstrate that you qualify as a sole proprietorship under the IRS definition, you’ll be good.

You’ll find plenty of online-only personal checking account options if you aren’t running your own venture.

Paper check writers

Novo is set up to be electronic, making it not quite ideal for those who still maintain a paper checkbook. If you need to write a check and give it to a vendor, you’ll have to go through Novo to initiate the transaction. Although it can be convenient to have Novo manage those transactions for you, for frequent check writers, it can become a nuisance.

Those who prefer brick-and-mortar banking

If you’re looking for a bank with a local branch, Novo won’t be the option for you. I keep my personal account for features like withdrawing cash and speaking to loan officers.

Businesses with cash deposits

I’m never paid in cash, but some small businesses are, and that can be a problem with Novo. You can only deposit via Novo’s mobile app, which means cash isn’t an easy possibility. You can turn that cash into a money order and deposit it that way, but this extra step won’t be feasible if cash deposits are a regular occurrence for your business.

Pros & cons

Pros

- Fee-free banking — There are no monthly fees and no minimum balance requirement.

- Easy setup — Link up your other banks and easily transfer funds from your business to your personal accounts.

- Convenient online banking — Deposit checks and transfer funds easily using the Novo app.

Cons

- Business accounts only — To sign up for Novo, you’ll need to prove you’re either a freelancer or operating a business.

- Electronic checks only — Novo is set up to be electronic, so paper check writers will have to go through some extra steps.

- No cash deposits — If you’re regularly paid in cash, you’ll be better off choosing a bank with a local presence.

Novo vs. competitors

| Financial Company | Monthly fees | Other fees | Minimum opening deposit |

|---|---|---|---|

| Novo | None | Insufficient funds: $27, Uncollected funds returned fee: $27 | $50 |

| LendingClub Bank | None | Insufficient funds: $25 Returned item fee: $25 | $100 |

| Lili | $0 for Lili Standard; $9 monthly for Lili Pro | $2.50 fee at non-MoneyPass ATMs | $0 |

| Chase Business Complete Banking℠ | $15; $0 for balances of $2,000 or more | 2.6%-3.5% + $.10 per swipe to accept credit cards | $0 |

Freelancers and startup founders have a wide range of options for checking. Although Novo is great, here are some competitors worth considering.

LendingClub Bank

LendingClub Bank offers both personal and business checking, with its business accounts targeted to small and midsize businesses. Like Novo, LendingClub Rewards Checking will let you do all your banking online, making it easy to transfer money back and forth from your personal account.

One thing that sets LendingClub Bank apart is that its LendingClub Tailored Business Checking Account earns interest. As long as your balance is $5,000 or more you can earn 1.00% APY. The required minimum opening balance is slightly higher, at $100, but you’ll earn unlimited 1% cash back on purchases made with your debit card which is a nice perk.

Lili

Lili is tailored toward freelancers, with solutions geared specifically to running a solo enterprise – with many simple and easy-to-use tax and expense management tools; your taxes don’t have to be time-consuming and frustrating! You can even set aside a percentage of your income into your Tax Bucket so you are absolutely certain to have enough for your taxes. There’s also a Lili Pro account that gives you advanced accounting features and cash back rewards for only $9 a month.

With Lili, you’ll get checking with no hidden fees or minimum balance requirements, so you can set the account up and use it as you need it. If you need cash, Lili lets you use more than 38,000 ATMs free of charge with your Visa® business debit card. You can also deposit checks and transfer funds using the mobile app. Like Novo, Lili is an online-only banking option, so you can sign up directly on the website in just three minutes (they even timed it).

Chase Business Complete Banking℠

If your business accepts credit cards, Chase Business Complete BankingSM is a competitor to consider. QuickAccept lets you swipe credit cards with no contract or monthly service fees. You’ll pay 2.6% + $.10 for in-person transactions using a provided mobile card reader or 3.5% + $.10 for purchases through the Chase Mobile App.

There is a monthly service charge of $15 if you maintain a balance under $10,000. Once you reach $10,000 or above, though, that service fee will be waived. You’ll also get fraud protection and same-day deposits of credit card transactions.

My experience using Novo

Technology has made it easier than ever to start and run a business. If your business is a freelance venture, like mine, think of Novo as your business’s bookkeeper.

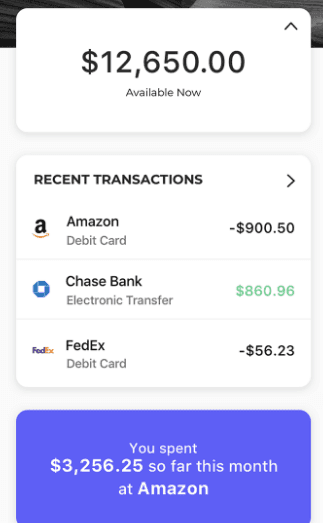

I use apps to make everything else I do easier, so why not my business finances? When you log in, you’ll get all your recent transactions in one place. I also get helpful tips like how much I’ve spent on purchases at a specific retailer this month.

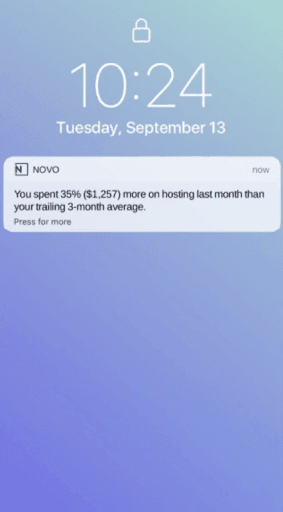

You don’t have to log into the app to get helpful tips, though. I opted in to notifications and now get helpful tips directly on my lock screen. I also love that it tracks my average expenditures in certain areas and weighs current spending against it.

But my favorite feature is the Send Payment option. You’ll choose your payee from a list. If you manage a team, you can add them to ensure they show up on the list. You can also input your regular vendors.

Once you’ve selected a payee, you’ll be prompted to input an amount and the type of transaction. ACH sends the money directly from your bank to the other party’s. However, you can also choose to wire the money, either domestically or internationally, at no additional cost to you. Novo also integrates with TransferWise if you prefer to send money to your international vendors using that app.

Everything can be done through my iPhone, which makes it easy to manage my business on the go. That keeps me from being chained to a desk 40 hours a week, which is one of the biggest benefits of being a freelancer. I also connect up to Xero so that at tax time, I can pull reports on my income and expenses for the year and take them to my tax preparer.

Summary

Whether you’re a freelancer or a small business owner, a free checking account from Novo will help you separate your finances without extra stress. You can link your banks and manage everything from your smartphone.

With Novo’s notifications, you’ll have ongoing insight into how you’re spending money so that you can find ways to reduce expenses to keep more of your monthly income.

Novo Disclosure - Novo is a fintech, not a bank. Banking services provided by Middlesex Federal Savings F.A.; Member FDIC.