Monevo Review 2023 - My Experience Applying For A Loan With Monevo

Rating as of based on a review of services December 22, 2022.

Ranking

8/10

If you’re considering borrowing money using a personal loan, there’s no downside to giving Monevo a shot. Here’s our full Monevo review.

Best for:

- Any credit type

- Higher loan amounts

- Access multi-lenders

If you’re looking for a personal loan, you probably understand how frustrating the process can be. Every lender has their own application you have to fill out. Each application at most traditional lenders, like banks, can result in a hard pull that may have a negative effect on your credit score.

You need access to money, but the process isn’t set up to help you get the best rate and terms possible. Thankfully, Monevo changes almost everything that’s bad about the process.

What is Monevo?

Monevo is a completely free website that allows you to shop for a personal loan from multiple personal loan providers at once. Rather than apply at many different lenders, Monevo does the legwork for you.

They gather multiple personal loan offers based on your application so you can pick the best offer for your situation.

In fact, Monevo searches over 30 top lenders and banks in 60 seconds without impacting your credit score.

How does Monevo work?

Monevo is a multi-award-winning matching service that allows you to receive personalized loan offers in seconds without affecting your credit score. Basically, you fill out an application form with Monevo. Then, Monevo shares that information with its extensive network of lending partners. Monevo has more lenders per credit tier than many other matching services..

The rate shopping process uses soft pulls to gather information from your credit report. Then, the lenders send their loan offers to Monevo which displays them for you. Monevo’s lenders offer loans in amounts ranging from $1,000-$100,000 to help you find the funds you need.

After you pick an offer, apply with the lender that offers the best rate and terms for your situation to get the loan process started.

If you aren’t familiar with personal loans, you may be confused when searching for personal loans with Monevo. Initially, you input what the purpose of your loan is. The list of options includes many choices from debt consolidation to auto and student loan refinancing.

While your loan purpose may slightly affect your interest rate depending on the lender you choose, it’s important to note that personal loans are not the same thing as car loans or refinanced student loans. Personal loans are typically unsecured and often come with higher interest rates than loans dedicated to a single purpose like refinancing student loans.

Once you’ve chosen a loan and completed the application process, funds are available as early as the next business day after your loan closes.

How much does Monevo cost?

Monevo is free to use, but they’re still making money. Monevo’s lending partners pay Monevo. Their website states:

The personal loan offers that appear on this website are from lending partners from which Monevo receives compensation for its services, tools, and facilities.

Monevo does not include all lending partners or all types of loan offers available in the marketplace, so you may wish to compare other offers outside of Monevo to ensure you’re getting the best terms available for your circumstances.

Types of loans available through Monevo

Monevo lists a bunch of different loan purposes, from debt consolidation to education and many more. But it’s important to note that these are all personal loans, which are typically unsecured loans which might often have a higher interest rate.

For example, if you’re looking for a loan to fund your university education, you should look for a student loan – and even though Monevo lists education as a loan purpose, the loan you’ll be getting is a personal loan.

Features of Monevo

The two best features of Monevo are:

- Monevo is able to present you with multiple personal loan offers with one application.

- Only soft credit pulls are used in the process of getting pre-qualified offers so the application won’t affect your credit score. Of course, if you do select one of the offers presented by Monevo, the lender will then do a hard pull on your credit score – but that happens after you get to see all the best offers available.

One application, many offers

Traditionally, you’d have to spend hours filling out multiple applications to get multiple personal loan offers to compare. If you were working with brick and mortar lenders, you may even have to drive from lender to lender. Monevo takes all of that headache away with their single online application.

You can complete the application from the comfort of your home or even on your phone if you’d like. The application contains the information needed for multiple lenders to give you personal loan quotes. With Monevo, you get more lenders per credit tier than with other matching services, making it easier to get the best rate available.

Soft credit pull

The other major feature of Monevo is the fact that they only use soft credit pulls in the application process. When you apply for credit at traditional banks and credit unions, the lenders typically use a hard pull to gather credit information as part of the process to determine whether you’re approved or not.

These hard pulls can hurt your credit score. Using soft credit pulls, on the other hand, has absolutely no impact on your credit score at all.

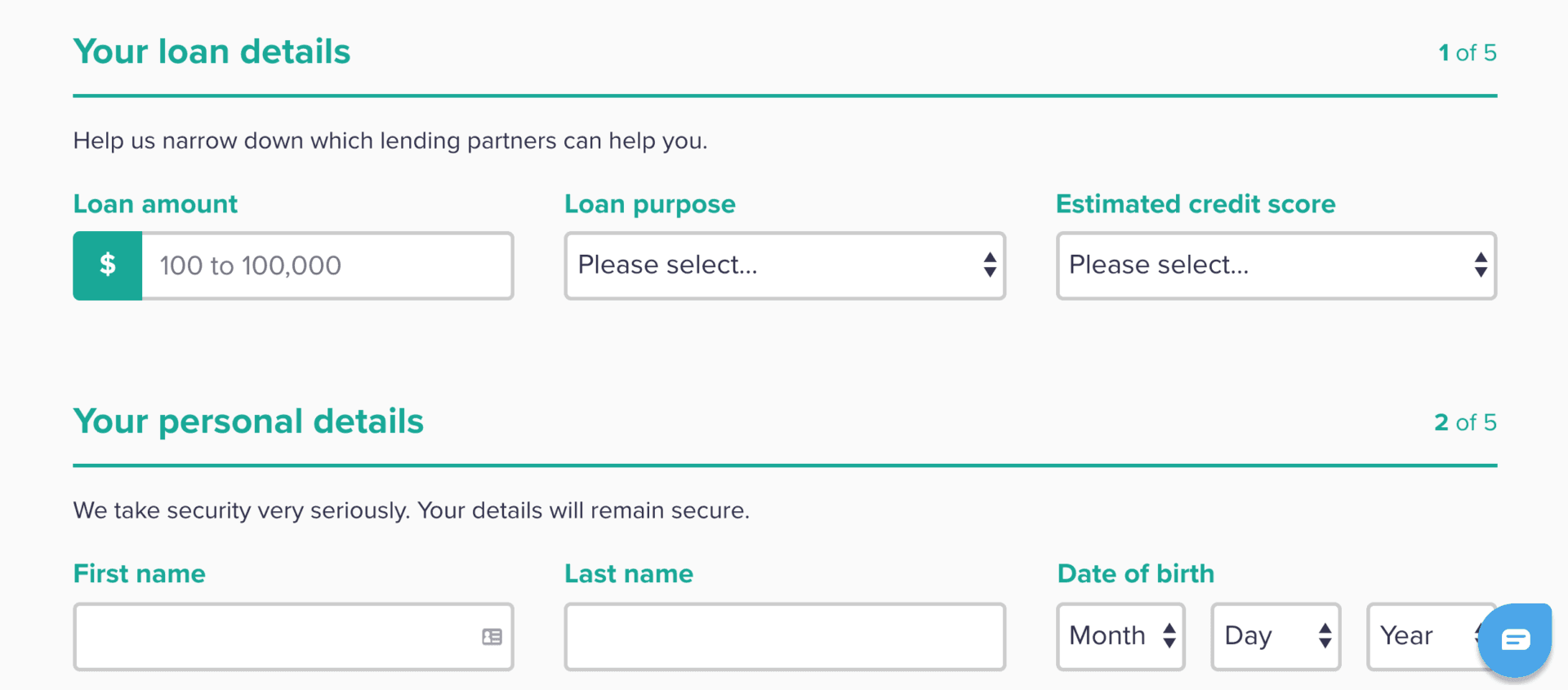

Applying to shop for a Personal Loan with Monevo

Applying to shop for a personal loan with Monevo is a quick and easy process as long as you have the correct information available.

First, enter your desired loan amount, the purpose of your loan and your estimated credit score. Then, you’ll be brought to the application page which asks for the following:

Personal information

- Name

- Date of birth

- Contact information

- Education level

- If you own your car free and clear

Your housing situation

- Address

- Monthly payment

- Time at current address

- Information about previous housing situations if you’ve lived at your current address 2 years or less

Your employment information

- Employer

- Annual pre-tax incomeSocial security number

After you fill out the form, click the get your results button. You should receive offers in just 60 seconds. It’s that easy!

Who can use Monevo?

Monevo is a good option for anyone that wants to make sure they’re getting a great rate and terms on their loan without the headache of filling out multiple loan applications.

If you’re looking to consolidate credit card debt, borrow money for a home improvement or any other reason, Monevo makes it easy to find the best personal loan option for your situation.

Who shouldn’t use Monevo?

Those who want to compare personal loans and other loans

Monevo only offers personal loans, so it isn’t a good fit for someone that wants to compare personal loan options to other lending options all in one place. Sometimes it makes more sense to use a home equity loan or line of credit when consolidating debt or borrowing money for home improvements due to the lower interest rates that typically come with these types of loans.

That said, you can use Monevo to compare personal loan offers then compare other types of loan offers with other providers. Just realize Monevo won’t be a one-stop shop. Once you have offers for both personal loans and the other loans you’re considering, you can decide whether to use the personal loan from Monevo’s partners or the other type of loan from another provider.

Anyone in debt

Finally, a personal loan may not be a good option for you if you’re currently struggling with debt. Until you fix the source of your debt problem, a personal loan may make your financial problem even worse.

Pros and Cons

Pros

- Personalized offers — Allows you to select the best loan offer for your financial profile and needs

- High loan amount — Maximum loan amount of $100,000 is higher than most personal loan lenders

- Access to multiple lenders — More lenders equal more options

Cons

- Loan aggregator — Not a direct lender

Monevo vs. competitors

Monevo isn’t the only website offering personal loans. In fact, they have quite a few competitors that offer similar services. Additionally, any lender that offers personal loans is an indirect competitor in the sense you could get a loan directly from that lender if you don’t feel like rate shopping.

EVEN

EVEN Financial has a similar business model to Monevo – they’ll scour the online marketplace for loan offers that match your needs, and match you with their lending partners.

They have relationships with most of the major lenders, including Prosper and Lending Club, and they have a quick and simple application process. You can get a loan for anywhere between $1,000 and $100,0000. Loan lengths last 24-48 months depending on the lender.

Prosper

Prosper also offers personal loans but doesn’t really compete directly with Monevo. Prosper will only give you one personal loan offer after applying with them while Monevo gives you several.

In fact, Prosper is one of the loan providers Monevo checks when looking for personal loan offers.

SoFi

Finally, SoFi is another lender that offers personal loans but doesn’t necessarily compete with the service Monevo offers directly. While SoFi will give you a personal loan offer, they can only give you their offer. Like with Prosper, SoFi is actually one of the lenders Monevo checks when looking for the best personal loan offers for you.

| Loans Offered | Best For | |

|---|---|---|

| Monevo | Loan aggregator - Personal loans | Personal loans |

| EVEN | Loan aggregator - Personal loans, installment loans | Personalized loan offers |

| Prosper | Personal loans | Subprime loans |

| SoFi | Personal loans, student loans, mortgages | Student loans |

Summary

If you’re considering borrowing money using a personal loan, there’s no downside to giving Monevo a shot. In the worst case scenario, they don’t have a personal loan offer you like and no damage has been done. In the best case scenario, you find a great personal loan offer and potentially save a ton of money over higher priced personal loans you may have taken out elsewhere.