Marcus By Goldman Sachs Review: An All-In-One Tool For Managing Your Finances

Rating as of based on a review of services January 30, 2023.

Ranking

9.8/10

With Marcus by Goldman Sachs, you get a fee-free high-yield savings account. You can also shop for loans or open a CD. By linking up your external accounts, you’ll be able to manage all your finances in one place.

Best for:

- Setting money aside

- Finding personal loans

- Live customer support

All the experts advise saving for a rainy day. I know I sleep better at night when I have a little extra money in the bank.

Marcus by Goldman Sachs provides fee-free savings, CDs, and loan options to help you work toward a solid financial future. Your money will earn interest, whether you choose a savings account or a CD, and you’ll pay no fees for your account. If you ever need a loan, Marcus can help you out there, too. You can choose from a variety of loan options that offer competitive interest and terms.

Let’s take a look at all that Marcus has to offer!

What is Marcus by Goldman Sachs?

Goldman Sachs is a well-known name in the world of finance. It began in 1869 in Manhattan as a small business buying and selling promissory notes. By 1890, the company that had been founded by Bavarian-born immigrant, Marcus Goldman was processing more than $30 million each year.

Marcus by Goldman Sachs launched in 2016 after Goldman Sachs conducted extensive market research and solicited direct feedback from customers. That feedback helped Goldman Sachs create an app that was the antidote to these three most-mentioned frustrations: “confusing jargon, inflexible products, and hidden fees.”

Today, Marcus by Goldman Sachs operates solely online. Since opening, the lender has grown to an impressive force in online finance, with $50 billion in deposits, $5 billion in consumer loan balances, and four million customers located in the U.S. and the U.K.

How does Marcus by Goldman Sachs work?

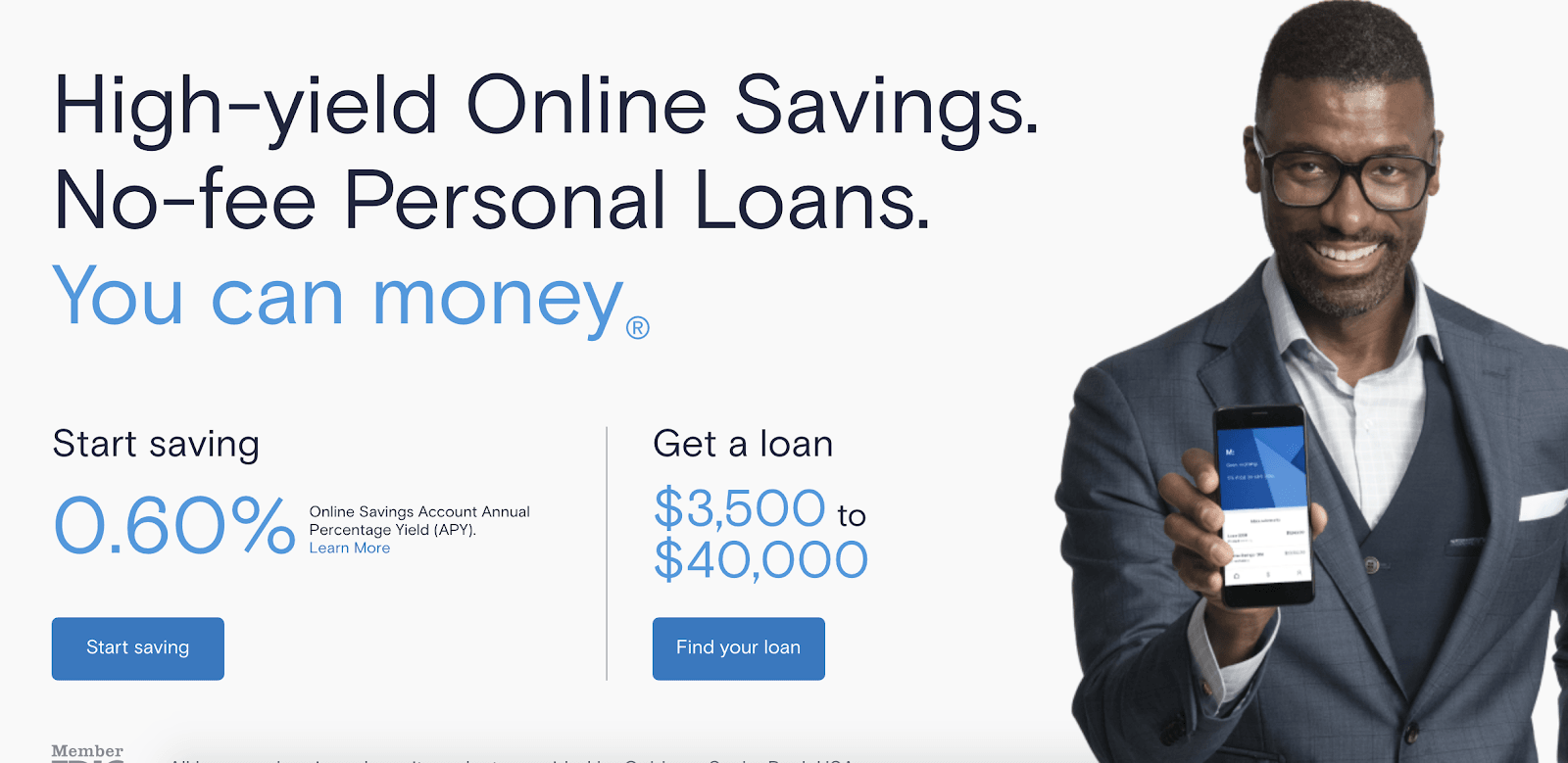

You have two options when signing up for a Marcus by Goldman Sachs account. You can either sign up for an online savings account or get a loan ranging from $3,500 to $40,000. The homepage provides the current percentage yield for savings to help you decide right away if it’s a better deal than you’re getting.

In my case, it definitely was.

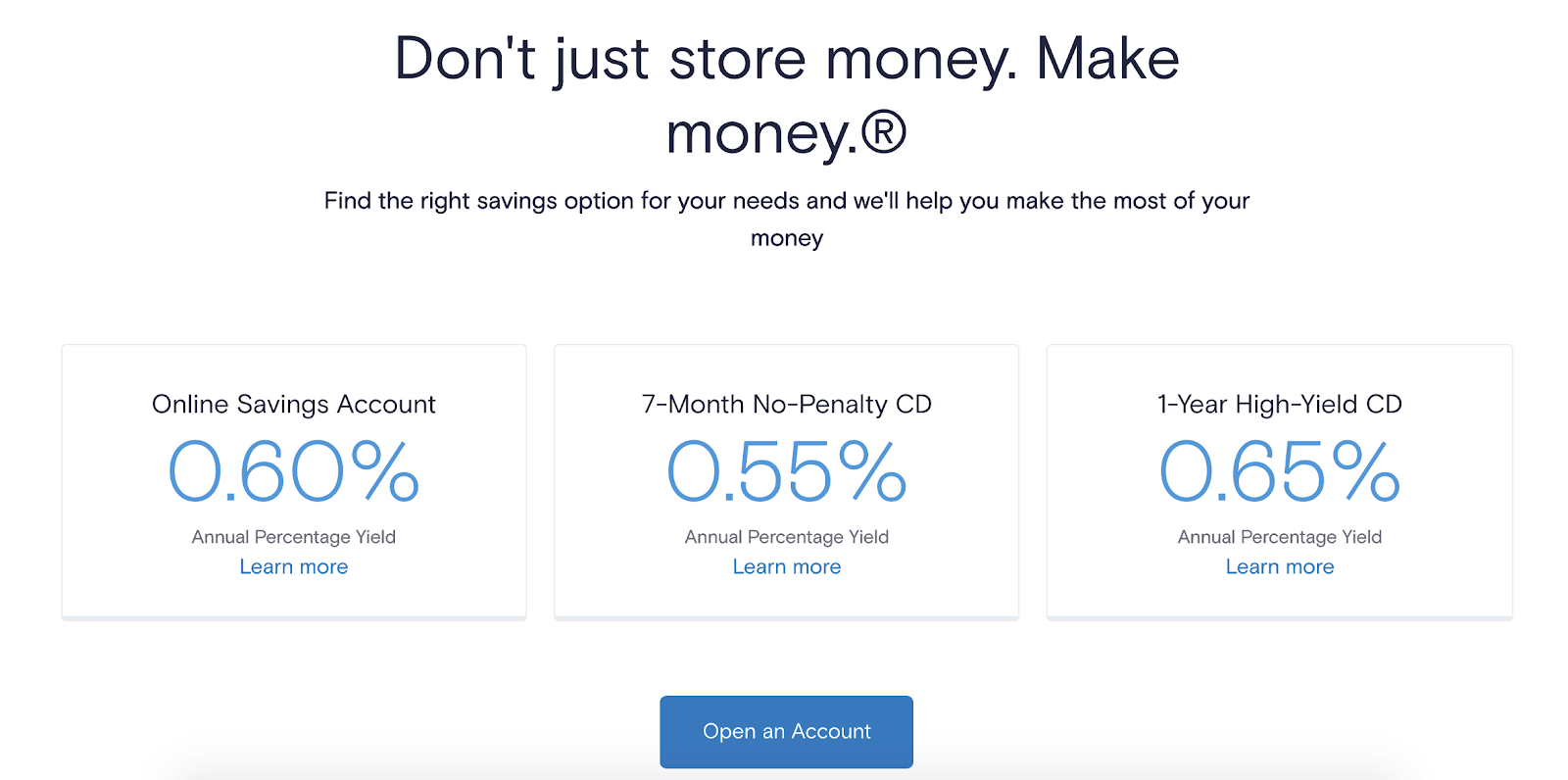

You’ll get two choices under the savings option: a savings account or a CD. You can currently get a better deal on a savings account than a seven-month CD, but there’s no penalty for withdrawing your money with a seven-month CD, so check the rate before choosing.

Signing up for a savings account

I chose the savings account option for now.

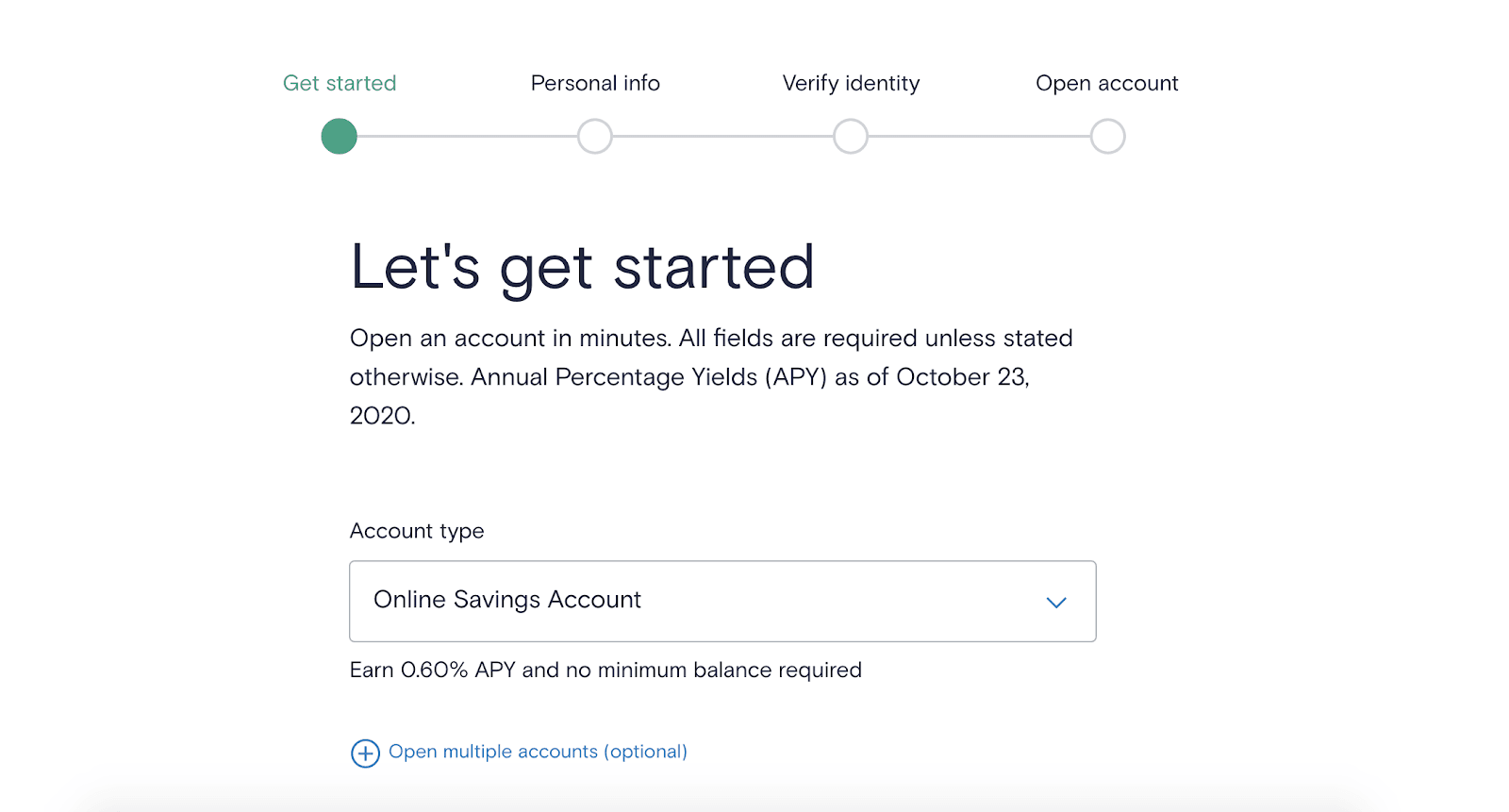

Once you’ve clicked “Open an Account”, you’ll be prompted to choose the type of account you want. As you toggle between the choices, you’ll see the current interest rate for each in the text beneath the drop-down box.

If you’d like to split your money into multiple savings accounts, multiple CDs, or a combination of savings accounts and CDs, you can do it all on one screen. This is the easiest process I’ve seen for doing that.

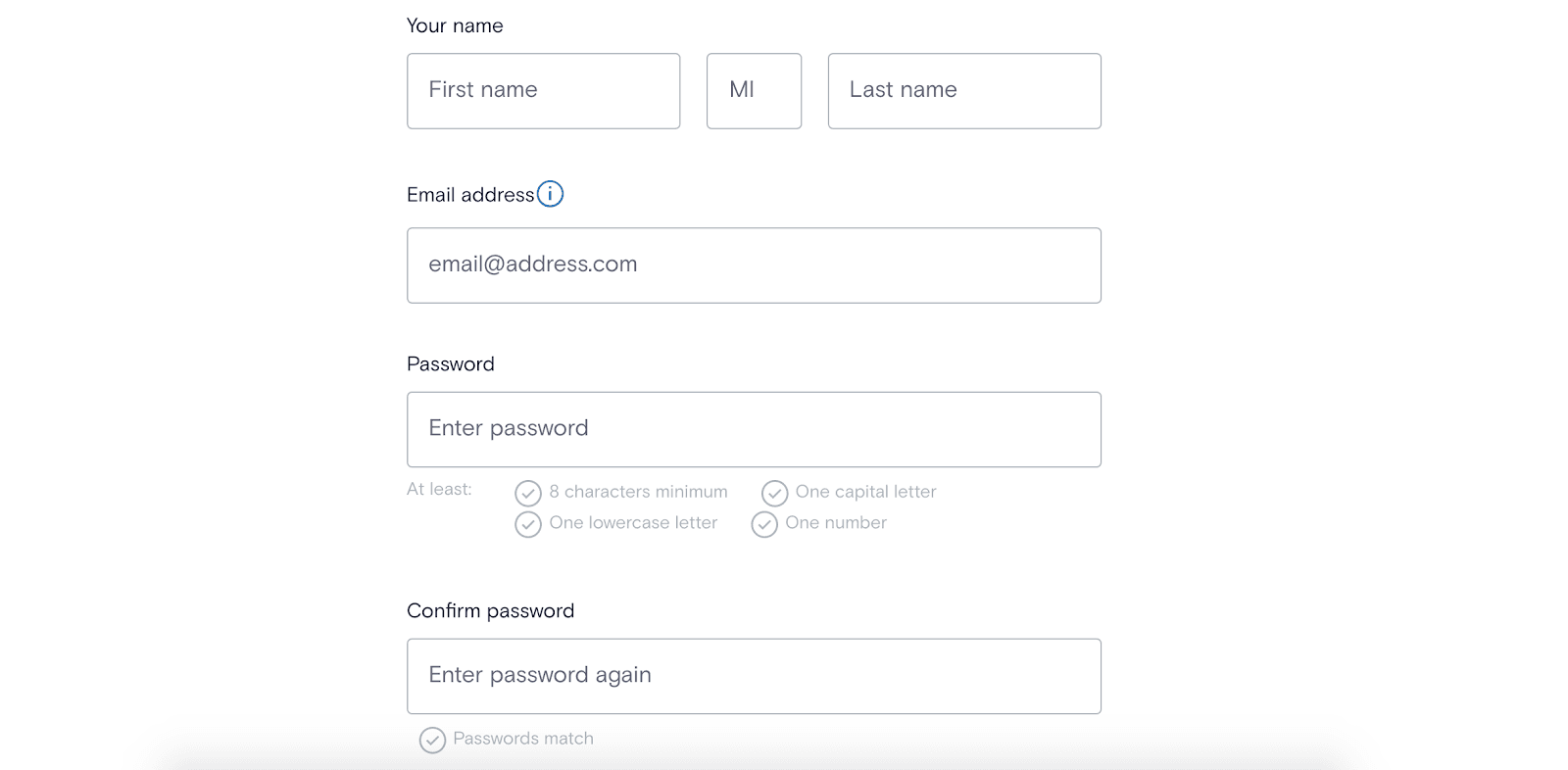

From there, you’ll input your name and email address, as well as choosing a password.

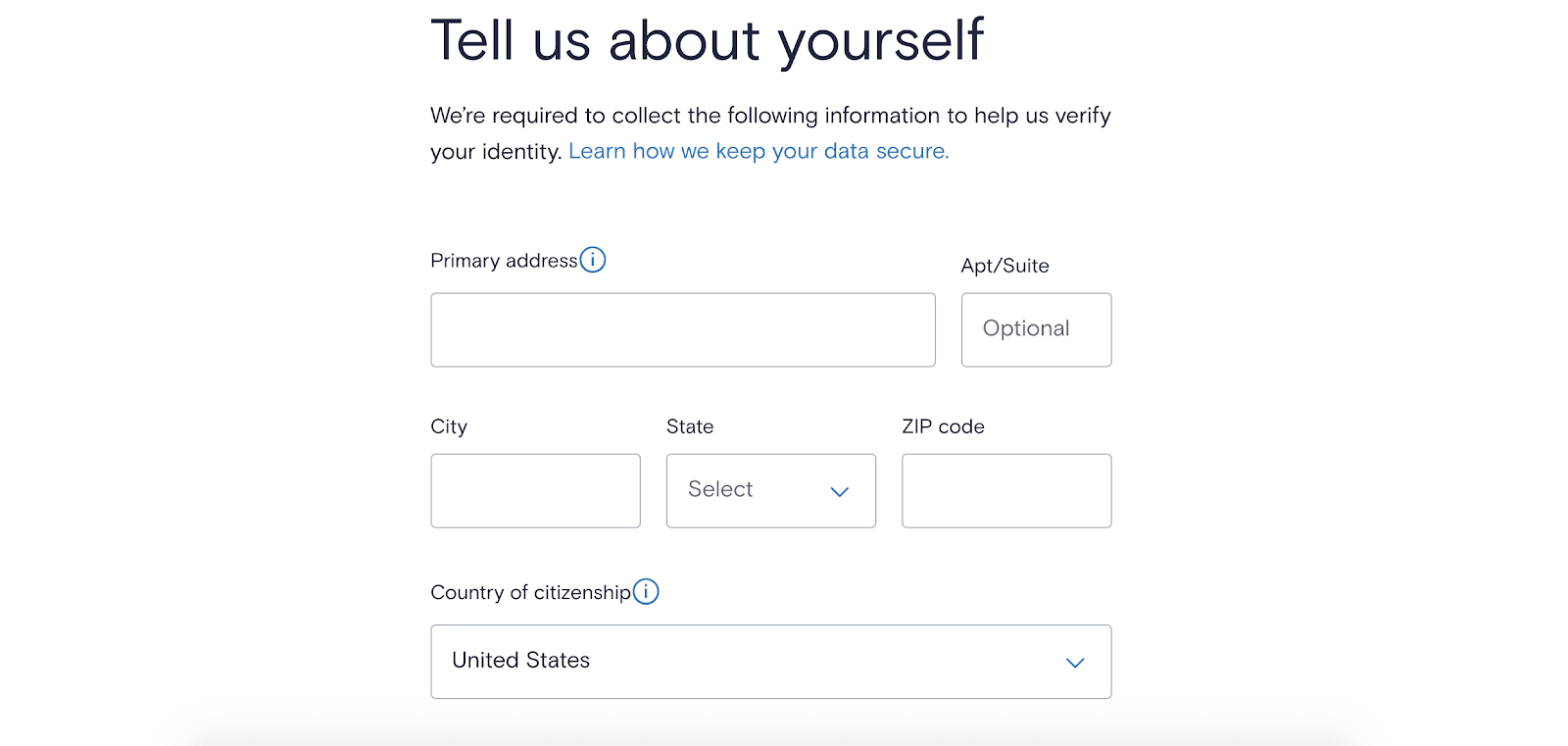

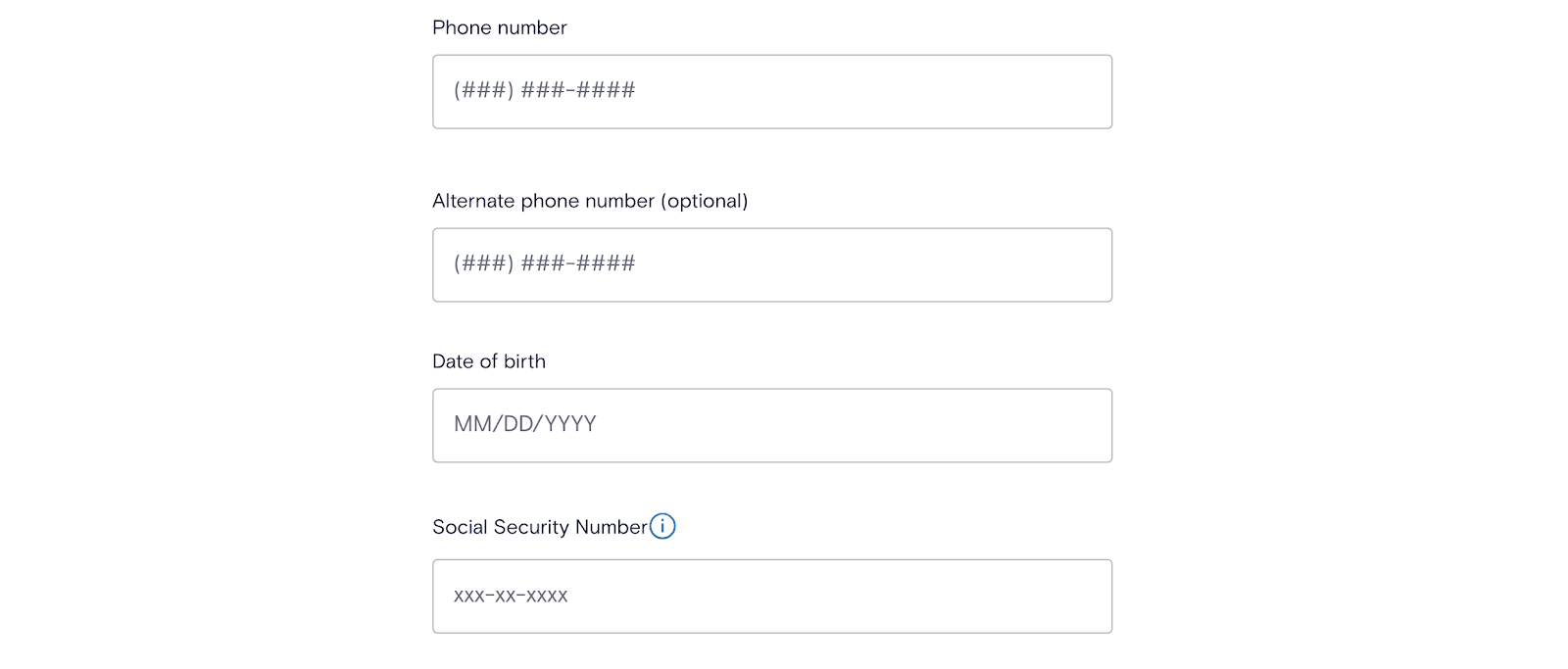

With any bank account signup, you’ll be asked for information on your birthdate, address, phone number, and Social Security number. This information is used to verify your identity. Marcus by Goldman Sachs includes its data security policy on this page so you can quickly review it before proceeding.

On the same screen, you’ll input your phone number, date of birth, and Social Security number.

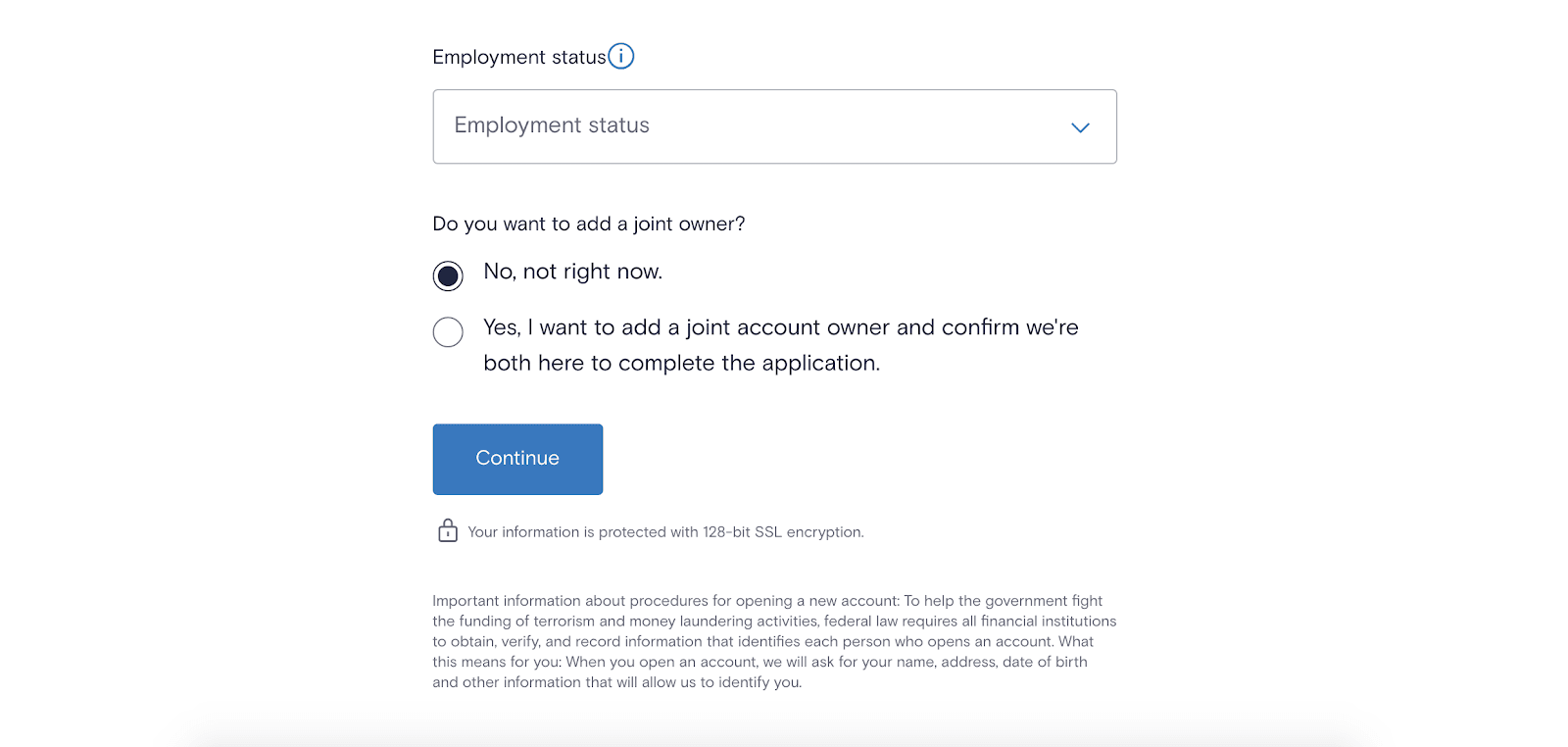

Lastly, you’ll need to specify your employment status. You can choose from the following options:

- Full-time employed.

- Part-time employed.

- Self-employed.

- Unemployed.

- Retired.

With each option, you’ll get questions about your occupation and income range.

You can also add a joint owner here, and if you choose “Yes,” you can submit both the joint owner and your info with the same application.

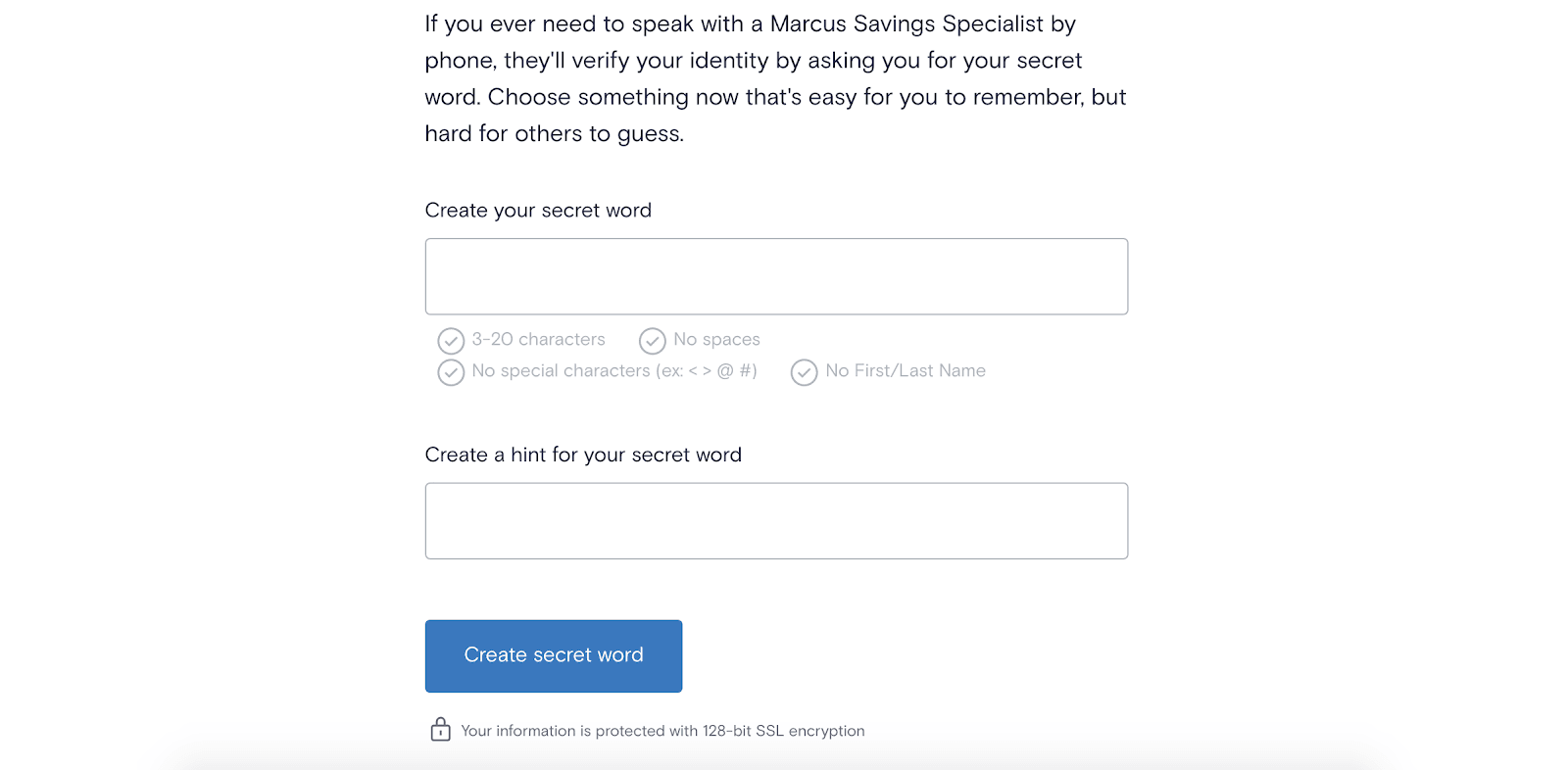

Marcus by Goldman Sachs has a handy feature called “Secret Word.” You’ll provide a word that you can use if you’re ever speaking with a representative about your account. You’ll also create a hint for yourself in case you forget that word.

Once you’ve finalized the signup process, Marcus will verify your information and issue an approval.

Signing up for a personal loan

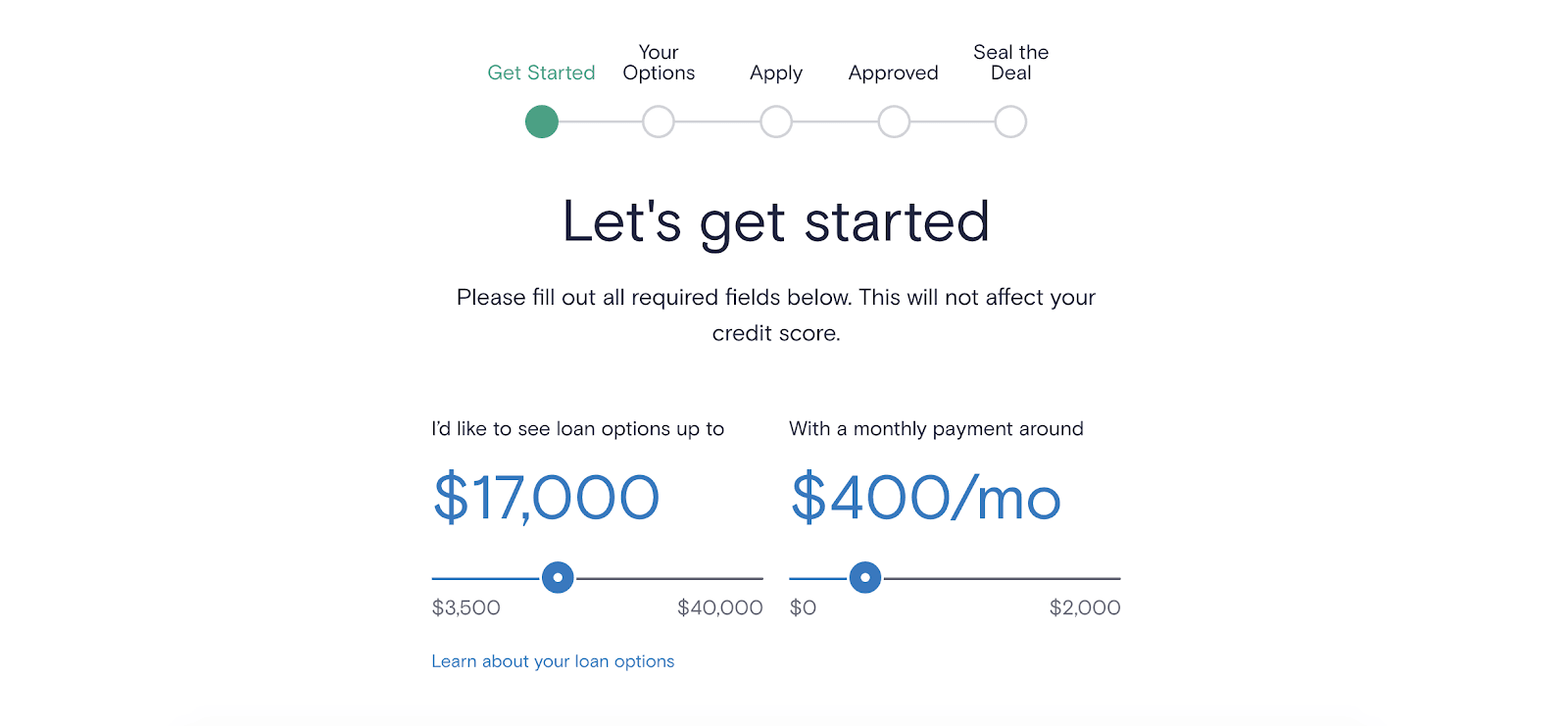

If you need a loan, the process is just as easy as signing up for a savings account. You’ll choose “Find Your Loan” from the main page, then “Review Your Options.”

You’ll start by detailing the loan options you’re interested in seeing. You can see options up to a maximum amount and specify the monthly payment you’d like. Where you set the slider will affect the loans you’re offered, but your loan purpose and creditworthiness will also come into play.

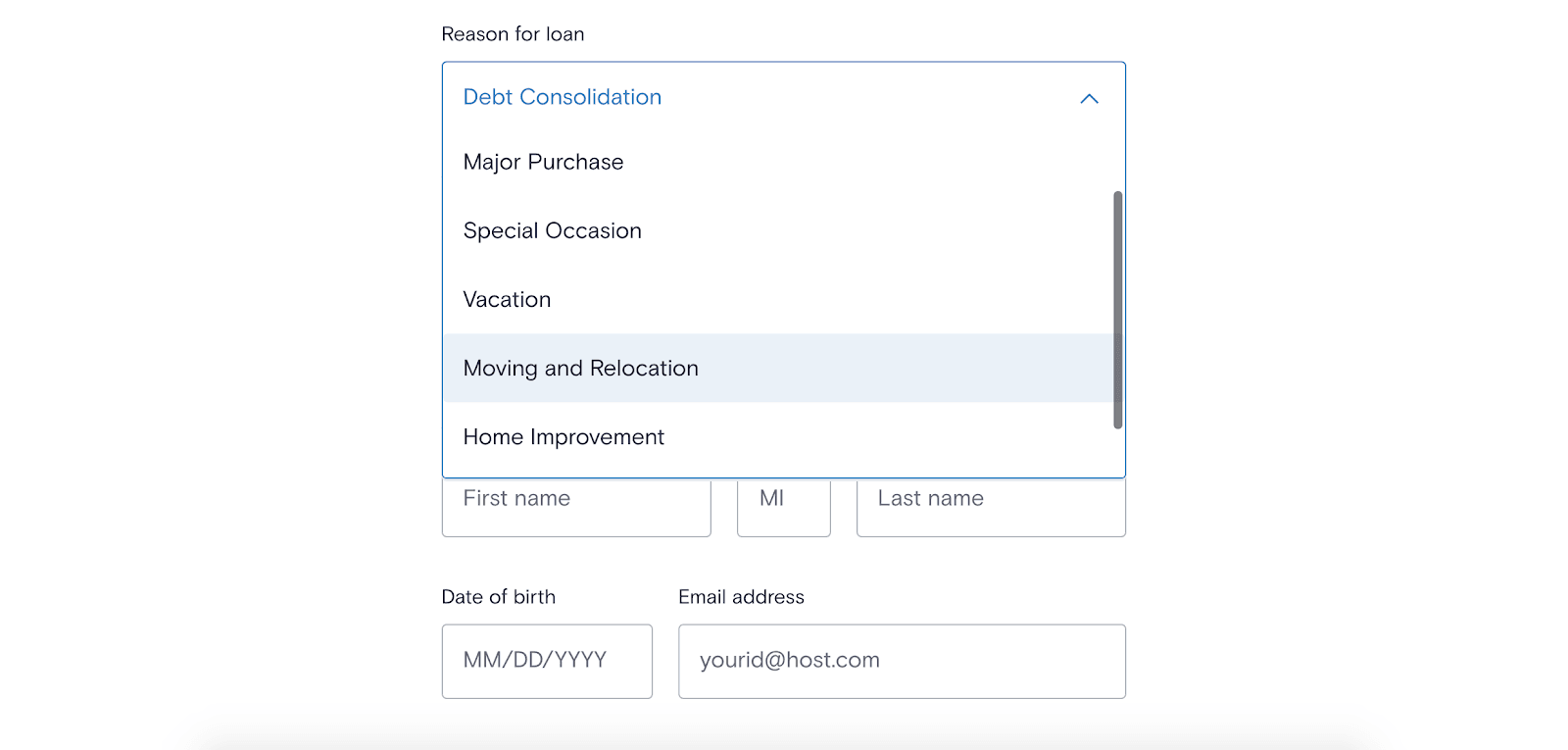

Next, you’ll specify your reason for the loan. You can choose:

- Debt consolidation.

- Major purchases.

- Special occasion.

- Vacation.

- Moving and relocation.

- Home improvement.

- Other.

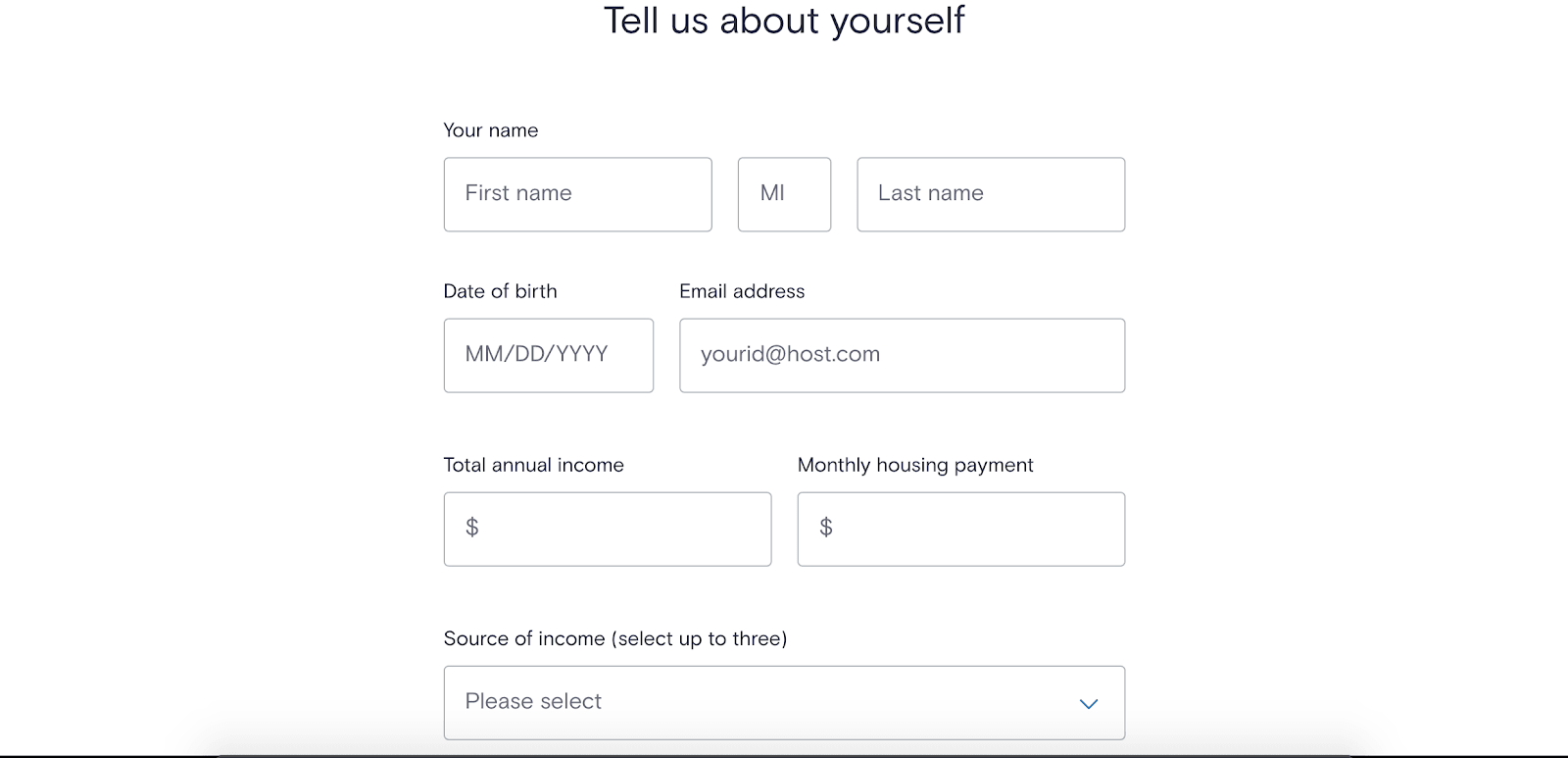

Input some information about yourself to get your loan application started.

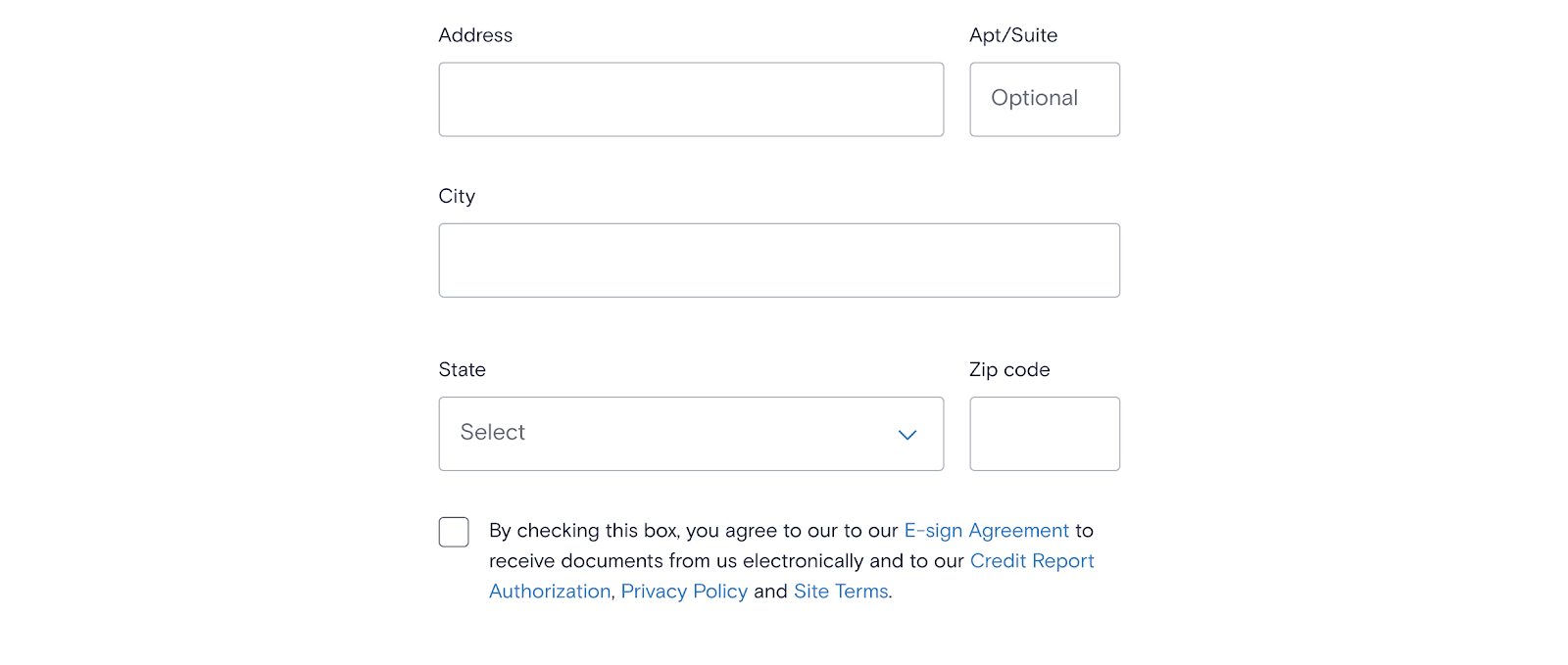

After you input your address, you’ll need to check the box to state that you agree to receive documents electronically. You’re also consenting to allow Marcus to pull a credit report on you to determine your creditworthiness.

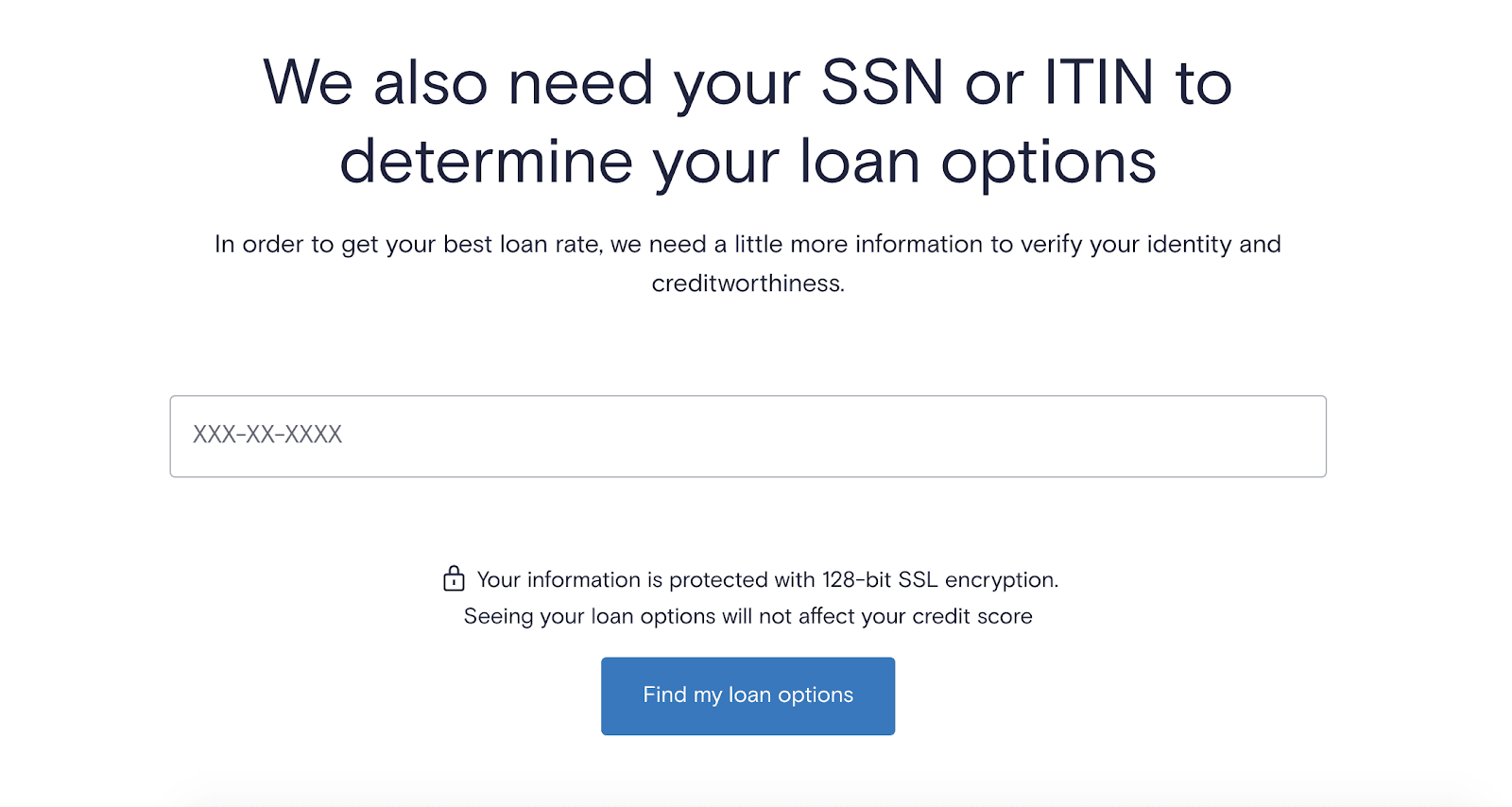

Marcus by Goldman Sachs needs your Social Security number to pull your credit report and determine the loan amount and interest rate available to you.

One of the best things about Marcus by Goldman Sachs is how quickly you can receive the funds; many Marcus customers receive funds in as little as 3 days.

Pricing for Marcus by Goldman Sachs

In addition to earning interest on your money, you’ll also save on fees. Marcus by Goldman Sachs has no monthly service charges and you’ll pay no fees for transferring funds in and out of your account. Currently, there’s no limit to the number of transfers you can make. There is a limit of $125,000 per transfer on online transfers, but you can call 1-855-730-SAVE if you need to move a larger amount.

If you opt for a CD, there are no fees for that, either. You will be subject to penalties unless you choose a no-penalty CD, though. For CDs with terms of less than 12 months, your penalty will be 90 days simple interest on the rate, increasing to 270 days if the CD has terms between 12 months and five years. If your CD has a term of more than five years, your penalty will be 365 days simple interest. Choosing a no-penalty CD can help you avoid those fees while still enjoying the extra interest you’ll get from a CD.

No fees and on-time payment reward

You’ll also pay no fees on loans you take out through Marcus by Goldman Sachs. Even better–pay your bill on time each month and you’ll get an on-time payment reward. Borrowers who pay their loans on time for 12 consecutive months get to skip one month’s payment with no interest accruing during that month; your loan will simply be extended for one month.

Marcus by Goldman Sachs features

If you’re researching savings and loan options, you probably already know there are many options. Here are some reasons I think Marcus by Goldman Sachs stands out.

Quick, easy access to personal loans

Marcus currently offers multiple types of loans of between $3,500 and $40,000, each with competitive rates and no fees. You’ll be given your options in just a few minutes so you’ll know right away if you want to proceed. Plus Marcus offers a fixed APR for the life of your personal loan. With this fixed rate, you know exactly how much you need to pay each and every month. Rates range from 6.99% - 24.99% APR.

Once you’ve finalized the application and it’s approved, your loan is available with terms and interest rates based on the loan purpose, in addition to other factors, but with a fixed term that will give you a set schedule for paying it back.

Here are some of the five types of personal loan Marcus offers.

- Debt consolidation. There are some good reasons for consolidating multiple debts into one loan. You’ll have one easy payment each month rather than trying to keep up with multiple bills. But many also find that they can move debts over into a lower interest rate with consolidation, saving significant money over the course of repayment. Marcus’s competitive rates on no-fee loans make them well worth considering for your debt consolidation. With Marcus, qualified applicants can borrow between $3,500 to $40,000 to pay off their debt.

- Home improvement. Improvements to your home can boost its value, as well as make it more enjoyable for you, your family, and guests. Marcus offers home improvement loans that can be used on everything from kitchen remodels to decks and patios. Terms range from three to six years for a loan ranging from $3,500 to $40,000 with a fixed interest rate, so you’ll have plenty of time to repay the funds while you’re enjoying your improvements.

- Wedding loan. If you are getting married, you are eligible for an unsecured personal loan from $3,500 to $20,000 with terms ranging from three to six years that you can use to pay for your wedding expenses including the caterer, honeymoon, clothing, flowers, your wedding photographer, and much more. This can save you a significant amount of money versus what you might otherwise save by paying a higher interest with your credit card.

- Moving and relocation loan. If you are moving, a relocation loan will help you cover the cost of moving regardless of the distance. The loan will cover the moving truck or company, packing material, paying for a storage unit, and even gas for the moving truck, plus much more. Loan amounts are available between $3,500 to $20,000 with terms from three to six years.

- Vacation loan. If you’re taking a vacation, you are eligible for an unsecured personal loan for anything related to the cost of your vacation, including air travel, land travel, hotels and bed and breakfasts, travel insurance, and much more. You will receive your loan within five days and the loan will be a fixed rate and a fixed term so you’ll pay the same amount every month without extra fees or changing interest rates. Vacation loans are available from $3,500 to $20,000 with terms from three to six years.

No fees

You won’t pay any service fees for using Marcus by Goldman Sachs, whether you’re opening a savings account, putting your money in a CD, or taking out a loan. There are also no sign-up fees and no prepayment fees.

CDs do have a minimum deposit requirement of $500, but this is lower than you’ll find with many other lenders. There’s no minimum balance requirement to open a savings account.

Recurring transfers

Building savings takes time and persistence. Marcus by Goldman Sachs helps with that by letting you set up recurring transfers. You can automatically schedule transfers from or to your linked accounts, choosing the frequency and amount. You can easily change the timing or amount at any time in the app.

Term lengths on CDs

You’ll be hard-pressed to find a lender that offers as many CD options as Marcus by Goldman Sachs. All CD options require a deposit of at least $500. Here are the two options:

- No-penalty CDs. If you want to earn interest without having to commit to leaving your money alone, this is the option for you. You can withdraw your funds at any time after the first seven days without penalty. These CDs are available in 7-, 11-, and 13-month terms. You can’t deposit additional funds to a no-penalty CD after the additional funding.

- High-yield CDs. Although you’ll need to leave your money in place for the full term, a high-yield CD can earn you higher interest. You’ll also find you get to choose from far more term options. You can add funds to your high-yield CD during the first 30 days. As your maturity date approaches, there’s an online maturity center for managing what happens next with your funds. Here are the terms available with a Marcus by Goldman Sachs high-yield CD:

- 6 months.

- 9 months.

- 12 months.

- 2 years.

- 3 years.

- 4 years.

- 5 years.

- 6 years.

Convenient mobile app

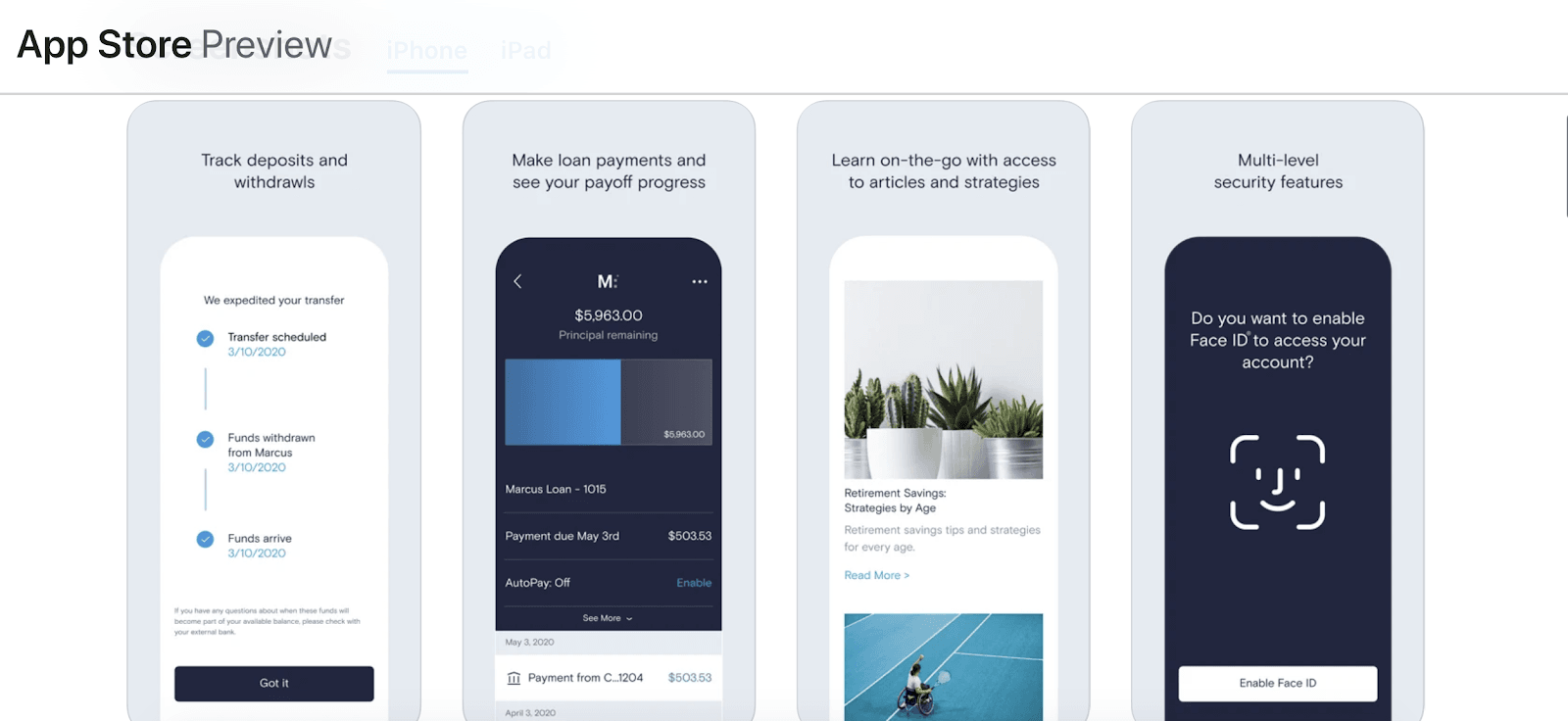

Marcus by Goldman Sachs certainly isn’t the only online lender with a mobile app. But what I like about their app is the extra tools built-in. You can easily move money in and out, check your balance, and pay on your loan through the app.

AutoPay

You can manage your loans through the app by making payments and viewing your current balance. AutoPay is an automatic payment tool that withdraws a regularly scheduled payment from your checking account so you don’t have to worry about forgetting. Plus, Marcus gives you a 0.25% APR reduction so that a larger portion of your monthly payments is applied to your principal loan amount.

Marcus Insights

One of the things I like best about Marcus is that I can pull in my external accounts, managing everything in one place. You’ll go through a brief authentication process with each account, but from that point on, you’ll be able to use Marcus Insights. And it’s 100% free to use.

This included tool helps you pull reports on your finances, providing information like spending by category, your monthly cash flow, your monthly contributions to savings and investment accounts, and your historical spending patterns. This can all work together to help you make better financial decisions moving forward.

MarcusPay

This feature gives you an easy way to finance big purchases. Look for the MarcusPay option at checkout while you’re shopping and choose it to pay large purchases in installments with no fees, no deposit, competitive interest rates, plus transparent monthly payments as a result of having a fixed-rate installment loan. You’ll fill out a quick application and choose between 12- or 18-month terms. The option is available on purchases between $750 and $10,000.

Same-day transfers

In addition to rapid loan turnaround, Marcus by Goldman Sachs also helps you move money quickly. As long as the amount is below $100,000, Marcus can have the funds in your other accounts the same day. You’ll need to request the transfer before noon ET on a business day to have it transferred by 5 p.m. that same day.

Daily phone support

If you need help with your account, you can easily get it. Marcus by Goldman Sachs’ U.S.-based customer support line is open seven days a week. Mondays through Fridays you can call between 8 a.m. and 10 p.m. E.T. and on weekends, support is available from 9 a.m. to 7 p.m. E.T.

My experience researching Marcus by Goldman Sachs

If you want a risk-free way to earn interest on your income, Marcus by Goldman Sachs is well worth considering. I spent some time looking around at the various features including their website which is well organized and easy to navigate. What really struck me was the mobile app, which took me over to the iTunes Store. (There’s also a version for Android).

I love the visual representations, including the graph that shows how your savings has grown over time. If you link to external accounts, you can get a full overview of your finances in one place. The app also shows where your money is going each month.

The app lets you set up Face ID to keep your funds secure while also making it convenient for you to access your account as often as you want.

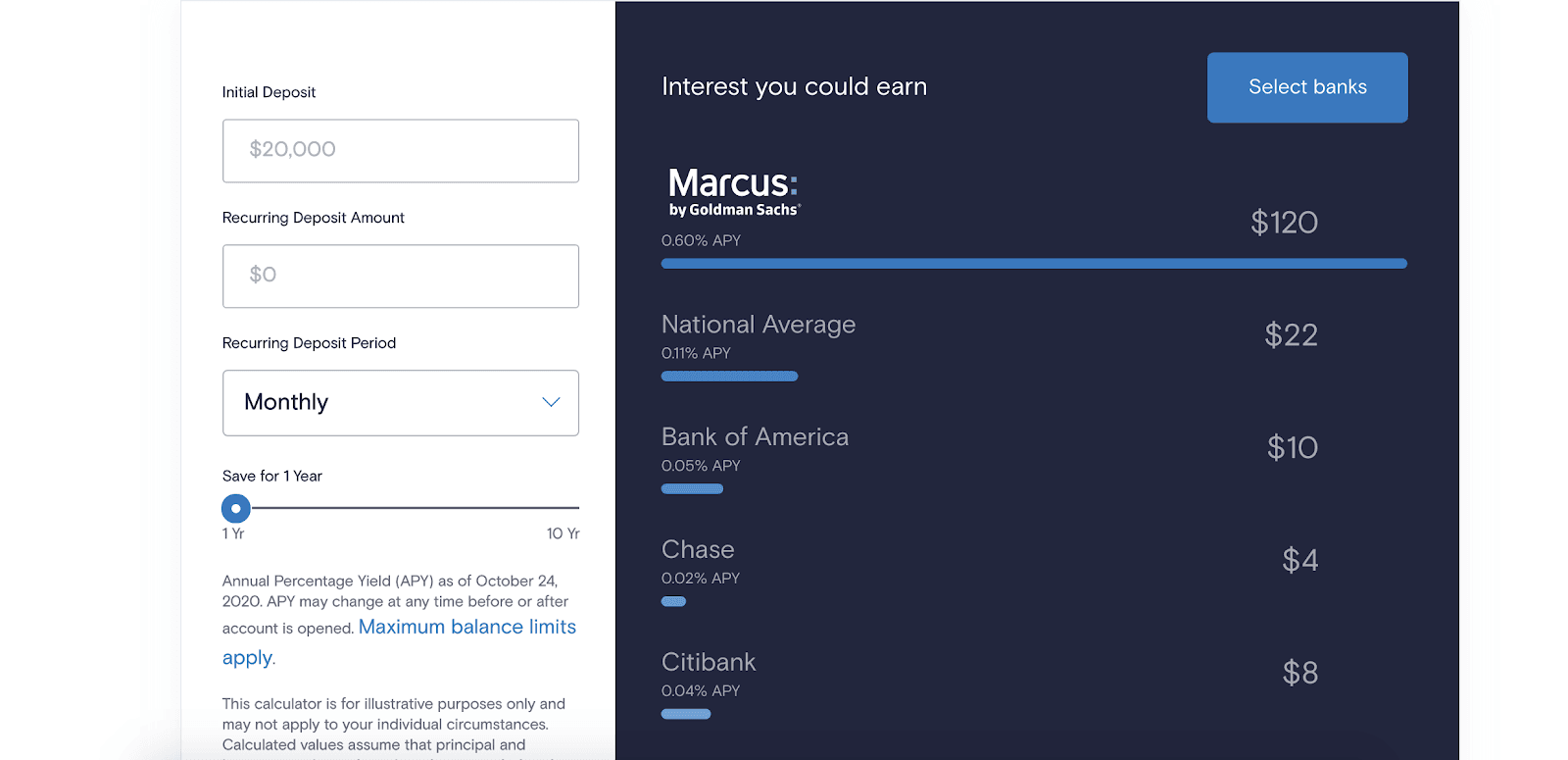

But there are plenty of handy features on the website, too. I liked the interest calculator that lets you easily compare the interest you’ll earn with a Marcus by Goldman Sachs savings account versus corporate lenders. You can see by crunching a few numbers just how much you’ll make on your money over time.

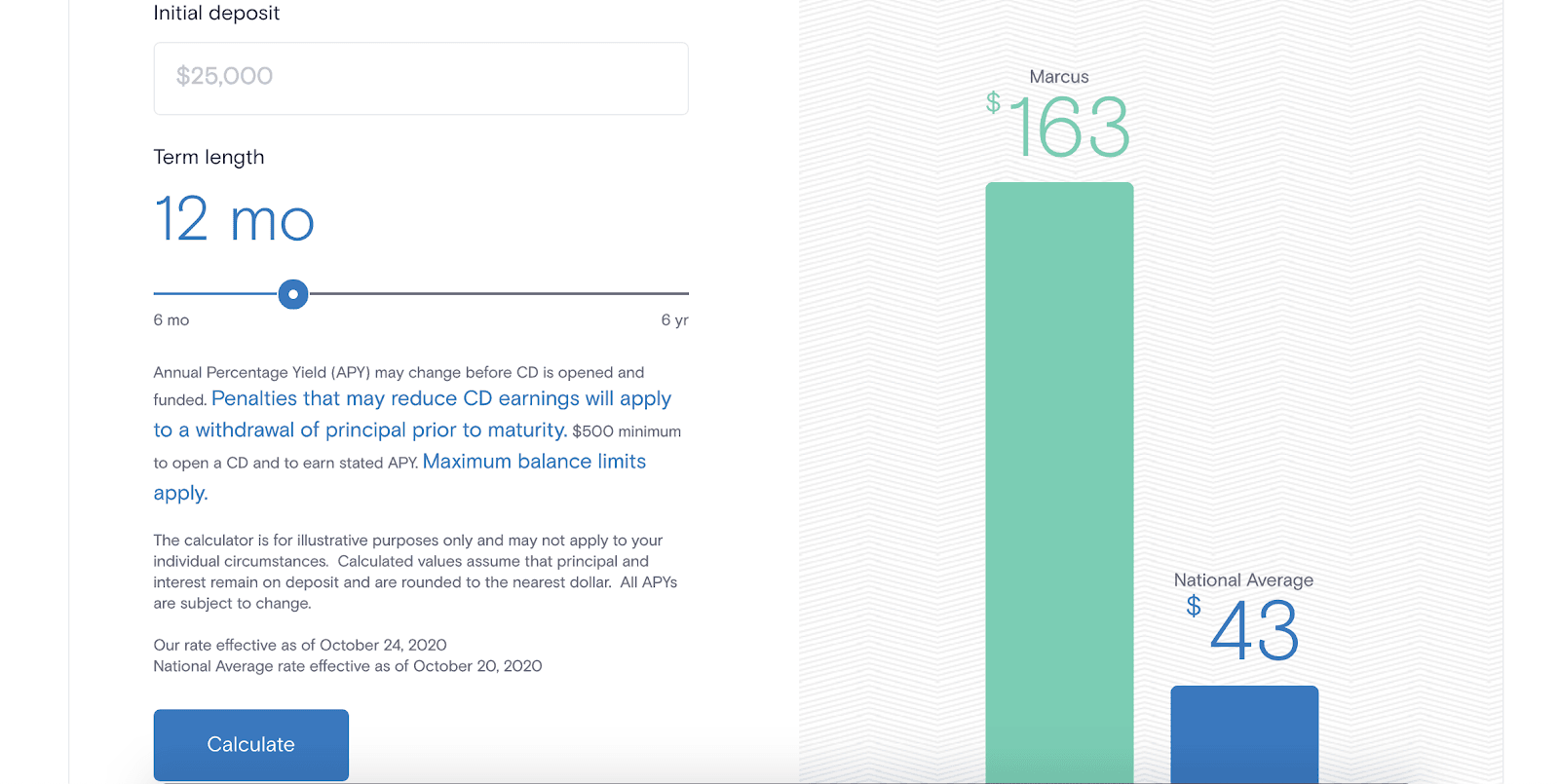

If you’re considering putting money into a CD, Marcus by Goldman Sachs has a calculator for that, too. Just enter the initial deposit, choose your term length, and tap the “Calculate” button to see how much you’ll earn on your investment. You’ll also see the national average to show how your earnings compare.

Once you’ve applied and been approved, you’ll have access to money management tools that you don’t get with other lenders. By being able to monitor your money, you’ll gain the expertise necessary to achieve your financial goals.

Who is Marcus by Goldman Sachs best for?

Loan seekers

As long as you have the credit, Marcus by Goldman Sachs can help you with a loan. You don’t have to limit your loans to just paying off debt. You can take out a loan for your upcoming wedding, major purchases, to make improvements to your house, go on vacation, and move. There are no fees, and you’ll be able to see your loan options before you finalize the application.

Those saving for the future

Savings accounts are great for having money set aside for the future. The options at Marcus by Goldman Sachs mean you can put your money into savings or a CD. If you think you might need to withdraw some or all of your funds in a few months, a savings account may be a better option.

But you can also put your money into a no-penalty CD and still have access to it. Compare the current interest rates being offered for each and be honest with yourself about how accessible you’ll need your funds to be.

Those with existing accounts

Marcus by Goldman Sachs provides only savings, CDs, and loans, but they make it incredibly easy to connect to other accounts. Once your account is set up, you can connect to any other accounts you have at other lenders.

I’ve found once you’ve done that, you should be able to pair your checking and investment accounts with Marcus and easily transfer funds around. Even if you regularly receive paper checks, you can deposit them into your checking account and move the funds over to Marcus in a few screen taps.

Those who like the personal touch

If you like to be able to talk to a representative about your account, Marcus has you covered. You can pick up the phone and speak to a U.S.-based representative seven days a week. Other online lenders have you talking to chatbots or placing a ticket and waiting for someone to get in touch with you.

Who shouldn’t use Marcus by Goldman Sachs?

Those looking for all-in-one banking

If you like to keep all your funds in one place, Marcus by Goldman Sachs may not be the best choice for you. You’ll find it’s easy to transfer funds between Marcus and external accounts, but you won’t have a checking account option with Marcus. Plus there is no mobile check deposit, ATM network, or debit card for Marcus savings accounts.

Extra-high interest seekers

Although Marcus by Goldman Sachs offers APYs on savings that are well above the national average, there’s a lot of competition these days. But before picking a higher interest rate, make sure you’re comparing everything being offered so you’re comparing apples to apples and not apples to oranges.

Pros & cons

Pros

- Fixed APR — You'll get a fixed APR rate for the life of your personal loan so you know exactly how much you owe each month.

- Fee-free structure — There are no fees with Marcus by Goldman, whether you’re taking out a loan, investing in a CD, or storing your funds in a savings account.

- Quick access to funds — From same-day savings transfers to rapid turnaround on loans, Marcus by Goldman Sachs excels at keeping things moving.

- On-time payment reward — If you pay your loan on time and in full every month for twelve consecutive months, you can defer one payment without interest accruing during this time. Your loan is simply extended for one month.

- Easy funds management — Being able to integrate with your other accounts is a huge benefit, making it easy to maintain an overview of your finances.

Cons

- No ATM card or debit card — There is no free ATM network or debit card for Marcus savings accounts.

- No checking and mobile check deposit — Marcus by Goldman Sachs offers savings, CDs, and loans only, but they make it easy to link up to external checking accounts. And if you have a paper check, you’ll have to transfer it from another account or mail it to the Illinois offices for deposit.

- APY rates — The savings interest rate Marcus by Goldman Sachs offers is definitely solid, but there are more competitive options available.

Marcus by Goldman Sachs vs. the competitors

Marcus by Goldman Sachs Fiona Credible

Fees $0 Savings varies by lender; no application fees; some lenders may charge 1%-6% origination fee for loans Fees vary by lender; no application fees

Account/ loan options Savings, CDs, personal loans Personal loans, life insurance, credit cards, student loan refinancing, and savings Student loans, student loan refinancing, personal loans, mortgage, mortgage refinancing, and credit cards

Application process Easy application process for all account types; access to funds within five days of loan approval Easy application process for all account types; quotes in minutes; turnaround on loan funds depends on chosen lender Easy application process for all account types; quotes in minutes; turnaround on loan funds depends on chosen lender

Whether you’re looking for savings, loans, or other banking options, it’s important to shop around. Here are some other online lenders to consider.

Fiona

If you need student loan refinancing, Fiona has many of the same benefits as Marcus by Goldman Sachs. In just 60 seconds, you can get quotes from multiple lenders for personal and student loan refinancing. One of the best things about Fiona is that getting a quote is easy as pie. You simply input a few details and wait for your quotes. The full application happens only if you choose one of the quotes.

If you need student loan refinancing, Fiona has many of the same benefits as Marcus by Goldman Sachs. In just 60 seconds, you can get quotes from multiple lenders for personal and student loan refinancing. One of the best things about Fiona is that getting a quote is easy as pie. You simply input a few details and wait for your quotes. The full application happens only if you choose one of the quotes.

Like Marcus by Goldman Sachs, Fiona offers other financial products. You can find great deals on life insurance, credit cards, and savings. In each case, you’ll be inputting information and getting quotes from multiple providers. It’s a great way to shop around, but you won’t actually be working with Fiona after you’ve accepted one of the quotes.

Credible

Another service that shops multiple lenders, Credible, goes beyond student loan refinancing to also help you track down great deals on private student loans, too. Additionally, you can get quotes on personal loans, mortgages, mortgage refinancing, and credit cards. Like Marcus by Goldman Sachs and Fiona, Credible doesn’t charge a fee to get a no-obligation quote, and you’ll have quotes in a matter of minutes.

Another service that shops multiple lenders, Credible, goes beyond student loan refinancing to also help you track down great deals on private student loans, too. Additionally, you can get quotes on personal loans, mortgages, mortgage refinancing, and credit cards. Like Marcus by Goldman Sachs and Fiona, Credible doesn’t charge a fee to get a no-obligation quote, and you’ll have quotes in a matter of minutes.

One feature that puts Credible ahead of Fiona is that you can get personalized help if you need it. When you’re applying for a loan, you might have some questions, and you can get assistance by email, phone, or webchat. Credible charges no fees on its end, but you may pay fees to the lender you choose. Look at the terms carefully before finalizing the application.

Credible Operations, Inc. NMLS# 1681276, “Credible.” Not available in all states. www.nmlsconsumeraccess.org.” Credible Credit Disclosure - To check the rates and terms you qualify for, Credible or our partner lender(s) conduct a soft credit pull that will not affect your credit score. However, when you apply for credit, your full credit report from one or more consumer reporting agencies will be requested, which is considered a hard credit pull and will affect your credit.Summary

Although you can certainly find fee-free interest-earning savings options out there, few offer the many perks you get with Marcus by Goldman Sachs. You can choose to move your money into CDs and apply for loans using the same app you use for your savings account. Add your external financial accounts and use the free tools to manage all your finances in one place.

Marcus By Goldman Sachs® Offer Terms and Conditions - Your loan terms are not guaranteed and are subject to our verification of your identity and credit information. Rates range from 6.99% to 24.99% APR, and loan terms range from 36 to 72 months. For NY residents, rates range from 6.99%-24.74%. Only the most creditworthy applicants qualify for the lowest rates and longest loan terms. Rates will generally be higher for longer-term loans. To obtain a loan, you must submit additional documentation including an application that may affect your credit score. The availability of a loan offer and the terms of your actual offer will vary due to a number of factors, including your loan purpose and our evaluation of your creditworthiness. Rates will vary based on many factors, such as your creditworthiness (for example, credit score and credit history) and the length of your loan (for example, rates for 36 month loans are generally lower than rates for 72 month loans). Your maximum loan amount may vary depending on your loan purpose, income and creditworthiness. Your verifiable income must support your ability to repay your loan. Marcus by Goldman Sachs is a brand of Goldman Sachs Bank USA and all loans are issued by Goldman Sachs Bank USA, Salt Lake City Branch. Applications are subject to additional terms and conditions. Receive a 0.25% APR reduction when you enroll in AutoPay. This reduction will not be applied if AutoPay is not in effect. When enrolled, a larger portion of your monthly payment will be applied to your principal loan amount and less interest will accrue on your loan, which may result in a smaller final payment. See loan agreement for details.Read more:

Rating Methodology

Money Under 30’s ratings for banks, brokers, robo-advisors and credit cards are weighted averages of the five or more categories we consider, depending on the product, which include fees, transparency, ease of use, variety of available options and rates. Factors we consider include advisory fees, user-experience, customer service and mobile technology. The ratings are from poor (one to four out of 10), satisfactory (five to seven out of 10) to excellent (eight and up).