LendingClub Review: A P2P Lender-Turned-Neobank for Fair Credit Borrowers

Rating as of based on a review of services January 6, 2023.

Ranking

7.5/10

With above average rates and high origination fees, LendingClub is best for borrowers with fair credit who may otherwise have limited borrowing options. As a bank, its standout products include a 1% cash back debit card and a high-yield savings account with unlimited withdrawals.

Best for:

- Fair credit

- Cash back debit

- High-yield savings

In a stunning move, LendingClub has gone from one of the biggest threats to modern banks to becoming a bank itself.

It’s a bit like Tesla shutting down its Gigafactory to build gas-powered pickups. Not necessarily a bad move, just an interesting one.

So what are LendingClub’s new offerings as a bank? What do its new loans look like? How is it trying to stand out among other online-only “neobanks,” and are any of its loans or services right for you?

Let’s investigate LendingClub 2.0.

What Is LendingClub?

Launched in 2006, San Francisco-based LendingClub quickly became the world’s largest peer-to-peer (P2P) lending platform.

If you’re unfamiliar with P2P lending, it’s where people can borrow from each other without going through a bank. Platforms like LendingClub just act as the middleperson, seeking loan funding from investors and handling payments.

Read more: Best Peer-to-Peer Lending Sites for Borrowers and Investors

But after a leadership scandal rocked share prices in the late 2010s, LendingClub shut down its P2P lending platform, acquired Radius Bank, and secured its own banking charter.

Having shifted from new- to old-school banking, LendingClub has plenty to offer, from high-yield savings accounts to cash back debit cards to personal loans (that it now funds itself).

So let’s dive in and see if LendingClub is a fit for your banking or borrowing needs.

Pros & Cons of LendingClub

Pros

- Accepts fair (600+) credit — Most lenders require a score of at least 660, making LendingClub one of the few that’s open to fair credit.

- No prepayment penalty — LendingClub won’t charge you for paying off your loan early, so you can save big on interest worry- and penalty-free.

- Compelling savings account — LendingClub’s HYSA offers 2.85% APY, zero fees, and unlimited withdrawals.

- 1% cash back on debit purchases — With Rewards Checking you’ll get 1% cash back on all debit purchases plus zero fees and 25 free checks.

- Unlimited ATM fee rebates — LendingClub doesn’t charge ATM fees and will rebate any you incur from the other bank.

- Solid customer support — You can access LendingClub’s support team 12 hours a day, M-F and 8am to 5pm PST Saturday.

Cons

- Steep origination fee on loans — LendingClub charges a 3% to 6% origination fee on loans, meaning you could pay as much as $600 upfront to borrow $10k.

- Restrictive loan terms — LendingClub only offers terms of three or five years. Some competitors offer many more options inside a wider range (two to seven years).

- No physical presence — As an online-only “neobank,” LendingClub has no physical branches or ATMs.

How Does LendingClub Work?

Whether you’re seeking a personal loan or banking services through LendingClub, the process is super simple.

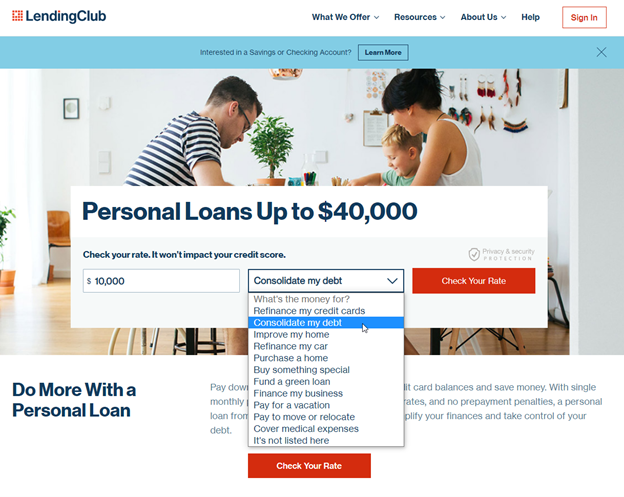

For personal loans, you just enter the amount and purpose of the loan.

Source: LendingClub

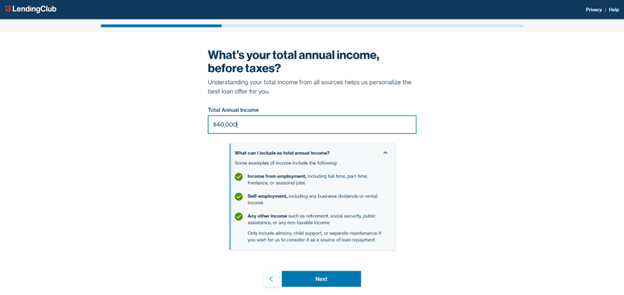

This will launch a quick, two-minute application where LendingClub will ask for your name, address, income, and other basic info in order to provide you with a rate estimate via email. It’s also a soft pull, so it won’t affect your credit score until you accept their loan offer.

Source: LendingClub

As for a timeline, LendingClub says most of their loans are approved and funded within hours.

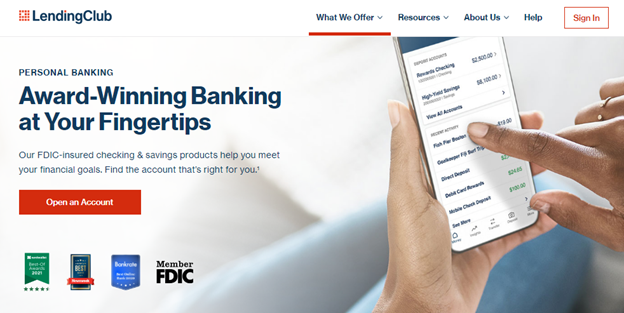

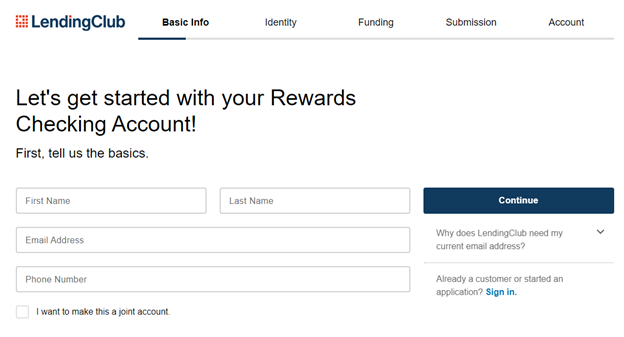

On the banking side of things, let’s say you want to open a checking account. You’ll head to LendingClub and click “Open an Account.”

Source: LendingClub

Next, you’ll choose an account type: High-Yield Savings (HYSA), Rewards Checking, or Certificate of Deposit (CD). I’ll cover all three in detail below.

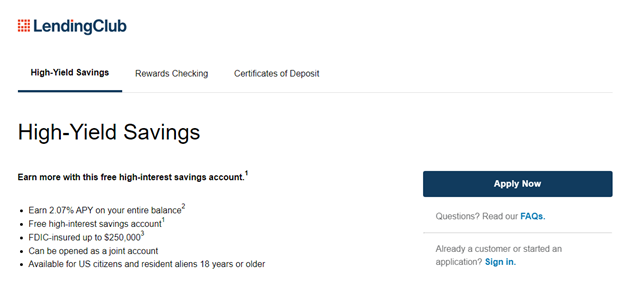

Source: LendingClub

From here on out there are no surprises. Nor are there any account minimums, so you don’t need to fund your account right away to avoid fees.

Source: LendingClub

How Much Does LendingClub Cost?

On the banking side of things, LendingClub pretty much only charges wire fees.

- Maintenance fee: $0 for Rewards Checking and Savings accounts

- Overdraft fee: $0

- Out-of-network ATM fee: $0

Heck, LendingClub will even rebate what the other bank charges for an out-of-network ATM.

Here’s the full fee schedule for LendingClub’s banking services. As you can see, they’re mostly just legal fees that (hopefully) won’t apply to you.

On the lending side, however, it’s definitely a mixed bag.

- Prepayment fee: $0

- Brokerage fee: $0

- Late payment fee: varies

- Origination fee: 3% to 6% of loan amount

To start with the good, it’s nice that LendingClub doesn’t charge a prepayment fee — meaning if you want to pay your loan off in full much earlier to save on interest, they won’t charge you for that.

LendingClub doesn’t disclose their late fees on loan payments, but at least you get a 15-day grace period before one triggers.

But that origination fee might be a dealbreaker for most borrowers. More on why in a bit.

LendingClub Services

Personal Loans

Here’s the good, the bad, and the ugly of LendingClub’s personal loans.

First, the good: LendingClub charges no prepayment penalty, offers a nice range of loan amounts from $1,000 to $40,000, and offers a 15-day grace period for missed payments. Best of all, the minimum credit score to apply is just 600.

Now the bad: LendingClub’s rates aren’t the lowest in town. With a range of 8.30% to 36.00%, LendingClub charges much higher interest than competitors like LightStream (5.24% with AutoPay) and Marcus by Goldman Sachs (6.74%). So borrowers with excellent credit will almost certainly find better rates elsewhere.

Plus, LendingClub’s loan terms are oddly restrictive: just three or five years. The new norm is two to seven years, with plenty of options in between. Some lenders even let you use a flexible sliding scale to pick your term, so you can pay off your loan in exactly three years and seven months, if you want.

Finally, the ugly: on top of higher-than-average rates, LendingClub charges borrowers a 3% to 6% origination fee. On a $10k loan, that’s $300 to $600 in upfront fees. And considering some competitors charge 0.99% or even 0% origination fees, it makes borrowing from LendingClub that much less appealing to anyone with a good or better (670+) credit score.

Rewards Checking

Things start looking up when we talk about LendingClub’s award-winning Rewards Checking account.

With Rewards Checking, you’ll get:

- Unlimited 1% cash back on debit card purchases

- 25 free checks

- Zero ATM fees (or any other fees, for that matter)

- Unlimited rebates on ATM fees charged by the other bank

- 0.10% APY on account balances over $2,500; 0.15% APY with account balances of $100,000 & up

- Direct deposit

All told, that unlimited 1% cash back makes the Rewards Checking account a nice option for someone who may not have access to a credit card. Credit cards do exist for helping you build credit, but they don’t offer 1% cash back!

Read more: The Best Credit Cards for Building Credit from Scratch

High-Yield Savings

LendingClub also offers a high-yield savings account (HYSA) generating an impressive 2.85% APY as of September 2022 (see the latest rates). You only need $100 to open one, and there are no maintenance fees or account minimums to worry about.

The other big perk is free unlimited external transfers. So you could keep most of your spending money in your HYSA to generate 2.85% APY, and only transfer what you need into your Rewards Checking account to get 1% cashback on spending.

The only drawback is that LendingClub doesn’t offer a sign-up bonus for their HYSA, which can sometimes be as high as $150. But overall, it’s a compelling option if you’re shopping for an HYSA.

Read more: Best High-Yield Savings Accounts

Tailored Checking (Business Checking)

Combining the best of Rewards Checking and their HYSA, LendingClub’s Tailored Checking business account generates 1.00% APY on balances under $100k and 1% cash back on all qualifying debit purchases.

The interest-bearing feature is nice, but if you’re an entrepreneur, your business purchases will be much better rewarded (and protected) using a business credit card.

Read more: Best Business Credit Cards For Young Entrepreneurs

Who Is LendingClub Best For?

As a lender, LendingClub is best for borrowers with fair credit (600 to 660) who need to take out a personal loan before they can start improving their credit.

A great example would be someone who needs a debt consolidation loan but keeps getting turned away from other lenders due to their fair credit.

Read more: How to Improve Your Credit Score, Step by Step

They may have to pay LendingClub a high origination fee plus high interest, but at least they’ll get the funds they need to pay off old debt, stop the bleeding on their credit score, and consolidate their monthly payments.

That said, if you’re struggling to get a personal loan simply due to your limited credit history, I have an alternative suggestion below.

As a bank, LendingClub has a lot to offer someone who wants to pair an interest-bearing savings account with a rewards debit card.

For example, if you’re saving for a house and want to keep your money super liquid and accessible, keeping it in a LendingClub HYSA with unlimited free withdrawals might be a smart move.

Who Shouldn’t Use LendingClub?

If you have good (670) or better credit, you’ll almost certainly get a better rate with a different lender that rewards more qualified borrowers. You’ll probably save a few hundred bucks on origination fees, too.

If you’re struggling to get a personal loan due to your limited credit history (e.g., you’re a recent grad or immigrant), I’d recommend Upstart over LendingClub. You can read more about them below.

Finally, as a bank, LendingClub clearly isn’t for someone who wants an all-in-one banking experience. By that, I mean physical branches, first-party ATMs, mortgage options, a brokerage account, and more, all in one dashboard. As a new bank, LendingClub’s offerings are compelling but certainly limited.

LendingClub vs. the Competition

Upstart

As mentioned, LendingClub is best for borrowers with fair credit. If your issue is that you have limited credit, Upstart might be a better option.

That’s because Upstart doesn’t care about your credit score, and instead looks at factors like your job, grades, and more. The idea is to be fair to recent grads and immigrants who may be 100% capable of paying back a loan, but just don’t have the credit score to prove it (yet).

Learn more/apply or read our full Upstart review.

Marcus by Goldman Sachs

Marcus is Goldman Sachs’ answer to all these fancy, newfangled neobanks trying to take their young clients away. And they’ve made one heck of a counteroffer.

Rates on personal loans start at just 6.74% with the 0.25% autopay discount, there are no origination fees, late fees, or prepayment fees, and perhaps best of all, Marcus will let you skip a month every 12 months and just pay it later without additional interest. All in all, it’s a much better option for qualified borrowers with very good (730+) credit.

Learn more or read our full Marcus by Goldman Sachs review.

Marcus By Goldman Sachs® Offer Terms and Conditions - Your loan terms are not guaranteed and are subject to our verification of your identity and credit information. Rates range from 6.99% to 24.99% APR, and loan terms range from 36 to 72 months. For NY residents, rates range from 6.99%-24.74%. Only the most creditworthy applicants qualify for the lowest rates and longest loan terms. Rates will generally be higher for longer-term loans. To obtain a loan, you must submit additional documentation including an application that may affect your credit score. The availability of a loan offer and the terms of your actual offer will vary due to a number of factors, including your loan purpose and our evaluation of your creditworthiness. Rates will vary based on many factors, such as your creditworthiness (for example, credit score and credit history) and the length of your loan (for example, rates for 36 month loans are generally lower than rates for 72 month loans). Your maximum loan amount may vary depending on your loan purpose, income and creditworthiness. Your verifiable income must support your ability to repay your loan. Marcus by Goldman Sachs is a brand of Goldman Sachs Bank USA and all loans are issued by Goldman Sachs Bank USA, Salt Lake City Branch. Applications are subject to additional terms and conditions. Receive a 0.25% APR reduction when you enroll in AutoPay. This reduction will not be applied if AutoPay is not in effect. When enrolled, a larger portion of your monthly payment will be applied to your principal loan amount and less interest will accrue on your loan, which may result in a smaller final payment. See loan agreement for details.The Bottom Line

As a P2P lender-turned-neobank, LendingClub seems to be carving a niche for helping folks with fair credit get the loan and banking services they need.

But if you can get your credit score into the 700s by the time you turn 30, the world will be your oyster.