If you’re new to real estate investing, you’ve probably heard two things about it:

- It requires tons of research and effort

- It’s a passive form of investing

Wait…

Source: thefrisky.com

In this article, I’m going to clear all that up.

Is real estate truly a form of passive investing that generates passive income? What exactly is passive income? Why do some real estate investors love being called passive investors, while others hate it?

And how can you make passive income through real estate with minimal effort?

What’s Ahead:

What is Passive Income?

Technically speaking, [adjusts glasses], the IRS defines “passive income” as cash generated from the following “passive activities”:

- Trade or business activities in which you don’t materially participate during the year.

- Rental activities, even if you do materially participate in them, unless you’re a real estate professional.

To define material participation, the IRS has seven “tests” you can run your investment activity through. Pass one test and your passive investment becomes active for the tax year.

You can read up on all seven here, but broadly speaking, your passive investment becomes active once you’ve dedicated more than:

- 100 hours this year, or

- 500 hours total

That’s important context for passive investing in general, but within the realm of real estate, let’s not forget that the IRS’s rules maintain the presumption that all rental activities qualify as passive income — regardless of material participation.

The IRS’s rules also highlight why pretty much everyone thinks of real estate as passive investing. By the laws governing our country, it totally is.

Even still, if you refer to real estate as “passive investing” in front of an experienced real estate investor, they may get saltier than a Sonic breakfast burrito.

Copyright source: The Big Lebowski, distributed by Gramercy Pictures

Why is that?

Is Real Estate Passive Investing/Income?

Depends who you ask.

In a legal sense, yes. REITs, crowdfunding, and even landlording over your own properties are all considered passive forms of investing — and therefore income — in the eyes of the IRS.

And many real estate investors will proudly agree. They’ll say yes, real estate is passive income, and that’s why I love it. It’s the ultimate vehicle to the American Dream — I own property, pay lower taxes, and make money in my sleep.

Others, however, will disagree. Sometimes vigorously.

In my personal experience, landlords and flippers are the first to say no, real estate is decidedly not passive income. They’ll point the to the drywall dust in their hair, crusty beige paint on their overalls, and the 59 unread text messages from tenants and say:

“There’s nothing passive about what I do.”

Tax advantages be damned, some investors just don’t like the “passive” label because they feel it diminishes the amount of sweat equity they have to invest.

Source: Giphy.com

I was once having dinner with my friend Rosa, who owns three rental properties of her own, when her phone buzzed on the table. Upon reading the text, she closed her eyes and let out a sigh long enough to fill a Zeppelin.

“Chris, this is why nobody should call real estate a ‘passive’ form of income.”

The text said:

Ran bath, fell asleep. First floor flooded. No power. Please help.

Now, this isn’t to say you shouldn’t go into more “active” forms of real estate investing like flipping property and managing your own tenants. These forms are often the most lucrative in the short term, and remodeling old homes can be immensely rewarding.

All of which is why, despite having a tenant torpedo her entire weekend, Rosa didn’t say “don’t do it.”

She just said “don’t call it passive.”

Source: VVD

So, circling back to our original question: Is real estate passive income?

Legally yes, subjectively no.

Clearly there’s a spectrum, and some forms are more passive than others. Let’s examine the more truly “passive” forms of real estate investing.

What are Some Examples of Passive Real Estate Investing/Income?

For the moment, we’ll consider house flipping and managing your own properties to be “active” forms of real estate investing.

What does that leave? How can you generate cash flow without getting drywall dust in your eyebrows?

Real Estate Investment Trusts (REITs)

For those lacking the capital (or patience) to invest in real estate directly, real estate investment trusts — or REITs — offer a convenient alternative.

REITs are companies that own income-generating real estate assets. These could be a mix of both residential and commercial properties including homes, storage facilities, student housing, hotels, warehouses, office buildings, mortgages, and more.

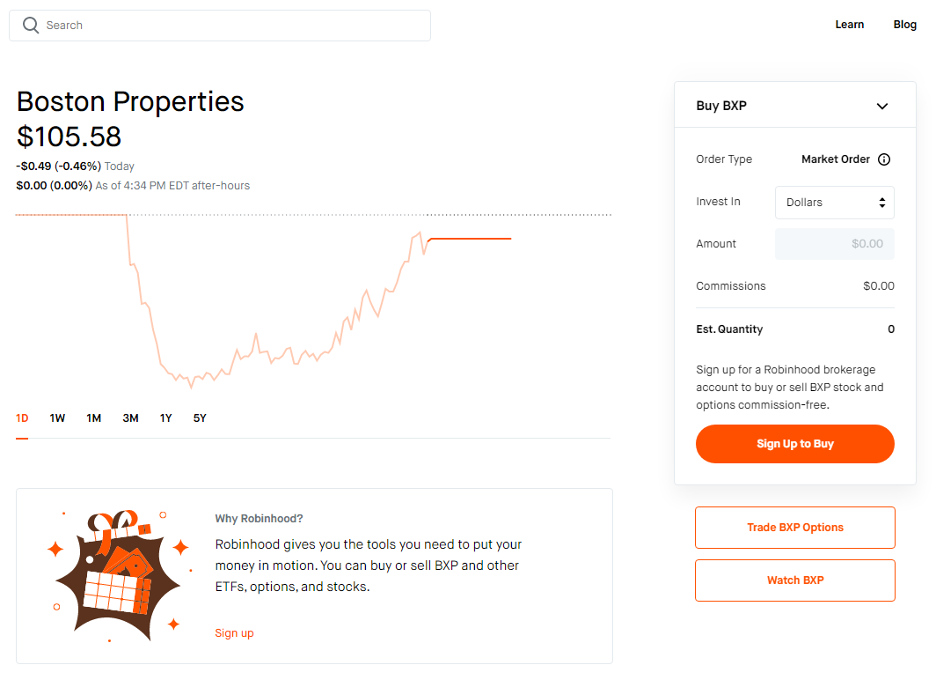

Accredited and non-accredited investors alike can buy and sell shares of publicly-traded REITs just like shares of a regular stock:

Source: BXP on Robinhood

REITs are also more liquid than property itself, which can take months if not years to sell.

As for passive income, REITs are required by law to distribute at least 90% of their income as dividends back to shareholders. Some pay higher. This is what attracts many investors to REITs in the first place — not necessarily the steady performance, but the steady income.

The chief drawback to investing in REITs, however, is the high trade fees. It can cost between 20% to 30% of an REIT’s value to purchase shares upfront, taking a shark bite out of your potential returns. Of course, that’s not much compared to a full down payment on a mortgage.

To learn more, check out our complete guide: Investing in REITs: everything you need to know.

Real Estate Crowdfunding

Another emerging option for generating passive real estate income is to participate in real estate crowdfunding.

Crowdfunding, as you probably know, involves raising large pools of capital, from an equally large pool of donors, to fund a project that none of those donors could have afforded to fund as individuals.

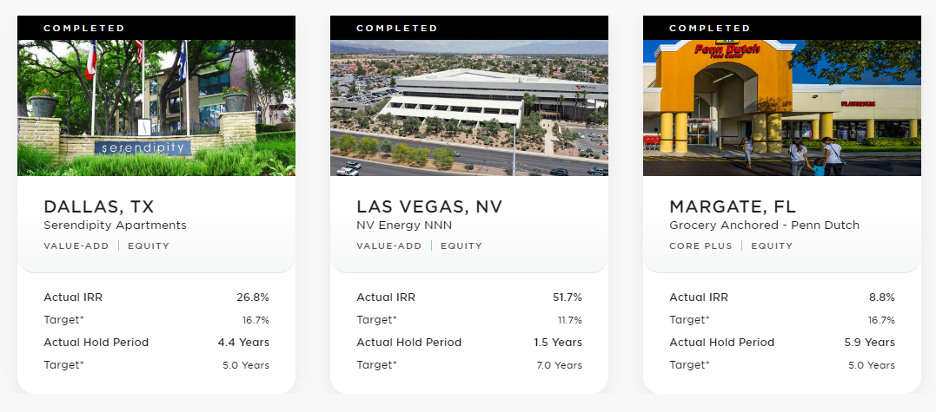

It didn’t take long for someone to apply the crowdfunding concept to real estate purchases, and now, sites like RealtyMogul.com can connect you to (mostly commercial) real estate investing opportunities.

Source: RealtyMogul

In a technical sense, what you’ll be doing is buying shares of an LLC that invests in another LLC that actually purchases and manages the property. This minimizes overhead, giving crowdfunding its chief advantage over REITs — significantly lower fees.

Think 1.5% compared to 25%.

Source: Tyler Perry Studios

However, crowdfunding investments aren’t nearly as liquid as REITs. The lockup period typically ranges from three to ten years, and dividends are usually paid out quarterly.

Still, it’s easier than buying property directly. And with crazy low fees, the returns can be much higher.

For more on real estate crowdfunding, check out our complete guide: Real estate crowdfunding: should you invest?

Hiring a Property Manager

Let’s say you follow our proven formula for buying rental properties and you really have a knack for it. You love scooping up discount properties, letting tenants move in and get cozy, and looking for the next great property.

But over time, your properties and tenants become difficult to manage. You’d much rather outsource the headaches of day-to-day landlording so you can focus on finding the next great property.

Plus, you really don’t want to get the same text Rosa got.

Luckily, your property manager is here to save the day!

Source: Late Show with James Corden, CBS

Property managers handle all of your landlording to-dos so that you can relax, enjoy the passive equity and income, and focus your time elsewhere. They typically charge between 10 and 15 percent of your tenants’ monthly rent, and for that they handle:

- Tenant screening and filling vacancies

- Collecting rent

- Incidental maintenance and repairs

- Regular inspections

- Dealing with squatters

Now that we’ve covered some methods for generating truly “passive” real estate income, let’s circle back to how it compares to more “active” methods.

Benefits of Passive Real Estate Investing/Income

Lower Upfront Investment

Passive investors pay less upfront — and less month-to-month — than active, hands-on real estate investors. Rather than making a $40,000 down payment on a single property, passive investors can put $500 in a single REIT ETF for instant diverse exposure.

Liquidity

Active real estate investors often get tied up in specific pieces of property, and as a result may miss out on the next big opportunity. Passive investors, on the other hand, have more liquid options such as REITs that allow them to move capital around more freely.

No Dealing with Tenants

Perhaps the most attractive aspect of truly passive real estate income is that you don’t have to deal with tenants. Nightmare tenants can squat, damage your property, file frivolous lawsuits, and otherwise devastate your bottom line. But buying REITs, crowdfunding, and hiring property managers distances you from all that.

Drawbacks of Passive Real Estate Investing/Income

Smaller Returns and Lower Monthly Income

The passive approach to real estate investing — holding REIT shares long-term, hiring property managers, etc. — will almost always shrink your bottom line. It’s typically worth it, but anyone looking to squeeze the most capital gains out of their real estate ventures will prefer an active approach.

Still Requires Beaucoup Research

Active or passive, there’s no super easy way to just dive into real estate investing. In order to generate passive income, you’ll still need to do plenty of research upfront to ensure you’re buying the right REIT or rental property at the right time.

How to Find Passive Real Estate Investing Opportunities

For REITs: Robinhood or Streitwise

Although you can technically buy shares of REITs on regular trading platforms like Robinhood, dedicated REIT exchanges like Streitwise provide a few advantages.

Notably, Streitwise offers just one REIT at a time (currently with a dividend yield of 8%), along with historical data of past offerings, making your selection process a little faster. Plus, you can even buy in with crypto.

Check out our full review of Streitwise or open an account today.

For Rental properties: Roofstock

Roofstock is like Zillow for rental properties. The platform and its listings emphasize rent and income-related metrics, and you can even buy properties with tenants already in place. Plus, should you grow tired of dealing with tenants the platform can instantly connect you to qualified property managers.

Check out our full review of Roofstock or open an account today.

For Real Estate Crowdfunding: RealtyMogul

Sure, condos are cool; but if you’re ready to own part of a dang office building, and rake in dividends when it does well, RealtyMogul is the crowdfunding site to do it.

Like Streitwise, RealtyMogul curates a small list of opportunities and charges a very small management fee of between 1 and 3 percent. And while there’s no secondary market and your capital will be tied up for three to seven years, the upside to investing in a big building could be tremendous.

Check out our full review of RealtyMogul or start browsing crowdfunding opportunities today.

The Bottom Line

It’s ironic that the IRS classifies most real estate income as “passive” when some forms of real estate investing are about as hands-on as you can possibly get.

Even still, truly passive forms exist (most notably REITs), and for anyone looking to make money in their sleep, they deserve a slice of your portfolio.