It’s easier than ever to invest in the stock market. All you need is the right app and some money, and you’re on your way.

But deciding where to put that money isn’t quite as easy. You can spend hours researching, but how do you know that you’re making the right decisions?

That’s where an app like Public can help. Public combines the convenience of managing your own investments with the benefits of social platforms. Your membership gives you access to a large community of fellow investors, from novices to experts, who help each other out. You’ll not only be able to make more informed investing decisions today, but you’ll gain valuable knowledge that will help boost your future investments.

Recently, Public’s vice president of marketing sat down with us to discuss what it’s like working for a startup, as well as how technology is changing the world of investing. Katie Perry (and no, not the pop star) has helped define marketing strategies for a variety of businesses, from startups to large corporations, and has plenty of great information to share.

What’s Ahead:

Why Public?

Public is redefining the way Millennials invest. Even the most novice investor can feel comfortable with the platform, thanks to the supportive community that’s full of tips and encouragement.

But Public isn’t just a community. You can also invest. You can invest in any stock with as little as a few dollars. They do this through something called fractional shares, which lets you buy a fraction of a share rather than having to fork over enough for a full share. This means you can buy into high-valuation stocks like Apple and Netflix with just a few bucks.

You can sign up for Public even if you don’t have anything to invest yet. There are no account minimums and you’ll pay no commissions on your trades. Millennials can join and start interacting, then begin investing when they’re ready.

Meet Public’s VP of Marketing – Katie Perry

Katie Perry joined Public after a decade of work in brand marketing and corporate strategy. Most of her career has been devoted to startups, but prior to taking the position at Public, she had the opportunity to work for a publicly-traded company. She found it an educational experience, but longed to get back to the startup world.

Her work with Public involves getting the word out about the app, which takes a social approach to investing. She shared with us what her career has taught her about finance, startups, and more.

Money Under 30’s interview with Katie Perry

You have a long history in marketing and brand strategy. What drew you specifically to the field of finance and investing?

I’ve always been passionate about working for companies with strong missions, incredible products, and leadership I trust and admire. For me, the opportunity to join Public, which is an investing app that makes the stock market social, checked all these boxes.

Moreover, the role also aligns with my personal interest in the financial markets. What I love about Public is that we’re shaking up an industry that hasn’t changed much in decades. We’re bringing these topics more into the mainstream in a way that is both educational and accessible.

Public takes a unique, social media-based approach to investing. Do you see the industry heading in this direction, and if so, why?

Public puts a social layer on the stock market, meaning we give people an opportunity to share why they invest and have constructive conversations with other investors. The idea is to share ideas and get smarter together. So it’s less about influencing (or being influenced), and more about exchanging knowledge you may have in a particular space with others, and in turn, benefitting from the diversity of thought in the community.

Here’s an example of a recent investment I made with my reasoning. Keep in mind that I’m not a financial advisor and this is not investment advice.

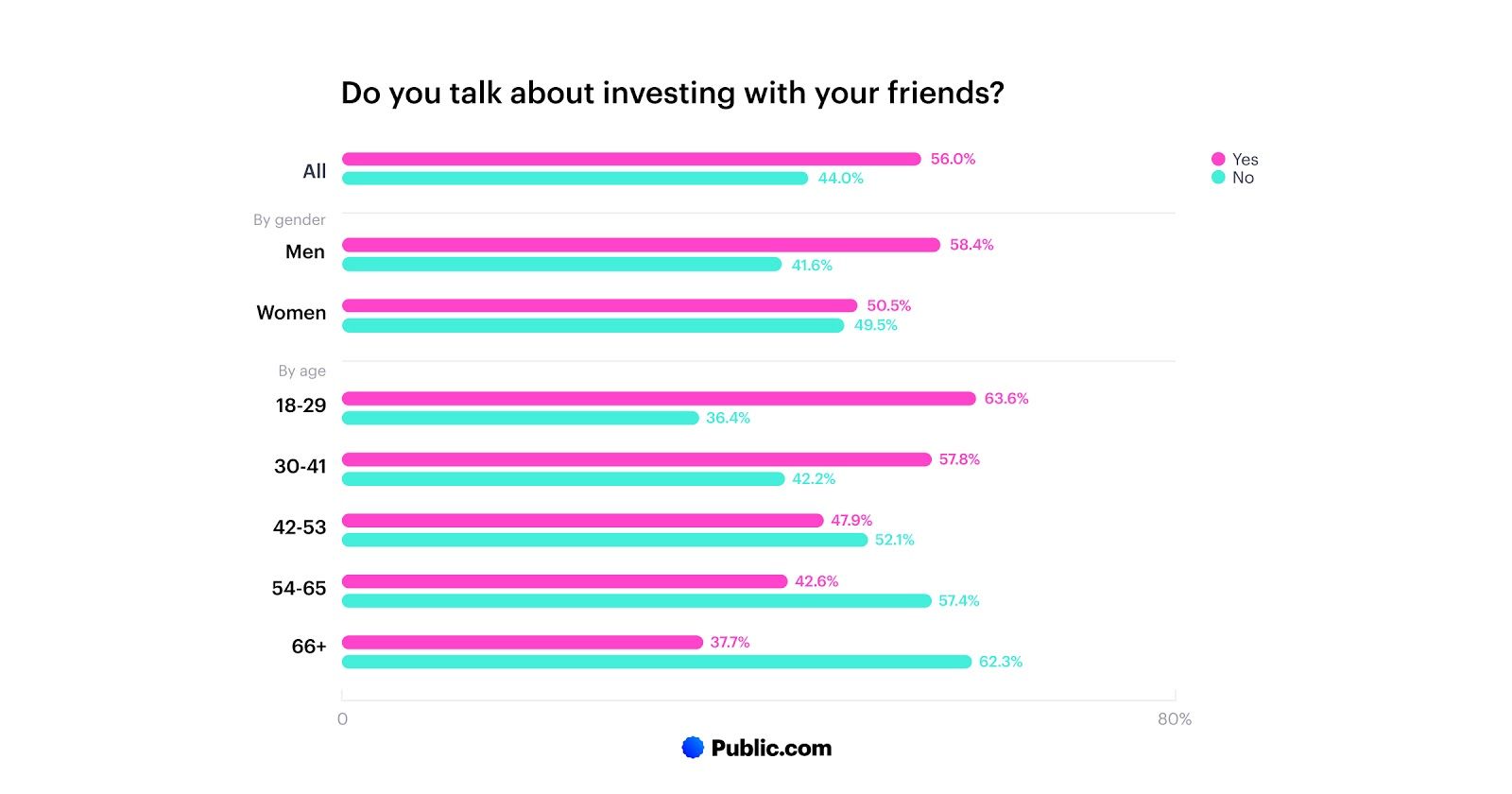

On a more macro-level, there are definitely signals that show that younger generations of people are more open to talking about money than older generations. I think this is a positive thing. Money has historically been a taboo topic, and while there are of course instances where discussing finances can be perceived as rude, there are others in which collaboration is an empowering thing. Opening up conversations about investing makes them more accessible to people and helps increase their comfort level as they progress on their journey as an investor.

New research from our community corroborates this trend, with younger people being more likely to say they talk about investing with their friends.

What advice do you have for Millennials who want to invest but are afraid of taking financial risks?

I am not a financial advisor so I can’t give direct advice. I will say that the topic of “risk” is a hot-button issue because of some of the headlines you’ll often see around trading. A big thing here is to understand the difference between trading in the short-term and being a more long-term investor.

Longer-term investors tend to withstand the ups and downs of the market because they have a longer time horizon. They are looking for businesses they believe in months, years, or even decades down the line. Experts will say that when you invest in the short-term, timing becomes a factor and most people will never time the market successfully every time. Because of that, longer-term investing tends to carry less risk, although past performance does not guarantee future results.

How have your personal financial habits changed since joining a finance startup?

Since joining Public, I’ve learned so much, not only as an employee at the company, but also as a member of our community. Every day in the app, I am learning something new from our members. I liken the experience to the process of learning a language. Sitting in a classroom and studying vocabulary and grammar is one thing (and it’s critical!), but the real fluency occurs when you can assimilate yourself in an environment where that language is being spoken organically.

Here’s another example from our community:

At Public, I am discovering new companies and industries in the feed and getting daily insights from chat groups I participate in around the specific topics I care most about. For example, in the Future of Fitness chat we discuss what Amazon’s announcement of a Peloton competitor means for the at-home exercise space.

What would you say to a Millennial who is torn between investing via an app or getting a broker?

It’s common for people first starting out to seek direct feedback. What should I do? Or what should I invest in? An important thing to keep in mind is that this will be different for everyone. Everyone has unique financial circumstances, appetites for risk, and goals for why they invest.

Understanding where you’re at financially and what your goals are is an important first step that any financial advisor (and I am not one) would recommend.

How is marketing for a startup different from marketing for a more established company?

The biggest difference is that you’re building the train tracks at the same time you’re speeding 100MPH down them, and on top of that, the path is rarely linear. It’s a lot of iteration and optimization. I’ve worked at larger companies where we spent weeks or even months establishing a plan—oftentimes in a lengthy PowerPoint deck—and only when the plan was completely set did we act on it.

Larger companies have reasons for functioning this way—there are more stakeholders and more complexities. At a startup, you can be more agile, but it also requires a meticulous focus on what’s working, what’s not, and what could be better.

How has COVID changed investing? Do you see investors approaching things differently than they did previously?

During the early months of the pandemic, one of the more interesting trends I saw was that business news was the fastest-growing category of news, ahead of sports, politics, and entertainment. The world slowed down, but business became more interesting. People were curious about how companies would adapt and which would emerge as innovators to solve the challenges of our new normal. Money was a topic on everyone’s mind because the market was volatile and the economic outlook was unclear.

On top of this, people new to the world of investing didn’t necessarily want to navigate it alone. We saw a surge of interest in our product, in line with broader retail investing trends, and we saw people becoming more engaged with content in the app. They wanted to discuss what they were seeing with friends and other investors, and collaborate to learn together.

What is one thing that Public accomplishes that you think is an absolute game-changer in the industry?

In addition to making the stock market more accessible for more people, we’re changing the very culture of investing. Too many people have been marginalized and made to feel like investing isn’t “for them” because historically, this has been such a closed-off environment.

Growing up, I rarely saw women in any ads for financial products, and the same could be said for people of color. Not seeing yourself in the experiences you want to be a part of can create a psychological barrier to entry. Our community is about 40% women, and we have a diverse mix of people coming from different regions and backgrounds. In Public, you can find business analysts, teachers, doctors, creatives, small business owners, and more.

Tell us about a personal accomplishment that has shaped your career.

After about seven years in the workforce, I decided to quit my job to start my own consultancy for advising companies on their marketing strategy. It was a big leap at the time because I had a great job working alongside people who would become life-long friends, but I wanted to see if I could cut it on my own.

In that experience, I was able to build a strong pipeline of clients and learn the ins and outs of running a business. It was the hardest I’d ever worked in my life, but it was incredibly rewarding, and I learned a lot that I was able to apply to my next roles.

Who in your life has been the most instrumental in teaching you about money management?

I was very fortunate that my parents set really strong examples that I’ve adopted as an adult. We lived frugally, well within our means, and spent money strategically. Money was seen as a tool, and it was spent responsibly and with purpose: on education, lessons, activities, books, etc. We had one car for as long as I can remember at a time when a lot of people around me were being gifted new cars for their 16th birthdays. A trap some people fall into is only considering the income part of the equation, failing to remember that money saved is money earned.

On the investing side, I was again very fortunate that my parents taught me how to invest when I was still a teenager. My dad took the time to sit me down on a weekend and go over the basics: stocks and bonds, the difference between trading and long-term investing, and the importance of starting early. Seeing a compound interest calculator as an 18-year-old is life-changing.

One of the main reasons I joined Public was because I wanted to help more people get the same level of education and access that I had. Basic concepts about budgeting, saving, and investing are completely missing from our education system. So, what happens is people get into early adulthood and they are trying to learn all this stuff on top of paying student loans and navigating the first few years of their career. I am passionate about our mission because I believe that what we’re building can have a positive impact on people’s lives.

What’s the best advice you’ve received (not necessarily money-related) that has shaped how you lead your life?

I remember seeing the book How to Win Friends and Influence People on an executive’s desk early in my career and was intrigued by the title. I picked up a copy and read it, and it changed me for the better. I am usually not big on self-help books, but this is a classic guide to treating people well and getting what you want. It has shaped the way I navigate relationships inside and outside of work and made me a more empathetic professional.

One of the more salient tips is to always assume someone’s best intentions and to be “hearty in your approbation and lavish in your praise.” Positive feedback is a powerful motivator.

What’s your top personal finance tip?

Hold yourself accountable. One of the best things I did when I first got out of college and was juggling a ton of student loans and the costs of living in an expensive city was to track every dollar I spent. And when I say every dollar, I mean every dollar. It might sound crazy, but I mapped everything out in Excel, and set parameters for different categories of spending.

Once you subtract all of the things you need to spend money on (obligations), you have a much better sense of what you have to work with on the other stuff, like travel and dinners with friends. I had parameters for each category which kept me honest.

These days, I use Mint to keep track of where I’m spending, but getting into the habit of accounting for my spend as if I were running my own business (that business being myself) will change the way you view money, even if you’re not tracking every last cent.

What is the financial book/website/podcast that has most influenced you?

The book I think everyone should read if they want to learn more about investing is The Bogleheads’ Guide to Investing. Warning: it’s pretty dry, but it has all the basics you need. If you’re a long-term investor, the fundamentals haven’t really changed all that much—what has changed are the tools and mechanisms you use to invest.

I also really enjoy Morning Brew’s “Business Casual” podcast. The show’s host, Kinsey Grant, books some of the biggest names in business and does an incredible job of getting new insights out of these leaders in a way that’s approachable and humanizing.

What piece of wisdom would you give your 20-year-old self about managing money?

I would tell myself to be more comfortable when it comes to talking about financial topics with my friends. What is so inspiring about Gen-Z in particular, and especially some of the younger people we see on the app, is that they are so curious and interested in learning about investing.

The cultural zeitgeist has changed a lot even in the last 10 years. Entrepreneurs are the new celebrities, and so you see young people taking more of an interest in personal finance. I think this generation is going to be years ahead because they are proactively educating themselves and collaborating with each other to get smarter and better together.

Summary

Technology has made investing accessible to investors of all experience levels. For Millennials, an app like Public not only makes it easy to get started with a few dollars, but it also makes investing a social experience. This social interaction gives members a sense of community that makes investing both fun and educational.

Learn more about Public or read our Public review here.

This is not investment advice. See Public.com/disclosures.