Even if you’re new to bonds, you probably already know three things about them:

- They’re low risk

- They’re not as exciting as stocks

- Old people love them

All three are 100% true. But once you understand how they work and their best-hidden qualities, you’ll realize that bonds have a lot to offer investors under 30.

So what are bonds? Why do old people love them? How do you buy them, and should you buy them?

Let’s investigate how to buy bonds.

What’s Ahead:

What are bonds?

A bond is a loan. When you buy bonds, you’re lending money to the entity you bought it from.

That’s the main way bonds are different from stocks. When you buy stock, you’re buying an actual slice of ownership in the company.

But when you buy bonds, you don’t own anything. You’re just lending money to the government, city, or a corporation and they slowly pay you back over time.

How do bonds work?

Here’s the short version:

- You purchase a bond.

- The bond issuer pays you back your purchase price on the “maturity date,” aka expiration date.

- In the meantime, the bond issuer also pays you regular interest payments.

I’ll provide an example below, but in order for it to make sense, I have to cover some essential terms first.

Bonds have five main characteristics:

- Face value is the asking price of the bond.

- Coupon rate is the interest you’ll earn, expressed as a percentage of the face value.

- Coupon date is the date you’ll get your interest payments, typically every six months.

- Maturity date is the date the bond expires.

- Issue price is the face value plus market adjustments and/or other fees.

Most bonds sell “at par,” meaning the face value is the same issue price (i.e., no extra fees).

Now, let’s say you purchase a bond with a face value/issue price of $5,000, a coupon rate of 5%, and a maturity date of 2032.

Since your coupon rate is 5%, the bond issuer will pay you $250 a year, or $125 every six months.

And if you hold the bond until maturity, the bond issuer will give your $5,000 back in 2032.

You can also sell your bond on the secondary market for a profit, though you’ll forfeit the regular income and principal.

Why do people buy bonds?

People buy bonds for three main reasons:

1. They’re low risk

Bonds have an extremely low default rate — meaning you’re gonna get your money back. Even the “riskiest” bonds (corporate bonds) have a default rate of just 0.40% in 2022.

The U.S. government has only defaulted on bonds four times since the Civil War, and not since 1971.

2. They provide a consistent stream of income

If you buy enough bonds you can essentially retire on the regular income they provide.

That’s why as people get older they tend to move money out of the stock market — where it’s at risk — and into bonds.

3. They’re boring and predictable

You might’ve heard that people buy bonds when the stock market is looking bearish (aka not so good). That’s because bonds are predictable and boring, which is exactly what you want if you’re looking to ride out a period of chaos and volatility.

Folks also like buying bonds during bear markets because they know demand for bonds will go up — and they can resell their bonds at a higher price, just like stocks.

Types of bonds

There are three main types of bonds: treasury, municipal, and corporate. Here’s a description of each, with their advantages and drawbacks:

U.S. Treasury bonds

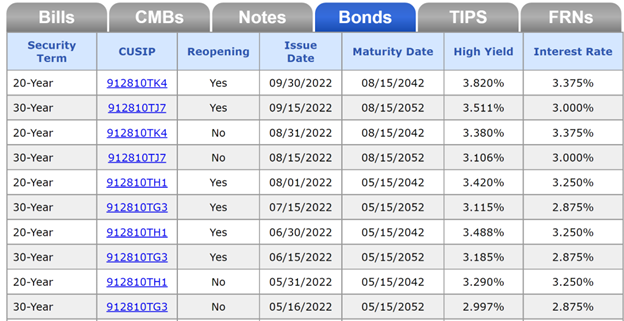

U.S. Treasury bonds are loans to the U.S. government. You can buy them in $100 increments on TreasuryDirect.gov and see the latest rates here.

Source: TreasuryDirect.gov

As you can see, treasury bond rates tend to hover in the 3% range, meaning a $10,000 bond purchase today would pay you $150 every six months until the bond’s maturity rate (typically 20 or 30 years with government bonds).

3% is… just OK for bonds, not great. But people still buy them because Treasury Bonds are backed by the Treasury and have virtually zero risk of default.

If you’re looking for a bond that’s short-term, zero risk, and way higher interest, check out the U.S. Treasury Series I Savings Bond. It’s a special type of treasury bond that matches the rate of inflation, so through November 1, 2022 they’re paying an insane 9.62%.

Municipal bonds

Municipal bonds, aka “muni bonds,” are issued by a state, city, or county. These local governments sell them to help fund parks, schools, libraries, etc. So, there are some warm and fuzzies to be had buying municipal bonds and supporting your city.

The other advantage of municipal bonds over treasury bonds is that your income from the latter typically isn’t taxed. You can also earn a little more; at the time of this writing, the interest/coupon rate for Chicago general municipal bonds is sitting around 5%.

The drawback is that municipal bonds are more likely to default than treasury bonds. Case in point: Detroit defaulted on its bonds in 2013. Plus, municipal bonds typically have to be purchased through a broker who takes a small cut/commission. And finally, muni bonds typically sell in increments of $1,000.

But overall, muni bonds are a great option if you want to invest in your city’s growth while earning a trickle of regular income.

Corporate bonds

Finally, corporate bonds are bonds that you buy from — you guessed it — corporations. And just like with muni and treasury bonds, you’ll be lending money to corporations.

Corporate bonds pay more but involve more risks and drawbacks.

- They start at $1,000 a pop.

- Some have a variable interest rate.

- Pretty much all of them have a higher default risk than muni or treasury bonds, since if the company goes bankrupt, you may never see another interest or principal payment.

So yes; even the boring world of bonds has its own “high risk, high reward” option.

To learn more about the less common types of bonds (junk, foreign, etc.) and the risks involved, check out How Does a Bond Work?

How to buy bonds

Buying bonds isn’t quite as simple as opening Robinhood and searching for a ticker. Depending on the type of bond you’re looking for, you have a few options:

Directly from the government

The U.S. government makes it pretty easy to buy bonds. After all, they want to sell them to you. So it’s no surprise they have a pretty slick website for it.

Check out TreasuryDirect.gov. There, you can buy bonds, manage your account, and learn all about the variety of treasury bonds out there. It’s a bonafide Amazon for government bonds.

Source: TreasuryDirect.gov

From a broker/brokerage app

For municipal and corporate bonds, most investors work through a human broker or a brokerage site like TD Ameritrade.

TD Ameritrade even has a “Bond Wizard” that can help you find bonds that suit your financial goals and needs.

And unlike buying directly from the Treasury, buying bonds on a brokerage app lets you tap into both the primary and secondary markets. That means you can buy bonds directly from the issuer at the true face value, or you can buy them from other investors looking to sell theirs either at a premium or below face value, depending on how popular those bonds are.

Bond ETFs and mutual funds

Bond ETFs, like Vanguard‘s Total Bond Market ETF (BND), are like “baskets” of bonds that you can buy all at once. They may contain thousands of treasury, muni, and corporate bonds, and you can buy a tiny slice of the whole basket for under $100.

Bond mutual funds are just like bond ETFs, only they’re actively managed — meaning a team of professionals is constantly changing up and optimizing its contents.

Here are the advantages of bond ETFs/mutual funds:

- You can buy shares for well under $100.

- You can purchase them virtually anywhere regular stocks and ETFs are traded (Robinhood, Public, etc.).

- They still pay regular income through monthly dividends (so it’s even more frequent than regular bonds).

But the chief drawbacks to bond funds are:

- Income isn’t fixed.

- There’s no big principal payment coming at maturity.

- The value of bond ETFs can fluctuate more than bonds themselves in the secondary market.

But overall, bond ETFs (and ETFs in general) are excellent choices for young investors due to their convenience, low risk, and inherent diversity.

Read more: How to invest in ETFs

What to know before buying bonds

If you’re leaning towards mixing some bonds into your portfolio, what else should you know beforehand?

1. Know your risk tolerance and invest accordingly

Your risk tolerance is your financial and emotional readiness to accept a loss in your portfolio. You can determine your risk tolerance in about five minutes by taking this short quiz.

Bonds are great for low-risk tolerance, but if you have a high-risk tolerance, you might want to keep the bulk of your capital in stocks where it can grow faster.

2. Don’t just chase the highest yield/interest rate

You may be tempted to sort your bond options by the highest yield/interest rate/coupon rate, but keep in mind that high interest rates are usually a direct reflection of the risk of the bond issuer defaulting.

The one glorious exception to that rule is the I bond.

3. If you can, talk to a professional before buying

The bond market is complex, which is why even seasoned investors typically work through a broker or financial advisor.

To connect with one and discuss bonds, check out our guide on the Top Financial Advisors for Millennials and Gen Z.

Should I buy bonds?

If you have a low-risk tolerance, are approaching (early) retirement, and/or like the idea of getting fixed income from your investments, bonds are a great choice.

If you have a medium- to high-risk tolerance, don’t need regular income from your investments (your day job pays just fine), and would rather generate higher returns from the stock market, your portfolio is probably fine without bonds right now.

Besides, you probably already have some — if someone else manages your Roth IRA or 401(k), they’ve almost certainly mixed some bonds in there

If you’re on the fence, snag some bond ETFs!

The bottom line

Even if you don’t plan to buy bonds soon, it’s great that you already know how they work at this young age. Not only do they help you retire and live a great life, but bonds also help the issuers build roads, hospitals, and better-running companies.

Featured image: eamesBot/Shutterstock.com