When you think of budgeting, you may imagine allocating cash in separately labeled envelopes or crafting complicated spreadsheets with various colors and fonts.

Budgeting can mean those things — but did you know that credit cards can be one of the most potent budgeting tools? It sounds counterintuitive since unsecured credit lines can too easily tempt many cardholders to overspend rather than save. But if you have the discipline, they’re an excellent budgeting resource.

If you suspect you are an emotional spender, it’ll undoubtedly behoove you to stay away from credit cards until you’ve conquered that aspect of your fiscal habits. “Good” types of debt exist (like mortgages and auto loans), but credit card debt isn’t one of them.

But if you’ve got the financial maturity, follow these principles to budget with credit cards successfully.

Read more: How to use a credit card responsibly

Use your cards like cash

Whether you’re deliberately budgeting with a credit card or not, the key to credit card success is to treat them like cash. When you purchase something, pay it off (almost) immediately.

You don’t have to wait until you receive your monthly credit card bill to make payments. Many of us, including me, make multiple payments during a billing cycle rather than one monthly lump payment. It’s unnecessary (unless you’re making big purchases), but it’s a psychological maneuver I use to help me think of my lines of credit as cash — not just free money.

I watch my monthly net income dwindle with each credit card payment, and it keeps me on track. Plus, you’ll never have to worry about being dinged with a late fee.

Use built-in budgeting software

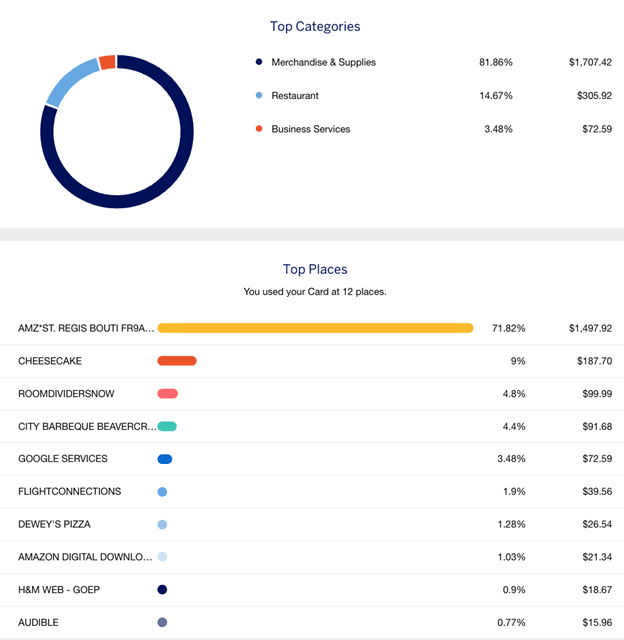

Many credit card issuers (like Chase and Amex) neatly track your spending and make it easy for you to view at a glance how much you’ve spent in each category each month. It’ll show you what you’ve expended for travel, dining, merchandise, business services, etc.

This is huge for diligent budget-keepers. You should reference this very digestible (and pretty) tool against the limits you’ve set yourself. If you’re a few days into the month and you’ve already spent an inordinate amount on entertainment, you can spot the trend immediately.

Note that this data’s default will likely display your spending since your last billing cycle. If you’re interested in month-to-month, or perhaps paycheck-to-paycheck, you’ll have to manually change the date ranges you’d like to view.

Source: American Express

Issuers also often allow you to set alerts for your credit card spending habits. For example, Amex gives you the option to receive an alert when you spend a certain amount during a billing cycle or make a purchase above a specified amount. You can also receive a weekly snapshot of your account spending.

Use different cards for different purchases

I currently have eight credit cards. Six are personal cards, and two are small business credit cards. I like to keep my personal and business spending separate — and using small business cards helps tremendously when budgeting for monthly expenses.

Read more: 12 reasons credit cards are must-haves for financial wellbeing

Whether you’re in a similar situation or simply find it helpful to place certain expenses on different cards, this can be another way to enforce your budget and categorize your cash flow. For example, you may have a credit card dedicated to:

- Grocery stores.

- Monthly utilities.

- Gas stations.

- Everything else.

When you log into your gas station card’s online account, you’ll quickly see how much you’ve spent on gas for the month. No other purchases have posted to that account — and if they have, they’re either fraudulent, or you’ve been impulse-spending.

This can be a way to clear the noise from a single card with a list of transactions a mile long. If you’re over budget this month, you’ll find the problem on your “everything else” card.

Read more: Using multiple bank accounts to control your spending

Add (and use) authorized user cards

Many cards offer the benefit of free authorized users — or in the case of small business cards, free employee credit cards. The magic budgeting trick here is that some banks (like American Express) allow you to set spending limits unique to authorized user/employee cards.

You could simply add friends or family members to your card and keep them yourself. Add as many authorized users as you have spending categories, and set each limit accordingly. American Express allows you to lower each spending limit to $200.

Buy gift cards

One of the benefits of budgeting with cash is that you are forced to stay within your means — or you’ll simply run out of money. The danger of credit cards is that you can impulse-shop your way into five paychecks from now if you’re not vigilant.

While not a flawless plan of attack, you can still emulate a cash-based budget with a credit card. I’ve done this myself before, and it really can be helpful.

Lots of merchants sell Visa gift cards which can be used anywhere Visa is accepted. At grocery stores, you can often buy them in variable increments up to $500. If you’ve established a budget of $200 per month for dining out, you can purchase a $200 gift card and mark it as “restaurants.” If your monthly budget for entertainment is $150, you can buy a $150 gift card and mark it “entertainment.”

In any category for which you want to ensure you don’t overspend, you can buy a Visa gift card for that exact amount. When the gift card runs out, you’re done until next month.

If this strategy appeals to you, consider the bonus categories of whichever credit card you plan to use; you may be able to earn bonus rewards on your gift card by tactfully purchasing your gift card from certain stores. For example:

- If you have the Amex Gold Card, you can buy your gift cards from a supermarket. This card earns 4 Amex Membership Rewards per dollar on up to $25,000 in purchases at U.S. supermarkets per calendar year (then 1 point per dollar).

- If you have the Ink Business Cash® Credit Card, you can buy your gift cards from Staples. This card earns 5% back on the first $25,000 you make in combined purchases each account anniversary year at office supply stores and on internet, cable, and phone services.

The main downfall of this strategy is that gift cards usually come with an activation fee of $5 or more. If you’re not willing to eat $5 (it can add up quickly if you’re buying multiple gift cards), wait for the intermittent store promotions that waive this fee.

Quick note: you (probably) can’t use your credit cards for everything

A handful of expenses simply cannot be made with a credit card. For example, most lenders will not permit an auto loan or mortgage to be paid with a credit card. However, if it helps your budgeting to run all payments through your credit card, there are loopholes:

- Plastiq is a service that charges a fee (2.85% at the time of writing) to pay just about anything with a credit card — including mortgages and car payments. Use your credit card to pay Plastiq, and they’ll cut a check to nearly any biller or merchant for you. There are some card issuer-specific restrictions, so investigate if this interests you.

- The no annual fee Bilt Mastercard® is the only credit card on the market that allows you to pay rent for zero fees. You’ll even earn one Reward per dollar on up to $50,000 in rent each year. Note that you must make at least five purchases per billing cycle to earn rewards.

With these services, you can pay your biggest monthly bills while still using your credit cards as budgeting tools.

Read more: Cash vs credit vs debit — which should you use?

Bottom line

Strictly using cash is the old-school — and foolproof — way to budget. If you don’t use credit, you won’t find yourself in debt, and you won’t be subject to nightmarish interest charges.

But the problem with this method is that you won’t bolster your credit history or earn valuable credit card rewards by budgeting this way. If you know a few tricks, budgeting with credit cards can be incredibly effective, not to mention easy. Just be sure to budget for credit card annual fees if you plan to use cards that incur them.

Featured image: Geobor/Shutterstock.com