One of my mentors, Carol, is rich.

By rich, I don’t mean she takes selfies on private planes. Rather, she’s achieved a level of comfort and freedom that most sensible people are striving for.

Carol lives in a nice place in the safe part of town, donates generously to charity, and spends more of her time on her passions and hobbies than on work. Her bank account balance has two commas in it, and she hasn’t really worried about money since Barack Obama held a senate seat.

Carol’s neighbors in the “Whole Foods-y” part of town are mostly lawyers, CEOs, and even a few movie stars hiding from the paparazzi. There’s even a Bitcoin zillionaire living somewhere above her, trading crypto all day and “sucking up the building’s power” she jokes.

But Carol is none of these things. In fact, she’s never made more than $60,000 a year. Instead of scaling some corporate ladder or selling a tech company, she somehow got rich just by rotating pretty normal job roles for 35 years. At some point on her career carousel, she’s been a teacher, accountant, and secretary.

So how exactly did Carol get rich? Inheritance? Luck? Buying 1,000 shares of TSLA in 2011?

When I asked her (we have that kind of blunt relationship), her tone was so mundane and matter-of-fact that you’d think she was giving me the time of day:

“Get rich slowly, hun!”

Wait, what does that mean? How can you get rich and achieve lasting comfort and freedom without selling a company or winning the lottery? Why is Carol’s method of “getting rich slow” so effective, and how can you pull it off?

In this piece, I’m going to teach you how totally normal people like Carol get rich (and you can, too). Without further ado, let’s investigate how the rich get rich (and you can, too).

What’s Ahead:

Defining “rich” to avoid a common trap

There are two types of rich people: happy rich people and unhappy rich people. The key to becoming a happy rich person is to establish your “why.”

Why do you want to get rich? After all, a seven-figure bank statement is just numbers on a screen. What do you want to do with the money?

Well, you probably want to get rich so that you can buy something.

Some people want to get rich so that they can buy something with a price tag, like a mantis green Lamborghini Huracán or a six-bedroom house. But chances are that if you’re reading Money Under 30, you’re probably more interested in something more enduring and conceptual, like freedom, comfort, safety, health, or the most valuable asset of all: time.

If you think about it, everything I just listed is a currency. You have a “balance” of each, and you exchange them back and forth all day like a personal stock exchange.

For example, when you go to work, you trade 8-10 hours of time for one day’s salary. Conversely, when you take an Uber to the airport instead of the bus, you trade $31 to save an hour of time.

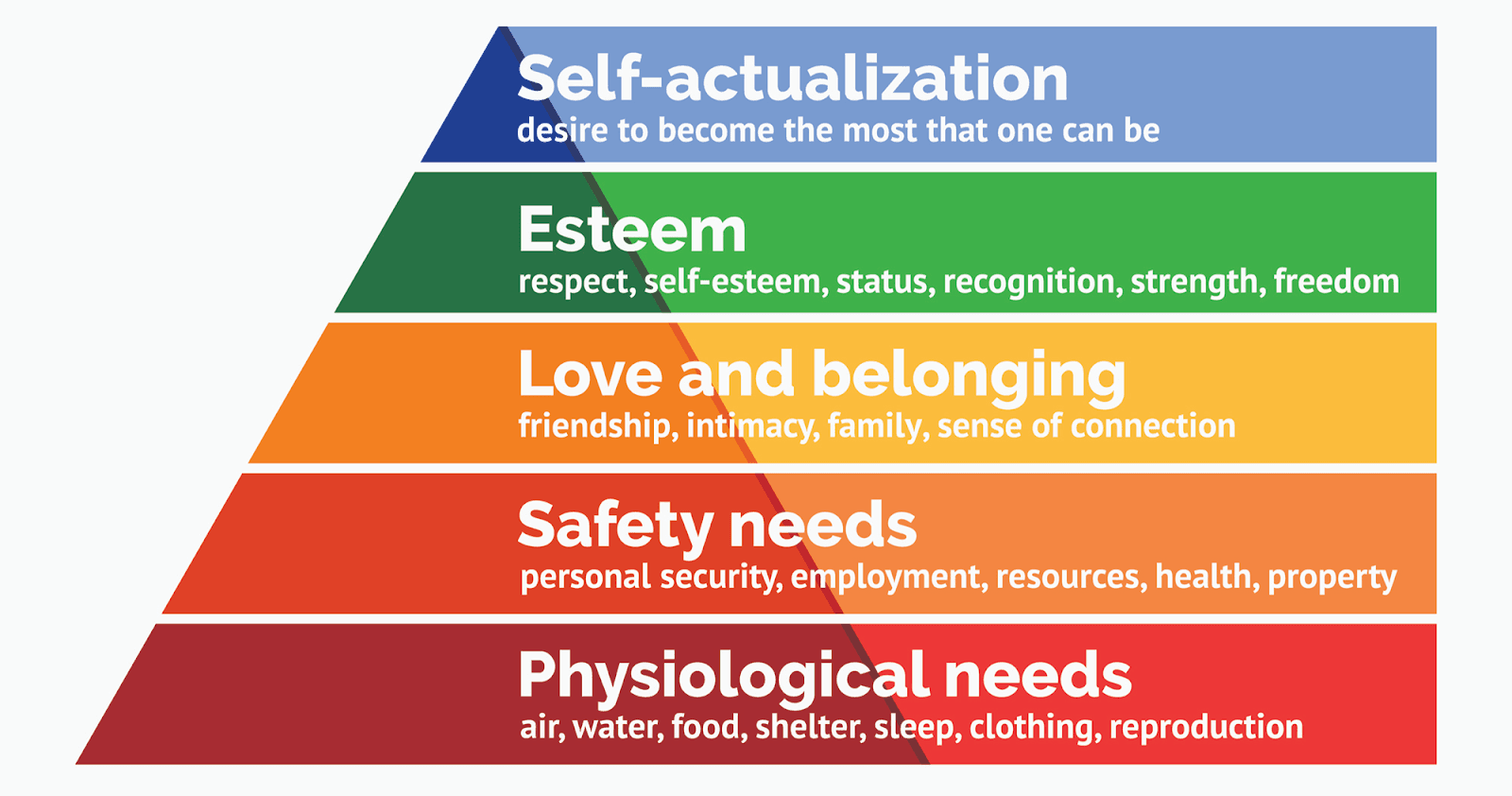

For a good visual of these intangible currencies, I like to look at Maslow’s Hierarchy of Needs.

Photo credit: SimplePsychology.org

On a conscious or subconscious level, most people try to get rich so that they can take care of all of their basic needs. Naturally, they take care of their physiological needs first (shelter, food, etc.), and then keep earning to cover “safety” needs (paying off debt, health insurance, etc.).

However, level three of the pyramid is where happy and unhappy rich people tend to diverge.

Unhappy rich people keep earning piles of money and forget to convert it to needs. Although they could work a little less to spend time with family or developing their passions, they choose not to. Over time, they even give up their safety needs, working so hard that it negatively impacts their health. With heavy money bags weighing them down, they end up tumbling back down the pyramid.

The whole point of getting rich is so that you can take care of your needs, all the way from sheltering yourself to finding purpose and achieving self-actualization.

If the act of getting rich makes you miserable, what’s the point?

I enlisted the help of Varun Marneni, an advisor with Atlanta’s CPC Advisors and Raymond James Financial Services. At 31 years old, Varun is 23 years younger than the average wealth advisor in America and is passionate about making an impact on people by helping them navigate the complexities of their finances.

How to not end up rich and depressed

Happy rich people like Carol never lose sight of why they wanted to get rich: namely, to achieve freedom.

“Remember – your goal isn’t to get ‘rich’ – it’s to become financially independent” says Varun. “After a certain point, it’s time to stop trading your other needs for money, and reverse the flow. Money can (and should) buy freedom, which in turn can facilitate love, belonging, esteem, health, and self-actualization. Besides, giving up your mental health to get rich is counterproductive. Unhealthiness can affect your ability to perform, be a good person, and even make money. The simple fact is that it’s easier to get rich when you’re happy along the way.”

So how can you get rich without giving up your needs along the way? Well, let’s look at the options.

4 ways the rich get rich

In his decade-plus studying wealth-builders, Varun has seen four general ways the rich get rich. He also has an easy recommendation for the method you should use.

Let’s analyze the four most common methods to getting rich.

Method 1: save and invest

“Get rich slowly, hun!” Carol said, matter-of-factly.

Then, she silently returned to the task of fetching two Key Lime Pie LaCroixs from the fridge.

I, on the other hand, was bubbling up with questions like a shaken champagne bottle. I asked her to elaborate and mentally cleared my calendar for a four-hour coaching session. But before she could even sit, she’d already given me her entire strategy:

“I’ve saved and invested 20% of my income since I was your age.”

But… what did you invest in, I zealously inquired?

“Oh, hun, I don’t invest any of my own money. I let Andrew [her financial advisor] do it.”

In addition to her 401(k), Carol had opened an investment account in her mid-20s, contributing as much of her paycheck as possible to it while her financial advisor managed it. They set a medium-risk portfolio, and she let it mature for years.

So… that’s it? The secret to getting rich without working 12 hours a day or betting the farm on Bitcoin is to open an investment account, keep adding to it, and… wait?

“Pretty much, yeah,” Varun says.

Carol’s not just some lucky outlier, either. According to Thomas C. Corley, author of the Rich Habits series of books, roughly half of rich Americans are just average earners who saved and “prudently invested” 20% of their income for decades. No CEO salary, no crypto bets, just smart money management.

Prudent investments could be hands-on like real estate, but for most low-key rich folks, it was just depositing into an investment account managed by someone else.

So if this method is so effective, and totally normal people get rich that way, it begs the question why nobody talks about it.

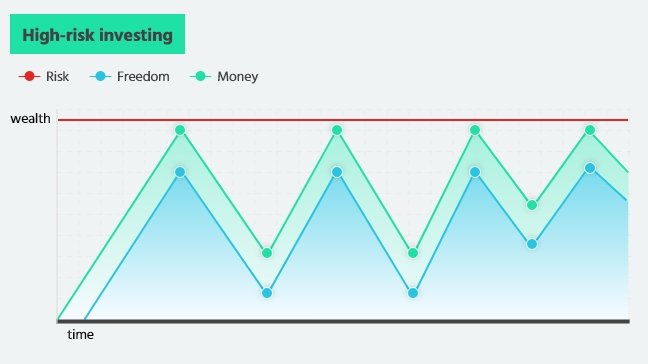

Method 2: high-risk investing

Carol’s neighbor, “the Bitcoin zillionaire,”, is 29. Rumor has it that he bought thousands of bitcoins when they traded at $2 a pop, which would’ve been around November of 2011. At the time of this writing (early 2021), a single bitcoin is worth $50,000.

Stories like that create a pretty potent sense of FOMO. A few clicks and he never had to break out his resume ever again. Sigh.

But if you truly want to subject yourself to FOMO Central, look no further than r/wallstreetbets, the now-infamous subreddit for retail aka amateur investors.

“WSB” is full of 22-year-old millionaires proudly showcasing their skyrocketing portfolios after having bet the farm on individual stocks.

But if it seems too good to be true, it probably is. Such is the case with r/WSB. “This isn’t investing; it’s gambling” warns Varun.

Even if you do get lucky once, amateur day trading simply isn’t a path to sustainable long-term wealth. “Sure, you can make a 100% return on a stock – but how are you going to do that month after month?”

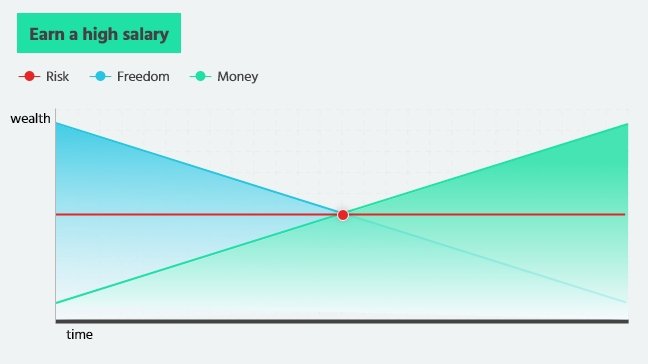

Method 3: earn a high salary

This method to getting rich is to work your fanny off. You can become a partner at Deloitte, for example, and make $355,000 on average (according to Glassdoor). And that’s chump change compared to your bonuses, retirement benefits, and stock options.

However, the path to becoming a partner at Deloitte isn’t short, easy, or even guaranteed. It takes more than a decade of sterling work, plus a chest full of medals and the universal approval of your clients and colleagues.

The sky-high bar for entry is why only out of 113,000 Deloitte employees, fewer than 1,000 ever reach the level of partner.

Attaining a high-salaried position is a surefire way to get rich, but it can be extremely difficult to juggle your work and your needs. In most roles earning $250,000+, you’ll end up trading most of your time and freedom: the two currencies that are the hardest to buy back.

Even getting there can take a lot of time and freedom. All of Glassdoor’s top 25 highest-paying jobs “require many years of advanced education [or] years of experience gained over time.”

Of course, there are plenty of people working high-salaried roles who love their jobs and have a great work-life balance. But it’s not the norm, and getting to that point can take decades.

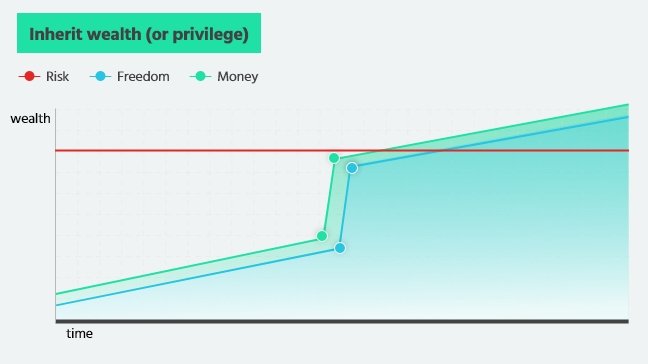

Method 4: inherit wealth (or privilege)

In 2019, when Forbes announced Kylie Jenner as the youngest self-made billionaire ever, we all responded with the world’s largest collective eye-roll.

Sure, she’d built a profitable makeup and modeling empire, and claims that her parents had cut her off at 15, but was she really on an equal footing to the rest of us, as the title implies?

Certainly not, because even if she didn’t inherit cash, she did inherit her parents’ platform, network, and financial guidance; all worth way more than a lump sum.

The Forbes/Kylie Jenner drama serves to highlight a common way the rich get rich and stay rich: through the passing down of cash and assets, but also platforms, privilege, and financial guidance.

You may or may not inherit wealth in the traditional sense, and it’s safer to assume that you won’t. According to CNBC, over 70% of young people expect an inheritance, but only 40% of their parents plan to give one.

But that doesn’t mean inheritance is totally out as a way to get rich. If your folks have done well for themselves, you can ask them for other forms of inheritance, such as advice and connections. For example, if your parents are financially independent, chances are they have a great financial advisor helping them who would gladly have a complimentary planning session with you.

Overall, however, inheritance isn’t really a viable or predictable way to get rich.

What’s next?

Here’s why nobody talks about the easiest way to get rich

Getting rich slowly is the most simple and straightforward way to get rich in this country. So why does nobody talk about it?

Well, here’s my theory:

Getting rich slowly is boring as hell

How would you react to this headline?

“She saved 20% of her income for 30 years, and now she’s rich!”

You’d probably think ummm… duh? And that’s the whole point! Getting rich slowly, the way half of rich people did it, isn’t headline-worthy at all. It’s boring. Martin Scorcese simply isn’t making movies about investors who build wealth over decades of safe investing.

Getting rich slowly isn’t glamorous, either. In fact, most people who look rich are in debt. Those Instagram influencers dangling Bentley keys and Prada bags in their followers’ faces are most likely in deep financial trouble. 96% of YouTubers make under $15k per year, and as one former influencer with 340k followers confessed, “I’ve walked a red carpet with $80 in my bank account.”

“Most people who are actually rich look and act pretty normal,” says Varun. They shop at Publix, drive eight-year-old Acuras, and live in homes just big enough for them and their loved ones. “Rich people don’t buy into the ‘rich people lifestyle’ because it costs money that they’d rather invest.”

There’s nothing wrong with buying fancy things, especially if they support your needs like comfort, health, or esteem. I “invested” in an old Lexus because of its low True Cost to Own®. Likewise, my friend Amanda bought a Burberry coat because it’s well-made, long-lasting, and it simply makes her happy.

But “slow rich” people never feel the need to prove how rich they are. They get rich precisely because they don’t buy into the glamorous lifestyle.

Like vampires, truly rich people are among us, hiding in plain sight. It can be hard, then, to spot one and ask them for advice.

Thankfully, we have Varun and Carol to set us up.

How to get rich without becoming a CEO or winning the lottery

Saving and investing 20% of your income is an essential part of getting rich, but it’s only part of the picture.

“The path to financial independence is like a chair. There are four legs, and if one is too short or missing, the chair topples over.”

So, what are the other three legs to getting rich slowly?

1. “Squeeze the lemon”

As Varun puts it, “squeezing the lemon” is maximizing your existing money through:

- Tax efficiency.

- Patching leaks.

What I’m about to share may sound obvious, but “9 out of 10 people don’t squeeze the lemon, and it needlessly delays their financial goals.”

Tax efficiency

Tax efficiency, not to be confused with tax evasion, is simply making sure you’re not paying more taxes than necessary.

A big part of tax efficiency is filing your taxes accurately and on time. Any tax software that helps you maximize deductions, such as those for Home Office and charitable donations, is great.

Another way to become tax efficient, specific to 1099 folks, is to funnel your income through an LLC. This will slash your self-employment taxes and provide some bankruptcy protection. If you own a business with more than one employee, I recommend consulting with a tax attorney for more ways to be tax-efficient, since there are too many to list here. A phone call could save you thousands.

Lastly, always be sure to take advantage of your various retirement plans offered through employers such as 401(k)s or IRAs and Roth IRAs.

“Many employers offer 401(k) matching and it’s important to at least put enough money in to take advantage of that,” says Varun.

So that’s tax efficiency: simply making sure you’re not giving Uncle Sam freebies.

Patching leaks

Patching leaks involves, quite simply, slashing unnecessary expenses.

As a first step to getting rich, I strongly recommend you consolidate all of your financial information into a single dashboard. Getting a holistic picture of all of your accounts in one place is a huge stress-reliever and helps you find unpleasant “gotchas” like hidden charges and disused subscriptions.

Once you squeeze the lemon to save money, the next step is to multiply it.

2. Save and invest

Thomas C. Corley says the secret to sustainable wealth is “prudent investing.” What exactly does that mean? Are you going to have to get your Series 7 and start trading?

Not at all. In fact, it’s better if you don’t. Prudent investing just means responsible investing, and there’s nothing more responsible than letting a trained professional invest for you.

Carol has never personally traded a stock in her life.

Use a financial advisor

Human financial advisors typically charge a 1% management fee, which includes comprehensive wealth management solutions, soup to nuts. Think guidance on buying or selling a business, retirement planning, education funding help, insurance advice, and estate planning.

Use robo-advisor options

Robo-advisors typically charge 0.30%. The tradeoff is that they may not offer a human touch or personalized financial planning advice. But once you set some goals and risk parameters, they’ll manage your money for you, 24/7, for less.

Whether you opt for a real-life or AI-driven financial advisor, the important thing is that you invest. A pile of money in your checking account is just losing value due to inflation.

If you can’t afford to invest 20% of your paycheck, start with 5% and work your way up. Squeeze the lemon harder and pool that money into your investment accounts.

Invest your credit card rewards

Another great source of investment capital is your credit card rewards points. Oftentimes this is cash you didn’t even realize you had, so you might as well invest it!

A solid, “investor-friendly” card option is the Chase Sapphire Preferred® Card. It offers 5X points on travel purchased through Chase Ultimate Rewards®, 3X points on dining, 2X points on all other travel purchases, so you can quickly accumulate points and dump them straight into your investment account.

Lastly, don’t panic and pull out your investments

Prudent investing isn’t just about putting money in; it’s about leaving it in. When markets dip or accounts lose value, people tend to panic-pull, and it’s almost always a mistake.

Per Varun:

“the most difficult thing to do in investing is disentangling personal emotions from logic and tuning out the media. The so-called pundits will always give you 100 reasons why times have never been scarier and why you shouldn’t be investing and they are usually incorrect. 1968 was a difficult year for our country with the assassination of Martin Luther King, Robert Kennedy, War in Vietnam and the highly contentious election. Since then, we have had wars, 9/11, impeachments, tariffs, COVID 19 more recently and so much more. Despite all of this, the Dow Jones Index marched from 906 in 1968 to 32,000 as of this writing”

Daily market news can challenge your investment discipline. Their messages are often meant to stir anxiety about the future and your finances.

But as Varun says, “successful investors look beyond the headlines, have a long-term approach, and follow certain time-tested principles such as diversification and suitable asset location.”

3. Protect yourself from bankruptcy

Once you’ve begun investing money, it’s time to protect it. You don’t want bankruptcy to saw off a leg on your chair!

Earlier, I mentioned a critical form of bankruptcy protection for self-employed folks: routing payments through an LLC. Having an LLC as a “middleman” is important because it means anyone paying you has to sue the LLC first before suing you personally, reducing your liability.

However, lawsuits aren’t the most common source of bankruptcy in this country. Not even close.

“The #1 source of personal bankruptcy in America medical debt.”

If you can afford it, good health insurance will help insulate you from bankruptcy. But staying healthy itself is a key component of getting rich. Running, meditating, doing yoga, and eating healthy don’t just create happiness – they’re part of getting rich. “Healthy people are less likely to end up in the ER, and they work more effectively and make better decisions.”

4. Enjoy the journey

Varun doesn’t want you to live like a pauper while you slowly get rich. In fact, getting rich slowly should be extremely enjoyable and fulfilling.

But what are rich people spending money on, if not Aston Martins?

“Rich people buy experiences, not things.”

Science overwhelmingly supports the idea that experiences make us happier than things. Plus, they’re often cheaper. That’s why most low-key rich people have come to the same conclusion:

Experiences are a good investment. Remember that happy rich people reinvest their capital into their needs. They realize that experiences provide more freedom, esteem, love, and belonging than most things can, so that’s what they choose to spend on.

Part of what makes experiences such a great investment is that the happiness you glean from experiences is infinitely renewable. Here’s some advice that Varun often offers his clients:

“In 10 years, you’ll remember the time you spent in Hawaii. You’ll remember who you were with, the laughter you shared, the experiences you had. You won’t remember what kind of watch you were wearing.”

Unlike an Aston Martin, experiences are affordable even while you’re getting rich and won’t delay your goals. Even after you put 20% of your paycheck into an investment account, you’ll probably still have enough cash left over for a pair of tickets to that funky new museum or a one-night AirBnB stay in the mountains.

Plus, experiences are less susceptible to hedonic adaptation, which drives our tendency to want to upgrade our things every few years. For example, even if you buy a brand new phone and a fast new car today, eventually you’ll get bored of both and want to pay for an upgrade. But a $20 ticket to a concert will always be fun, and never go out of style.

Even before hedonic adaptation can kick in, Varun warns of another expensive psychological trap many fall into: the Diderot Effect. In his essay “Regrets on Parting with My Old Dressing Gown,” Denis Diderot, an 18th-century French philosopher, describes how his fancy robe made his closet look cheap. So he upgraded his closet, but that made his room look cheap. Upgrading his room made his house look cheap, and before he knew it, he sat bankrupt in a mansion.

Experiences may drive the desire to have more experiences, but they don’t necessarily have to be more expensive ones. Furthermore, those experiences will help grow you as a person, provide companionship, and support your mental health.

Things are awesome, but experiences are a more cost-effective way to feel joy while you accumulate wealth.

“Getting rich slowly won’t feel slow if you’re enjoying the journey.”

Take these steps today to start getting rich

Before I wrap up, what smart moves can you make in the next 30 minutes to start getting rich?

Start unfollowing fake rich people

Fake rich people on Instagram are fun to watch, but they can create FOMO and encourage bad buying decisions. They are “influencers,” after all.

Instead, Varun strongly recommends that you “surround yourself with people who have financial discipline.”

Break the ice with your friends about financial planning, swap advice, and try to cultivate a sphere of positive influence. To prevent awkwardness, talk about how you’re investing, not how much. I have a few friends that I regularly talk to about financial planning, and it helps the process feel social, validating, and fun.

Patch the leaks in your accounts

If you haven’t already, head to your online banking dashboard and spend a few minutes browsing through all of your transactions from the last month. If there are any recurring charges you don’t recognize or don’t need, cancel them.

If you cancel $25 worth of subscriptions today, that’s $10,000 you might’ve wasted over 30 years. If you invest that $25 per month instead, it can create $15,000 in 30 years. That’s a delta in your net worth of $25,000, all accomplished in a few clicks.

Open an investment account

To get rich by investing, you don’t have to pick a single stock yourself. Again, it’s actually better if you don’t. What a wonderful world we live in where “lazy portfolios” exist as one of the best ways to build wealth.

Once you’ve opened an investment account and set goals and risk parameters, your final (but critical) step is to set up monthly auto-deposits of 20% of your paycheck (or however much you can afford).

Then, you’ll start getting rich in your sleep.

Summary

Investing 20% of your income for 30 years is a proven method that roughly half of rich Americans used to achieve financial independence. It’s boring but it works.

If you’re intimidated by the prospect of investing, that’s all the more reason to let a professional do it for you, human or otherwise. You can open an investment account and set up auto deposits in just a few minutes, and your future self will let out a massive sigh of relief when you do.

As you’re making money in your sleep, remember that truly rich people don’t buy into “the rich lifestyle.” Don’t be seduced by designer bags or meme stocks on r/wallstreetbets. If your method of getting rich feels slow and boring, you’re doing it right!

While the method to getting rich slowly might be boring, the journey should be anything but. “Investing” in experiences, passions, and relationships along the way will set you up to be a happy rich person; martyrdom to work is not necessary.

Enjoy the journey, and for more on saving and investing, stick with Money Under 30.