For people who love to travel or who travel often for business, the Capital One VentureOne Rewards Credit Card is designed to help cardholders achieve miles for flights faster.

A sister card to the Capital One Venture Rewards Credit Card, the Capital One VentureOne Rewards Credit Card doesn’t charge an annual fee and provides a smaller bonus, but within easier reach.

This card can be a good entry for travelers, earning 1.25 miles per dollar.

What’s Ahead:

Capital One VentureOne Rewards Credit Card key facts

- Introductory offer: The Capital One VentureOne Rewards Credit Card provides 20,000 bonus miles once you spend $500 on purchases within the first 3 months from account opening

- Unlimited rewards: Earn 1.25 unlimited miles on every purchase.

- APR: Rates for purchases vary at 19.74% - 29.74% (Variable) APR.

- Annual fee: $0

- Best for those with good and excellent credit: This card is offered to those with 700 and higher credit scores.

- Travel benefits: You’ll pay no foreign transaction fees.

- Shopping made easy: Use points to make purchases on Amazon.com for faster rewards.

How many miles can I earn in rewards?

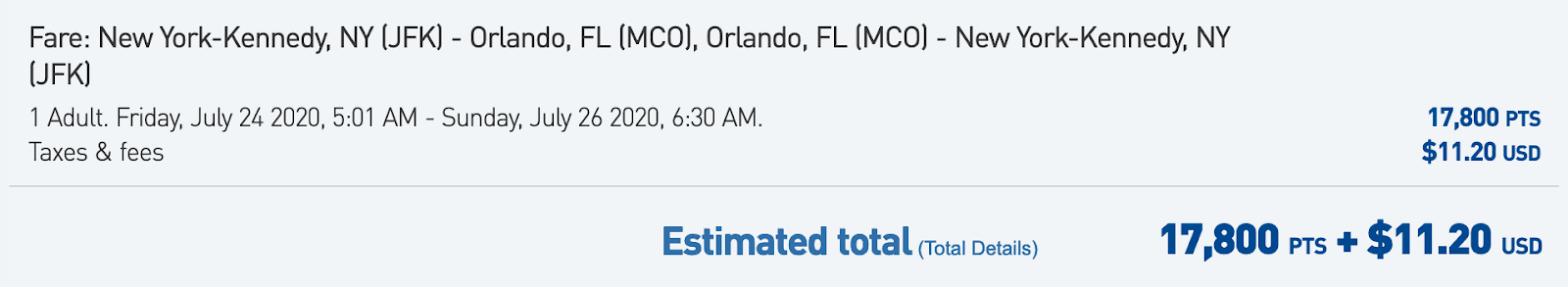

The signup bonus is 20,000 bonus miles once you spend $500 on purchases within the first 3 months from account opening. That’s one of the lowest bonus requirements available. And 20,000 miles is enough to earn you a free flight, such as this example of a flight between New York City and Orlando on partner JetBlue that is less than 20,000 miles roundtrip. This means, if you spend a grand (and $11.20 in fees) and earn a free flight.

Granted, that JetBlue flight would be cheaper than $1,000 but let’s say you spend $2,000 per month. You’ll earn 2,500 miles each month along with the signup bonus, giving you 70,000 miles for the first year you have your Capital One VentureOne Rewards Credit Card.

That’s enough to get you almost three free flights for spending you were already planning to do — not such a bad deal. The following year, the same spending will earn you only 30,000 miles, but it’s still free travel.

Earnings during year one Earnings in subsequent years

Annual fee $0 $0

Sign-up bonus 20,000 bonus miles once you spend $500 on purchases within the first 3 months from account opening N/A

1.25x rewards for spending $2,000 per month 30,000 miles 30,000 miles

Total rewards earnings 70,000 miles 30,000 miles

Other considerations

Although it may not be worth it to use the card for hotel rewards, there are some nice touches the Capital One Venture Rewards Credit Card offers in addition that you may want to consider. For example, cardholders receive roadside assistance for emergencies, such as tire changing, and are covered when renting a car.

Capital One also has its own travel agency, Capital One® Travel. If you use your Capital One Venture Rewards Credit Card to book hotels or rental cars, you will receive 5x the miles per dollar spent. If you’re traveling anyway, try their service and see if you can’t get some extra miles in your account.

Summary

The Capital One VentureOne Rewards Credit Card is a good starting card for rewards travel. This card provides rewards you can actually use without any expiration date on what you earn. You’ll be able to earn free flights and upgrades on spending in every category — you’ll get 1.25 miles on all your purchases. In your first year as a cardholder, you should easily reach 70,000 miles.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.