Fundrise Review: A Low-Cost Introduction to Real Estate Investing

Rating as of based on a review of services March 9, 2023.

Ranking

9/10

Fundrise offers an accessible, affordable path to investing in real estate — an asset class that can help investors diversify their portfolios. But early exit fees make Fundrise a viable option only for those with a long-term investment horizon.

Best for:

- People interested in real estate investing

- Long-term investors

- Investors who don’t have a lot of cash to get started

Now you can earn passive real estate investment income without high fees, hands-on labor, or huge capital reserves. Fundrise is an online investing platform that allows regular, nonaccredited investors — people without millions in the bank — the opportunity to invest in real estate beyond their primary home.

So, let’s dive into what makes Fundrise stand out.

What Is Fundrise?

Founded in 2012 by Ben and Daniel Miller, entrepreneurs from Washington D.C., Fundrise was created with one question in mind: “Why does an investment company have the right to invest but the public doesn’t?” For the Millers, it was time to even the playing field and give communities the right to invest in themselves.

Their online platform, which has a minimum investment of just $10, allows non-accredited investors to buy into Fundrise properties without paying exorbitant fees or commissions.

Pros & Cons

Pros

- Low investment minimum — You don’t need millions (or even thousands) to start, just $10.

- Diversify your portfolio — Fundrise allows you to expand beyond simple stocks and bonds.

- Easy to get started — The Fundrise website is simple and easy to use.

Cons

- Long term — Don’t expect to dip in and out with this method. Realistically, you'll be stuck investing for five years or more.

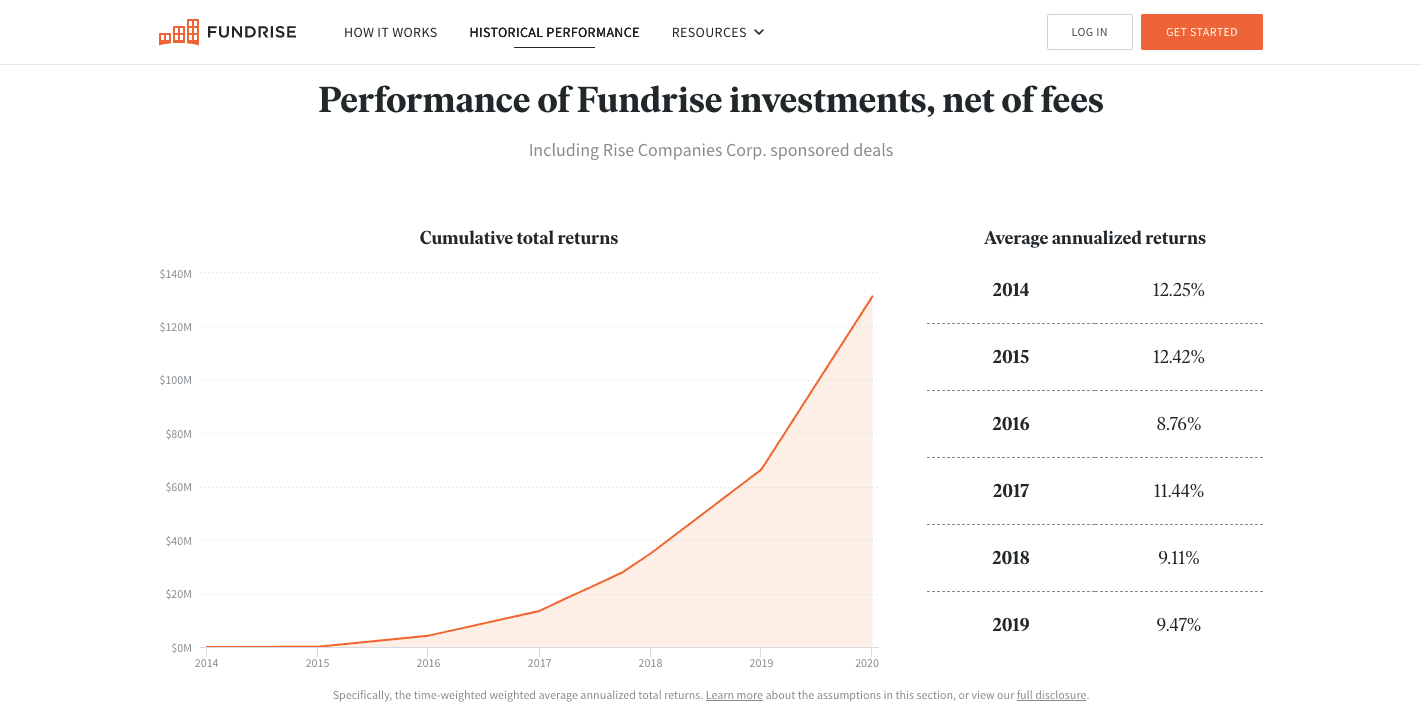

- Investment risk — Past performance doesn’t guarantee future results, and crowdfunding makes looking at performance over time tricky.

How Does Fundrise Work?

Fundrise makes loans to buyers of commercial real estate — such as apartment and office buildings — and bundles those loans into investments, called eREITs. These are Fundrise’s proprietary version of real estate investment trusts. Fundrise then sells shares of the eREITs to the investing public through their website.

Read more: Everything You Need to Know About Investing in REITs

You use the Fundrise app or website to select a portfolio of property investments that reflects your goals and desired strategy. Like any other online shoppers, investors can browse through different eREITs until they find one they like.

All you need is a free account, which is easy to sign up for. Fundrise asks for your country of residence, and you’ll need a Social Security number to complete your setup.

When you find an investment you want to invest in, all it takes is a couple of clicks and you’ve entered the real estate business. Fundrise has one of the lowest minimum investment requirements ($10) among the various crowdfunded real estate startups.

In the past, only accredited investors (people who are worth at least $1 million or who make at least $200,000 a year) were allowed to participate in the real estate market, but the Jumpstart Our Business Startups Act of 2012 allows stock to be sold to the general public, including both accredited and non-accredited investors, over crowdfunding sites.

Once you’ve invested, you make money typically from quarterly payments (these are taxed as income), but each property differs in length and returns.

Unaccredited Investors Are Still Limited in the Investment World

Fundrise may open up the world of real estate investment to a larger group of people, but for some, they still can’t offer much.

If you’re an unaccredited investor, you have only three public offerings to choose from. This is because most real estate companies that work with Fundrise opt to use Regulation D Rule 506, which, in the simplest terms, means that only accredited investors can invest in their property for security reasons.

Accredited investors, on the other hand, have the opportunity to take advantage of the $10 minimum and can invest in many different projects instead of putting a large chunk of money into just one.

How Does Fundrise Make Money?

Fundrise has an honorable goal in trying to make real estate investing more accessible to the general public. But business isn’t just built on good intentions. And although Fundrise gives you control over certain aspects of your portfolio, they still have one middleman — themselves.

Fundrise does cut costs by allowing you to manage your own portfolio, but they don’t cut out intermediaries entirely. And as with other investment platforms, with Fundrise you need to pay special attention to fees, which can eat into your returns.

Fundrise Fees

Fundrise’s fees help pay their fund managers, who keep track of Fundrise’s investments and, in doing so, make sure your investments are safe.

Investment Advisory Fee

You’ll pay a 0.15% annual investment advisory fee, which covers the professional advisory service baked into the platform.

Asset Management Fee

For the funds in Fundrise’s standard portfolios, you’ll pay an annual asset management fee of 0.85%.

Fundrise’s investment advisory and asset management fees total 1%, so for every $10,000 invested, you’d pay $100 in fees. Hopefully, your returns exceed 1% or you wouldn’t make any money on your investments.

Fundrise Features

Fundrise is a little different from other investing platforms in several ways.

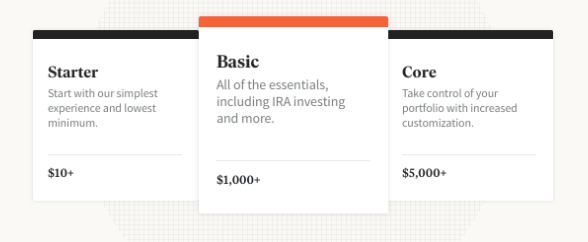

Account Levels

Your account level is determined by how much you invest and it’s separate from your plan. The five investment levels are:

- Starter: $10

- Basic: $1,000

- Core: $5,000

- Advanced: $10,000

- Premium: $100,000

Each account level offers a different set of features. Starter includes auto-investing, quarterly liquidation, Investor Goals, and bonus shares, but only the option to invest in the Flagship Real Estate Fund. Premium includes everything Fundrise has to offer and the option to invest in any real estate fund.

If you want to upgrade to a higher level, you can increase your investment and move up without paying any additional fees.

Low Investing Minimums

Fundrise requires a low investment minimum of just $10 for the Starter account level, which makes it very accessible for the average investor.

No Accreditation Required

You don’t have to be a big real estate developer with millions in the bank in order to start earning returns on real estate investments. Fundrise opens that door to “regular” people who are willing to put in the work to research their options but don’t have a ton of cash lying around.

Diversified Portfolios

Your investment dollars fund diversified portfolios at Fundrise, whose team is constantly searching for and evaluating new properties. New assets are added to existing portfolios, with the intention of strengthening them and balancing risk.

Transparency

Since Fundrise’s focus is real estate, it’s hugely important that the company is transparent with its investors. That’s why they offer info on their investment strategy, risk tolerance, and timeline given current market conditions.

Fundrise discloses what you can expect from the company and its advisory fees are clearly expressed (although other costs may surface depending on investment).

My Experience Using Fundrise

I appreciate the dedication to transparency you see at Fundrise, and their website and investor dashboard are clean, clear, and easy to use. It’s a relief to be able to invest smaller amounts of money, and the fact that you don’t need to be an accredited investor is a huge plus.

They also provide a lot of investor education, which I think is important for new investors. It’s still critical that you do your research, though, both inside and outside the platform, so that you know exactly what you’re getting into and can forecast some trends out to the five and 10-year marks at least.

Who Should Use Fundrise?

Long-Term Investors

You’ll want to have a long-term outlook if you choose to invest with Fundrise. Real estate, while it can provide attractive returns, requires time to become profitable, so you’ll have to be patient while you wait for values to appreciate. This is especially true during abrupt economic downturns, when Fundrise may suspend redemptions.

DIY Investors

Are you ready to research? Fundrise is better suited for investors who aren’t afraid to roll up their sleeves before diving in. You should know what you’re getting into before committing for the long term. Fundrise provides a lot of information about its properties, plus investor education, to help you as you learn.

Who Should Not Use Fundrise?

Investors Without Any Margin

By this, I mean you should not use Fundrise if you can’t afford to lose your investment. Real estate investing as a whole is inherently risky. Crowdfunding adds even more potential risk as investors on crowdfunding sites typically aren’t real estate tycoons, and come from more modest means.

Returns are not guaranteed, and since real estate investing depends on so many interconnecting factors, you should be prepared for unexpected short-term drops in the values of your investments.

Risk-Averse Investors

Outcome predictions are just that — predictions. How much money you’ll get back is based on past performance, and in the crowdfunding world, which is still new, there simply isn’t enough of a history to provide an accurate picture of what might happen.

Maybe inflation will increase the rent and, in turn, the business costs and investors will be left paying larger fees. Or maybe the project will fail altogether and interest in the property will be low. This may be unlikely, but not impossible.

Remember to always proceed with caution when you consider investing in real estate. The past doesn’t always predict the future.

Fundrise vs. Streitwise vs. Crowdstreet

Fundrise isn’t the only real-estate-focused investment platform. How does it stack up to its competitors?

Fundrise Streitwise CrowdStreet

Investment minimums $10 $5,000 Varies; usually $25,000 and up

Costs and fees 1% in fees 2% asset management fee Fees may be charged by project sponsors

Investment options eREITs/eFunds Non-traded REITs Varies; direct and indirect

Support E-mail Online support, live chat Online support, live chat

Streitwise

Streitwise is focused pretty exclusively on non-traded REITs (meaning REITs you can’t find on the New York Stock Exchange, for example).

Streitwise is focused pretty exclusively on non-traded REITs (meaning REITs you can’t find on the New York Stock Exchange, for example).

They promise 2% in total advisory fees and a minimum investment of $5,000. Like Fundrise, Streitwise permits unaccredited investors — but it is NOT a crowdfunded site, so your returns may be a little easier to predict. And speaking of returns, their historical average return is a whopping 9.3%!

Streitwise is open to international investors, as well as trusts, LLCs, and IRAs. You can even fund your investments using Bitcoin or Ethereum. With an iOS app, you can keep an eye on your real estate portfolio from wherever you are.

Learn more by reading our complete Streitwise review.

CrowdStreet

CrowdStreet, on the other hand, is aimed toward more experienced and higher net worth investors, with minimums that range from $25,000 to $100,000 depending on the investment.

CrowdStreet, on the other hand, is aimed toward more experienced and higher net worth investors, with minimums that range from $25,000 to $100,000 depending on the investment.

You must be an accredited investor to use the platform. Their investment options range beyond the REITs and eREITs of the other two companies to include direct investment in property, making them one of the largest and most diverse commercial real estate marketplaces.

Learn more by reading our full Crowdstreet review.

Summary

If you’re looking for an investment opportunity that allows you to manage your own investments at a low cost and you happen to be in the financial position to take on some risk, as well as potential rewards of real estate investing and crowdfunding, then Fundrise could be the perfect platform for you.

On Fundrise’s website, you can enter your email address to immediately explore available investment opportunities.

Visit Fundrise to learn more about their real estate investing platform.