FNBO Direct Review: My Experience Using FNBO

Rating as of based on a review of services January 27, 2023.

Ranking

9/10

FNBO Direct allows its customers to easily manage their money online. With attractive accounts, this could be your banking solution.

Best for:

- Online banking

- High APY

- Tech-savy customers

No one loves a bank with lots of fees and cumbersome platforms. But most of us choose to stay at traditional banks that offer little in the way of friendly customer service with very few rewards.

Luckily, it doesn’t have to stay that way forever since banks like FNBO Direct are available to provide a user-friendly platform with a reliable history.

FNBO Direct offers solid banking products in an easy-to-use platform. If you are looking for a reliable bank for your financial future, FNBO Direct could be the perfect bank for you.

I will dive into the details of the FNBO Direct products to see how they could help you improve your finances.

What is FNBO Direct?

FNBO Direct is an online-only bank that is a part of the First National Bank of Omaha. Although FNBO Direct was founded in 2006, the First National Bank of Omaha has been open for over 160 years. Currently, has over 5,000 employees and $24 billion in assets.

With the backing of a solid financial institution that has been around for over 160 years, you can breathe easy when trusting your money with FNBO Direct. In fact, the bank was ranked as one of the Best Banks in American in 2020 by Forbes.

How does FNBO Direct work?

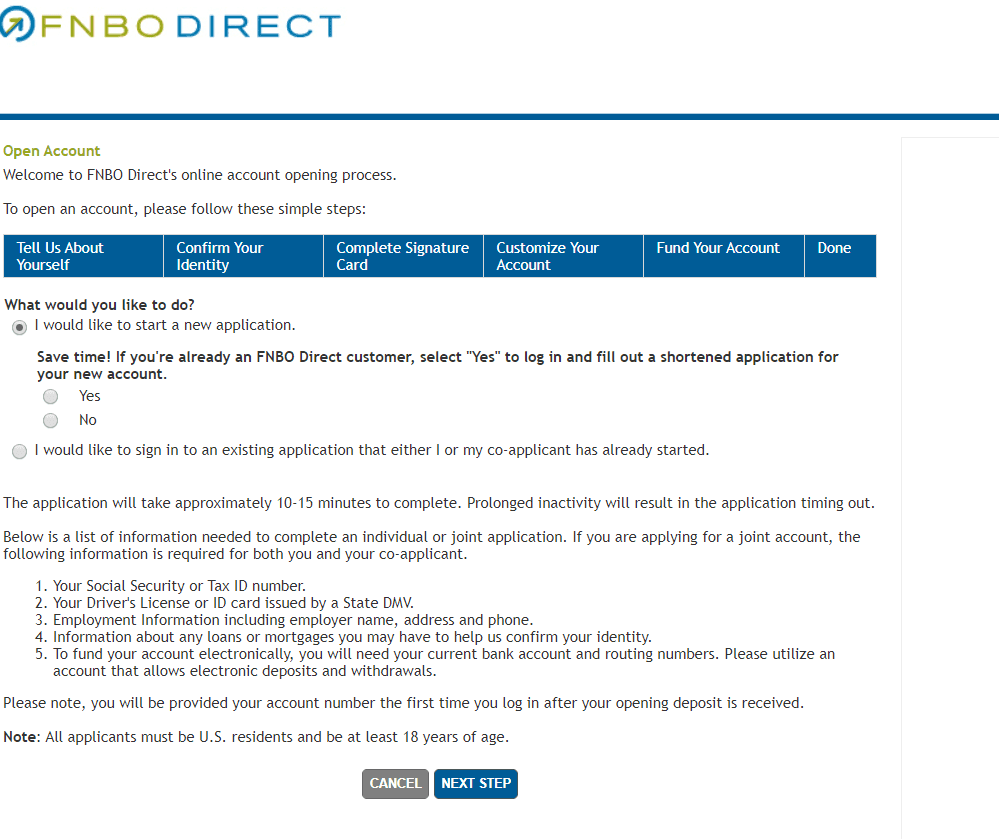

If you are interested in working with FNBO Direct, then you’ll need to open an account online. The process is completed entirely through FNBO Direct’s website. It should only take 10 to 15 minutes to complete the entire application.

Please note that you will need to be at least 18 years old in order for your application to be approved.

Once you start your application, you will be asked for a variety of personal and financial information. Make sure to have this information on hand:

- Social Security Number or Tax ID number.

- Driver’s license.

- Employer information.

- Current information on any loans you have.

- Current bank account information to fund your account.

You will be asked to provide this information, complete a signature card, customize your account, and fund your account. For the best possible experience, collect this information before starting your application. Although you can return to finish your application later, it may feel more manageable if you complete it in one sitting.

Once you complete these steps, you will be able to move forward as an FNBO Direct banking customer. You’ll be able to take advantage of their banking features right away. You’ll be able to get started with as little as $1 to open an account.

How much does FNBO Direct cost?

It doesn’t cost anything to open an account FNBO Direct! However, there are some fees associated with actions you might take in your account.

For example, you might be subject to late fees which can add up. Make sure to follow the rules of your account to avoid any unnecessary costs.

FNBO Direct features

FNBO Direct offers a variety of banking products. The bank also offers CDs and IRAs to help you build your savings. However, the checking and savings accounts offered by FNBO Direct are the most exciting.

Online savings account

In terms of online savings accounts, FNBO Direct offers a high-yield savings account with attractive rates. When you open an online saving account with FNBO Direct, you can start with as little as $1. After your account is open, you will not need to worry about monthly fees or maintaining a minimum balance.

With online and mobile banking, you’ll have the ability to manage your account on the go. Plus, direct deposit and digital payments will allow you to easily manage your money.

Currently, the account offers 0.40% APY. Although that may vary, this account is known for maintaining a high yield over time.

Online checking account

FNBO Direct offers an online checking account with many useful features that will allow you to manage your bills and grow your savings. With this account, you will not be subject to any monthly service fees. However, you will have access to BillPay and account alerts to help you manage your money efficiently.

When you sign up for this account, you will receive a free FNBO Direct Visa Debit Card to handle your purchasing needs. Plus, you’ll have access to over two million ATMs to avoid mounting ATM fees.

Digital payments

FNBO Direct gives you access to several types of digital payments. That can make your life simpler when you are attempting to pay for something on the go.

You’ll be able to use Apple Pay, Visa SRC, and Samsung Pay seamlessly with your FNBO accounts.

Person-to-person access

You can send money directly to a friend easily with your FNBO Direct accounts via Popmoney. Whether you need to split the rent or split the check, you’ll be able to do so without finding cash or writing a check.

CDs

CDs, or certificates of deposit can be a useful way to grow your money intentionally. FNBO Direct offers CDs with competitive APYs. With that, you’ll be able to use FNBO Direct’s account to continue growing your savings.

FNBO Direct’s CDs offer guaranteed earnings and automatic renewal for your savings goals to continue on autopilot.

My experience researching FNBO Direct

FNBO Direct is very straightforward with its banking information. In writing this review, I was able to find most of the information I needed in an easily accessible place. Although I also read through the fine print, I found that the bank truly offers most of the important information directly on the user-friendly website.

Additionally, when I called customer service to clarify a few details, they were very helpful. The wait time to talk to a real person was under a few minutes and the representative was ready and willing to assist me.

Overall, my interaction with FNBO Direct was very positive. As I consider switching my personal accounts from a large brand-name bank, FNBO Direct is definitely in the running for my business.

Who is FNBO Direct best for?

If you prefer to manage your money online, then FNBO Direct offers many useful features. With an easy-to-use platform, you will be able to manage your finances effortlessly through FNBO Direct.

As you get a handle on your finances, you will start to appreciate the many features this bank has to offer.

Who shouldn’t use FNBO Direct?

If you prefer an in-person banking experience, then FNBO Direct is not a good option for you. Although they offer customer service, they do not offer in-person assistance. The products offered by FNBO Direct are top of the line, but without physical branches, the bank may lack what you are looking for.

Pros & cons

Pros

- Large ATM network — With over two million ATMs in their network, you should be able to avoid ATM fees easily.

- No monthly fees — No one enjoys fees in their banking experience. FNBO Direct takes the monthly fees out of banking.

- High yields — The savings account offered by FNBO Direct offers competitive rates for anyone looking to grow their savings.

Cons

- No physical locations — If you want an in-person experience, FNBO Direct will not be able to help you.

- High overdraft fee — Although there are no monthly fees, high overdraft fees could upset your financial plans.

FNBO Direct vs the competition

Let’s take a closer look at how FNBO Direct stacks up against the competition.

| FBNO Direct | HSBC | Chime | |

|---|---|---|---|

| High-yield savings account rates | 0.40% | 0.15% | 2.00% |

| Physical location | No | No | No |

| Banking products | Savings, checking, CDs, 529 accounts | Savings, checking, CDs, debit cards, international banking | Savings, checking, Chime Credit Builder |

HSBC

HSBC offers similar features for its customers in terms of online savings accounts. However, their APY is generally higher. If you want to maximize the earnings of your savings account, then HSBC could be the best option.

Additionally, if you are considering depositing your money in a CD, HSBC tends to offer higher APYs. If the goal is to increase your funds quickly, then HSBC also might be the better option.

Chime®

Unlike FNBO, Chime is a relatively new bank.* In fact, it was founded in 2014! Since opening, Chime has proven itself as a bank that can keep up with modern banking needs, like automatic savings and a dedicated credit building account. Not to mention, its streamlined mobile platform makes banking on the go not only possible but also simple.

Unlike FNBO, Chime is a relatively new bank.* In fact, it was founded in 2014! Since opening, Chime has proven itself as a bank that can keep up with modern banking needs, like automatic savings and a dedicated credit building account. Not to mention, its streamlined mobile platform makes banking on the go not only possible but also simple.

Best of all, Chime is not only able to keep up with the times, but it can also help you save money. By offering an entirely fee-free experience,2 account holders are able to bank without the worry of losing money due to hidden bank fees.

* Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC.

2 There’s no fee for the Chime Savings Account. Cash withdrawal and Third-party fees may apply to Chime Checking Accounts. You must have a Chime Checking Account to open a Chime Savings Account.

Summary

If you are looking for an effortless way to manage your money online, then FNBO Direct offers a solution. With great rates and an easy-to-use online platform, it is hard to go wrong with FNBO Direct.