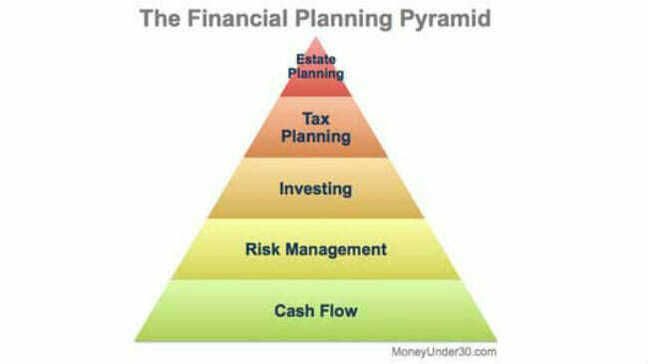

Proper financial planning takes into account the whole picture and not just a piece. Saving for retirement might be your current goal, but if you don’t have a plan for emergencies, that goal can get derailed in a second and and kill any dreams of sipping margaritas on the beach. Enter the Financial Planning Pyramid.

As you work on your finances, think of building your wealth as a pyramid. A good financial plan builds upon a solid foundation and enables you to reach your goals even in the face of life’s uncertainties.

Here, we’ll take a look at the five levels of the Financial Planning Pyramid, starting at the bottom.

1. Cash flow

In order to develop a comprehensive financial plan, you need to start with the most basic of needs – cash flow. If your income doesn’t exceed your expenses, it’s impossible to save for the future. It seems like a no-brainer, but this can be the most difficult part of the planning process. Even millionaires need to reassess cash flow from time to time.

Ensuring positive cash flow means working with a budget, trimming expenses and perhaps increasing your income. It’s hard work, but it’s so critical, it forms the base of the Financial Planning Pyramid upon which all else is built.

An honest assessment of what you spend each month is a vital part of a quarterly financial check up (you do this, right?) in order to get an accurate picture of how much you can invest. Even something as simple as $50 a month can amount to a significant sum.

Once you’re settled into a good balance of paying bills and investing, you’ll want to protect what you’ve built. The first defense you’ll want to set in place is an emergency savings account. This should be a savings account apart from your regular bank to which you transfer a few dollars every week or month — for years, Capital One 360 has been a favorite of Money Under 30 readers.

How much is enough? Financial advisors suggest saving between three and six months’ worth of expenses, but you can use your own judgment. If you’re self-employed or have a variable income, you may want to consider saving more than six months.

2. Risk management

The other part of the protection piece is managing risk. Insurance is hardly the most exciting part of planning, but it’s essential that you have the proper safety net in place to catch you in the event of an unforeseen catastrophe. So important, in fact, it’s the second level of the Financial Planning Pyramid. Health insurance, auto insurance and homeowner’s insurance all serve to protect you from facing catastrophic out-of-pocket expenses in the event of a loss.

Life insurance should be set up to replace income for enough time that a surviving spouse can make arrangements so he or she isn’t forced to sell your house or claim bankruptcy. Another consideration to keep in mind is the fact that more people end up disabled than dead; it may be worth your while to check into long-term disability policies.

3. Investing

We should all save for retirement, but if you’re savvy, you’ll also invest money for other goals, too: buying car, a home, or funding your kids’ college expenses. You’ll want to keep these savings goals independent from your retirement goals.

An online investing account is the perfect way to begin setting aside money for these life goals.

Paying off debt is essentially an investment, too. Rather than accumulating interest-bearing assets you’re eliminating interest-charging liabilities. Prioritizing debt repayment and investing for other goals is one of the most nuanced (and personal) financial decision you’ll have to make. That said, the important thing to remember is that any investment or debt payment increases your net worth, so doing something is better than doing nothing!

Retirement planning is usually the sole focus for most of you, but you can already see how it’s just one part of a bigger puzzle. Investing for retirement should take into account your 401(k) or 403(b), IRA, and any other retirement package you may have available. You can consult online calculators like this one to help you determine what you need to put into a retirement account in order to reach a specific goal.

A good rule of thumb is that you need to save 25 times your desired retirement income. This assumes a 4 percent annual withdrawal rate. So for example, if you hope to withdraw $50,000 a year in retirement, you’ll need to save $1.25 million. Keep in mind, also, that inflation means $50,000 will not go nearly as far in 30 years as it does today. So the more you can save, the better.

4. Tax planning

Tax planning goes hand-in-hand with retirement saving as well considering the tax advantages of 401(k)s and IRAs, but depending on your income level, you may want to make a plan for other investments as well. Some types of investments like municipal bonds allow you to avoid paying taxes on your gains. Once you accumulate a five-figure portfolio in retirement investments, consulting a tax advisor is a good idea.

5. Estate planning

On top of the pyramid is estate planning. Although it’s not something most people need to worry about until you get closer to retirement, you should at least familiarize yourself with how it works. This stage involves how you want your assets passed on to heirs or given to charity. Trusts can be used to carry out your plans much more efficiently than probate, your state’s legal process for executing your estate in the absence of an estate plan.

At a minimum, everyone’s estate plan should include a will that spells out basic wishes and bequests. Should you also own your own business, a proper plan for succession should also be set in place, just in case.

How are you doing? What level of the Financial Planning Pyramid are you on?