Fabric by Gerber Life Review: My Experience Using Fabric by Gerber Life

Rating as of based on a review of services October 27, 2022.

Ranking

8/10

Fabric by Gerber Life provides term life in 42 states. Quotes are available after taking a 10-minute questionnaire on a sleek and easy-to-use website.

Best for:

- Term life insurance

- People under age 44

There is nothing like “adulting” when you’ve left behind the single life and have started a family. With more people to care for, you may be wondering about life insurance. And, this is smart. If something were to happen to you, would your spouse be left with the burden of carrying two debts? What about a child if you were suddenly gone?

A variety of companies are aiming to make life insurance easier to understand, as well as easier to obtain. Fabric by Gerber Life is a direct-to-consumer provider offering such services. The company acts as a managing general agency, which means you can enroll for life insurance directly through Fabric by Gerber Life.

Is Fabric by Gerber Life right for you and your family? Here’s a look.

What Is Fabric by Gerber Life?

Fabric by Gerber Life was launched by parents for parents to help set up life insurance you need now that there is another member of your family to think about. It provides estate planning and wills, as well, to help make sure your little ones are cared for in the event you cannot be there in the future.

Founded in Brooklyn, New York, in 2017, the website aims to make it easier for parents to organize their financial lives.

How Does Insuring With Fabric by Gerber Life Work?

As a managing general agency, everything you need to enroll in life insurance is done entirely through Fabric by Gerber Life and can be done through the website.

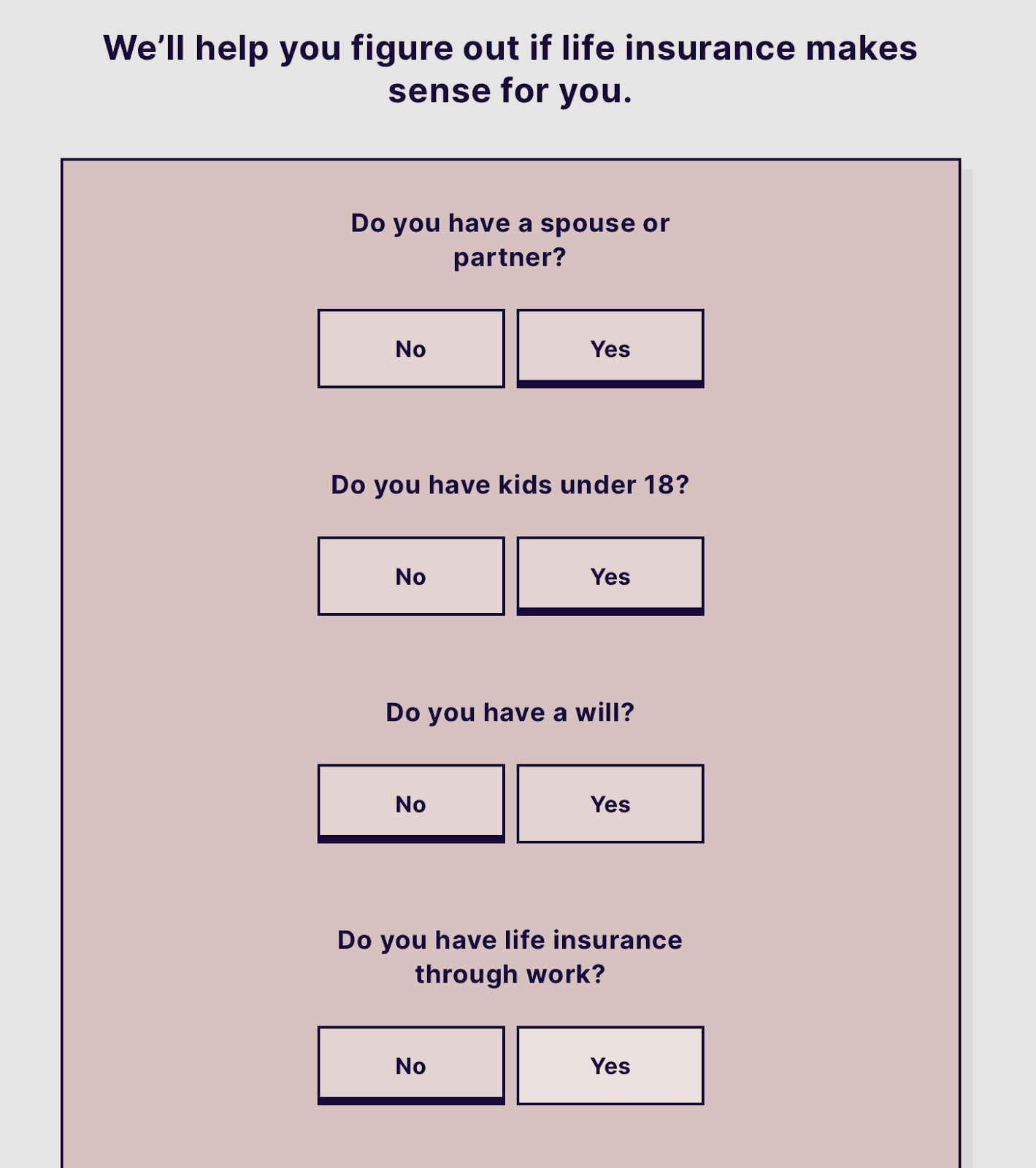

For term life insurance, start by answering a few basic questions, such as are you married, do you have life insurance through work, do you have children under the age of 18 at home, do you have student loan or credit card debt, and do you have a will.

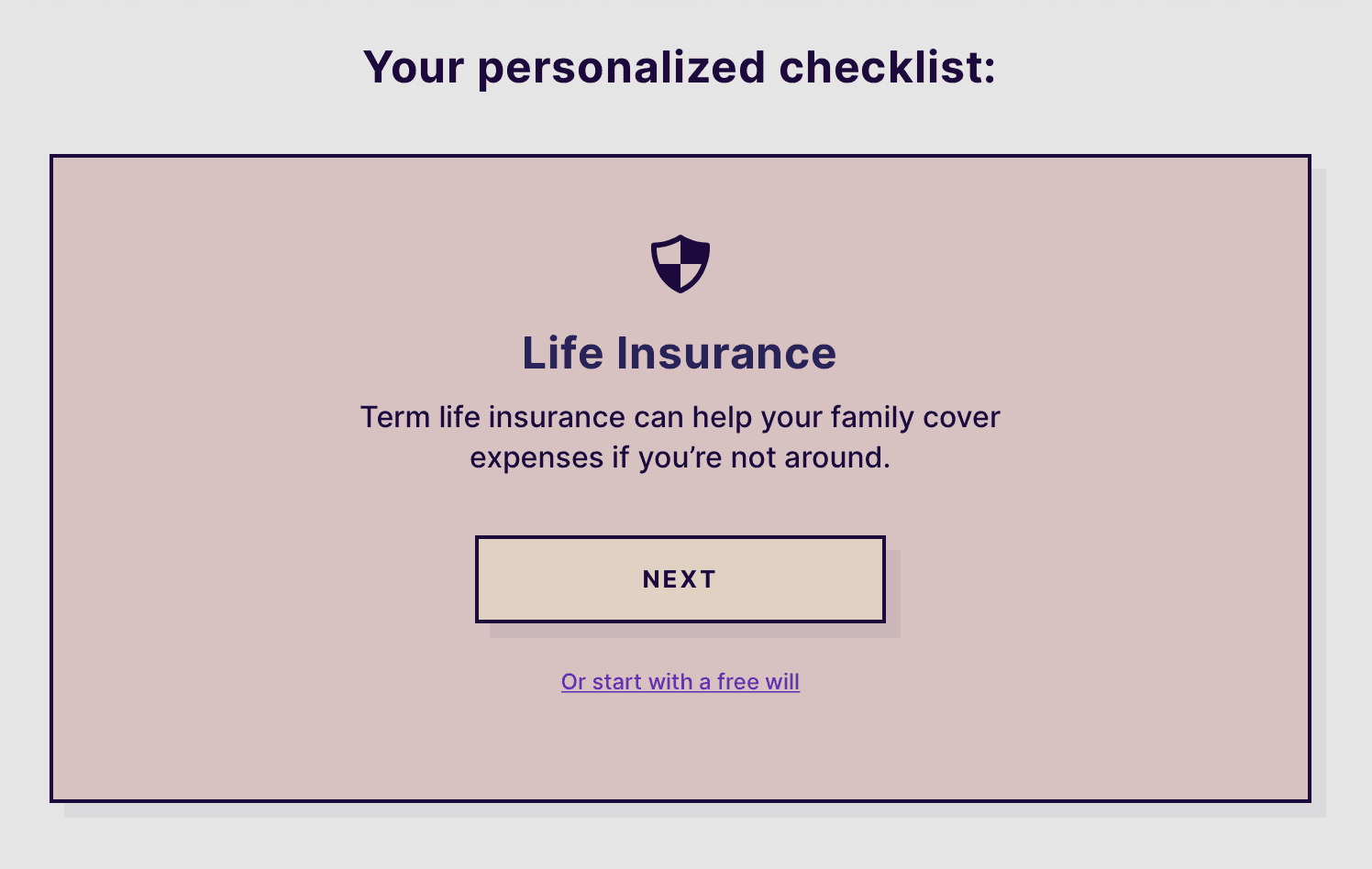

Once you answer the questions, Fabric by Gerber Life provides a “personalized checklist:” recommendations of what you need.

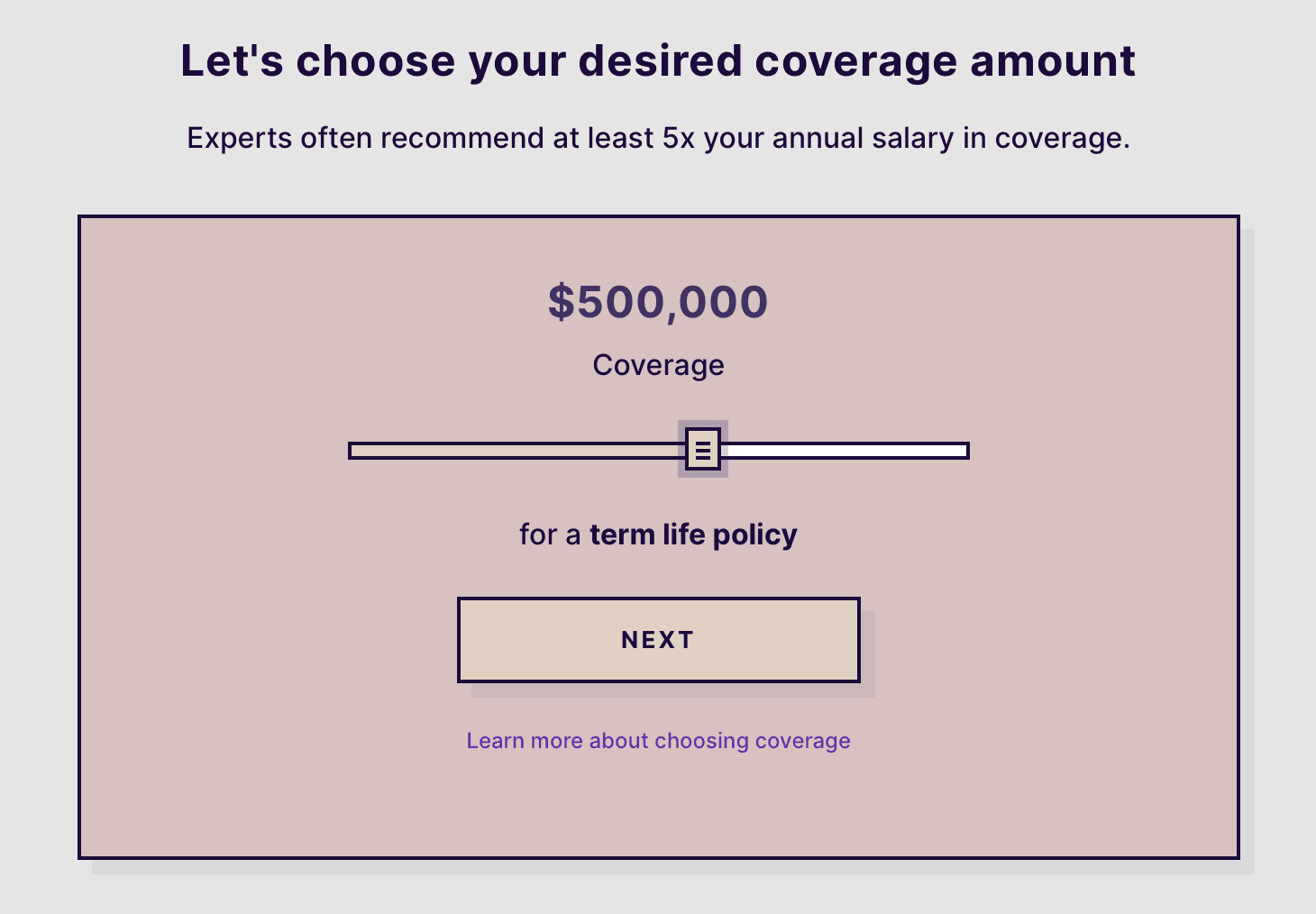

Next, Fabric by Gerber Life helps you calculate term life policy coverage up to $5 million dollars. Fabric by Gerber Life offers advice on how to calculate your needs based on your mortgage, debts, college tuition, and your health.

Once you select your amount, Fabric by Gerber Life asks for your age and state, then runs you through a series of questions about your lifestyle.

If you have had health issues, Fabric by Gerber Life will also easily walk you through various types that may affect your pricing, able to review hundreds of different issues you may be experiencing to ensure your quote will match your needs.

Related: How Life Insurance Works: What to Know About Buying a Policy

How Much Does Fabric by Gerber Life Cost?

When it comes to life insurance, there are many variables in determining costs, such as your state, age, and health. For Fabric by Gerber Life, they categorize customers under rate classes, which are:

- Ultra Select – This is for those in excellent health and no family history of bad health, who have not used tobacco in five years and who lead a low-risk lifestyle. This class receives the best rates.

- Select Plus – This is for those in very good health and good family history of health, who have not used tobacco in three years and who lead a low-risk lifestyle.

- Select – This is for those in good health and good family history of health, who have not used tobacco in two years and who lead a low-risk lifestyle.

- Standard – This is for those in acceptable health and acceptable family history, who have not used tobacco in one year and who lead a moderate-risk lifestyle.

- Tobacco User – This is for those in acceptable health and family history of health, who have used tobacco in the last year and who lead a moderate-risk lifestyle.

Fabric by Gerber Life Features

Why should you consider Fabric by Gerber Life for your life insurance? The company is simple: It works with one insurance company and, even then, only offers policies that help policyholders take care of their loved ones in the event of their deaths. Fabric by Gerber Life offers policies issued by Western-Southern Life Assurance Company, a Western & Southern company (with a heritage dating back to 1888), rated “A+” (“Superior”) for financial strength by A.M. Best.

Also, Fabric by Gerber Life recently announced several new product features, including no-exam eligibility for up to $1.5 million in term life insurance coverage, the addition of 25 and 30-year length terms options, and an increase in no exam allowance until age 60.

Here are the key features of the company:

Direct-to-Consumer

Fabric by Gerber Life is providing a direct-to-consumer model. You will be buying insurance from your computer. The good thing about this is by skipping an insurance agent, the insurance company is saving money and passing those savings off to you, its consumer.

Term Life Insurance

Term life is a policy that works well for young parents, as it has an end date. Often, parents select a 20- to 30-year term life insurance policy that ensures their children are provided for in case of an untimely death before the child has completed school. The policies end when children are self-sufficient and no longer in need of care.

These plans also are good for new parents because they are cheaper than whole life policies.

Related: Term Life vs. Whole Life Insurance: Which Should You Choose?

Last Will and Testament

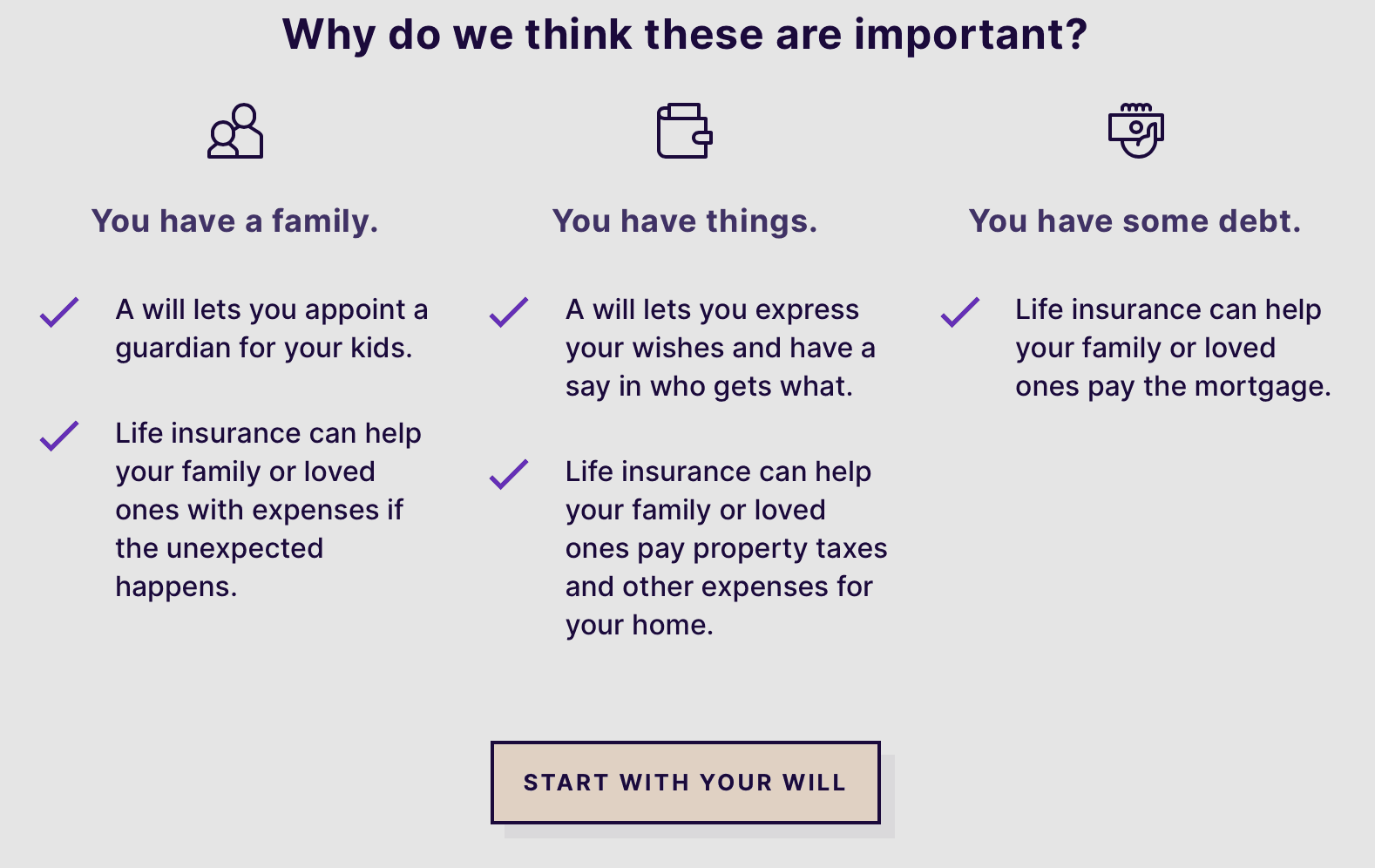

Although not insurance, Fabric by Gerber Life also provides a quick and easy will that is recommended for parents. A will makes sure that your wishes for your child are specified, down to who should be deemed legal guardian should anything happen to you.

My Experience With Fabric by Gerber Life

While it started easily enough to answer questions for a quote, Fabric by Gerber Life got very detailed, asking for doctors, addresses, additional policy numbers, and the like. It can be a pain when you’re trying to get a general idea on pricing, but then again, all of the details do help them give an accurate quote so you won’t be surprised when you are ready to make it official.

On the other hand, if you are ready to buy life insurance today — in 10 minutes you are done and, barring any health issues, may receive an offer on the spot.

But it would be nice if there was just a simple estimate that didn’t require a full log-in to receive.

Who Is Fabric by Gerber Life Best For?

New Parents

You may be overwhelmed by all of the things you need to do when you have a new baby, but Fabric by Gerber Life makes it very easy to get coverage, fast!

Related: When Do You Need To Buy Life Insurance?

Who Is Fabric by Gerber Life Not Ideal For?

Someone With a Pre-Existing Condition

It is more difficult to be approved for term life insurance without an in-person health exam.

Residents of California, New York, South Dakota, North Dakota, South Carolina, Wisconsin, Montana and Florida

These states are not eligible for Fabric by Gerber Life’s services.

Pros & Cons

Pros

- Easy-to-complete online — The application for insurance or a will is very easy to use and thoroughly sleek in design.

- High coverage — Fabric by Gerber Life can provide up to $5 million in coverage.

Cons

- Sub-standard rates — For heavy smokers, those with pre-existing illnesses and/or a family history of illnesses, sub-standard rates are available, but it is not what Fabric by Gerber Life specializes in. You won’t find good rates offered if you do qualify.

- Not available nationwide — Fabric by Gerber Life is not available in California, New York, South Dakota, North Dakota, South Carolina, Wisconsin, Montana and Florida

Fabric by Gerber Life vs. Competitors

Fabric by Gerber Life and other direct-to-consumer online companies are relatively comparable. These rates for a 20- to 25-year-old woman (non-smoker) are just an example of starting rates found between Fabric by Gerber Life and like providers.

Company Policies Coverage Ages Availability

Fabric by Gerber Life 10, 15, 20, 25, or 30 year terms $100,000 to

$5 million

21 to 60 Not available for residents of CA, NY, SD, ND, SC, WI, MT and FL

Bestow 10, 15, 20, 25, or 30 year terms $50,000 to

$1.5 million

21 to 55 Not available for residents of NY

Ethos 10-, 15-, 20- and 30-year term life $25,000 to

$10 million

18 to 75 Not available for residents of NY

Haven 10-, 15-, 20-, 25-, and 30-year term life $250,000 to

$3 million

20 to 64 Available in every state

Bestow

Bestow also 100% online and provides term life coverage. The company offers 10, 15, 20, 25, or 30-year terms between $50,000 and $1.5 million. While Fabric by Gerber Life doesn’t offer the shortest term, it does provide the opportunity to ensure more — up to $5 million.

Bestow also 100% online and provides term life coverage. The company offers 10, 15, 20, 25, or 30-year terms between $50,000 and $1.5 million. While Fabric by Gerber Life doesn’t offer the shortest term, it does provide the opportunity to ensure more — up to $5 million.

Bestow does not require any medical exams, however, this means you could be denied if you do not meet qualifications – just like all life insurance companies. Bestow offers products issued by one insurance provider: North American Company for Life and Health Insurance®. Bestow is available in all states with the exception of New York.

Ethos

Ethos is an online platform that lets you compare and review multiple life insurance options with one application. This aggregator can help you find both whole and term life insurance policies from a number of top providers including Legal & General America, TruStage®, Ameritas Life Insurance Corp, and more.

Ethos is an online platform that lets you compare and review multiple life insurance options with one application. This aggregator can help you find both whole and term life insurance policies from a number of top providers including Legal & General America, TruStage®, Ameritas Life Insurance Corp, and more.

For term life insurance, Ethos offers between $20,000 and $2 million in coverage with term lengths of 10, 15, 20, and 30 years. Like Fabric by Gerber Life, Ethos does not require you to submit a medical exam when applying (applies for less than $1 million of coverage for Ethos). Ethos could be a good option for you if you have had trouble getting approved for life insurance in the past because there are so many different companies and policies to choose from.

Learn more about Ethos or read our full Ethos review.

Haven Life

Working exclusively through renowned carrier MassMutual, you can find 10-, 15-, 20-, 25-, and 30-year term policies from $250,000 to $3 million with Haven Life.

Working exclusively through renowned carrier MassMutual, you can find 10-, 15-, 20-, 25-, and 30-year term policies from $250,000 to $3 million with Haven Life.

Unlike Bestow, you may need a medical exam to qualify (but that’s normal when it comes to getting health insurance).

Coverage through Haven is available for ages 20 to 64. Unlike Fabric by Gerber Life, Haven is available in all 50 states.

Summary

I found Fabric by Gerber Life to be an easy-to-use tool to get life insurance quickly, although I was concerned about the lack of reviews available on the company, as well as its insurance carrier.

Still, it is backed by its parent company, one of the oldest insurance companies in the country. Particularly helpful are the free wills to complete estate planning.