CIT Savings Builder account review: A high-yield account that encourages you to save

Rating as of based on a review of services February 28, 2023.

Ranking

9.5/10

The CIT Savings Builder account offers up to 1.00% APY for those with a balance of $25,000 or those who make a $100 deposit each month. You’ll also pay no monthly fees, and have a small minimum deposit requirement.

Best for:

- High APY

- High account balance

- Fast savings

When you visit the sites of any savings accounts, chances are, in big bold letters somewhere on the first half of the front page, they’ll post the APY they offer. While many of these accounts offer interest that far surpasses your local bank, not every bank backs up this high APY with reliable features that you actually need.

Today, we’ll find out if CIT, and one of their accounts — the CIT Savings Builder — offers these features. To start out, it’s good to know that they do offer a fairly generous APY of up to 1.00%.

About CIT and the CIT Savings Builder

- Minimum balance requirement: $100 opening deposit, but none after that

- APY: 1.00% when you have a balance of $25,000 or deposit at least $100 each month, See details here.

- Fees: None

CIT is a great bank for a lot of reasons. For one thing, they have tons of experience (a century of it, in fact). They also currently hold over $100 billion in assets, making them one of the largest banks in the U.S.

What I personally find impressive is that CIT makes sure their customers know they are invested in their community. CIT employees volunteer throughout the year and they focus on helping the underserved in Southern California. With so many banking options out there to choose from, it’s nice to see a large corporation that gives something back.

Pros & Cons of the CIT Savings Builder

Pros

- An APY on the higher side — The CIT Savings Builder offers a 1.00% APY on accounts with a minimum balance of $25,000, or on accounts that deposit $100 per month into their account.

- Multiple ways to earn high interest — You can earn 1.00% APY by having a high minimum balance of $25,000 or by depositing $100 a month into your account, making it a more approachable option for those looking to simply put a little something aside each month.

- Helpful resources — CIT has a very helpful resources page that offers calculators, a FAQs page, and more detailed info about CIT products.

Cons

- $100 minimum to open an account — To open a CIT Savings Builder account, you need to have a minimum deposit of $100. There are plenty of other options that require no minimum at all.

- Lower tier APY isn't as competitive — You need to maintain a balance of $25,000 or make a $100 deposit each month to get the 1.00% APY. If you can't meet these requirements, you'll earn a base tier rate.

- Poor customer service — CIT Bank doesn't have the greatest customer service reviews. Customers complain that it often takes well over 20 minutes to speak to a representative.

CIT Savings Builder Features

Earn 1.00% APY a Few Different Ways

The CIT Savings Builder offers two ways you can earn the 1.00% APY. If you can save enough to have an account balance of $25,000 or more, you’ll earn the 1.00%.

The other, more practical way for most, is to make a $100 single deposit per month. See details here.

CIT Offers Two APY Tiers

Most folks don’t have $25,000 sitting around, and not all of us can dedicate $100 every month towards a savings account (although, you absolutely should if you can). Luckily, CIT offers a decent bottom tier for those who can’t meet the minimum requirements for the top APY.

Their base tier rate of 0.40% (if the requirements for the higher tier aren’t met) is still significantly better than the APY traditional banks and credit unions offer.

No Maintenance Fees and Free Bank Transfers

Yes, there is a minimum of $100 to open an account, but there are no other fees associated with the CIT Savings Builder account.

CIT also offers free bank transfers to any account (inside the U.S.), not just their own checking and savings accounts.

Resources

CIT has a helpful resources page that can help you learn how much you can save with their account, understand the nitty gritty details of the CIT account, and answer the most common questions customers have.

Their calculators can help you determine how much you need to be saving to reach your goals:

- CD Calculator – You can determine how much you can earn with CIT’s CDs.

- Savings Account Calculator – You can determine how much you can earn with CIT’s Savings Builder.

How to Open a CIT Savings Builder Account

It’s easy to open a CIT Savings Builder account. I’ll take you through the first few steps to give you a sense of how easy it really is.

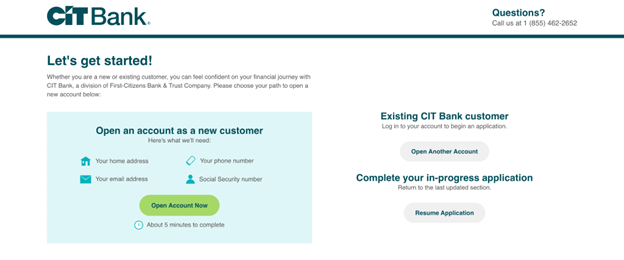

After you click “Open Account” in the right-hand corner of the CIT Bank homepage, you’ll be led to the following screen:

Source: CIT, screengrab by author

Right away, CIT tells you it’ll take about 5 to 10 minutes to open an account. Much appreciated. Start by selecting one of the options above. For the purpose of this review, I opened an account as a new customer.

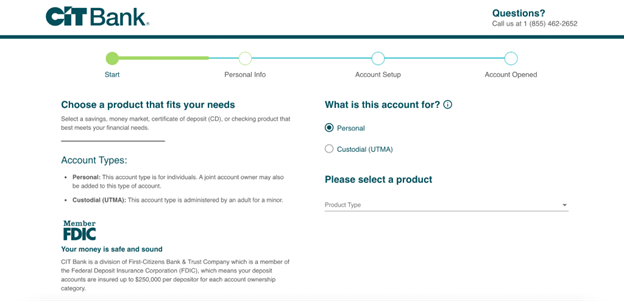

Source: CIT, screengrab by author

You can choose between a personal account and an account for your child. I went with personal. You’ll also select a product from the dropdown menu (for the CIT Savings Builder, select “Savings & Money Market”).

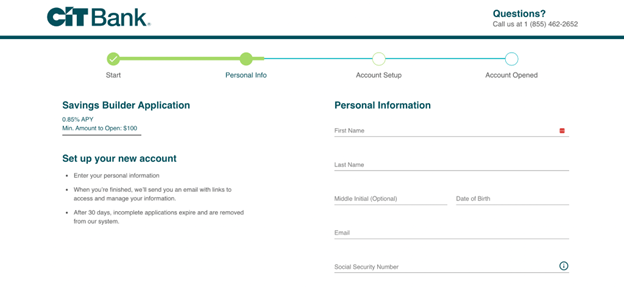

Source: CIT, screengrab by author

Finally, CIT starts asking for your personal details.

They’ll ask:

- Your name

- Your email

- Your Social Security number

- Your mother’s maiden name

The rest of the application involves reviewing your personal and bank information, then making your first deposit. These steps should only take a few more minutes.

CIT Savings Builder vs. CIT Savings Connect

The Savings Builder isn’t the only savings account CIT offers. Now, CIT offers the very impressive Savings Connect account. With just a $100 minimum deposit, you could earn 4.60% APY. This account also comes with no fees, a helpful mobile app, and a quick sign-up process.

It seems that for most bankers, the Savings Connect account is the better choice. Still, the Savings Builder stacks up as a worthy competitor for those looking to encourage themselves to start a savings habit, since you’ll need to deposit at least $100 each month to earn the higher APY. See details here.

Who Should Use the CIT Savings Builder Account?

Those Who Can Maintain a High Balance

Those who maintain a balance of at least $25,000 earn the top rate (1.00% APY). That means the CIT Savings Builder is best for those who earn enough to keep this balance.

Those Looking to Bulk Up Their Emergency Funds

Online savings accounts offer high yields, which is exactly why they’re perfect for storing your emergency fund. CIT is no different. They offer up to a 1.00% APY, which can equal hundreds or thousands in extra money over the years.

Read more: Emergency Funds – Everything You Need to Know

Those Who Want to Do Most of Their Banking at CIT

CIT doesn’t just off the CIT Savings Builder account. They also offer a Money Market Account, CDs, and home loans.

Additionally, CIT even has an interest-bearing eChecking account. You can earn 0.25% with a minimum balance of $25,000. Those with less in their account will earn 0.10%. See details here.

Money Market Account

You’ll earn 1.55% APY, and you’ll need a $100 minimum to open your account. See details here.

The Money Market Account is similar to the Savings Builder. It offers:

- Easy access to your funds

- No monthly service fees

- 24/7 secure banking

- FDIC insured

- Deposit checks remotely and make transfers with the CIT Bank mobile app

CDs

CIT offers three different kinds of CDs. See details here.

- Term CDs — You’ll need to have $1,000 minimum to open an account.

- No-penalty, 11-month CD — You’ll need $1,000 minimum to open an account.

- Jumbo CDs — You can choose from two, three, four, and five-year terms. You’ll need $100,000 minimum to open an account.

Home Loans

CIT offers decent home loans. They have many payment options, including 10-, 15-, 20-, 25-, or 30-year loan terms.

CIT also offers many different mortgage types, including FHA, Fannie Mae mortgages, and exclusive bank portfolio programs (for well-qualified borrowers).

eChecking

With eChecking you’ll earn 0.10% APY or up to 0.25% if you meet minimum requirements. Additionally, you’ll get the following features:

- Debit card with EMV chip technology

- Ability to easily transfer money through Zelle®, Bill Pay, Samsung Pay, and Apple Pay

- Mobile check deposits

- Up to $30 in outside banks’ ATM fees, reimbursed each month

The CIT Savings Builder vs. Other Savings Accounts

The CIT Savings Builder offers a healthy APY, but it still may not be the best account for you. Maybe you don’t want to maintain a high balance, or maybe you don’t want have to remember to deposit $100 each month. There’s some stiff competition out there, even for a good account option like the CIT Savings Builder.

Discover Online Savings Account

- APY: 3.90%

- Minimum account opening amount: None

- Fees: None

Discover’s Online Savings Account offers a 3.90% APY, immediately putting it ahead of the CIT Savings Builder. But it also beats CIT’s opening deposit requirement, which is nothing. Discover also offers no minimum account balance needed, and you won’t pay any monthly fees!

Plus, where Discover really pulls ahead is in their customer service. Discover offers some of the best customer service according to their customers.

Read our full Discover Online Savings review.

Capital One 360

- APY: 3.00%

- Minimum account opening amount: None

- Fees: None

Like Discover, the Capital One 360 pulls ahead of CIT in their APY offering. You’ll earn 3.00% on your daily balance, with no minimum required to open the account and no monthly fees to pay.

Capital One also holds their own against CIT, offering a beautiful mobile app, easy account transfers, and mobile check deposit. Where Capital One really stands out, though, is in their automatic savings options. You can open up to 25 savings accounts for your different savings goals and manage them all from one app or dashboard.

Read our full Capital One 360 Savings review.

Ally Bank

- APY: 2.50%

- Minimum account opening amount: None

- Fees: None

Yet another worthy competitor, Ally offers a 2.50% APY on their savings account.

There are no minimum balance requirements and no fees associated with the account either. Plus, Ally has adopted Capital One’s method, allowing you set multiple savings goals and set money aside for each of them. You can even set an end date for your goal so you can see your progress.

Ally offers one final stand-out feature worth mentioning that CIT and many other banks don’t. They call it their Suprising Savings feature. You simply link your checking account to Ally and their algorithms see if you have the room to set aside extra savings. If you do, it’ll be automatically moved to your Ally savings account.

Summary

The CIT Savings Builder offers a fairly high APY compared to some other online savings banks. The 1.00% APY can be earned in two ways:

- By maintaining a balance of $25,000 or more; or

- By depositing $100 each month.

For those who want to save fast, the $100 deposit requirement is a great way to force you to save.

CIT Bank. Member FDIC.Featured image: Nattakorn_Maneerat/Shutterstock.com