Capital One SavorOne Cash Rewards Credit Card Review: Is this cash back card worth it?

Rating as of Aug. 17, 2022 based on a review of services May 16, 2023.

- Good/

- Excellent

Foodies will love that the Capital One SavorOne offers unlimited 3% cash back on restaurants and grocery stores. Plus, you’ll enjoy that same 3% rate on entertainment and select streaming services. However, you’ll need to look elsewhere if you want a card that offers strong bonus rewards outside of these categories, as the SavorOne only gives 1% back on all other purchases.

-

Easily attainable, one-time $200 cash bonus after spending $1,000 in the first three months

-

3% cash back on dining, entertainment, popular streaming services, and grocery stores (excluding superstores like Walmart® and Target®) — with no limit to the rewards you earn.

-

No annual fee or foreign transaction fees, helping you keep costs as low as possible.

- Earn a one-time $200 cash bonus after you spend $1,000 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won't expire for the life of the account and there's no limit to how much you can earn

- 0% intro APR on purchases and balance transfers for 15 months; 19.74% - 29.74% variable APR after that; 3% fee on the amounts transferred within the first 15 months

- No foreign transaction fee

- No annual fee

For Millennials and Gen Z’ers with an active lifestyle, the SavorOne is easily one of the best cash back cards on the market, offering 3% cash back rewards on dining, entertainment, popular streaming services, and grocery stores — and all for no annual fee. Not to mention, cardholders even receive access to Capital One Dining and Capital One Entertainment for dibs on exclusive restaurant reservations and dining experiences, as well as tickets to top sporting events, concerts, and more.

In summary, there’s a lot to love about this card. Let’s do a deeper dive into the features and benefits of the Capital One SavorOne Cash Rewards Credit Card to assess if this is the best card for you.

Key features

- Cash back rewards. Earn 3% on dining, entertainment, popular streaming services, and grocery stores; 1% on all other eligible purchases.

- Sign-up bonus. $200 cash bonus after you spend $1,000 on purchases within the first 3 months from account opening.

- Introductory APR. Lengthy 0% intro APR on purchases and balance transfers for for 15 months, with a 3% fee on amounts transferred.

- Annual fee. $0

- No foreign transaction fees. Capital One waives fees when you pay in a foreign currency.

- Access to Capital One Dining and Capital One Entertainment. Get your hands on even more exclusive restaurants and experiences

Taking a closer look at the Capital One SavorOne Card

Cash back rates

Capital One SavorOne cardholders will earn an unlimited 3% cash back in four key spending categories:

- Dining, including restaurants, bars, and cafes

- Entertainment, such as movie theaters, sports tickets, and amusement parks

- Popular streaming services, such as Netflix, Hulu, and Disney+

- Grocery stores (excludes Walmart, Target, or superstores like Costco or Sam’s Club)

On purchases that fall outside of these bonus categories, you’ll earn 1% cash back.

Read more: Best cash back cards

Redeeming rewards

You can track your cash back rewards balance in your Capital One account. It’s easy to select from several redemption options, whether that’s a direct deposit, statement credit, gift cards, travel, PayPal, Amazon.com, etc.

There’s no minimum redemption amount, either. You can cash out your rewards once you’ve accrued $2 or $200 — it’s entirely up to you how you want to redeem.

Finally, by keeping your credit card account open with Capital One, your rewards will never expire.

Welcome offer

New applicants who apply for the Capital One SavorOne will earn a $200 cash bonus after you spend $1,000 on purchases within the first 3 months from account opening. This welcome offer is a great way to boost your rewards from the jump and is on par with other no-annual-fee, cash back cards out there.

Much like the rewards you’ll earn on an ongoing basis, you can elect to redeem your welcome offer however you please.

Read more: Best credit card welcome offers

APR

For the first for 15 months after your account is opened, there’s a 0% intro APR on purchases and balance transfers (19.74% - 29.74% (Variable) APR afterwards).

If you currently have debt on other credit cards, you can execute a balance transfer to take advantage of the Capital One SavorOne’s 0% intro APR in this period of for 15 months. However, a 3% fee of the amount transferred will apply.

Read more: Best 0% APR credit cards

Other fees and interest rates

If you miss payments or don’t pay your statement in full, here are the fees you’ll want to be aware of.

- Balance transfer fee: 3% of the amount of each transferred balance that posts to your account during the first for 15 months that your account is open. After the first for 15 months, there is no balance transfer fee.

- Balance transfer APR: 0% introductory APR for the first for 15 months that your account is open. After that, your APR will be 19.74% - 29.74% (Variable), depending on your creditworthiness.

- Cash advance APR: 29.74% (Variable)

- Cash advance fee: 3% of the amount of the cash advance, but not less than $3

- Late fee: Up to $40.

However, these fees are entirely avoidable if you are diligent about managing your finances and avoid using the SavorOne to get cash at the ATM.

Other benefits

All Capital One cardholders — including those with the SavorOne — get access to three of the issuer’s online platforms:

- Capital One Dining: Book hard-to-find reservations and once-in-a-lifetime restaurant experiences.

- Capital One Entertainment: Find tickets to sporting events, concerts, shows, and more in a city near you.

- Capital One Travel: Search for the lowest price for flights, hotels, and rental cars.

Pros & cons

Pros

- Sizable welcome offer for new applicants — You can earn a $200 cash bonus after you spend $1,000 on purchases within the first 3 months from account opening.

- Bonus categories great for foodies — Earning 3% cash back on restaurants and groceries has all your bases covered when it comes to grub.

- Redeem rewards your way — You don’t have to wait to accrue a minimum amount of cash back until you can unlock your rewards. When it comes time to spend your rewards, the SavorOne offers tons of redemption options for cash back, entertainment, travel and more.

Cons

- 1% cash back on non-bonus purchases — While the Capital One SavorOne’s bonus categories cover a lot of ground, any other purchase will only accrue 1% cash back.

- Grocery store bonus excludes superstores — For those who frequently shop for groceries at Costco, Walmart, Target, and other superstores, you’ll only earn 1% cash back (rather than 3%).

- You’ll need an excellent credit score to qualify — According to Capital One, those with excellent credit have never declared bankruptcy or defaulted on a loan, haven’t been more than 60 days late on a payment in the last year, and currently have a loan or credit card for at least three years with a credit limit above $5,000.

Capital One SavorOne Card vs. Capital One Savor Rewards Card

If you’re intrigued by the Capital One SavorOne card, you may also want to consider its older brother, the Capital One Savor Cash Rewards Credit Card.

| Capital One SavorOne Cash Rewards Credit Card | Capital One Savor Cash Rewards Credit Card | |

|---|---|---|

| Credit required | Excellent, Good | Excellent |

| Annual fee | $0 | See terms |

| Intro APR | 0% intro APR on purchases and balance transfers for the first for 15 months of account opening (19.74% - 29.74% (Variable) APR afterwards) | None |

| Regular APR | 19.74% - 29.74% (Variable), based on your creditworthiness | See terms |

| Signup bonus | $200 cash bonus after you spend $1,000 on purchases within the first 3 months from account opening. | $300 after spending $3,000 or more in the first three months of account opening (subject to availability) |

| Rewards | 3% cash back on dining, entertainment, popular streaming services, and grocery stores (excluding superstores like Walmart® and Target®); 1% back on all other purchases | 4% cash back on dining, entertainment, and popular streaming services; 3% back on grocery stores (excluding superstores like Walmart® and Target®); 1% cash back on all other purchases |

| Perks and benefits | Extended Warranty, Travel Accident Insurance, No Foreign Transaction Fees | Extended Warranty, Travel Accident Insurance, No Foreign Transaction Fees |

The Savor offers greater cash back potential than the SavorOne in the long run. However, it also comes with a $95 annual fee.

Additionally, new applicants of the Savor will earn $300 cash back after $3,000 or more spent in the first three months of account opening. While the Savor comes with a bigger payout, the minimum spend requirement is much higher.

Wondering if the Savor is worth the $95 annual fee? If you expect to spend $9,500 (or more) on dining, entertainment, and popular streaming services in a year, the annual fee on the Savor becomes worth it for the greater 4% earning potential (1% higher than the SavorOne in those spending categories).

Read more: Should you ever pay a credit card annual fee?

Who should apply for the Capital One SavorOne Card?

The SavorOne is a terrific no-annual-fee card for those with busy lifestyles. It’s an especially compelling card if you live in a big city with tons of events, as the SavorOne will help you earn and redeem rewards for tickets and experiences.

Ultimately, you should estimate your average spending habits each month. It helps to know roughly where your money goes. If your top spend categories are groceries and restaurants, the SavorOne is truly one of the best cash back cards to help maximize that spend.

Read more: How to choose a cash back credit card

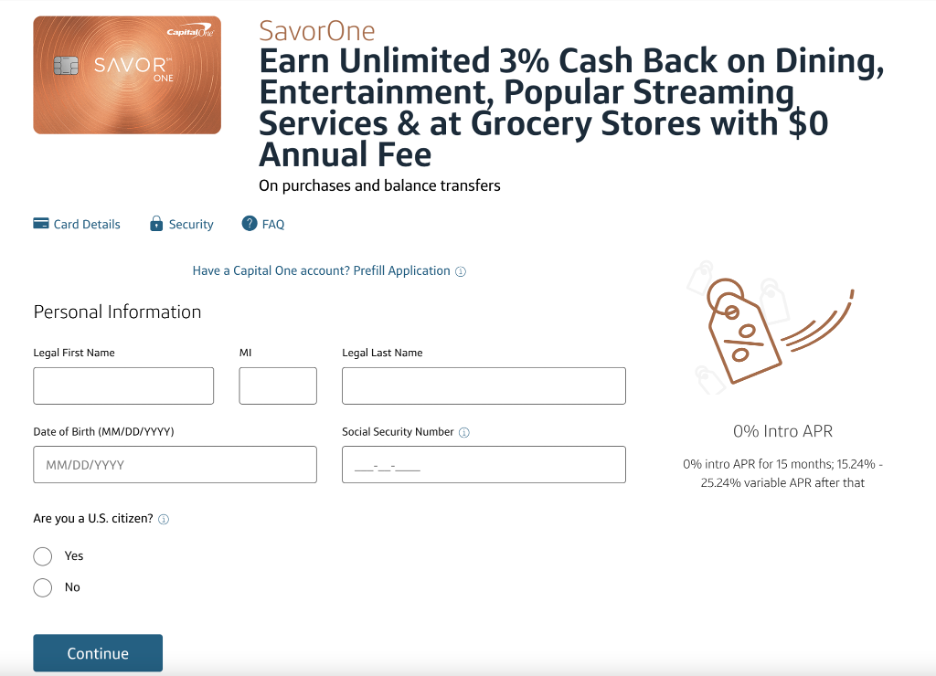

How to apply for the Capital One SavorOne Card

If you’re ready to apply for the Capital One SavorOne, you’ll want to gather the necessary information. The first step of the application will ask for your name, date of birth, Social Security Number, and U.S. citizenship status.

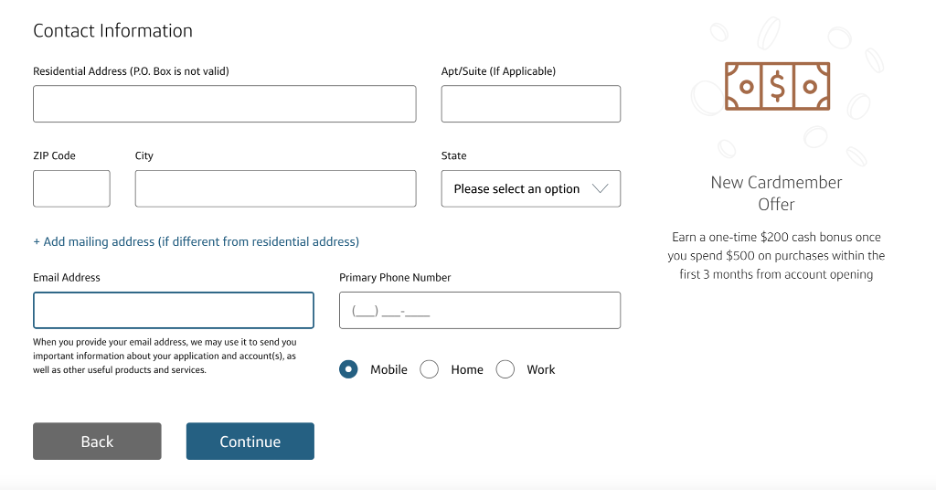

Then, you’ll need to provide your contact information, including your home address, phone number, and email address.

Finally, the application will ask for your financial picture, including your employment status and monthly income. Once you press submit, Capital One will analyze the data provided to approve or deny you. In some instances, the issuer cannot provide an instant outcome and may need more time to come to a decision.

FAQs

How does cash back work for the Capital One SavorOne?

When you use your credit card for a purchase within the SavorOne’s bonus categories, you’ll earn unlimited 3% cash back. However, merchants are assigned a category code. If the code does not fall under the card’s four bonus categories — dining, entertainment, popular streaming services, and grocery stores — then you won’t earn at the 3% rewards rate. Still, you’ll earn 1% cash back on non-bonus purchases.

How to redeem Capital One SavorOne rewards?

On your Capital One online account, you’ll find your statement balance and earned rewards. You can redeem your cash back at any time (and for any amount) for more than a handful of options, whether that’s for a statement credit or toward gift cards. Rewards never expire as long as you keep your credit card open and in good standing.

What are the Capital One SavorOne’s terms for balance transfers?

The Capital One SavorOne offers a 0% intro APR for purchases and balance transfers in the first for 15 months of account opening. During this period, a 3% balance transfer fee will still apply. After the introductory period, there’s a balance transfer APR of 19.74% - 29.74% (Variable) (based on your creditworthiness), but no balance transfer fee.

Summary

The Capital One SavorOne allows you to earn 3% cash back rewards while you’re out on the town, making it one of the top no-annual-fee options available. It’s a particularly good card for those in their 20s to 30s thanks to its lucrative rewards potential without an annual fee.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.