Capital One Quicksilver Student Cash Rewards Credit Card review: Earn 1.5% cash back, no annual fee, and build credit

Rating as of Feb. 23, 2023 based on a review of services March 9, 2023.

- Fair

Students will love the simplicity of this cash back credit card from Capital One. Earn an unlimited 1.5% cash back on every purchase, every day, and your rewards won’t expire for the life of the account. Plus there’s no annual fee, foreign transaction fees, or other hidden fees to worry about.

-

Early Spend Bonus: Earn $50 when you spend $100 in the first three months

-

Earn unlimited 1.5% cash back on every purchase, every day

-

Enjoy no annual fee, foreign transaction fees, or hidden fees

- Earn unlimited 1.5% cash back on every purchase, every day

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Lock your card in the Capital One Mobile app if it's misplaced, lost or stolen

- Earn up to $500 a year by referring friends and family when they're approved for a Capital One credit card

- Build your credit with responsible card use

- Whether you're at a 4-year university, community college or other higher education institution, this card might be an option for you

The Capital One Quicksilver Student Cash Rewards Credit Card is a solid choice for students but lacks a bit of firepower to be considered a strong all-around card.

An all-rounder credit card for students would offer:

- Low interest rates.

- Debt protection and credit-building tools.

- Cash back rewards.

- One or two perks.

But curiously, the Capital One QuickSilver Student Cash Rewards Credit Card skips right over letters A and B, and instead piles on C and D.

Cardholders seeking a simple earning structure will like this card, as it offers a generous 1.5% cash back on all purchases, with no annual fee to worry about.

Overall, it all depends on what you’re looking for in your first credit card.

Key facts

- Best for – Students building credit.

- Signup bonus – Earn $50 when you spend $100 on purchases within 3 months from account opening

- Cash back – Unlimited 1.5% cash back on every purchase.

- Intro APR – N/A.

- Regular APR – 19.74% - 29.74% (Variable).

- Perks and unique features – Extended Warranty, Master RoadAssist® Service® with 24-hour dispatch, Complimentary Concierge Service.

(MU30 disclaimer: the information on perks and unique features was independently gathered and reviewed by MU30’s editorial team.)

In-depth analysis of the Capital One Quicksilver Student Cash Rewards Credit Card

Let’s take a deep dive into the Capital One Quicksilver Student Cash Rewards Credit Card.

Rewards

The Capital One Quicksilver Student Cash Rewards Credit Card offers 1.5% cash back on all purchases, every day.

That’s it. Clean and simple.

At first, the lack of rotating spending categories with 5% cash back may seem stodgy, but you’ll be hard-pressed to find a good student credit card that offers 5% back on anything.

And offering a blanket 1.5% cash back on everything has its advantages, too.

- First of all, it means that as a busy student, you won’t have to keep track of constantly rotating rewards categories. I’ve personally felt a mix of frustration and FOMO when I forget that I could’ve gotten 5% back on a big purchase if I’d just remembered to time the purchase right.

- Second, credit card companies don’t offer 5% cash back out of the goodness of their collective hearts. They’re trying to encourage spending — which isn’t necessarily a bad thing, but it is problematic when you’re a student who’s trying to stick to a budget, build credit, and resist impulsive spending.

That’s why the Capital One Quicksilver Student Cash Rewards Credit Card’s 1.5% cash back on all purchases is such a good fit for students — it manages to be highly rewarding without encouraging non-essential purchases.

Bonuses

For a limited time, the Capital One Quicksilver Student Cash Rewards Credit Card is offering an easy-to-earn signup bonus of $50 when you spend $100 on purchases within 3 months from account opening.

APR

Depending on your creditworthiness, the Capital One Quicksilver Student Cash Rewards Credit Card’s APR could be its biggest drawback.

The card charges 19.74% - 29.74% (Variable) APR on all purchases. Now, if you’ve got a great credit record and can snag the lower APR, you’re doing well. But if you’re just starting out on your credit score journey, it’s likely you’ll be paying the higher APR.

If you’re new to credit card APR, here’s how it works.

Let’s say you place $1,000 worth of charges on your card and are unable to pay it back after 30 days (though you wouldn’t do that because you know that you should pay off your credit card balance in full every month). Here’s how to calculate how much interest you’ll owe (assuming you’re at the top end of their variable APR):

- Divide your APR by 365, so 0.2524 / 365 = 0.00069.

- Multiply by your balance, so 0.069 x $1,000 = $0.69.

- Multiply by days in your billing cycle, so $0.74 x 30 = $20.75.

$20.75 may not sound like much, but credit card debt can snowball quickly. That’s why you’ll want to be careful with the Capital One Quicksilver Student Cash Rewards Credit Card if you’re sitting in the higher APR range.

Annual fee

The Capital One Quicksilver Student Cash Rewards Credit Card charges no annual fee, which is standard among student-focused rewards cards.

Other fees

Whenever you consider signing up for a credit card, you’ll want to familiarize yourself not just with the perks and bonuses, but the fees as well. After all, one big “gotcha” fee can wipe out months of hard-earned cash back rewards.

In the case of the Capital One Quicksilver Student Cash Rewards Credit Card, the fees are pretty standard fare.

- Annual fee – $0.

- Balance transfer fee – $0 at this Transfer APR.

- Balance transfer APR – Varies by cardholder.

- Cash advance fee – 3% of the amount of the cash advance, but not less than $3.

- Late payment fee – Up to $40.

Unique perks and benefits

Things improve significantly with the Capital One Quicksilver Student Cash Rewards Credit Card’s perks and benefits.

In a somewhat surprising move, Capital One has positively loaded up its student rewards cards with special features typically reserved for top-tier cards with annual fees.

- No foreign transaction fees. Heading to Paris to meet with a friend? Don’t worry about getting nickel-and-dimed for every transaction — like many travel rewards cards, the Capital One Quicksilver Student Cash Rewards Credit Card doesn’t charge transaction fees for purchases made outside the U.S.

- Extended warranty. Store and manufacturer warranties will automatically be doubled on eligible purchases if you used your Capital One Quicksilver Student Cash Rewards Credit Card to pay for those purchases (this perk doesn’t apply to cars, sadly!).

- Credit limit raised after six months. Provided you make on-time payments, you’ll automatically be considered for a raise in your credit limit in as little as six months.

- $0 fraud liability. If your Capital One Quicksilver Student Cash Rewards Credit Card is ever stolen and used to make fraudulent charges, Capital One will not hold you liable for them (just be sure to report your stolen card ASAP!).

- Autopay. Capital One lets you set up autopay so you never miss a full (or minimum) payment on your account. Consider this step to be essential!

- Complimentary Concierge Service. Looking for tips on travel, dining, or entertainment? You can call up Capital One and get free guidance from their 24/7 concierge service.

- 24-hour Travel Assistance Services. Master RoadAssist® Service® with 24-hour dispatch help for towing, fuel delivery, and more.

These perks may not be worth much on a daily basis, but on a particularly bad day, they can be extremely valuable.

For example, if your $1,000 TV suddenly dies out on you three weeks after the manufacturer’s warranty expires, not to worry, your Capital One Quicksilver Student Cash Rewards Credit Card will cover the replacement, as long as you used the card to make the TV purchase.

How much can you earn with the Capital One Quicksilver Student Cash Rewards Credit Card?

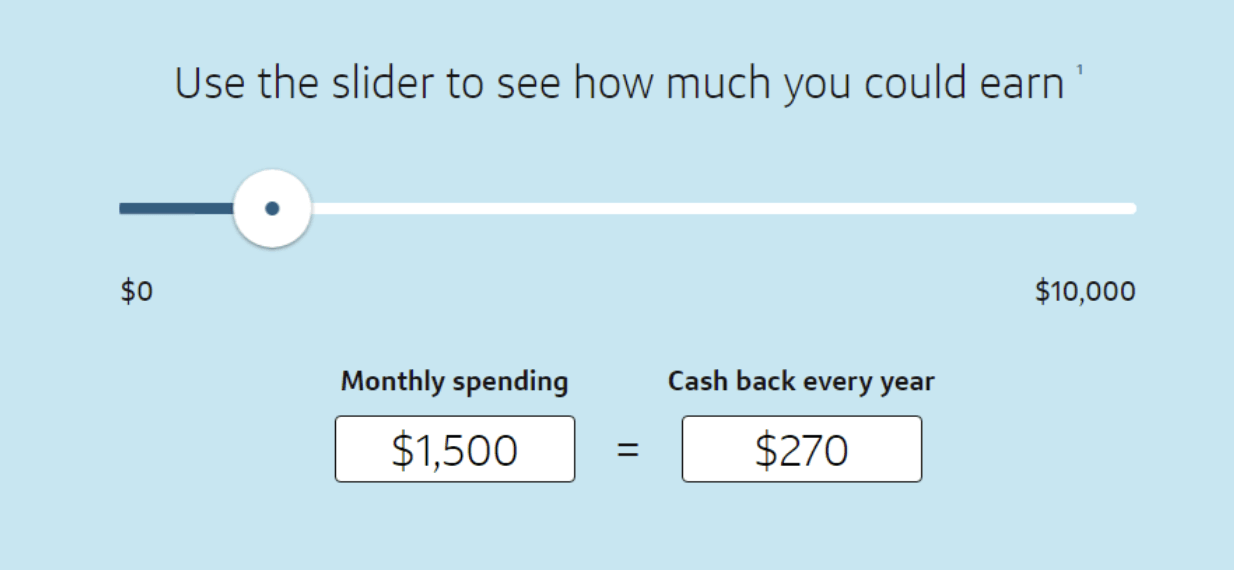

Normally, this is where I’d show you a big chart with various spending categories, percentages, and calculate how much you could earn in cash back depending on your lifestyle. But the Capital One Quicksilver Student Cash Rewards Credit Card’s rewards are so straightforward you can illustrate them with a simple slider.

For example, if you spend $1,500 monthly, you’ll earn back $22.50 in cash back per month or $270 per year.

It’s worth mentioning that you don’t have to redeem your points for cash back. You can also convert them to gift cards, use them to recharge your PayPal balance, or apply them to your Amazon purchases at checkout.

Pros & cons

Pros

- Unlimited 1.5% cash back — The Capital One Quicksilver Student Cash Rewards Credit Card offers generous and straightforward rewards — instead of having to track rotating categories, you’ll just get 1.5% cash back on everything.

- Accepts fair credit — The Capital One Quicksilver Student Cash Rewards Credit Card accepts fair credit (620+), which is important since as a student you may have limited credit history.

- No annual fee — The Capital One Quicksilver Student Cash Rewards Credit Card charges no annual fee, so you won’t get a “gotcha” bill for $95 in a year’s time.

- Doesn’t encourage nonessential spending — Lacking 5% cash back on rotating categories may seem like an omission at first, but their absence discourages unnecessary spending — which may be more important in the long run.

- Valuable perks — Perks like Master RoadAssist® Service® with 24-hour dispatch and extended warranty may be worth $1,000s on the day you have to use them.

- Credit monitoring tool — Capital One's free service CreditWise lets you monitor your credit score and get alerts when it changes.

Cons

- No intro APR offer — The Capital One Quicksilver Student Cash Rewards Credit Card doesn’t offer 0% APR for any amount of time on either new purchases or balance transfers, making it unviable for anyone looking to carry over old debt or potentially create new debt.

- Chance of dangerously high APR — 19.74% - 29.74% (Variable) APR from day one is a pretty threatening incentive to stay out of debt — and potentially catastrophic if you can’t.

- No debt safety nets — Unlike some other student-centric rewards cards, the Capital One Quicksilver Student Cash Rewards Credit Card doesn’t offer young cardholders tools or programs to help them stay out of debt, such as late payment forgiveness.

Capital One Quicksilver Student Cash Rewards Credit Card compared

How does the Capital One Quicksilver Student Cash Rewards Credit Card stack up to its closest competitors — including ones from within the Capital One stable?

| Capital One QuickSilver Student Cash Rewards Credit Card | Capital One SavorOne Student Cash Rewards Credit Card | Chase Freedom® Student Credit Card | |

|---|---|---|---|

| Credit required | Fair (620+) | Fair (620+) | Good (690+) |

| Annual fee | $0 | $0 | $0 |

| Intro APR | N/A | N/A | N/A |

| Regular APR | 19.74% - 29.74% (Variable) | 19.74% - 29.74% (Variable) | 19.74% Variable |

| Signup bonus | Earn $50 when you spend $100 on purchases within 3 months from account opening | Earn a $50 bonus when you spend $100 on purchases within 3 months from account opening | $50 bonus after first purchase made within the first 3 months from account opening |

| Rewards | 1.5% cash back on all purchases | 3% cash back on dining, entertainment, popular streaming services, and at grocery stores, plus 1% on all other purchases, plus 8% on entertainment purchased through the Capital One Entertainment Portal. | 1% cash back on all purchases |

| Perks and benefits | Extended Warranty, Master RoadAssist® Services, 24/7 Concierge, and more | Extended Warranty, Master RoadAssist® Services, 24/7 Concierge, and more | $20 Good Standing rewards on each anniversary of account opening for up to 5 years, credit limit increase after making 5 monthly on-time payments within 10 months |

Capital One SavorOne Student Cash Rewards Credit Card

$50 bonus when you spend $100 on purchases within 3 months from account opening shares most of its DNA with its stablemate, the Capital One Quicksilver Student Cash Rewards Credit Card. You’ll get the same APR, same perks, and same signup bonus.

The difference comes in the form of rewards. Rather than 1.5% cash back on everything, the Capital One SavorOne Student Cash Rewards Credit Card offers extra rewards (unlimited 3%) within categories that students tend to drop money in, including grocery store purchases, entertainment, and popular streaming services — plus 1% on all other purchases.

Chase Freedom® Student credit card

Chase’s counterpart to the Capital One Quicksilver Student Cash Rewards Credit Card, the Chase Freedom® Student Credit Card, eschews competitive rewards for a generous signup bonus.

You’ll get $50 just for making your first purchase within three months, plus a $20 “Good Standing” bonus on your account anniversary for up to five years (as long as you don’t default).

You’ll also get 1% back on all purchases, making the Chase Freedom® Student credit card a worthy contender in the space.

Should you get the Capital One Quicksilver Student Cash Rewards Credit Card?

Whether or not you should get the Capital One Quicksilver Student Cash Rewards Credit Card entirely depends on your spending habits in school — because it’s always better to let your spending habits pick your card, and not the other way around!

This card might be a fit if:

The Capital One Quicksilver Student Cash Rewards Credit Card might be a fit if you don’t plan on generating debt of any kind in school and you value simple, straightforward cash rewards.

The card’s potential for sky-high interest rates and lack of debt-forgiveness are extremely risky — but if you’re confident you’ll always be able to pay off your balance, it’s rewards may make up for the risk.

This card might not be a fit if:

Conversely, if you doubt your ability to pay off your credit card each month while you’re in school, you should probably avoid using the Capital One Quicksilver Student Cash Rewards Credit Card.

If you’re a student, you probably have enough to worry about before adding snowballing credit card debt to the plate.

It’s also not a great fit if you’re the kind of person who likes maximizing coupons and rewards — you may be happier with a card offering 3% cash back in certain categories.

Finally, if you’re looking for a student credit card only for use in case of emergency, it would make more sense to get a card with a signup and/or anniversary bonus, since you’ll earn more cash rewards for making just a handful of purchases each semester.

How to apply for the Capital One Quicksilver Student Cash Rewards Credit Card

If you decide the Capital One Quicksilver Student Cash Rewards Credit Card is a good fit, head to the card’s application page, where you can re-familiarize yourself with the card’s benefits.

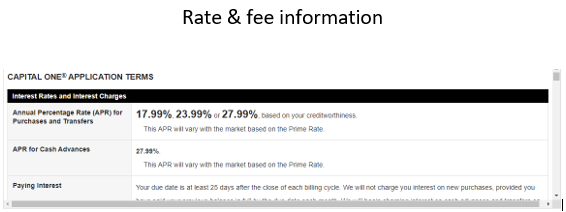

Be sure to also carefully comb through the card’s Rate and Fee Information, located in a scrolling window at the bottom of the page:

Note that when you apply, you’ll have to share your degree type and expected graduation date, as well as estimated annual income. Don’t worry if your income is low — you won’t be disqualified, you’ll just start out with a slightly lower line of credit (e.g., $3,000 instead of $5,000).

Once you’ve completed and submitted your application, you’ll receive your card in the mail within 7-10 business days. And since there’s no ticking clock on a signup bonus, there’s no rush to use the card once you activate it!

Summary

The Capital One Quicksilver Student Cash Rewards Credit Card is a great fit for the student who can always pay it off and appreciates simple, straightforward rewards. Its potentially high APR and lack of debt-avoiding safety nets are vexing, even threatening, but as long as you can make your payments, you’ll enjoy a card with solid cash back and even more generous perks.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.