One of the dilemmas for 20-somethings is the Catch-22 that comes with getting credit. In order to get a loan, you first have to have a credit score; but in order to get a credit score, you first have to have a loan.

On the surface, it seems like a no-win situation. But there are actually ways that you can begin building your credit score, even without having traditional credit.

And you need to do that. Not building credit earlier in life ranks among 20-somethings’ biggest financial mistakes. It can force you to pay higher interest rates on any loans that you do get, or even lead to loan declines. A lack of credit can also hurt you in getting an apartment or even qualifying for certain jobs.

So how do you build a good credit when you can’t get credit in the first place? There are at least two ways.

What’s Ahead:

Using secured credit cards

Secured credit cards are an option even if you don’t a previous credit history. The cards can be obtained from either banks or credit unions. They are secured by savings, and generally have credit limits of no more than $1,000.

You can put $500 or $1,000 into a bank account or a credit union account, then request that a credit card be issued using the savings as security. The credit card will act just as any other major credit card would. The major difference is that it would be secured.

As you use the card, and make payments, the bank will report your credit history to the credit bureaus. Over time, you will begin to build a credit score, and as you do, you can then apply for an unsecured credit card as well as other loans.

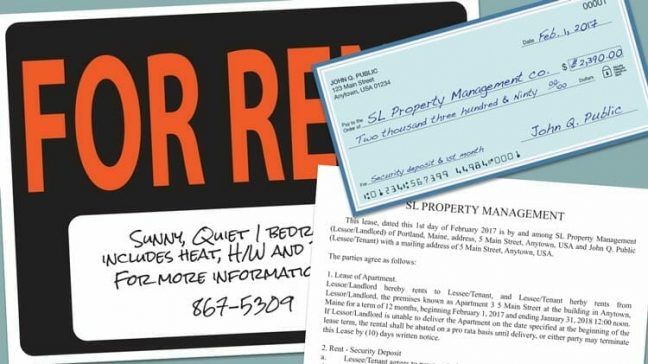

There is, however, another way to build credit, and it’s for something you have to do anyway: You can build credit by paying rent.

Rental reporting services

This is a relatively new service that’s available, but it’s been gathering steam in recent years. Since landlords typically don’t report your rental history to the credit bureaus, these services act as a third-party intermediary.

Small landlords can’t report tenant rental histories to the credit bureaus, because it would be considered a form of self-reporting. And while large apartment complexes and management companies with thousands of units could in theory, they usually don’t. Until now, the only rental history that would ever appear on your credit report was bad history – like a broken lease, or an unpaid rent balance or damage assessment.

But along comes rental reporting services who can act as a neutral, third-party verification service that can both verify your rent payments, and then report to the credit bureaus. Now you can get credit for on-time rent payments

Here are two such rental reporting services.

Rental Kharma

Rental Kharma reports your rent payment history to the credit bureaus, after verifying both your lease and your monthly payments with your landlord. Your rental payments will be verified each and every month that you are enrolled with the service.

Currently, Rental Kharma reports only to TransUnion, and not Equifax or Experian. However, they do plan to have those other bureaus in the future, and at no extra cost to you when they do.

Here’s an important fact to be aware of: In the credit reporting universe, rent payments are only considered to be late if they are more than 30 days late. If they are late, but less than 30 days, it will not count against you. However keep in mind that your lease may require that you make your payments by the first of each month, or shortly thereafter. If not, you may incur late payments, or worse, faced eviction.

Rental Kharma used to offer a free service, however it is now a paid subscription. You must pay a one time verification fee of $40, and then a subscription fee of $9.95 per month. There is no charge to your landlord for participating in the service.

Currently, they are offering six months free if you refer other customers to the service. If you do, and they sign up, both you and the referral will get six months of free reporting. Even better news: there are no limits to the number of months of free service you can earn as a result of sending them referrals.

RentReporters

RentReporters performs a similar service. They can verify your rent payments with your landlord, and then report your history to the credit bureau. Their website reports that “It is not unusual for a score to increase by 50 points”, although they don’t provide source information to prove that.

Like Rental Kharma, they also currently report only to TransUnion. But they also promise that when they do add the other two credit bureaus, that they will also report to them at no extra charge to you. That includes past history, which will provide an immediate credit score bump for each bureau as it becomes available.

The credit entry on a credit report will appear as “RR/Residence.”

But RentReporters does something that Rental Kharma doesn’t do, and that’s to provide your rent history for the past two years to the credit bureau. This can provide you with a boost in your credit score in as little as five days. Since the credit bureau will have an immediate two-year pay history on your rent, they may be able to calculate a credit score quickly, or improve on the score that you already have.

RentReporters charges a one-time enrollment fee of $59.95, which covers both the landlord verification process and reporting up to 2 years of previous rental payments. After the enrollment fee, you will pay a monthly subscription fee of $9.95.

They also provide a guarantee. If you’re not delighted with the initial increase in your credit score, they will issue a refund. (The refund request must be submitted within 48 hours from the time they notify you that your rental history has been added to your credit report.)

Rental reporting is promising, but there are still drawbacks and caveats

While rental reporting services are certainly innovative, and can provide a potential major benefit to you, they do have a few issues.

Only one credit bureau accepts the reporting

TransUnion accepts the credit data from the services, but Equifax and Experian don’t. The problem here is that if the lender you are applying with doesn’t use TransUnion as their credit source, the rental reporting will not benefit you.

Your landlord must cooperate

Your landlord must agree to participate in the service, otherwise it won’t work at all. There is no cost to the landlord for doing this, and there are even certain benefits. But you may get certain landlords who flat out refuse to participate, either because they are small operators and fear a loss of privacy, or because they are larger concerns faced with technical or legal challenges to reporting on a regular basis.

It may take a while for the service to work

This is especially true if you are a new tenant and have no prior history to report. It may take six months or more to accumulate enough on-time payments to give you a healthy credit score.

Cost

The services aren’t free. You have to pay an upfront fee between $40 and $60, and then a monthly fee of about $10. Those are a small price to pay in order to build a positive credit score. But if you have paid that fee, and applied for a loan with a non-TransUnion connected lender, it will turn out be—let’s face it—a waste of money.

You will no longer be able to make a late rent payment

If the purpose of using a rental reporting service is to improve your credit, you must be sure to make all of your rent payments on time. A single late payment within the past 12 months could sink your credit score in a heartbeat.

Are rental reporting services worth a try?

In the past, these services were provided free of charge. But now that you do have to pay both upfront and subscription fees, you really have to measure if it’s worth doing.

It certainly makes sense if you are trying to build your credit, and have few other options. In most cases, you will need at least two, and preferably three, credit references in order to build a satisfactory credit score. You might want to use a rental reporting service for one, and get one or two secured credit cards for the others.

Summary

The whole concept of rental reporting is very promising, but we are still very early in the development process. As the practice becomes more accepted—meaning that both Equifax and Experian join TransUnion in participating in the program – having this service will probably become the norm.

In the meantime, carefully weigh out the pros and cons.