With all of the offers floating around for 0 percent balance transfers, most people don’t even notice balance transfer fees. And even if you know that they’re there, it might be easy to pass them off as incidental expenses. After all, just about every credit card that offers a balance transfer charges them, right?

In most cases, however, balance transfer fees matter. In fact, under certain circumstances, they can seriously reduce or even eliminate the benefit of the transfer.

You can see how balance transfer fees can affect your savings with our balance transfer calculator. Why does this happen? Here are five reasons why balance transfer fees matter:

What’s Ahead:

- 1. A balance transfer fee increases your indebtedness

- 2. Balance transfer fees increase your annual percentage rate (APR)

- 3. It makes little sense on short-term transfers

- 4. You’re paying a high fee to move money from one account to another

- 5. They partially negate 0-percent introductory rate offers

- Are credit cards with no balance transfer fees better?

- Summary

1. A balance transfer fee increases your indebtedness

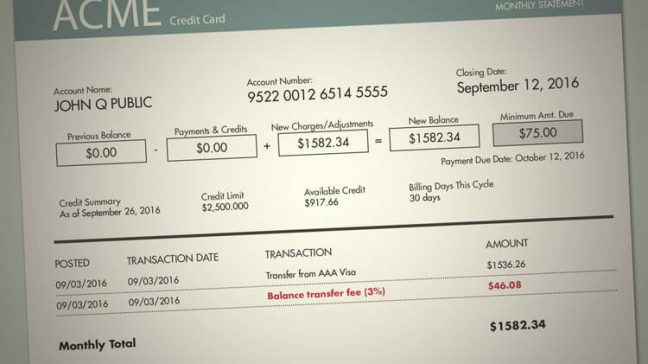

Most banks will charge a balance transfer fee of somewhere between 3 percent and 5 percent of the amount of credit card debt that is being transferred. If you are consolidating several credit lines with a total balance of $10,000, you will pay $500 as a balance transfer fee, if that fee is 5 percent.

The problem with this arrangement is that you will now owe $10,500. If the purpose of the balance transfer is get out of debt, then you just took a step in the wrong direction. Before you even begin your debt pay-off strategy, you’re already off to a bad start.

This situation is often overlooked or minimized in favor of taking advantage of either a 0-percent introductory rate offer, or of consolidating loans for the purpose of creating a lower monthly payment. But in this case, $500 will be a lot of money to pay upfront for that benefit.

If you are into serial balance transfers—meaning that you transfer balances as soon as new offers become available—then you are almost certainly repeating this cycle. $500 here, $300 there starts to turn into real money after a few years.

2. Balance transfer fees increase your annual percentage rate (APR)

Your APR is the effective interest rate that you are paying on the amount of money that you actually receive in a loan transaction. If there are any fees in connection with the loan, your APR will be higher than the note rate on your loan. That includes credit cards.

For example, if you borrow $10,000, but pay a $500 balance transfer fee, the fee is subtracted from the proceeds, and you’re actually only receiving $9,500.

If the rate on the note on the new loan is 10 percent, the APR will actually be 10.526 percent—not 10 percent.

That is calculated based on the fact that you will pay $1,000 ($10,000 x 10 percent) per year in interest, divided by the $9,500 loan proceeds that you actually received in the transfer.

That’s the effect of balance transfer fees on long-term debt. But the situation is much worse when it comes to short-term debt arrangements. And that’s hardly an unusual situation when it comes to balance transfers on credit card debt.

3. It makes little sense on short-term transfers

Balance transfer fees have a more serious impact on the effective interest rate that you will pay on a loan or a credit card balance. This is because the balance transfer fee is calculated based on a s shorter loan term.

Continuing the same example from above, let’s say that you pay $500 on a $10,000 balance transfer. If the loan is only outstanding for six months, and then you pay it off—perhaps with another balance transfer offer—the balance transfer fee charged will add 10 percent to whatever interest rate you are paying on the loan amount.

It works this way… since you’re paying 5 percent for the transfer fee, and the balance is outstanding for just six months, the fee applies to the balance for just one-half of one year. That means that for a full year you will be paying 10 percent, or 5 percent X two.

This will be the case whether you ultimately do still another balance transfer at the end of six months, or even if you pay off the transferred credit line balance completely.

The moral of the story is that balance transfer fees are a very expensive way to obtain short-term financing.

This is not accidental either. Credit card lenders are well aware of the short-term nature of credit card balance transfers. If they rely on interest alone, or if there is a 0-percent introductory rate offer, the bank will make less money on the transfer. Balance transfer fees act as a guaranteed minimum income for the banks—no matter how you decide to handle the transfer.

Related: See how much you could save with our balance transfer calculator

4. You’re paying a high fee to move money from one account to another

No matter how you slice it, a balance transfer fee of 3 to 5 percent is an expensive way to move money from one account to another. It doesn’t matter that you are moving debt from one account to another, rather than savings or some other form of investment capital. The ultimate reality that you are paying an exorbitant fee for a single transfer.

Most people complain over charges related to ATM withdrawals, or other bank related service charges. But those are often just a few dollars. Balance transfer fees run in the hundreds of dollars if you are transferring balances in the thousands of dollars.

If paying transaction fees to move money is a wealth killer, then the fees charged for balance transfers are even more extreme. For example, you might pay a $7 commission to buy stock worth $2,000, which is well below 1 percent. Why would it be OK to pay 3 to 5 percent for a balance transfer fee?

5. They partially negate 0-percent introductory rate offers

Finally, we come to the ultimate irony of balance transfer fees. The main reason behind credit card balance transfers is usually related to interest rates. This is most true in regard to 0 percent introductory rate offers. Transferring a balance on which you are currently paying 10 percent over to a 0 percent credit line is too tempting to pass up.

But introductory is the operative word when it comes to 0 percent introductory rate offers. It makes clear the point that the 0-percent rate offer is temporary. Generally speaking, that offer will be available on the transferred balance for anywhere between six months and 18 months. The point is, at some point in the not-too-distant future, a real interest rate will apply.

But in the meantime, balance transfer fees mean that a 0 percent introductory rate is never really 0 percent.

If the balance transfer offer provides for a 0 percent interest rate for the first 12 months, and you have to pay a 5 percent balance transfer fee, then you are effectively paying 5 percent on the balance transfer. In this situation, 0 percent actually translates to 5 percent.

That may not seem like much, if you’re transferring credit card balances from accounts that have an average interest rate of 20 percent. However, it does toss the whole concept of “0 percent” out the window. And worse, since the balance transfer fee is charged upfront, there’s no way to reverse course after the fact.

Are credit cards with no balance transfer fees better?

Some credit cards have a $0 balance transfer fee. If you can pair that with a 0 percent intro rate, then a $0 balance transfer fee card is the way to go. Sometimes, however, it may take longer than the intro period to pay your balance in full. In this event, you may actually save more with a card that gives you a few more months at 0 percent, but charges a balance transfer fee. You can experiment for yourself with our balance transfer calculator.

Related: Best 0% Intro APR Balance Transfer Credit Cards

Summary

A balance transfer fee may not be a deal breaker in the pursuit of a 0 percent introductory rate offer, but it does have a material impact on the real cost of the transfer. Be aware of how balance transfer fees can be a problem. And especially pay attention to how these fees will impact any transfer that is expected to be in place for less than one year.

Better still, look for balance transfer arrangements that offer both a 0 percent introductory rate, and charge no balance transfer fee. That’s the real deal.