It’s perhaps the biggest financial quandary facing every young saver: Personal finance advice— including our own—implores you to save as much for retirement as possible. But the younger you are, the more likely you are to have other important goals ahead: repaying student loans, buying a home, getting married, taking time for extended travel, starting a business – the list could go on.

So what’s the right answer?

First off, let’s be clear that before you start saving for anything else—whether retirement or a house—you should have a robust emergency fund. Without an emergency fund, your hard-earned progress on other goals can be completely erased by one bit of bad luck: a car accident, a medical emergency, or another unexpected expense.

But once you’ve got several months of expenses tucked away in a high-yield savings account, then you’ll need to think harder about how to properly allocate your money toward your various goals. Here’s how I balance saving for retirement with other goals.

What’s Ahead:

One approach: Half to retirement, half to other goals

Here’s a rule that can help you balance retirement savings and other goals: Take the total amount you can save each month and allocate half to retirement and half to other goals until you’ve maxed out your allowable annual retirement savings, then put additional money towards other goals.

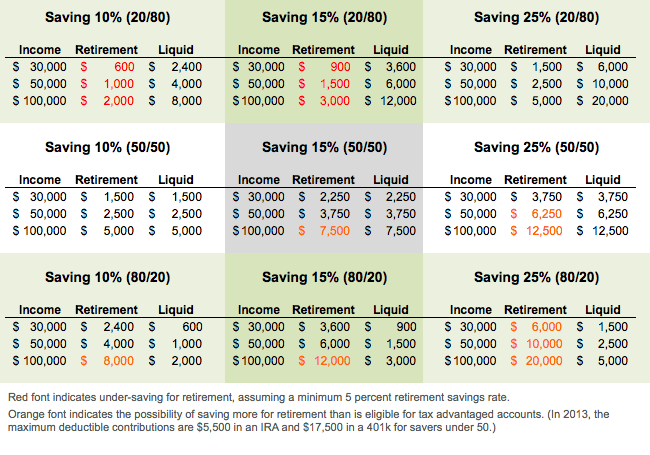

I realize this is a dramatic simplification. Some of you will want to save more for retirement to take advantage of the tax benefits, while others will need to save more for non-retirement goals and life events. I arrived at the 50/50 split because—for common income levels and savings rates—it provides the best chance of saving enough for retirement without exceeding IRS maximums for common retirement accounts. In the following chart, you can see how the 50/50 split works compared to saving 20 percent for one goal and 80 percent for another:

How much you’re actually able to save for each goal depends on two things:

- Your income

- Your savings rate

Your savings rate is the percentage of your gross income that you save. Working on continually increasing it should be a priority. As you can deduce from the chart above, somebody earning $50,000 and saving 25 of her income annually is saving more ($12,500) than somebody earning twice as much but only saving 10 percent ($10,000).

What follows are three scenarios and proposed savings rates for retirement and non-retirement goals. Of course, personal finance is personal, so how much you allocate towards non-retirement goals will depend largely on what you’re saving for and how soon you want to get there. If you’re getting married in a year and need $10,000 for your wedding, you may have to increase your non-retirement savings rate temporarily. Likewise, if you’re saving for a “someday” goal without a pressing timeline, you can save a little less because you have more time on your hands.

Beginner: 10 percent

We all have to start somewhere, and if you’re scraping by with an entry-level salary and student loans, it doesn’t make sense to stretch an already-thin budget by over-saving for retirement. If your budget is tight, first decide on what percentage of your income you can save. Let’s say you can afford 10 percent. I would put 5 percent into retirement and 5 percent towards other goals like paying down debt, building an emergency fund and other goals. If you earn $27,000 a year, for example, that’s a total of $2,700—$1,350 towards retirement and $1,350 for other goals.

As your income grows (or you trim other expenses), focus on increasing your overall savings rate and use the additional savings for your non-retirement goals.

Intermediate: 15 to 20 percent

So you’re more established. You don’t subsist on ramen anymore, and maybe you have six months’ living expenses in a savings account for emergencies. You don’t have credit card debt, and you’re focused on the next big thing: A down payment, wedding, paying cash for a new car—whatever it may be. Here’s where I would try to stretch your savings rate from 10 percent towards 20 percent. If you earn $50,000 a year, aim for at least $5,000 towards retirement and $5,000 towards other goals.

Advanced: 20 to 25 percent (or more)

In your friend group, you’re the one who has it together. Congrats. Perhaps you’ve paid off all of your debt. Or maybe you just have a healthy income and your expenses in check so you don’t worry about money as much and have a nice amount left over to save. You’re comfortable with a savings rate of 20 percent or more. You may have maxed out your IRA or even your 401(k) in years past, but you’re wondering if you can save some of that money for other things you’d like to do. If you earn $75,000 and aim to save 25 percent, that’s $9,375 in both retirement and non-retirement savings accounts.

If, however, you don’t have a 401(k) at work and can only take advantage of an IRA—savers under the age of 50 will only be able to contribute $5,500 towards retirement (with tax advantages). In this case, you would save $5,500 for retirement and $13,250 in other accounts. (You may, of course, wish to designate more than $5,500 for retirement even though you can’t put it in a tax-advantaged account.)

What if I don’t have specific savings goals?

Ok, so maybe you’re a powersaver but you’re content: You’re happy where you live, you have some emergency savings, and you have no plans to spend a big chunk of money anytime soon. You should just funnel all of your savings into retirement accounts, right?

Maybe not.

Although it’s certainly smart to exploit the tax advantages of retirement accounts—we have to remember that once your money is in a retirement account, it’s no longer liquid. With few exceptions, withdrawing money from a retirement account before you’re age 59 ½ will incur taxes and a 10 percent penalty.

Liquidity gives you options in the short term.

Lots of times, you hear about people withdrawing from or borrowing against their retirement savings to buy a home, fund a mid-career sabbatical, or start a business. If you’re savvy about your saving now, however, you may be able to have the cash on hand to do something like that without the need to sabotage your retirement savings.

With my retirement balances catching up to where I want them to be for my age—I’ll be following this strategy this year and allocating about 10-15 percent of our income to retirement and 10-15 percent towards saving for other goals.

Why we shouldn’t skip saving for retirement

Finally, if you’re young and hell-bent on a big wedding or a down payment on your dream house in the next few years, it may be tempting to delay contributing to your 401(k) until that goal is met.

Don’t.

Saving something in a 401(k) or IRA—even 5 percent of your salary—is more important than ever. Yes, there are tax benefits and yes, that money will compound for 30 or 40 years. But the most important reason to take advantage of retirement accounts is to get into the habit of investing—in other words: make it automatic. Nobody loves saving for retirement. It’s such a faraway goal, and it’s painful to say goodbye to money we have 10 uses for now. But chances are you’re going to live a long time and programs like Social Security—which will be around, in some form—may make up an significantly smaller portion of support that you can count on in your golden years.

Summary

With so many different goals vying for your extra cash, it’s important to allocate your money wisely. A 50-50 split between retirement and other goals like a house, a new car, or a big wedding is a good place to start, and you can tweak as your needs and wants become clearer.