Axos Bank is an online bank that focuses on eliminating fees and having intuitive technology. They offer both personal and business banking accounts, which can be super helpful for business owners like myself that prefer the simplicity of keeping all of their online banking accounts in the same place.

In particular, Axos Bank offers a handful of business banking solutions your business may be able to use to save money on fees or earn more interest depending on your needs.

I like that they offer three different types of accounts so they don’t try to force all businesses into the same checking solution.

Here’s what you need to know.

What’s Ahead:

- What are Axos Bank’s business checking products?

- How do Axos Bank’s business checking products work?

- How much do Axos Bank’s business checking accounts cost to use?

- Axos Bank business checking features

- Who are Axos Bank’s business checking products ideal for?

- Who shouldn’t use Axos Bank’s business checking products?

- Pros & cons

- Comparison of Axos Bank’s business checking account products

- Summary

What are Axos Bank’s business checking products?

Businesses come in many different forms. My small business run by my wife and me, doesn’t need a lot of heavy processing features that a large national company with hundreds of employees would need.

It makes sense Axos Bank offers different products with varying features. The three business checking accounts Axos Bank offers include:

- Basic Business Checking.

- Business Interest Checking.

- Analyzed Business Checking.

How do Axos Bank’s business checking products work?

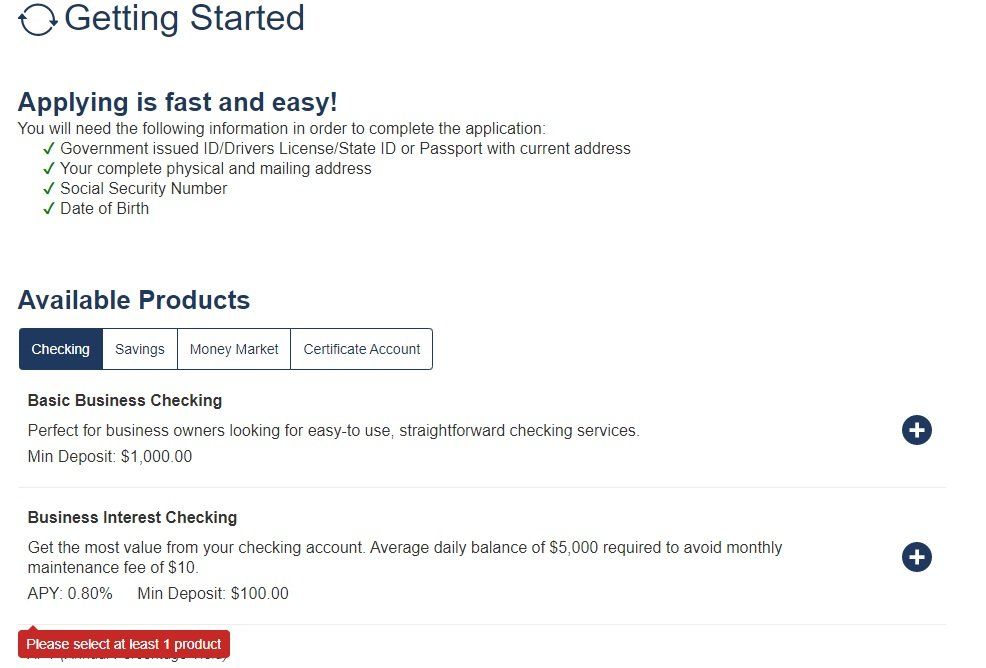

To get started, you have to open an Axos Bank business checking account. The process of opening a bank account can be painful, but it helps if you know what you’re getting into. That way, you can have all of the required documents available before you get started. Here’s what you may need:

- A copy of the driver’s licenses for all owners and authorized signers (all businesses.)

- If you’re doing business under a different name (DBA) you may need:

- Fictitious name certificate.

- Assumed name certificate.

- Certificate of trade name.

- DBA certificate.

- IRS SS-4 or 147c letter (Sole proprietorship.)

- General partnership agreement and all amendments (General partnerships.)

- Operating agreement, articles of organization and all amendments (Limited liability companies.)

- Limited partnership (LP) or limited liability partnership (LLP) agreement, all amendments, and certificate of LP or LLP filed with the state (LPs and LLPs.)

- Articles of incorporation and all amendments (For-profit corporations.)

- Articles of incorporation, all amendments, a letter from IRS of 501(c)(3) status, bylaws that state powers of the officers and the most recent meeting minutes with a list of active officers (Non-profit corporations.)

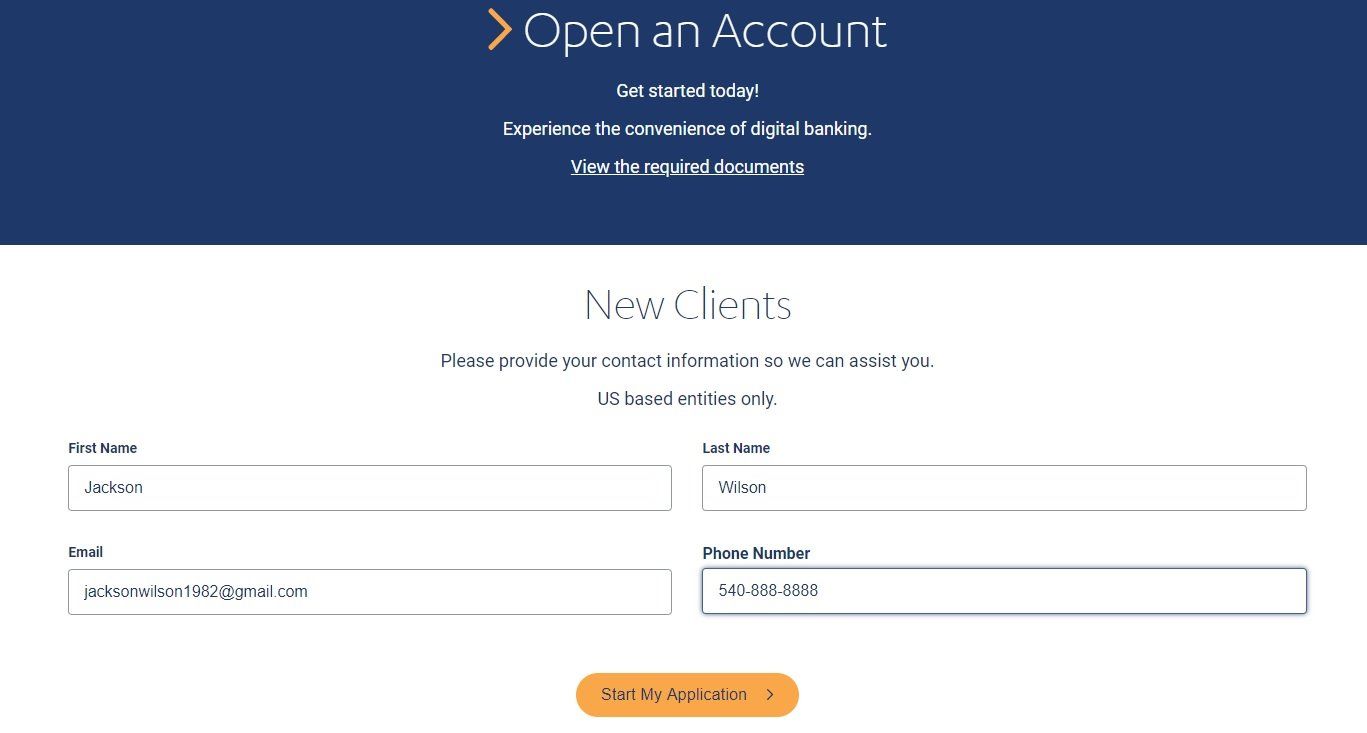

When you’re ready to open an account, navigate to the correct type of account’s page and click open an account.

Next, enter your basic information to start your application.

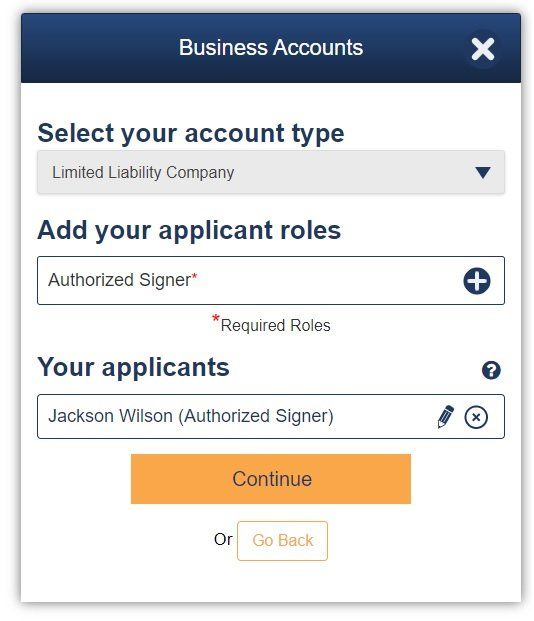

Select your account type by the type of business you are. Add your applicant roles. Then, click continue.

Select the products and features you want to apply for.

Read the required documents and check the boxes. Then, click continue.

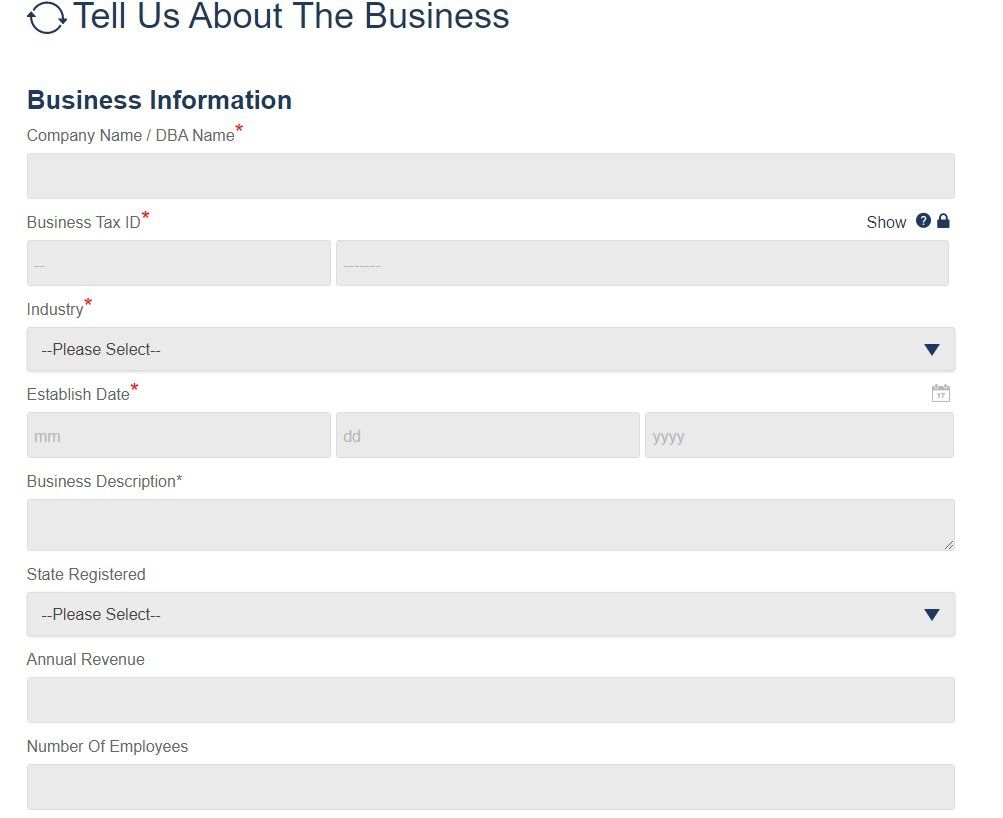

You now have to enter information about your business, contact information and business mailing address.

Next, you have to enter information about the authorized signers.

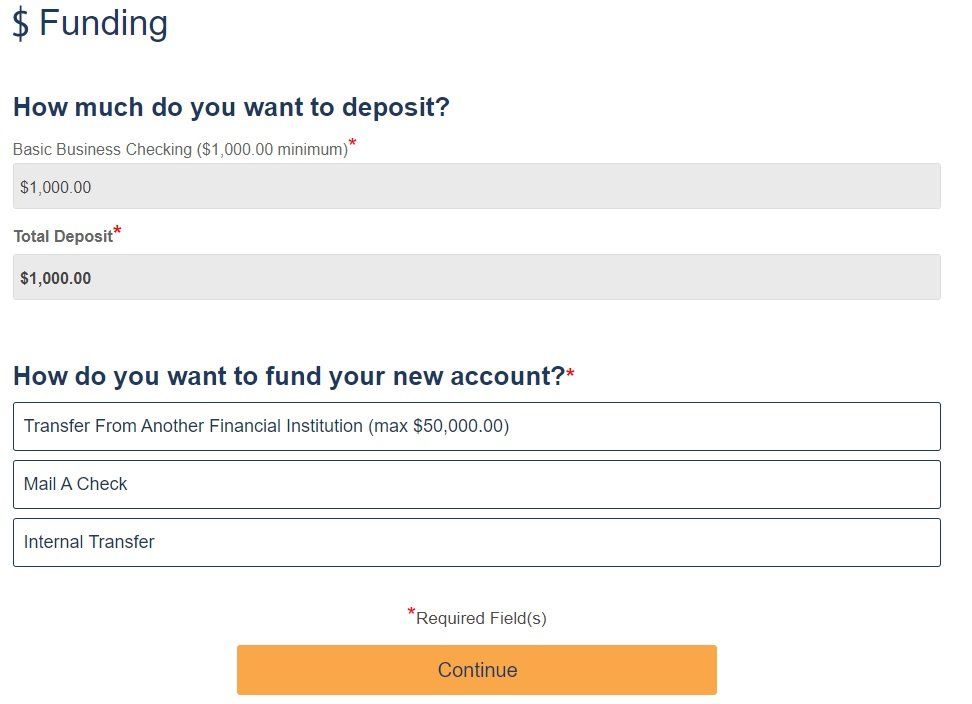

Select how much you want to deposit and how you plan to do so.

Finally, review your selected products, the data you entered, and answer a few final questions about your business as well as your banking needs before submitting your application.

Once you have a business checking account open with Axos Bank, the bank account works according to the rules of your specific type of account. Since Axos Bank is an online bank, you’ll communicate with them through the web or over the phone.

How much do Axos Bank’s business checking accounts cost to use?

Each type of Axos Bank business bank account has different costs associated with it. Here are the main fees to look out for each type of account.

Basic Business Checking

- Monthly maintenance fee – None.

- Items after 200 items per month – $0.30 per item.

Business Interest Checking

- Monthly maintenance fee – $10 if the average daily balance falls below $5,000.00.

- Items after 50 items per month – $0.50 per item.

Analyzed Business Checking

- Monthly maintenance fee – $15.00.

- Pay per item processing fee based on account analysis.

Fees for all account types

- Outgoing domestic wire transfers made online – $7.00.

- Outgoing domestic wire transfers – $15.00.

- Outgoing international wire transfers – $50.00.

- Deposited checks and other items returned unpaid – $10.00.

- Stop payments per request online – $10.00.

- Stop payments per request with assistance – $35.00.

Axos Bank business checking features

Each type of business checking account at Axos bank has different features. Here’s what you need to know about each type to help figure out which is best for your business.

Basic Business Checking

Axos Bank’s Basic Business Checking account has the following features and limitations that may make it a good fit for your business:

- New business owners get a $200 welcome bonus with promo code NEWBIZ200. Not a new business? Use promo code NEWAXOSBIZ for a $100 bonus.

- ADP Payroll Services – Axos clients receive 1st 4 months free

- Zero minimum monthly balance requirement

- First set of checks (50) are free.

- Zero monthly maintenance fees

- Unlimited Transactions

- Unlimited domestic ATM fee reimbursements

- $0 Minimum Opening Deposit requirement

- 2 Free Domestic Wires, monthly

- Cash Deposit capability via MoneyPass and AllPoint networks

If your business regularly has more than 200 transactions per month, you may want to look into other options that may be more cost-effective.

Business Interest Checking

Business Interest Checking may be a better fit if you prefer to earn interest on the money in your account, keep a balance of at least $5,000, and have a low transaction volume. It has the following features and limitations:

- Earn 1.01% APY*

- New business owners get a $200 welcome bonus with promo code NEWBIZ200. Not a new business? Use promo code NEWAXOSBIZ for a $100 bonus.

- $100 minimum opening deposit

- Pay no monthly maintenance fee with an average daily balance of at least $5,000.

- Unlimited domestic ATM fee reimbursements.

- Up to 50 free items per month, then $.50 per item thereafter (includes debits, credit, and deposited items).

- Up to 60 items per month for Remote Deposit Anywhere (includes monthly per item processing limitation).

- Enhanced Visa Debit Card Perks

- ADP Payroll Services – Axos clients receive 1st 4 months free

- Cash Deposit capability via MoneyPass and AllPoint networks

Businesses that keep a significant amount of money in the account may benefit from the interest this account pays as long as they keep their monthly transactions under the 50 item limit.

Otherwise, additional items can quickly eat away at the interest you earn at $0.50 each.

Analyzed Business Checking

Axos Bank’s Analyzed Business Checking account is a better fit for large companies looking to deal with complex banking needs. This account is usually much more than the typical small business owner needs access to.

Many of the features sound like a foreign language, but chances are you already know what they mean if your business needs these services. If you don’t, Axos Bank’s business banking team can help explain how the features work and why you may or may not need them. This account offers the following benefits and drawbacks:

- $100 minimum opening deposit.

- $15 monthly maintenance fee with no average daily balance requirement.

- Per item processing fee determined by account analysis.

- Up to $50 off your first order of checks for your checking account with the first 50 checks free.

- Free access to bill pay, image statements, and online banking.

- Up to 60 remote deposit items.

- Treasury management services availability.

- Premium Bill Pay subject to account analysis.

- Lockbox services.

- Merchant remote deposit capture.

- Online wire transfer services.

- Payment portal.

- Zero balance account services.

- And more…

If all of these features sound like overkill, this probably isn’t the business checking account that’s the best fit for you. I wouldn’t need hardly any of these features for my small business. That said, a large corporation like one of my previous employers would have used almost all of these features.

Who are Axos Bank’s business checking products ideal for?

Depending on the type of business you run, Axos Bank may have a product that’s a good fit. You have to be comfortable with banking online or over the phone without a local branch location though.

Personally, I never go to a branch so an online banking account wouldn’t be a problem for me at all.

If you’re a small business that wants to earn interest on the money in your account, Business Interest Checking may be a good fit for you. Just keep an average daily balance of at least $5,000 to avoid the monthly maintenance fee and keep your monthly transactions at 50 or less to avoid the per-item fee.

If you’d rather avoid minimum balances and account maintenance fees than earn interest, Basic Business Checking could be a good solution as long as you don’t exceed 200 transactions in a month.

If you’re a large company that needs access to the more advanced features Analyzed Business Checking offers that would likely best your best fit.

Who shouldn’t use Axos Bank’s business checking products?

Axos Bank’s business checking products won’t be a good fit for people who prefer to do their banking in person at a branch.

According to Axos Bank representatives, they only have one small branch in San Diego. Instead, they’re focused as an online-based bank that uses technology to keep their costs down and pass the savings along to their customers.

Pros & cons

Pros

- Those that prefer banking online, on the phone or on an app don’t have to interact with local bank branch representatives.

- Axos Bank saves money by not having a branch network which may make their fees and interest rates more competitive than some brick and mortar competitors.

- You can easily open a business banking account online to get your business started without having to visit a local branch.

Cons

- Only one physical branch location in San Diego.

- Higher APYs may be found elsewhere.

Comparison of Axos Bank’s business checking account products

| Basic Business Checking | Basic Interest Checking | Analyzed Business Checking | |

|---|---|---|---|

| APY | 1.01% | N/A | N/A |

| Minimum initial deposit | $1,000 | $100 | $100 |

| Monthly maintenance fee | None | $10 if average daily balance falls under $5,000.00 | $15 |

| Per item fee | $0.30 for items after 200 | $0.50 for items after 50 | Subject to account analysis |

| First set of 50 checks free | Yes | Yes | Yes |

Summary

I personally would have no hesitation about signing up for an Axos Bank business checking account if it fit my business’s needs and I was in the market for a new business banking account. If Axos Bank fits your needs and is the best option out there for your business banking, you can open an account today.