Ally Bank Review: Earn High Yields for Savings (But Skip Checking)

Rating as of based on a review of services March 27, 2023.

Ranking

9.5/10

Ally Bank, an online-only bank, offers a high-yield savings account that’s on par with other mobile savings accounts in the digital sphere. Customers can expand to CDs, money market accounts, and investment options.

Best for:

- Online savings

- Multiple savings goals

- Robo-advisory

To be competitive in the online banking industry these days, banks need to offer a lot of features — convenient mobile deposits and transfers, 24/7 customer service, handy bank-on-the-go apps, and high interest rates on savings accounts.

Ally Bank has all of these features and more. It offers the products you’d expect from a major online bank, like savings and checking accounts, as well as some optional features to help savers budget for specific goals.

What Is Ally Bank?

A full-service online-only bank, Ally Bank is the digital banking arm of the larger company Ally Financial.

Ally Bank itself includes a ton of financial services, from home and auto loans to Individual Retirement Accounts (IRAs) and investment robo-advisors. I looked most closely at their checking and savings accounts, but their lending and investment services are worth consideration too.

Pros & Cons

Pros

- No minimum opening deposit or minimum balance — You don’t need a minimum amount to open or maintain an Ally savings or checking account. This means you don’t have to stress about Ally charging you or closing your account if you have a lean few months.

- High Annual Percentage Yield (APY) on savings and money market accounts — The APY you’ll get on your savings or money market account is 2.50%, regardless of your balance. This is one of the higher APYs I’ve seen for low balances, even with online banks, which tend to have higher yields.

- Interest-bearing checking account — Earning a little extra interest through your checking account is always a plus. Ally checking accounts earn modest interest rates — 0.10% to 0.25%, depending on your balance — but they’re better than nothing.

Cons

- Some transactions have fees — While most regular transactions, like incoming transfers, don’t have fees with Ally, there are fees attached to a few less common transactions. This is worth noting, since some competitors don’t have fees at all.

- No physical branches — As a digital bank, Ally doesn’t have any physical branches. If you prefer to open accounts or get answers to your questions in person, this may be a dealbreaker.

How Does Ally Bank Work?

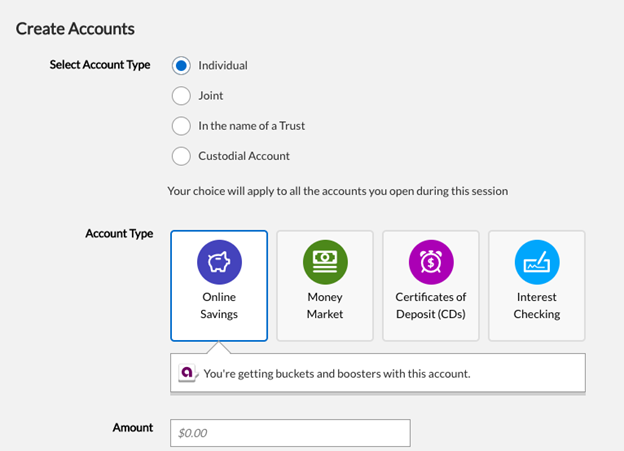

The online sign-up process is simple and, as with most digital banks, pretty quick.

Ally Bank encourages but doesn’t require you to open multiple types of accounts, which you can do in a single session or over time.

Source: Ally Bank

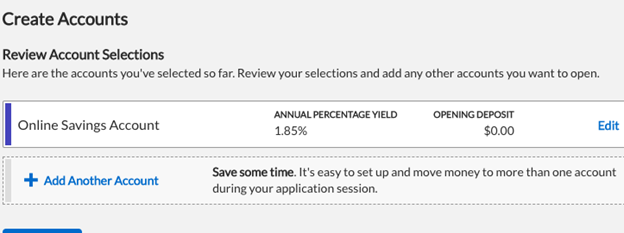

Before you transfer any money, you have options to review and add (or delete) any accounts.

Source: Ally Bank

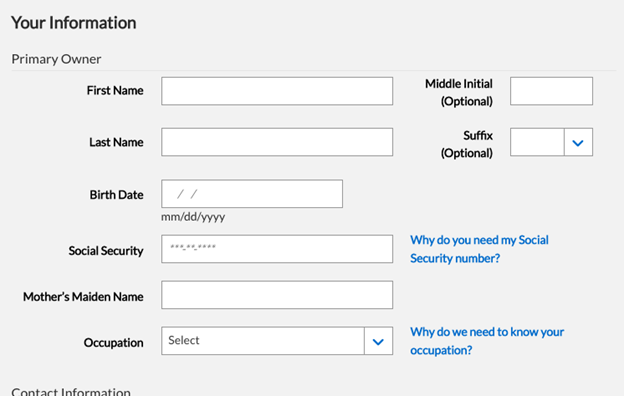

Their info-gathering process is fairly standard; they do require some sensitive information, which is kept secure through encryption.

Source: Ally Bank

Once you’re ready to fund your account, you can:

- Set up a transfer from an external checking or savings account

- Set up paycheck direct deposit

- Take a photo of a paper check via their eCheck Deposit system

- Use a wire transfer

To withdraw cash, you can use an Allpoint ATM (they’re almost everywhere) for free. If you use a fee-charging ATM, Ally reimburses you up to $10 per statement cycle for other ATM fees. Electronic transfers to an external account or another Ally account are also free.

Pricing for Ally Bank

First, the good news: you won’t pay monthly maintenance fees or overdraft fees with Ally Bank. Other no-fee transactions include incoming wire transfers, standard and expedited transfers, and low or zero balances. According to their website, Ally isn’t enforcing fees for “excessive transactions” in a statement period (normally $10), so you should be able to make unlimited transactions.

However, you will be charged:

- $7.50 for returned or rejected deposits

- $20 for outgoing domestic wire transfers

- $15 for expedited delivery

- $25/hour if you have a situation that requires research into your bank account history

You may not encounter any of these situations, but if you do, be prepared for charges.

Ally Bank Features

Savings Account

Ally Bank’s flagship product is their high-yield savings account. With a 2.50% variable APY and interest compounded daily, this account is true to its “high-yield” claim. The website mentions different APY “tiers” for different balances, but the APY looks to be consistent across tiers (though that may change).

Taking a cue from budgeting apps, Ally lets you divide your savings account balance into up to 10 “buckets” that represent different goals.

Money Market Account

Money market accounts have the same 2.50% rate, and they come with a debit card for unlimited ATM withdrawals.

Read more: Money Market vs. Savings Accounts

Checking Account

Ally checking accounts earn interest, though at a much smaller rate than their savings and money market accounts. You’ll earn an 0.10% APY if your balance is less than $15,000, and an 0.25% APY if it’s $15,000 or more.

Ally doesn’t charge overdraft fees, but if you want to limit your risk of overdraft, you can set up automatic transfers between Ally savings and checking accounts. They also have a CoverDraft service that gives you up to $250 in overdraft coverage if you use direct deposit (though overdraft protection isn’t always the best idea for people who struggle to limit their spending).

Round Ups and Surprise Savings

Round-ups are Ally’s way to help you sneak more money into savings without noticing. If you opt in, Ally rounds up transactions from your checking account to the nearest dollar. When the total gets to $5, it goes from checking to savings.

Surprise Savings does the same thing through a different technique. Link any checking account (whether it’s an Ally checking account or not), and their algorithm will analyze your spending habits and let you know if you have any extra money that’s “safe to save.”

Certificates of Deposit (CDs)

If you want to save money for three months to five years down the road, Ally has no-fee, no-minimum CDs with a lot of customization options. The APYs are high-yield, ranging from 0.75% to 3.00%. The longer your term, the higher your APY.

Want to withdraw your money early? The No Penalty CD (11 months, 2.00% APY) lets you take money out with no fees.

Read more: CD Interest Rate Calculator

Investment Options

Ally Invest, the investing arm of Ally, starts with an accessible $100 minimum. You can use their robo-advisor or direct your own portfolio, and Ally offers multiple portfolio types based on your goals and risk tolerance.

Read more: Ally Invest Review

Mobile App

The versatile Ally app can take care of most, if not all, of your everyday banking needs: free electronic transfers, bill pay, check deposits, finding ATM locations, and more.

My Experience Researching Ally Bank

While looking into Ally Bank customers’ experiences, I learned that Ally checking account holders faced a wave of debit card frauds in August 2022. Customers reported strange charges on cards they’d never used or even activated. Naturally, this event flooded Ally’s customer service phone lines.

Some users commented that Ally wasn’t prepared for this situation, and callers faced long wait times. Users also mentioned they had a difficult time identifying the fraudulent charges on their statements via the website and app, and that Ally doesn’t offer virtual card numbers, which can hide a real debit card number from hackers.

Taking advice from cyber-experts, Ally is working to prevent these disasters in the future by analyzing accounts more closely. Ally’s official security guarantee protects users from liability as long as they report unauthorized charges within 60 days.

Any debit card is vulnerable to fraud, regardless of the company. Still, this research made me think Ally Savings may be a more secure bet than Ally Checking.

Read more: How to Protect Your Money from Fraud, Fees, and Scams

Who is Ally Bank Best For?

- People saving for several different goals — The “buckets” feature in Ally Savings makes it simpler to compartmentalize your goals without opening separate accounts.

- People who want multiple types of accounts in one place — Theoretically, you can have your investments, savings, and checking accounts all with Ally, consolidating your financial life nicely.

- People opening CDs — Ally has a lot of choices for CDs, and its early withdrawal charges aren’t as high as the penalties many other banks charge.

Who Shouldn’t Use Ally Bank?

- People who need to deposit cash — Ally doesn’t have any way to deposit cash into a checking or savings account. If you earn cash tips at work or need to stash cash for other reasons, another bank would be better.

- People who want in-person assistance — With no physical branches, Ally’s customer service is strictly over the phone or online.

Ally Savings Account vs. Competitors

Discover Online Savings Account

- Products: Savings, Checking, Money Market, and CD accounts

- APY: 3.90% APY on savings account

- Fees: No minimum balance or monthly fees

Discover accounts come with a lot of fee-free services, including no fees for returned deposits (which Ally does charge for). They’re also an exclusively online bank, but with plenty of ATMs and mobile features, including mobile check deposits. Savings accounts are even eligible for Early Pay, where you can access direct deposits up to two days early.

Read our full Discover Online Savings review.

Capital One 360 Savings

- Products: Savings, Checking, Money Market, and CD accounts

- APY: 3.00% APY on 360 savings account

- Fees: No minimum balance or monthly fees

Capital One shares many features with Ally, including an interest-bearing checking account (0.10% for most balances) and a high-yield savings account. You can open different savings accounts for multiple goals and earn a 3.00% APY on each balance. Capital One 360 accounts are online, but if you want personal assistance, Capital One does have physical branches.

Read our full Capital One 360 Savings review.

CIT Bank Savings Builder

- Products: Savings, Checking, Money Market, and CD accounts

- APY: 0.40%–1.00% APY on savings account, depending on balance

- Fees: $100 minimum to open; no monthly fees

CIT Savings Builder accounts have tiered interest rates that encourage you to bulk up your savings. After a brief 1.00% introductory APY, you’ll earn 0.40% until you’re eligible for an APY hike — which you can get by depositing at least $100 each month or hitting a $25,000 balance. See details here. The rates aren’t as high as Ally’s, but this is still a solid choice.

Read our full CIT Savings Builder review.

CIT Bank. Member FDIC.Summary

Ally Bank accounts aren’t completely fee-free, and their checking accounts’ security breach in 2022 put a lot of customers on alert. But overall, Ally’s savings account products are trustworthy and on par with competitors.